sturti

The late, great John Bogle, founder of Vanguard, did a lot for the retail investor, including creating the concept of the 60/40 portfolio mix. What he couldn’t do while he was alive was to stop those investors from turning a good idea that worked for a while into something that would one day stoke over-confidence, and blind investors and financial advisors to the inherent weaknesses the so-called “balanced” portfolio.

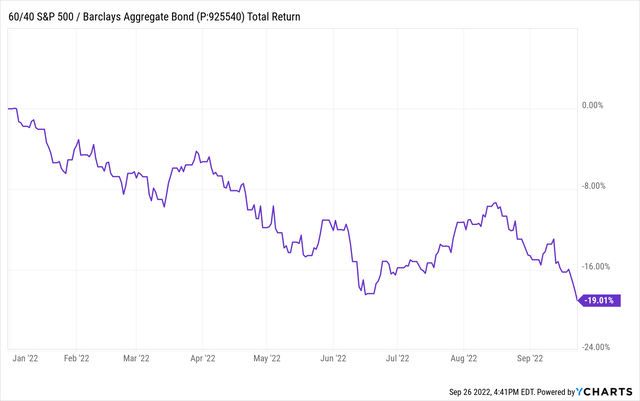

Here is the slippery slope that has been that 60/40 mix so far in 2022.

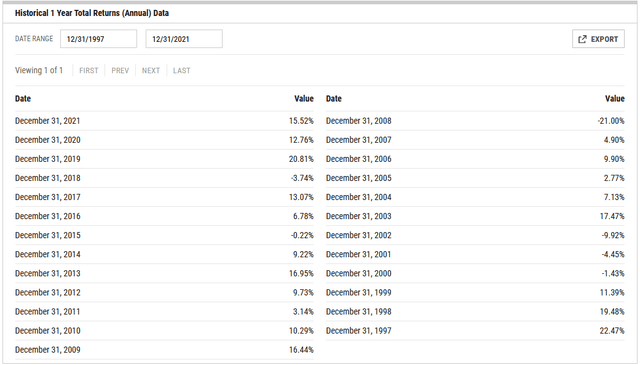

And below, you can see the annual return for that same mix of 60% S&P 500 (SPX) and 40% Barclays Aggregate Bond Index (BBUSATR), re-balanced annually. It won’t take much for 2022 to surpass 2008 as the worst-performing year for 60/40 since 1997.

What – no more roses and puppy dogs?

While it would be easy to dismiss this year’s nearly 20% decline in that asset mix as just a blip on the radar, I’m here to tell you it’s not that simple. For balanced investors and the Wall Street machine that has made “60/40” a familiar phrase to many, the reckoning is in progress. And this time, the reason this traditional asset mix has seemingly always turned itself around quickly is no longer likely. The stock market is in bad enough shape, with the S&P 500 again hovering in 20% decline territory. But this time, the bond market is not cooperating to save balanced investors.

Federal Reserve interest rate policy appears to be aimed at breaking the “easy money” era created by … the Federal Reserve! Unless they do a mea culpa and reverse course on rates soon, bond rates could edge higher for a while longer. That, and the precarious position faced by S&P 500 investors (and stock market investors overall) combine to create a potential no-win situation for the 60/40 crowd.

Complacency – brought to you by your local financial advisor

As someone who has spent three decades in the financial advisory space and experienced it from the inside and out, I think there are some additional worries for 60/40 investors that are not as obvious as falling stock and bond markets. You see, the industry has committed so deeply to the stock/bond allocation concept, and had investors pour so much money into it as a “long-term, set it and forget it” investment mix, pivoting from that position as quickly as they need to in 2022 might be difficult.

That’s what happens when you don’t see the writing on the wall. After all, the 10-year U.S. Treasury Bond has spent the majority of the past decade under a 3% yield. That means rates had fallen for many years prior, which inflated bond returns so high that they looked like equity returns. I believe many investors, be they clients of financial advisors or self-directed ones, are just getting familiar with the idea that bonds can drop in price significantly, and not recover for years.

This comes at a time when so many investors of my generation, the baby boomers, can least afford to have both parts of their balanced portfolio misfiring at the same time. And what are Wall Street cheerleaders for 60/40 portfolios doing? Some are shoveling “advice” like “just hang in there,” “corrections are healthy,” and “be a long-term investor.” That’s like saying french fries are healthy, and that 60-year-olds should ignore the next 10-20 years, while “everything works itself out” in the markets. Hogwash!

