da-kuk

Introduction

Following green shoots emerging during 2021 for Martin Midstream Partners (NASDAQ:MMLP), early 2022 saw further improvements that as my previous article highlighted, stand to see their distributions surge higher. Whilst the third quarter was subsequently impacted by unexpected headwinds, luckily nothing appears to be structurally wrong and thus investors can merely heed this as a timely reminder that the market both gives and takes away, as discussed within this follow-up analysis.

Coverage Summary & Ratings

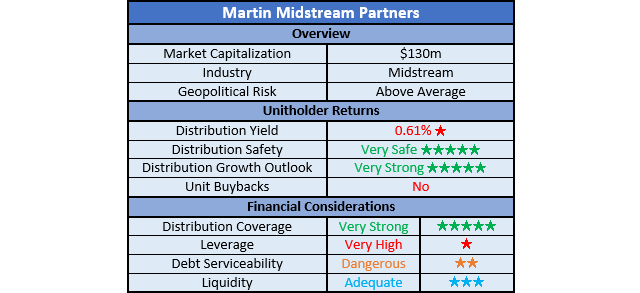

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

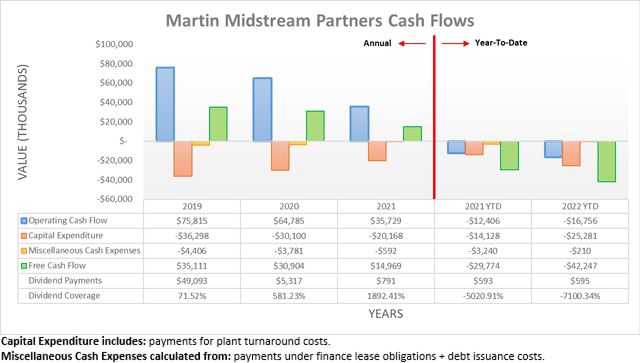

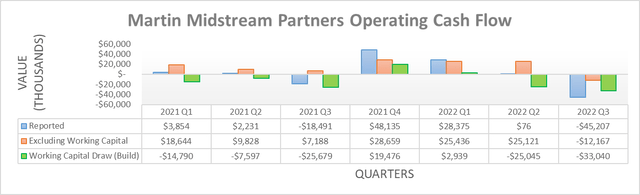

Upon seeing strong cash flow performance during the first quarter of 2022 when conducting my previous analysis, hopes were high heading into the second and third quarters. On the surface, it is difficult to tell whether these hopes were miss placed with their operating cash flow at negative $16.8m during the first nine months, which initially seems terrible. Although, one year prior their previous result was negative of $12.4m during the first nine of 2021, both of which stem from their routine seasonal fluctuations within their financial performance, driven by their routine working capital movements.

When viewing their operating cash flow on a quarterly basis, their results during the third quarter of 2022 were impeded by a larger-than-normal working capital build of $33m. If combined with the working capital build during the second quarter, it totals $58.1m, which is a very sizeable impact for this small partnership to endure across only two quarters. Looking back at the second and third quarters of 2021, these two quarters saw a combined working capital of $33.3m, which whilst still large, was still not as extreme as recently during 2022.

If excluding these working capital movements, the second quarter of 2022 saw their underlying operating cash flow at $25.1m, which was more than 100% higher year-on-year versus their previous equivalent result of $9.8m during the second quarter of 2021. Unfortunately, this was not carried forward into the third quarter with their underlying result sliding to negative $12.2m, thereby making for a complete wipe-out year-on-year versus their previous equivalent result of $9.8m during the third quarter of 2021. Whilst the third quarter is notoriously tough due to their seasonal financial performance, sadly, it was particularly bad in 2022 due to various unexpected market and economic headwinds impacting their sulfur and natural gas liquids business segments, as per the commentary from management included below.

“However, the Sulfur and Natural Gas Liquids segments experienced volatility during the third quarter. In the Sulfur segment, both the fertilizer and sulfur groups faced pricing instability resulting in lower fertilizer sales volumes. In addition, the pure sulfur business was impacted by unplanned maintenance expense related to the marine assets deployed in support of the business. Finally, within the NGL segment the butane blending market was negatively impacted by steeply falling prices in September, resulting in a significant non-cash inventory value adjustment.”

-Martin Midstream Partners Third Quarter Of 2022 Results Announcement.

