hapabapa

Netflix (NASDAQ:NFLX) changed the way we watch and gave viewers freedom of when and how to consume movies and shows. The company evolved from a firm that shipped DVDs to its customers, to a streaming service giant with over 209 million subscribers in more than 190 countries. It worked perfectly for years and investors were handsomely rewarded until the first competitors started to emerge, combined with a global economical weakness.

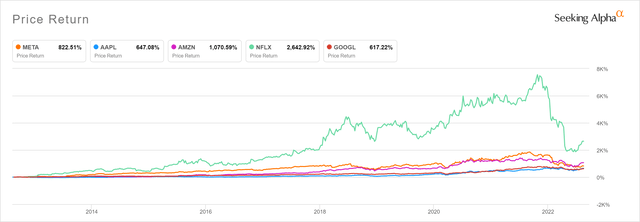

The company is one of the five FAANG behemoths that have ruled the broadly understood technology space which has been also reflected in its stock price. Interestingly, Netflix was the one that massively outperformed the rest of the group hitting almost 5000% in price appreciation in the 10-year period before the sudden drop that happened this year.

Price Return of the FAANG stocks over the last decade (Seeking Alpha)

Each of the FAANG companies has seen rapid revenue growth and some of them could compete for the best balance sheet in the world with significant cash reserves, solid margins, excellent returns on invested capital, consistent free cash flow, or ongoing share buyback programs. Unfortunately, Netflix can’t brag about some of these. However, after the share price collapse the business might be an interesting pick when considering the Netflix brand, the number of active subscribers, the broad offering, and the recent moves made by the company that should be reflected in growing revenues.

The purpose of the article is to analyze the company from a value perspective, with a focus on risk, the margin of safety, and the long-term outlook for the business. In the process following questions should be answered.

1. Is the business model simple to understand?

2. Is it a great business?

3. What is the worst-case scenario for the company?

4. Is the business selling for a fair price?

5. Does the reward outweigh the risk and does the company qualify for purchase upon thorough analysis?

Answering these questions will help the reader to decide whether Netflix trades for a reasonable price and whether the company qualifies as a sound investment for the long term.

The Moat

Netflix has undoubtedly a very simple business model that is easy to understand. Nevertheless, a closer look should be given at the moat that the company has. Competitive advantage, also called a moat, is an essential part of an investment thesis. A moat can differentiate a good business from a great business. It gives the enterprise a sort of protection making it almost untouchable from the competition. It basically lets the company operate with little to no concern about its superiority and longevity. A great example of a business with such a moat is Disney (DIS) which happens to be a direct competitor of Netflix. In the article from January 11th, 2022, I contrasted both companies in terms of the moat as follows:

However, if both companies were compared from a bigger perspective disregarding the financials and short-term sentiment, the following situation could be pictured to understand the fundamental difference between Disney and Netflix or in fact, any other competitor. Let’s imagine that there are two companies with equally competent management. Both can be provided with all the funds they would need to grow their business. Each company is assigned a mission: one would have to dethrone Netflix as a leading streaming platform and the other – Disney. What might quickly become obvious is that no money in the World might help the second company to beat Disney at its game. The moat Disney has created over the century is something unique, which a long-term investor should be appealed to.

These two businesses started being compared around the time Disney launched its direct-to-consumer (DTC) segment in December 2019. Since then, Amazon (AMZN) with its Amazon Prime, Apple (AAPL) with Apple+, Warner Bros. Discovery (WBD) with HBO Max, Paramount (PARA) with its Paramount+, and more players started flooding the market with their new offerings, and expanding libraries. Having an apparently narrow moat led to cracks in the walls of Netflix’s streaming kingdom until the judgment day came when the company announced its earnings for the Q4 FY 2021 and the share price tumbled 20% on slowing subscriber growth. Over time it hit the bottom at $162.71 and it’s currently trading at $221.68, far from the 52-week-high of $700.99. In addition, equity markets and macro economical environment have been weak for almost a year which makes investors even more hesitant to bet on Netflix. With competition posing a real threat to the company’s business model, the streaming giant found itself in a very uncomfortable situation.

