chinaface

Introduction

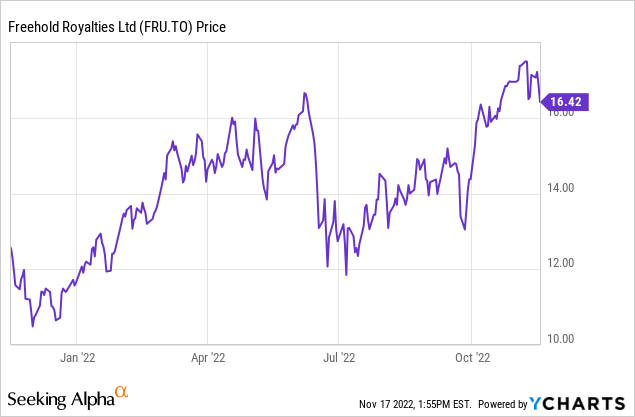

Royalty companies are still one of the easiest ways to gain exposure to the oil sector. As this type of companies gets a percentage of the top-line revenue, its financial performance should be roughly in line with how the oil price trades (minus the overhead expenses and normal business expenses). I bought Freehold Royalties (TSX:FRU:CA) (OTCPK:FRHLF) in 2021 and the share price has doubled since. As the cash is gushing in, Freehold has acquired more assets and has hiked its monthly dividend multiple times.

The third quarter was once again strong, and the cash flow remains robust

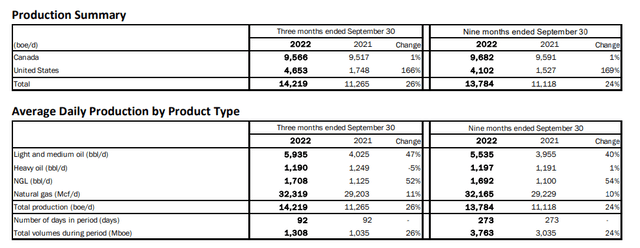

During the third quarter, the average attributable oil production rate was 14,219 barrels of oil-equivalent per day. Approximately 30% of the production now comes from the United States as Freehold has been focusing on increasing its exposure to US assets through acquisitions. Interestingly, only about half of the oil-equivalent production actually consists of oil. Natural gas liquids make up over 10% while the natural gas output represents approximately 38% of the oil-equivalent production.

Freehold Royalties Investor Relations

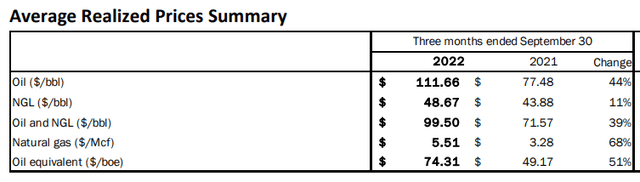

During the quarter, the company recorded an average oil price of just over C$110/barrel while the average realized natural gas price was C$5.51, resulting in an average realized price of just over C$74 per barrel of oil-equivalent. That’s an increase of approximately 51% compared to the third quarter of last year, thanks to the 68% increase in the average realized natural gas price.

Freehold Royalties Investor Relations

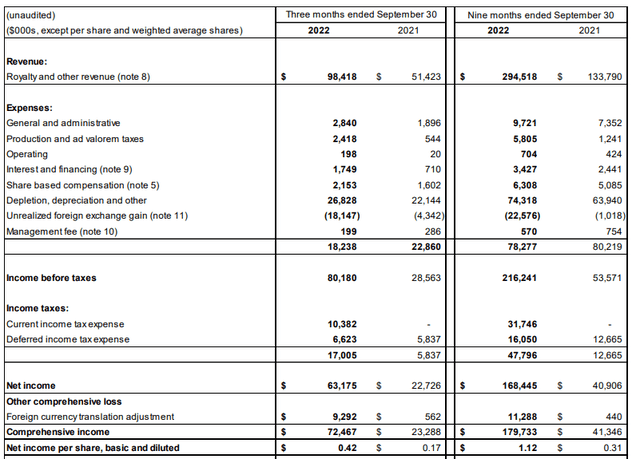

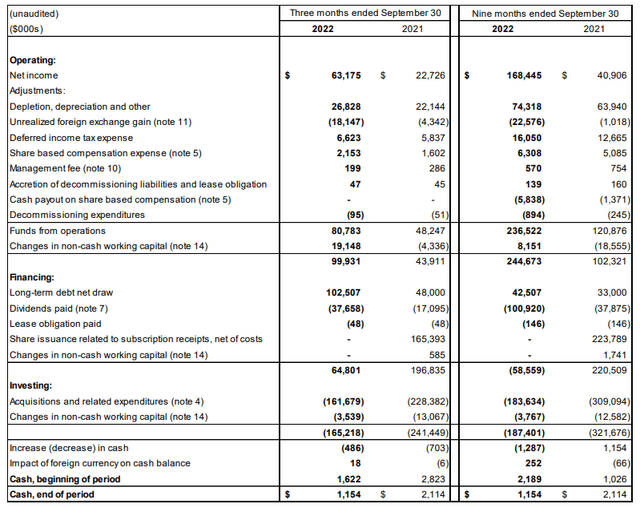

This resulted in a total revenue of just over C$98M and as you can see below, the total operating expenses came in at just C$18M thanks to a C$18M FX gain. Freehold’s bottom line shows a net income of C$63M, for an EPS of C$0.42.

Freehold Royalties Investor Relations

Of course there’s more than meets the eye here, and royalty companies should be valued based on a cash flow perspective. The C$18M in FX gain is a non-cash gain but on the other hand, the C$27M in depreciation and depletion charges and the C$2.2M in share based compensation aren’t cash expenses either.

So while the Q3 EPS of C$0.42 and the 9M 2022 EPS of C$1.12 appear to be attractive, it’s also very important to pull up the cash flow statement. As you can see below, Freehold reported a C$81M funds from operations. That also is the free cash flow (after deducting C$48,000 in lease payments) as a royalty company does not have to contribute a single dollar to the ongoing capital expenditures on an oil asset. Freehold buys a royalty, pays upfront in cash, and that’s it. This means the depletion and depreciation expenses are just an accounting element.

Freehold Royalties Investor Relations

Of course, no oil field will produce forever, but the operators will obviously do their best to squeeze as many barrels oil and as many cubic feet of natural gas out of the assets. And Freehold can use the incoming cash flow to acquire new royalties on other assets.

The dividend is well covered, even if the oil price goes down

Freehold recently increased its monthly dividend to C$0.09 per share per month. As there are just under 151 million shares outstanding, the dividend is costing Freehold about C$13.5M per month. Considering the EPS was C$0.42 in Q3, the C$0.27 in dividends going forward would be easily covered.

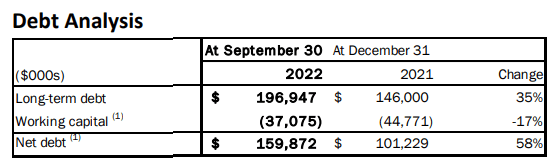

The coverage ratio improves when you compare it with the free cash flow. The Q3 free cash flow result was just over C$80M which means the C$40M in dividend payments at the current dividend yield are well-covered. The remainder of the cash will be used to strengthen the balance sheet. As of the end of September, Freehold Royalties had a net debt position of just under C$160M although the calculation method used by the management is a little bit unconventional.

Freehold Royalties Investor Relations

Rather than deducting the cash position from the gross debt position, Freehold assumes the working capital elements are “as good as cash.” That’s original and not necessarily wrong, but keep in mind the official net debt position is based on an unconventional calculation method.

As Freehold is able to retain quite a bit of cash, the net debt and gross debt should decrease which will also have a positive impact on the interest expenses in the long run.

Investment thesis

Although I recently reduced my exposure to Freehold Royalties (I basically took my initial investment off the table) I still am a shareholder. The dividend is well-covered with a payout ratio of approximately 50% based on the Q3 cash flow which means that even when the oil price and natural gas prices decrease, the dividend will still be covered.

Generally speaking, the current dividend remains fully covered up to a 40% decrease in realized prices compared to the realized prices in Q3. That’s the theory. Freehold Royalties uses a 60% payout ratio as its dividend policy and if we are entering in a prolonged period of oil prices between $60 and $70/barrel the dividend will obviously be cut to a level in line with the payout ratio. But as the management mentioned on the conference call the current monthly dividend will be maintained based on a longer-term oil price of $75 oil, I don’t expect to see any changes anytime soon.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment