carroteater/iStock via Getty Images

Smith-Midland (NASDAQ:SMID) is a manufacturer of precast concrete products, including walls, highway protection barriers and sound blocking barriers.

The company operates in a competitive industry, with a little help from patented products. However, the company has been able to operate profitably for most of its history. SMID has also been able to more than double its revenues in the past two decades.

SMID does not have a lot of debt and has been able to generate interesting cash flows, with low working capital or PP&E requirements.

That is, SMID is a good company. However, for reasons that I cannot grasp, the company trades at what I consider an unjustifiable, extremely high price. Even under the most positive circumstances, I believe there is no way SMID can generate a level of business that is consistent with their current valuation.

Note: Unless otherwise stated, all information has been obtained from SMID’s filings with the SEC.

Precast industry characteristics

The precast industry is a low moat, high competition industry. The reasons are its low barriers to entry and the technical competence of its customers.

Beginning with barriers to entry, precast is not a capital intensive industry like cement manufacturing is. Please don’t get me wrong, precast manufacturers do need factories, but their cost is not even comparable to that of a cement manufacturer. With manufacturing processes that are free for public use, anyone with some capital can join the business.

There are multiple products that can be manufactured by precasting concrete, the National Precast Concrete Association (NPCA) lists almost a hundred. That means some manufacturers can build a niche in specific applications.

Precast is also affected by logistic costs, being a heavy product. That means that companies can build some moat by being close to their customers. Competitors may not be able to compete because their logistic costs are higher.

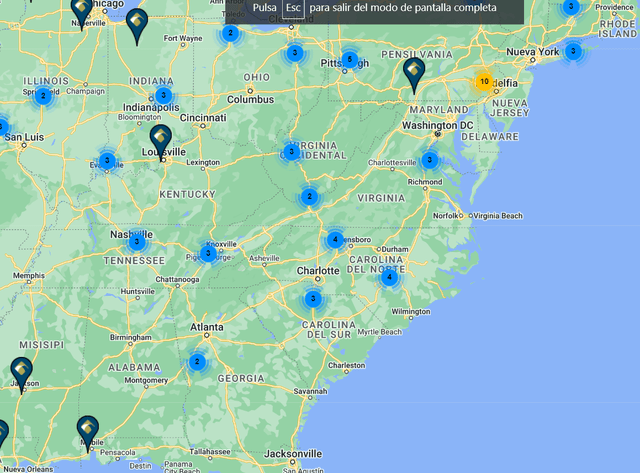

In the case of SMID, the company has three manufacturing facilities, located in Virginia, North Carolina and South Carolina. The map below, obtained from the NPCA, is filtered to show only NPCA certified manufacturers of walls and highway barriers, SMID’s two core products. The map shows that even in its home states, the company faces competition, and even more so outside of them.

NPCA certified manufacturers of precast walls and highway barriers (National Precast Concrete Association)

A second factor generating competition in the industry is that its customers are technically competent. Contractors purchase precast to apply in their construction projects. The purchase process is probably led by engineers that have a suite of metrics to compare the relative value of each competitor’s products.

SMID has tried to fight these factors (low barriers to entry and metric based competition) by developing patented products. These include Slender Wall, a precast wall for building construction, and J-J Hooks, a highway barrier, the company’s star product. According to SMID these products enjoy enhanced technical characteristics that make installation easier and durable. The company also has trademarks or patents for its other product lines.

These patented products do enjoy some competitive power. SMID has licensed them to several manufacturers in other US and abroad (Australia, Belgium, New Zealand and Trinidad). The company charges between 4% to 6% on sales as royalties. In 2021, SMID received $2.2 million in royalties, which would translate to approximately $44 million in products sold by its licensees.

Finally, most of SMID’s products are sold on a non recurring basis. Walls, highway barriers, sound barriers and precast buildings are all sold on a project by project basis. Each project can represent a significant portion of that year’s revenues. This means that the product mix is also changing constantly.

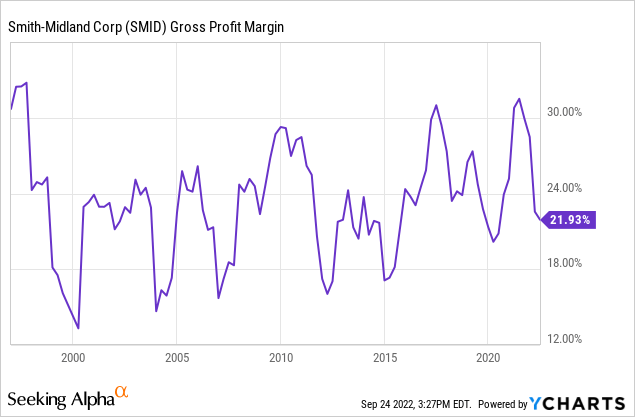

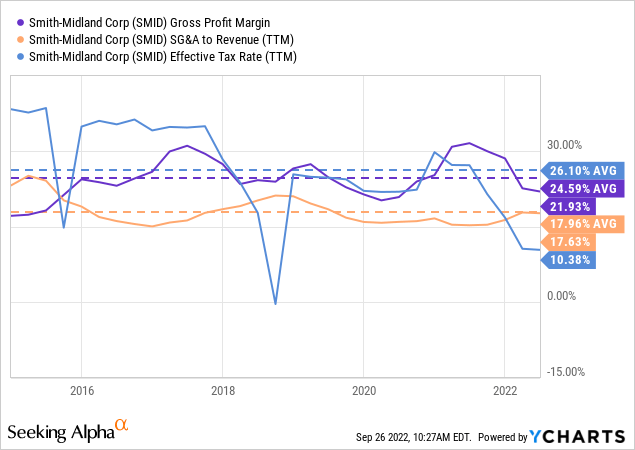

All in all, the dynamics of the industry affect SMID, whose gross profit margins have been relatively low and also variable, as the chart below shows.

Smith-Midland’s cost and financial structure

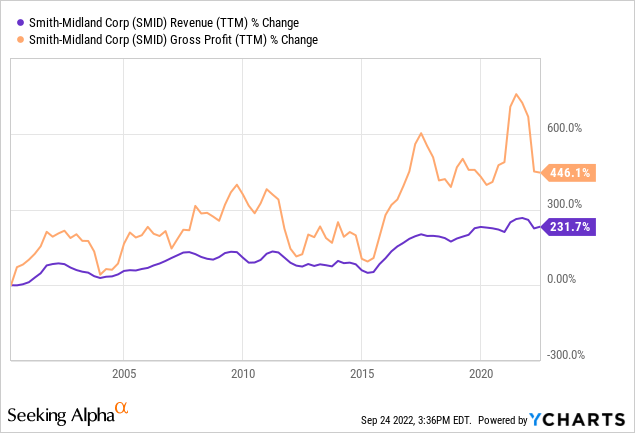

As the chart below shows, SMID’s has been able to consistently grow revenues. Even during the financial crisis, the company was able to keep a consistent level of revenues. In the meantime, SMID was able to grow its gross profits, albeit these present higher variability because of product mix changes.

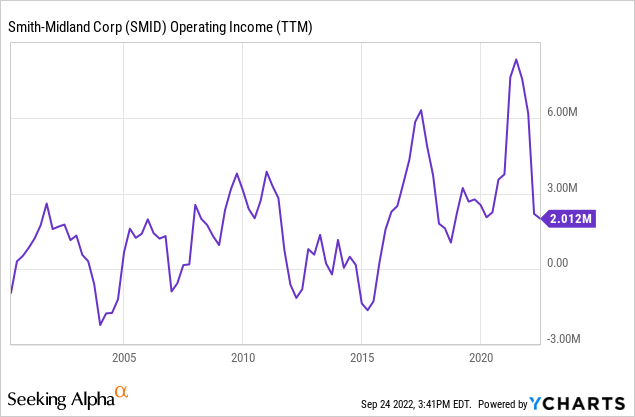

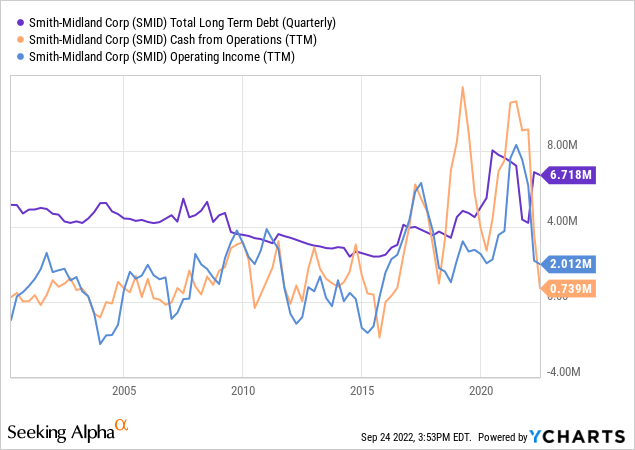

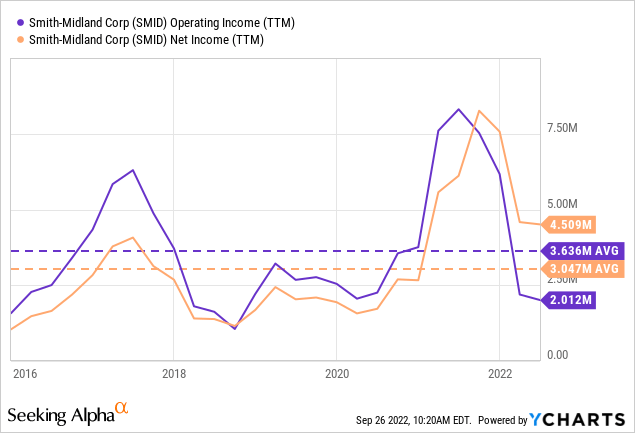

Variable gross margins generate substantial operating leverage at the operating income level. SMID’s SG&A costs are not enormous, averaging 20% of revenue since the 2000s. The problem is that the 20% figure is too close to the company’s gross margin. The result is extremely variable operating income. Fortunately, the company has rarely been operationally unprofitable.

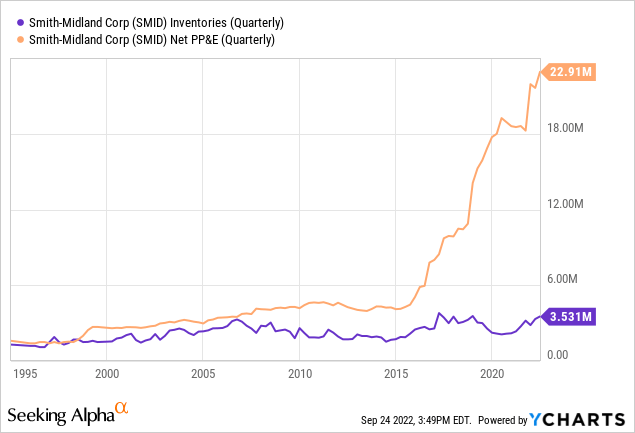

On a more positive note, SMID requires little PP&E expending and also a low level of inventories that are turned quickly. The company manufactures mostly after a contractor places an order. The jump in PP&E below is substantial and will be explained in a different section, but still, $22 million in net PP&E for a $50 million revenue company is not substantial.

This has generated a good cash flow structure, where SMID is able to convert operating income into FCF. Low levels of investment also allow the company to avoid substantial debt.

Dependence on government spending

Some readers may have noticed a sudden increase in revenue, gross profits, operating income and net PP&E beginning in 2015.

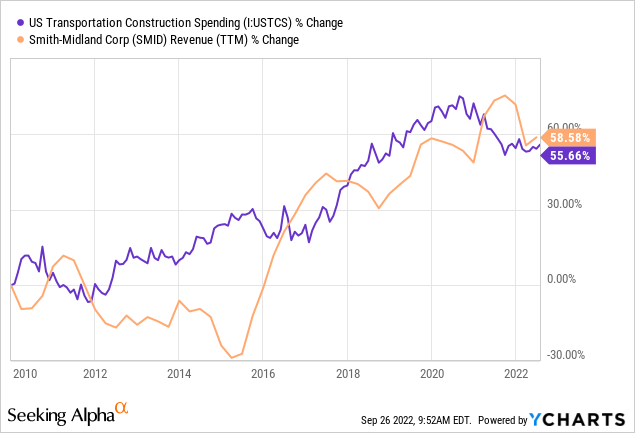

In my opinion, this increase was caused by increased infrastructure spending by the US government, but also by SMID’s gaining market share.