Mounting Hurdles

The company’s narrowing moat has been exposed in recent years as its competitors started to withdraw from licensing its productions to Netflix. Instead, they could include them in their own streaming libraries and draw customers to alternative streaming platforms. At this point, Netflix has no bargaining power and the only thing it can do is to offer more money for the rights to include movies or shows in its libraries. Criminal Minds, the most-watched Netflix show in 2021, was pulled from Netflix and moved to Paramount+. Several Marvel productions also left Netflix and are now available on Disney+. The most-streamed show in 2020 on Netflix in the USA – The Office was removed from the platform as well. These are just a few examples of major content losses the company has experienced.

Pictured: After, The Amazing Spider-Man, Schitt’s Creek, Hemlock Grove (whats-on-netflix.com)

Just in October 2022, there are 152 shows and movies leaving Netflix! Among those are timeless movie creations such as I Am Legend (2007), Once Upon a Time in America (1984), Troy (2004), Full Metal Jacket (1987), and many more. Of course, the company constantly adds content. Just this month 143 positions are being added, as many as 90 of which are made by Netflix. An investor should ask himself if this is the right strategy and if the business model can be sustainable with the developments going in this direction.

A natural move for Netflix and seemingly the only chance to be less dependent on other studios was to focus at some point on original content. In 2016 2.6% of the whole content was original, while 97.4% was licensed. A shift in focus led to a drastic change in proportions where currently 50.7% of the films on Netflix are original productions. It has resulted in ballooning content costs which increased by 17.54% CAGR between 2018 and 2021. Expenses on produced content more than quadrupled from $1.02 billion in 2018 to $4.18 billion in 2021 in the same period of time. Unfortunately, these exponential cost hikes don’t translate into subscriber growth which has been a key metric to value the company till recently. To keep viewers on its platform and gain significant numbers of new ones, Netflix would need shows like Squid Game much more often. Sad truth is that the originals have been far from high-quality in most cases. I touched on this matter in the article from January 11th, 2021

On the other hand, there are many Netflix Originals that are terrible in terms of quality. Sadly, some of them rank below any current cinematographic standards.

Contrasting Netflix with HBO Max, one can conclude that an HBO logo by the movie titles has always stood for the high-quality and best cinematographic experience. With Netflix originals, it looks quite the opposite. Before clicking Play, it’d be wise to double-check the ratings and reviews to save an hour or more of poor entertainment.

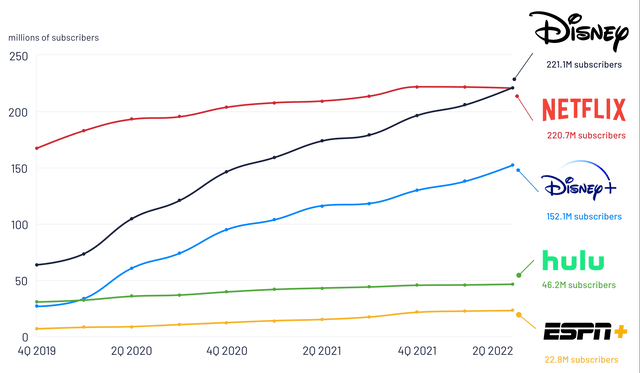

Disney launched its streaming platform at the perfect moment, which was two months before the pandemic started and people got locked at home watching movies and playing computer games. It’s been less than three years and Disney with its Disney+, Hulu and ESPN+ overtook Netflix in terms of subscribers number.

Number of Subscribers: Disney vs. Netflix (genuineimpact)

This should have been one of the few crucial moments for anybody invested in Netflix to revisit the investment thesis and thoroughly think about the outlook of the company.

Valuation

There are plenty of valuation methods that can be used when valuing a company. Discounted earnings or discounted cash flow models are among the most popular ones. The value of a productive asset such as a business is in fact expressed by the present value of its all future cash flows. In the long run, however, earnings should match the free cash flow generated by the company. And here is the first red light when looking at Netflix financials.

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| EPS $ | 0.04 | 0.26 | 0.62 | 0.28 | 0.43 | 1.25 | 2.68 | 4.13 | 6.08 | 11.24 |

| FCF $ | -0.17 | -0.05 | -0.03 | -2.16 | -3.87 | -4.54 | -6.56 | -7.17 | 4.38 | -0.30 |

Source: Author, with data from Seeking Alpha

The table below compares earnings per share (EPS) and free cash flow per share (FCF) over the last ten years. Thanks to the accounting technique called amortization, Netflix has made its earnings look very pretty. However, what really stands for the strength of a business is the free cash flow it generates over a long period of time. It’s calculated in most cases as cash from operations minus capital expenditures. In the case of Netflix, it’s very disturbing that there was no single year except for the year of the pandemic when Netflix had a positive free cash flow. The reason for this unbelievable cash drainage is again – content spending.

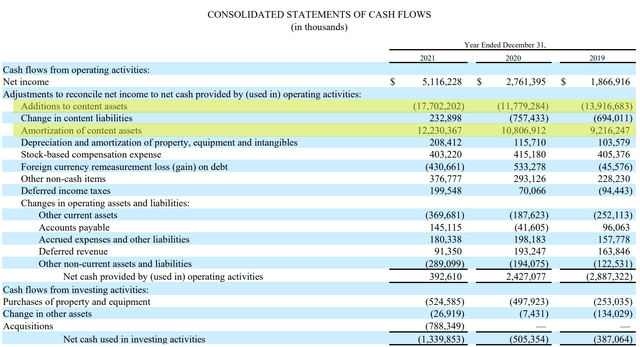

Consolidated Statement Of Cash Flows (Netflix – Investor Relations)

Over the last three years, Netflix has spent substantial amounts of money on content, a big part of which is being amortized, which means that the loan payments are spread out over time. The management refers to it in the annual report:

On average, over 90% of a licensed or produced content asset is expected to be amortized within four years after its month of first availability. The Company reviews factors impacting the amortization of the content assets on an ongoing basis. The Company’s estimates related to these factors require considerable management judgment.

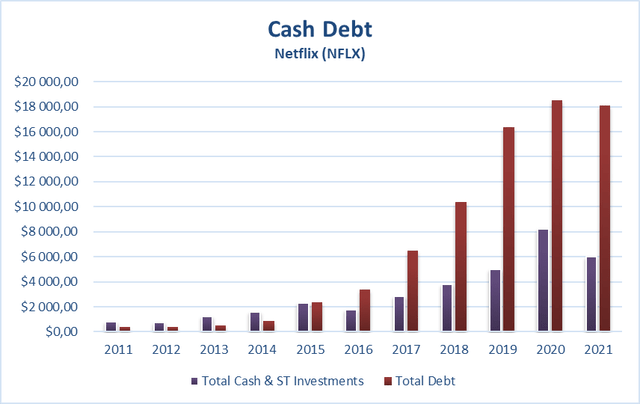

Comparison of Netflix cash and debt positions (Author’s diagram based on Seeking Alpha data)

As one can see, the issue with disproportional cash outflow and mounting debt, partially covered by the amortization of the content assets started in 2016 when the management decided to shift its focus to original content production. Since then the spiral of rising liabilities has been accelerating and currently, Netflix’s total debt is 3 times higher than its total cash including short-term investments. Besides that, the company’s Current Ratio and Quick Ratio which represent ratios of the total assets to total liabilities and current assets to current liabilities respectively, are below 1, which also indicates a mounting debt burden.

Since using a discounted cash flow method isn’t possible due to the negative and unpredictable free cash flow, one can get a sense of Netflix’s value with help of other methods.

A suitable method in this situation would be Discounted Earnings Model, where earnings growth is projected over the next ten years and a present value of all the future earnings is calculated.