This is a reminder that the market both gives and takes away, as commodity price movements, much like economic conditions are outside of the control of management. Ideally, across time these should be skilfully managed accordingly but realistically, no one is perfect and as such, unitholders have to take the good with the bad. Following these unexpected headwinds, they have now revised their guidance for the fourth quarter of 2022 lower, along with their full-year guidance, as per the commentary from management included below.

“Although the markets and the factors that influence them are unpredictable at this time, the Partnership has been able to improve our financial results year over year. However, as commodity prices continue to move erratically from the risk of a global recession and fears of weak oil demand, we are revising our fourth quarter adjusted EBITDA guidance to between $19 and $24 million, resulting in a range of $116 to $121 million for full year 2022.”

-Martin Midstream Partners Third Quarter Of 2022 Results Announcement (previously linked).

Whilst lower guidance is nothing positive, their new range for full-year 2022 is still above their previous result of $114.5m during 2021. As such, in the grand scheme, these recent headwinds are not a particularly big deal nor reflect structural problems, especially as the remainder of their business segments performed strongly during the third quarter of 2022. To this point, their terminalling and storage segment saw its operating income increase year-on-year to $5.6m from $4.3m, whilst their transportation segment saw an even larger increase to $12.1m from $3.9m across these same two points of time.

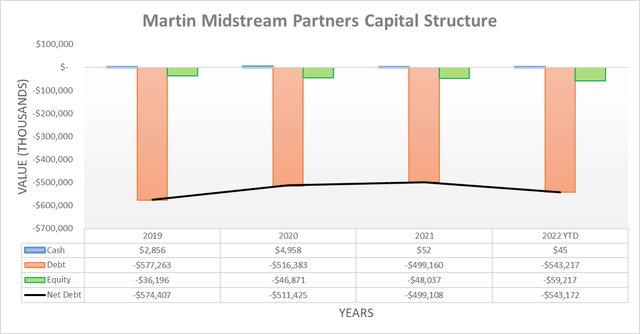

After having initially seen their net debt decrease in the first quarter of 2022 to $483.1m from $499.1m at the end of 2021, their working capital builds during the second and third quarters have now left it higher at $543.2m. Although this is not necessarily ideal, if not for this routine seasonal event, their net debt would have otherwise been broadly flat and thus should not be considered a reason for concern as these builds should reverse into draws in the future.

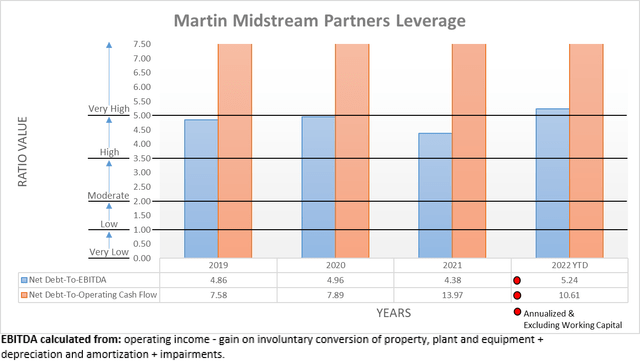

When moving onwards to their leverage, unsurprisingly, their net debt-to-EBITDA and net debt-to-operating cash flow both increased following the second and third quarters of 2022 on the back of their higher net debt. These are now sitting at 5.24 and 10.61 respectively, up from their previous results of 3.02 and 4.75 following the first quarter. Although this change seems extreme and now sees both above the threshold of 5.01 for the very high territory, given their seasonal financial performance, it would be prudent to wait until their fourth-quarter results before making any assertions.

More importantly, they continue making progress reducing their adjusted leverage ratio that is defined by their credit facility and carves out working capital movements within their seasonal financial performance. Under the terms of their credit facility, it contains a covenant whereby they cannot declare quarterly distributions above their current tiny rate of $0.005 per unit, unless their adjusted leverage ratio is below 3.75, as was discussed in detail within my previous analysis. Very excitingly, their latest result of 3.63 is now actually beneath this limit, albeit only to a small extent, as per the commentary from management included below.

“The partnership’s bank-compliant adjusted leverage ratio at the end of the quarter was 3.63x, which incorporates our working capital supplement debt carve-out related to our seasonal NGL inventory build. The actual debt increase attributable to the NGL inventory build was approximately $95 million while the maximum debt carve-out allowed for the quarter was $50 million.”

-Martin Midstream Partners Q3 2022 Conference Call.

Whilst management is obviously yet to have increased their distributions nor discussed the process publicly, it should now only be a matter of time, thereby placing it on the radar in 2023. I suspect they will wait until their adjusted leverage ratio is lower, likely around 3.25 to provide a margin of safety in case market events outside of their control impact their financial performance once again. Especially because they also face a large debt refinancing on the horizon in 2023 that is a top priority, as subsequently discussed.

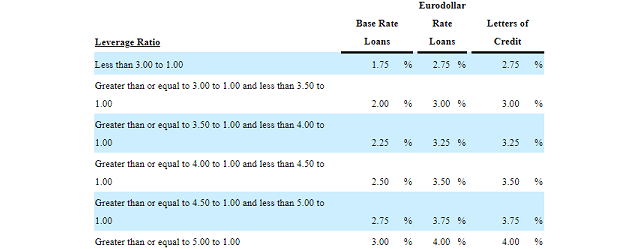

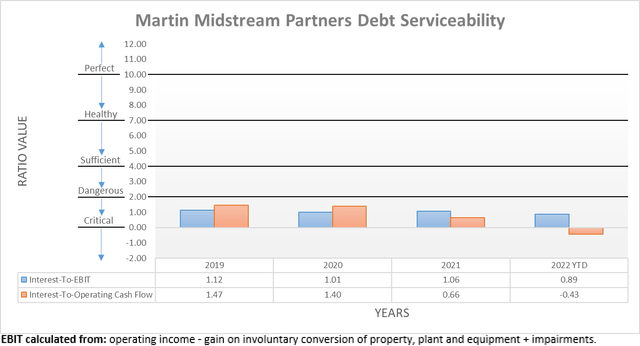

Apart from creating scope for distribution growth, pushing their adjusted leverage ratio lower also helps enhance their debt serviceability, which is becoming increasingly important to consider as interest rates climb rapidly. This is particularly useful because as it stands right now, their interest coverage is dangerous at only 0.89 when compared against their accrual-based EBIT, whilst their negative operating cash flow renders any cash-based comparison useless. Their credit facility, which houses around one-third of their total debt, sees its interest rate vary not just on SOFR but also on their adjusted leverage ratio.

Martin Midstream Partners 2021 10-K

The lower their adjusted leverage ratio, the lower the fixed component of the interest rate on their credit facility debt. Whilst this alone does not necessarily make or break their partnership, it nevertheless creates another motivation to push their adjusted leverage ratio lower, thereby helping combat the impacts of rapidly tightening monetary policy.

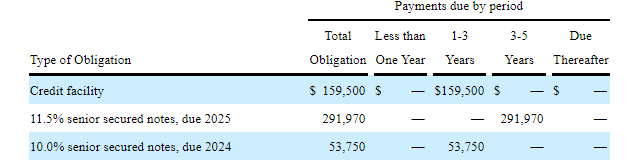

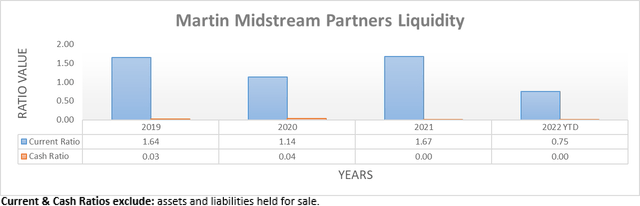

Following the second and third quarters of 2022, their liquidity saw its current ratio plunge to 0.75 after ending the first quarter at 1.68. Whilst still adequate, this change stems from their current liabilities now including a large $200.7m of debt maturities relating to their credit facility, which thankfully, they have already begun the process of refinancing, as per the commentary from management included below.

“The credit facility borrowings are shown as current on our September 30 balance sheet since the facility matures on August 31, 2023. We are in the process of amending and extending the credit facility and believe we will be successful in that endeavor.”

-Martin Midstream Partners Q3 2022 Conference Call (previously linked).

Since they have until August 2023 to address this debt maturity, they should have ample time but nevertheless, it still provides another hurdle stopping management from pushing their distributions higher right now, despite the progress with their adjusted leverage ratio. Once completed, at least they only see a relatively minor maturity of $53.8m during February 2024, thereby making for an easier year before having to deal with their far larger $292m debt maturity in February 2025.

Martin Midstream Partners 2021 10-K

Conclusion

I suspect the refinancing of their credit facility will be a catalyst to see distribution growth or if not, at least, see discussion returning with a broad timeline because their adjusted leverage ratio is now below the covenant limit imposed by the said credit facility. Whilst the market created headwinds recently, structurally nothing is wrong with their partnership and investors should remember, the market both gives and takes away and thus as a result, I believe that maintaining my strong buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Martin Midstream Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment