blackdovfx/E+ via Getty Images

Beyond The Limits

Breakthroughs in physics, engineering, and classical computing were prerequisites for building a quantum computer, which is why for many decades the task was, and in some cases remains, beyond the limits of available technology. – IonQ Annual Report FY ‘21

The last 6 words of the quote above should be etched into the minds of every potential and existing IonQ (NYSE:IONQ) investor.

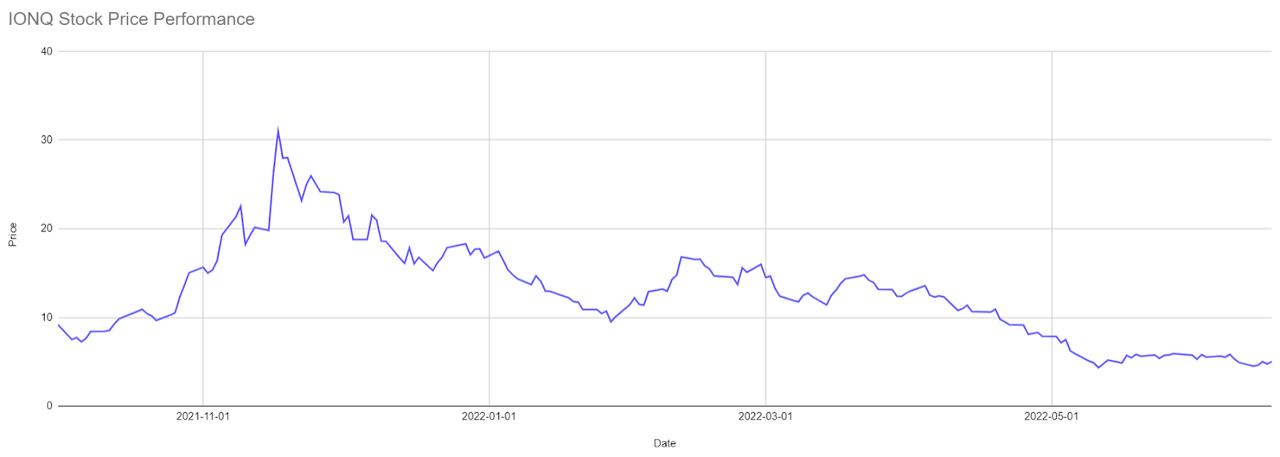

Figure 1: IONQ Stock Price Performance (Yves Sukhu)

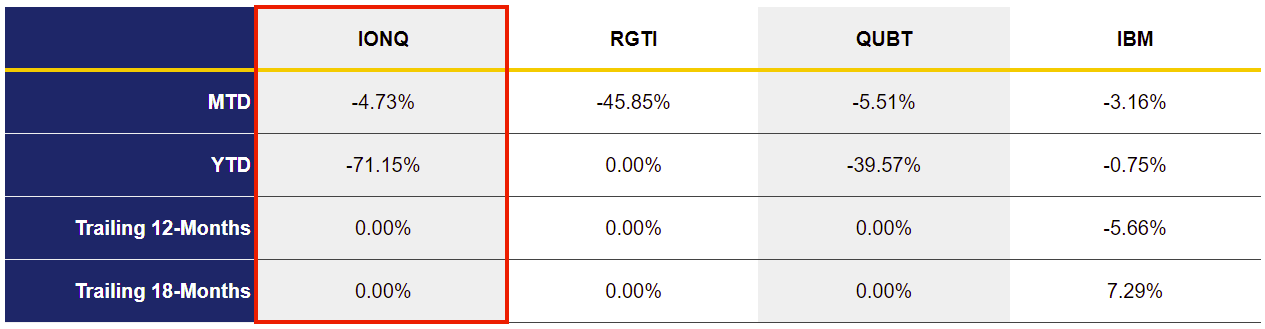

I certainly hope most long investors in IONQ understand that the stock, even at ~$5/share, must be, by every definition, speculative given that (extrapolating from their own words) practical quantum computing systems may never exist. If so, presumably those investors were and are prepared for steep losses, as with the stock’s ~(71%) decrease so far this year.