Scenario 1

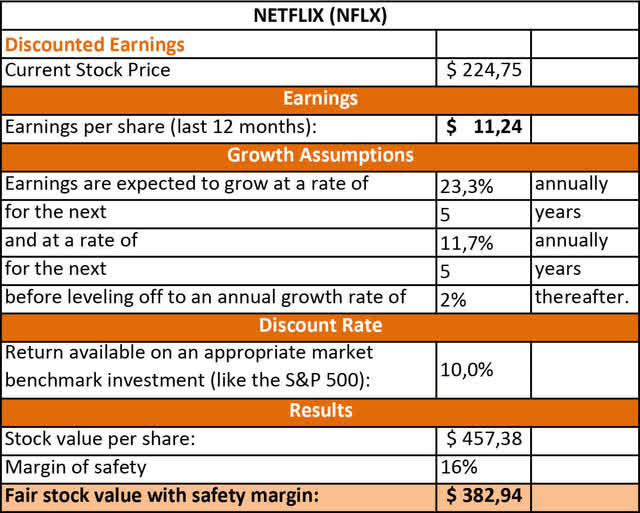

In the first scenario, Netflix’s earnings growth outlook is at 23.3% in the first five years, as projected by Seeking Alpha. It was assumed that in the following years, growth will be half as high.

Discounted Earnings Model – Scenario 1 (Author’s Calculation)

Assuming 10% as a discount rate and a 16% margin of safety (calculated in reference to the strength of the short-term and long-term health of the company), a fair price per share comes at $382.94. The result suggests that Netflix is a tremendous deal and a heavily undervalued asset being on sale. Of course, calculated fair share price depends on several factors. However, what should be considered with great caution are growth estimates. In the current environment with challenges Netflix has to face, a 23.3% earnings growth CAGR over five years might be very difficult to achieve.

Scenario 2

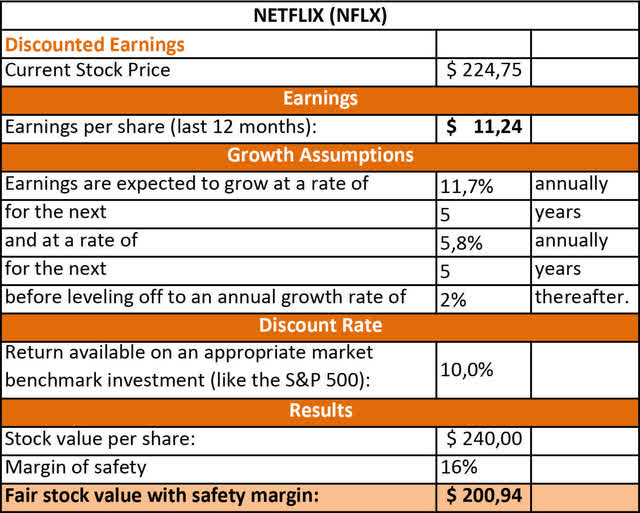

In Scenario 2, growth in the first five years was lowered to 11.7% and it’s assumed it’ll decrease to 5.8% CAGR in the following years before reaching perpetual growth of 2%.

Discounted Earnings Model – Scenario 2 (Author’s Calculation)

The fair price of the business with such assumptions is substantially lower, as expected. However, these projections are supposed to take into account all the mentioned obstacles that Netflix faces. The projections are conservative, but the down risk is substantially limited by applying such growth values into the model. Assuming, that Scenario 2 is the preferable one for a conservative investor, Netflix has still room to fall in order to become an interesting investment choice.

Conclusion

Netflix is introducing ads to its platform ($6.99 for the ad-supported tier), closing the door on password sharing, and keeps investing in content. It can also increase subscription fees which will drive its revenues higher. There are probably more ways the company can get back to growth. If some of these growth drivers start materializing, the investment thesis can be revisited with more promising projections. Nevertheless, what the business relies on the most has been subscriber growth, engaging content, and no competition around. This has changed dramatically over the last years and the results could be seen in recent months. At some point, the company also has to start generating free cash flow. It didn’t happen in the years of prosperity and it will be even more difficult in the bad years. Value investors may want to follow one of the investing principles shared by Charlie Munger – Vice President of Berkshire Hathaway (BRK.A):

A great business at a fair price is superior to a fair business at a great price.

One of the conclusions drawn from this article shall be that Netflix is not a great business. Thus it’s better to stay away from it when considering a long-term, low-risk, high-reward investment. It doesn’t mean that the stock price will not go up or not overperform the market or other equities over periods of time. It means that the risk of the business losing its position (which has already happened) is not low enough compared to the reward the investment may bring over a long period of time which should be at least 10 years.

Be the first to comment