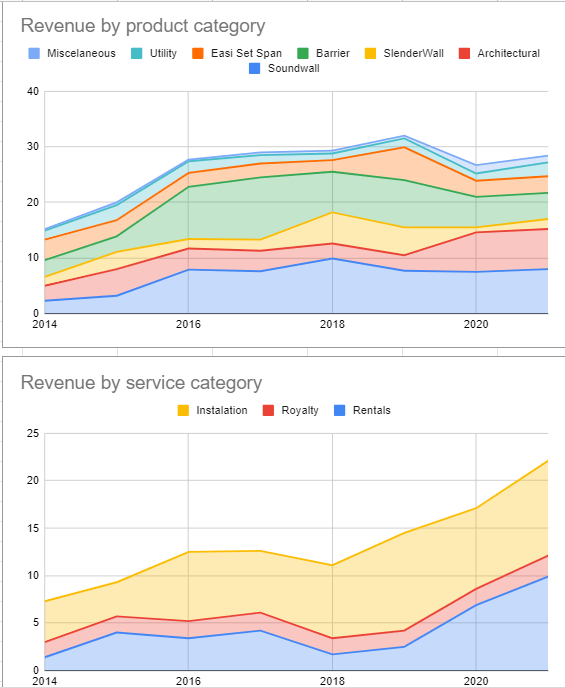

The two charts below show that the fastest growing product categories after 2015 were barriers and sound-walls. These categories are almost exclusively demanded by the federal, state and local governments (indirectly through contractors). They are used in transportation infrastructure projects, highways in particular.

In the service field, the increase in installation and rentals is also associated with barriers, and therefore to transportation infrastructure. The fastest growth stage for these services starts in 2018, cannibalizing a significant portion of barrier sales. The increase in barrier rental explains the jump in net PP&E, as barriers that are rented are considered company property.

SMID’s revenue by product and service (SMID’s filings with the SEC)

As the chart below shows, there has definitely been a significant increase in transportation construction since 2010 in the US. However, transportation construction spending and SMID’s revenues do not go hand in hand. Between 2012 and 2014, spending grew but SMID’s revenues decreased. Since 2015, SMID’s revenues started growing before spending did. This all signals that although construction spending has become an important driver for SMID’s business, the company can both lose and gain market share in this industry as well.

Going forward, an extreme valuation

As a summary, I commented that the precast industry is relatively prone to rivalry, based on its low barriers to entrance and competent customers. Some protection against rivalry can be provided by geographic location (transportation costs) and patents.

In the context of this industry, SMID has been able to grow revenues, concentrating mostly on government generated demand segments. The company’s gross margins are low, and this generates some operational leverage. Working capital requirements are low, and therefore the company has mostly avoided debt.

However, even in the best years the company has only been able to generate $8 to $9 million in operating income. Peaks in operating income have been followed by valleys, as specific contracts can have significant effects in one particular year’s profitability.

Given that, I find unexplainable that the company is valued at $130 million. Its industry is not fantastic, being also dependent on discretionary government spending. The company has never been able to come even close to generating a level of net income that is consistent with that valuation, and has shown variable, unpredictable income from year to year. Using the past seven year average, the company is valued at 43 times earnings.

The bullish thesis seems to be that the famous trillion dollar infrastructure bill signed during Biden’s administration will generate a jump in income similar to that seen after 2015.

In order to test the bull thesis, we can build a simple and even optimistic financial model, to find out how much growth is already priced in the current valuation. As assumptions, we consider a gross profit margin that varies around an average of 25% of sales, SG&A to revenue spending that varies around 15% of sales, and an effective income tax rate of 25%. We also optimistically assume that no external financing is needed, and that the company’s product mix cycles are smoothed out.

What would be needed for the company to generate $13 million in net income? Almost $18 million in pre tax income, which combined with a 10% operating margin (25% gross profit margin minus 15% SG&A to revenue ratio), imply $180 million in revenues.

That is, taking relatively optimistic assumptions, like no debt, smooth cycles, a lower SG&A expense ratio, and no capital requirements, the company should still triple its revenues before generating a 10% earnings yield. It seems like an aggressive objective, to say the least.

In my opinion, SMID is not a bad company, it has room to grow, but its current valuation already prices in everything positive that could happen to the business. If on the contrary, some of the expected positive developments do not become a reality, or even worse, some factors deteriorate, then SMID’s valuation provides zero margin of safety.

The decision seems clear. Even for the speculator, SMID is currently a no-go.

Be the first to comment