Figure 2: IONQ and Selected Competitor Performance (Yves Sukhu)

Yet, it must be acknowledged that IONQ, along with their true peers in the quantum computing space, is trying to build, what appears to be, the next great leap in computing systems. On that point, the company may merit a value that is somewhat independent of what might be deserved on “mere” financial performance alone. After all, the combined economic and societal value of practical quantum computing – if it could be realized – may be almost unimaginable.

Trading at just over $5/share as of market close June 17, 2022, IONQ may appear as something of a bargain considering its 2021 high over $30. But, is it?

“Bra-keting” IonQ’s Bull And Bear Points

I couldn’t resist going a bit “nerdy” in the title of this section. For readers who don’t get the reference, I will explain at the end of the article. For readers who do get the reference, yes, I know – it was corny <grin>. But, back to business.

I think there are a few reasons to be excited about IonQ’s prospects, which I outline as follows.

1. The market for quantum computing hardware, software, and services could exceed several billion dollars in a few years.

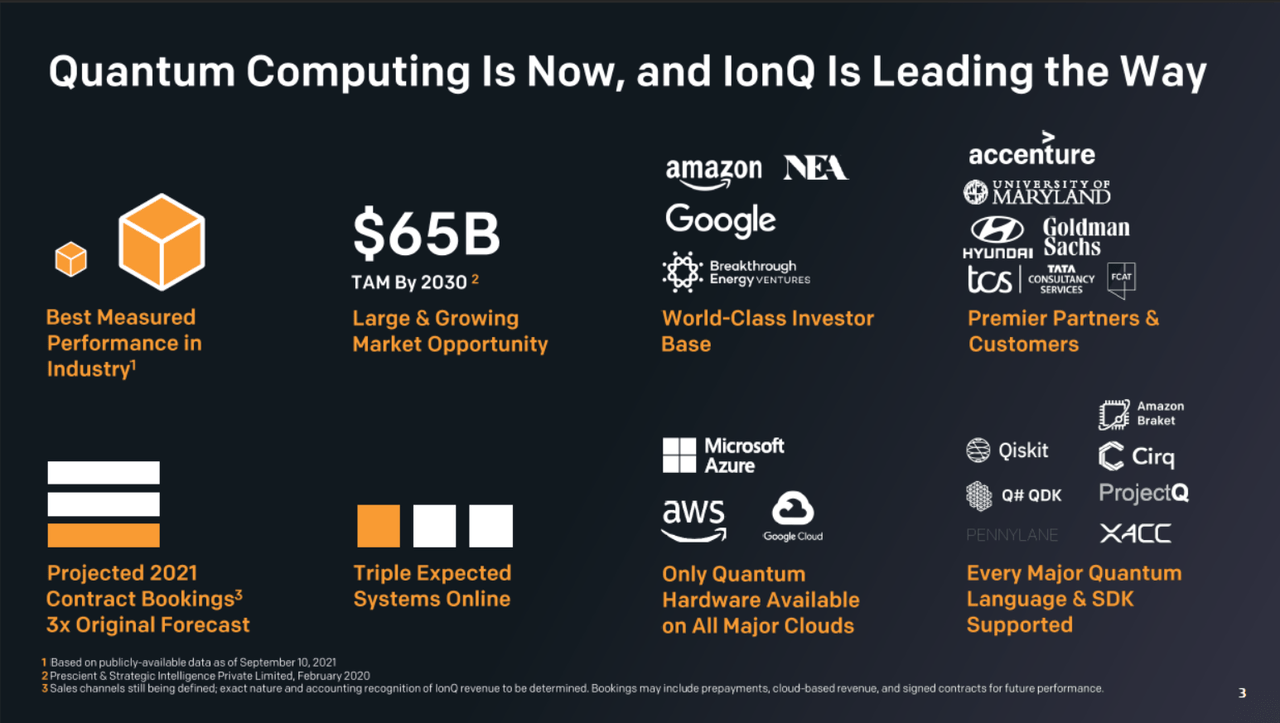

Figure 3: IonQ Company and Market Overview (IonQ Investor Updates Presentation March 2022)

As I write this, IonQ’s market capitalization is a hair below $1B. That might seem reasonable against a projected total addressable market (“TAM”) of $65B, as offered in Figure 3. At first glance this forecast may strike as realistic, given the many potential applications for practical quantum computing; these applications vary from new drug discovery to options pricing within the finance industry to network and loading optimization for shipping and logistics carriers. If the forecast is accurate, it might be argued that IonQ is actually undervalued based on the potential of the market. Although, in making that statement, investors should keep in mind the quantum computing space is fairly crowded with both large and small public players, including IONQ, Rigetti (RGTI), IBM (IBM), Alphabet (GOOG, GOOGL), and Honeywell (HON), as well as a growing number of start-ups. In other words, the “pie” hardly belongs exclusively to IonQ. Still, the “riches” of quantum computing are expected to grow exponentially as true quantum advantages (i.e. quantum computers with provable advantages over classical computers) hopefully emerge in the future.

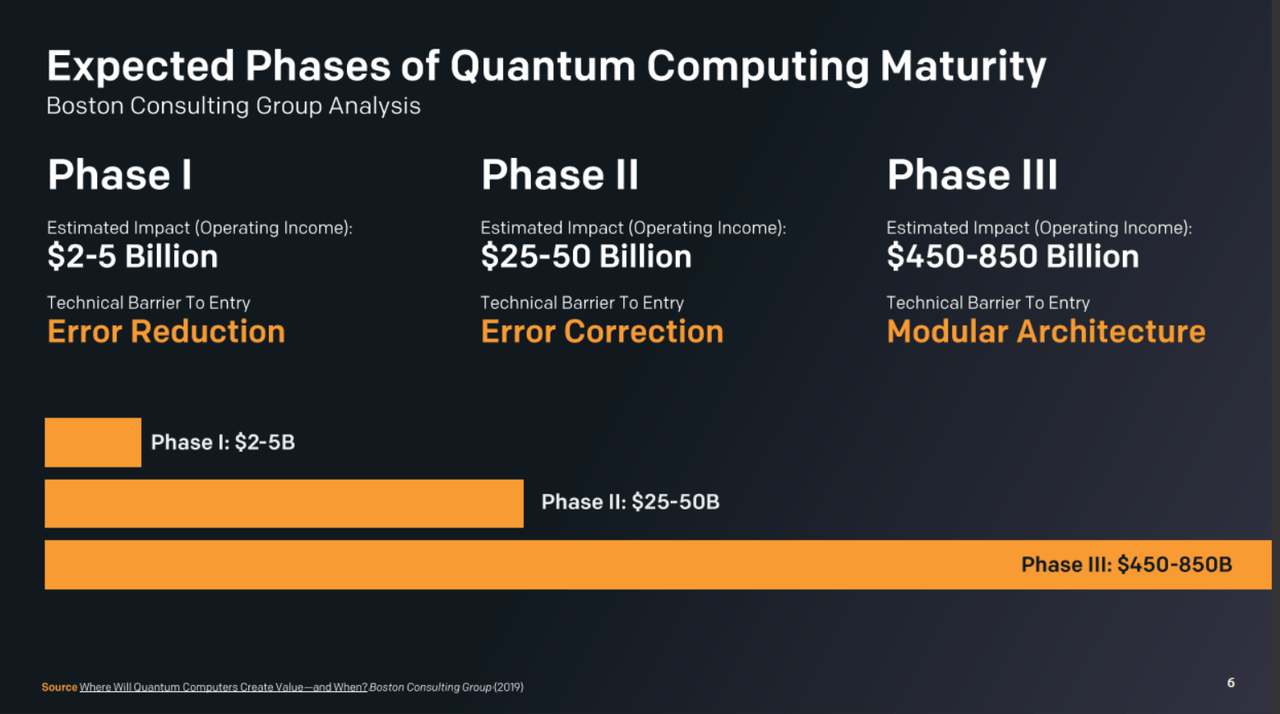

Figure 4: Expected Phases of Quantum Computing Maturity (IonQ Investor Updates Presentation March 2022)

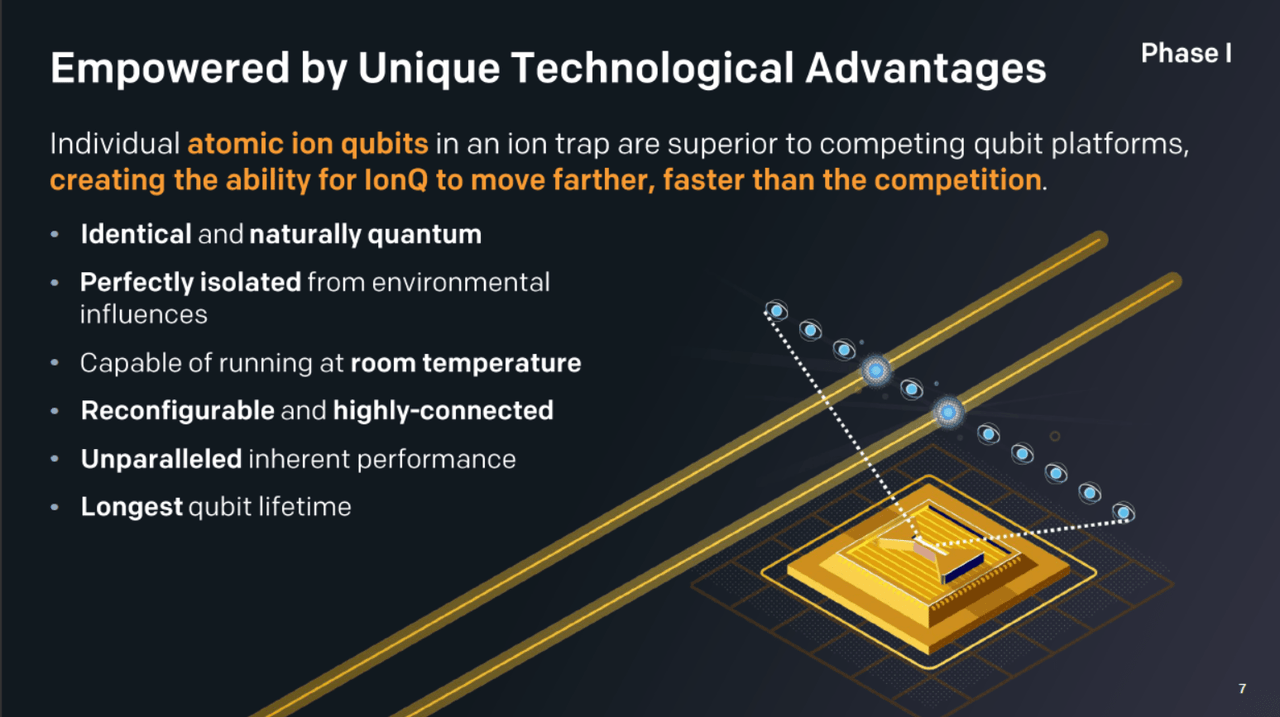

2. IONQ’s technological path could be the right path that allows them to win the race. As mentioned in the introduction, a practical (or “useful”) quantum computer is the ultimate prize being chased after by the various major quantum computing players. I imagine most IONQ investors are aware that the company differentiates itself (largely) on the basis of its particular approach to quantum computing hardware, which is trapped-ion technology pioneered by IONQ co-founders Chris Monroe and Jungsang Kim. This stands in contrast to competing quantum computing hardware approaches being explored by other players who use fundamentally different technologies to implement physical qubits, such as photon-based systems and superconducting circuits. IONQ notes a number of advantages with respect to trapped-ion technology, including its error-resilient characteristics and ability to operate at room temperature.

Figure 5: IonQ Unique Technological Advantages (IonQ Investor Updates Presentation March 2022)

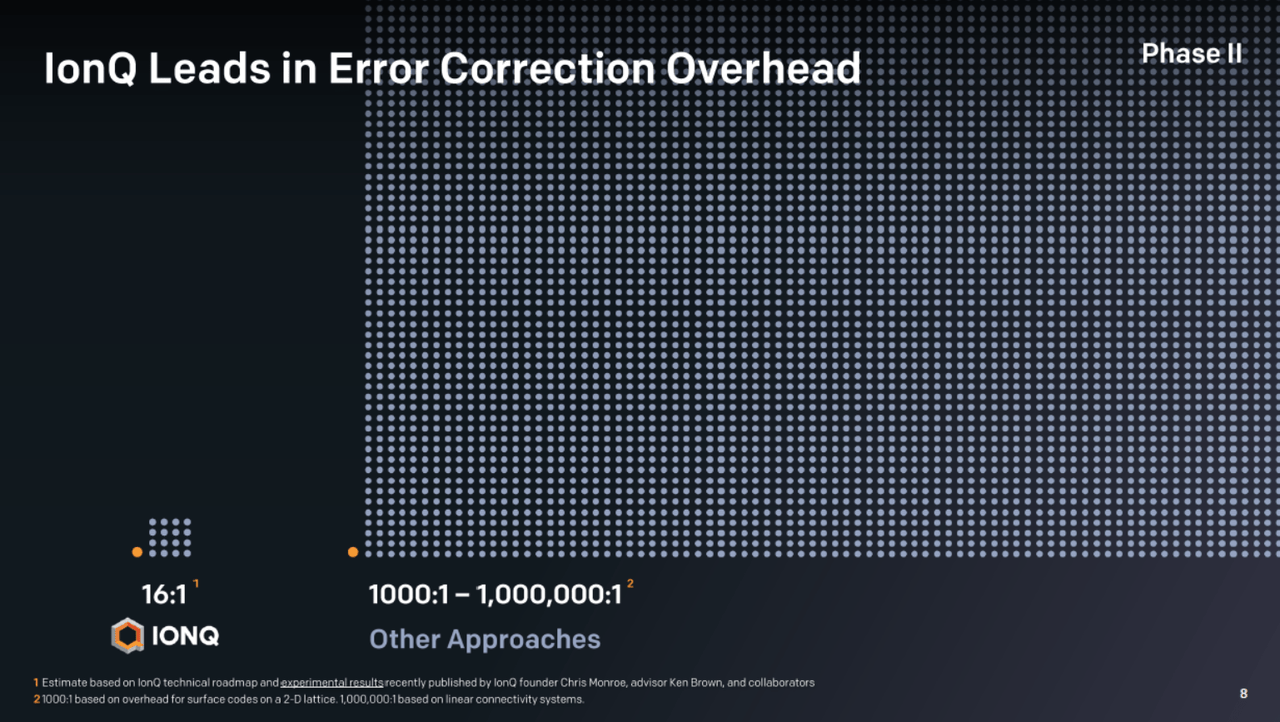

In regard to the latter, certain competing technologies such as superconducting circuits can only operate at very, very low temperatures. The former is an important point as well since individual logical qubits in a quantum computing system must be composed of several individual physical qubits due to decoherence and other error-inducing aspects of maintaining and manipulating physical qubit systems. The reduced error correction overhead required by IONQ’s hardware suggests that the firm’s technology may ultimately yield to smaller, more practical systems. If you have read about quantum computing firms introducing quantum computing machines with larger and larger amounts of qubits, that is in part driven by the need to “compensate” for a single logical qubit with many physical qubits.

Figure 6: Expected Phases of Quantum Computing Maturity (IonQ Investor Updates Presentation March 2022)

Finally, the company also details that they have solved, or may be on the path to solving, certain engineering and manufacturing challenges typically associated with trapped-ion technology, thus affording the firm something of a competitive moat versus other players seeking to build competing quantum computing systems based on trapped ion technology.

3. IONQ’s backing includes leading academic and governmental research entities, as well as premier technology investors. IONQ as a business entity was born in 2015 with $2M in seed funding from New Enterprise Associates, with enabling technologies based on its founders’ research activities at Duke University and University of Maryland. The company’s subsequent funding rounds included Google Ventures, Amazon Web Services, and Samsung as investors. I think we can all agree that the prior entities hardly seem like the type that would “suffer fools”; and therefore IONQ’s investor base lends credence to the (potential) viability of their technological approach as discussed in the point above, although these investors are likely to bet on multiple approaches versus a single one. Nonetheless, IONQ more recently announced they were selected by the Defense Advanced Research Projects Agency (“DARPA”) as the only quantum computing hardware vendor to participate on a multi-million dollar quantum benchmark project with the intent to establish reliable metrics by which to compare the “power” of different quantum computing systems. This too, I think, must say something (positive) about the firm’s technological path.

Of course, I would be remiss not to discuss negative points and observations; and I thus offer the following counter-arguments against a play in the firm.

1. No one knows what technology might win. While IONQ lays out a compelling story around their trapped-ion technology for quantum computing, no one really knows what technology (or technologies) will win in the end. After all, if it was obvious that trapped-ion technology is a superior path, every other player would have switched to that approach by now.

2. IONQ has virtually non-existent revenues as compared to its market cap. IONQ’s net revenue for FY ‘21 stood at just over ~$2M. The good news is that sales growth is trending in the right direction, with the company recording $2M in net sales in Q1 FY ‘22 alone, along with $4.2M in total bookings. The revenue forecast for FY ‘22 is in the range of $10.2M to $10.7M. Readers can do the math: with ~198M shares outstanding, the high end of the FY ‘22 forecast range produces a P/S multiple above 90 using the current share price.

3. Forecasts for the quantum computing market are questionable at best. IONQ references a Prescient and Strategic Intelligence report from February 2020 when identifying their TAM forecast of $65B by 2030 in Figure 3. The actual report, which I believe to be this one, appears to offer a different forecast for the quantum computing market; so, I am not exactly clear how IONQ derived the estimate listed in the prior graphic. Regardless, with no one even sure if practical quantum computing is even possible, any forecast must obviously be taken with a grain of salt.

My Take On It

It must be acknowledged that IONQ, along with their peers in the quantum computing space, is attempting to tackle what may ultimately prove impossible: practical quantum computing may be prohibited by nature itself, as I noted in a prior article on the subject. On that point, the company may merit a value that is somewhat independent of what might be deserved on “mere” financial performance alone. After all, the combined economic and societal value of practical quantum computing – if it could be realized – may be almost unimaginable.

As I mentioned, IONQ’s market capitalization is just below $1B as I write this. Is this valuation fair? This is going to sound like a “cop-out”, but I honestly have no idea. How do you value something that could be worth $0, if practical quantum computing proves infeasible, or be worth an amount beyond your wildest dreams if practical quantum computing is feasible and IONQ happens to have the technology that is going to win?

I hypothesized in the introduction that most investors in IONQ must know that their investment is necessarily speculative. On that basis, I would think a “Hold” recommendation is logical since we, as investors, can only sit back and watch how the story in quantum computing unfolds. A word of caution, however. I was reading an article some time ago by Scott Aaronson, another leading mind in the world of quantum computing, who said (paraphrasing) that it would be a shame to find out that any given scientist (like him) spent most of their life chasing a computing paradigm (i.e. practical quantum computing) and that paradigm turns out to be impossible. But, lest I end this analysis on a bad note, Mr. Aaronson offered in that same article that scientific evidence hints that practical computing may be possible.

I concede that IONQ does not fit my personal investing strategy as I am hesitant to jump on a firm whose future is somewhat binary (i.e. worth nothing or worth everything). That being said, I find their story and technology compelling. Should the stock suffer another steep drop – for whatever reason – I might be inclined to buy a few shares, but purely on a speculative basis.

P.S. If you got this far, thanks for reading. The “nerdy” title reference I made in the second section was with respect to bra-ket notation, which is used within quantum computing and quantum mechanics to describe quantum states.

Be the first to comment