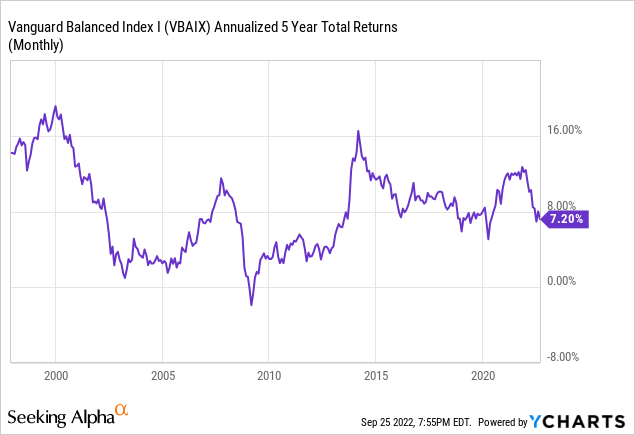

The chart above shows the history of five-year “rolling” total returns for one of the longest-tenured balanced funds, the Vanguard Balanced Index.

This is indeed a picture that has helped promote complacency. For nearly all of this century, you could invest in a 60/40 mix and usually produce a five-year return of 6%-12%. Only during the Global Financial Crisis did you take a “goose egg” for a five-year period. But remember, this chart does not show a historically overvalued stock market at the same time an inflation-fighting cycle of interest rate levitation is in its early stages. That is what we have now.

Keys to a modern investment allocation

So, if you agree with me that 60/40 and other balanced portfolios are on the outs as a go-to core portfolio, what can you do as an alternative? As someone who has devoted about two decades to solving this inevitable problem for investors, let’s start with my “big 3” things you can do to start to turn your 60/40 ship around. Hint: it has nothing to do with changing what’s in the 60/40 mix.

Markets are in a “regime change”

It starts with embracing the regime change that is rapidly occurring in financial markets. If you can acknowledge that, you have taken the first step toward giving yourself a fighting chance as markets begin to reward very different behaviors than in the past decade. No longer can you simply buy stocks or an index fund and hold them without taking on historically high risk.

These are not our parents’ markets. They are driven in large part by “indifferent” investors: index funds and high-frequency traders. Index funds don’t care what they buy and sell. They are simply trading to meet the demands of investors who add or remove assets from their funds. To the astonishment of many investment veterans, index funds have yet to suffer massive outflows. At some point in this cycle, that is likely. And, when that happens, it won’t matter what you own if its swept up in a wave of index selling.

High-frequency traders, hedge funds, and the dramatic increase in retail investor day trading is another new factor that can create more friction for 60/40 types than in the past. Market gyrations are being augmented by the increase in investment capital that is more concerned about “scalping” a small price movement than what it is they are trading. This all throws a wrench into the way markets trade.

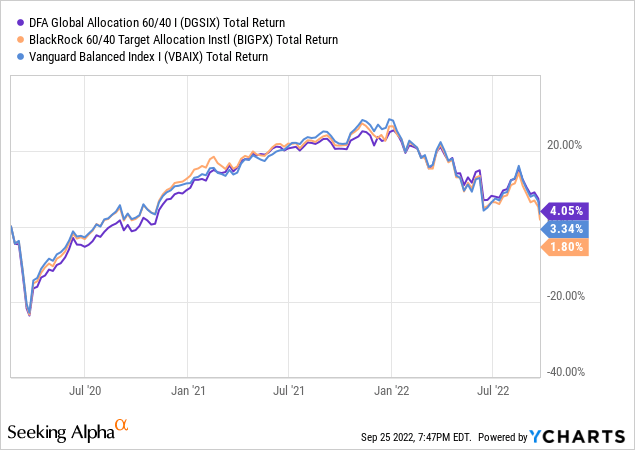

Here is a picture of what the change in fortune for 60/40 portfolios looks like. The chart below shows the recent return path of DFA Global Allocation 60/40 I (DGSIX), Blackrock 60/40 Target Allocation Institutional (BIGPX), and Vanguard Balanced Index I (VBAIX). These three popular mutual funds all use that “classic” allocation approach, and the chart shows their returns since the market peak on Feb. 19, 2020, as the COVID-19 pandemic began to disrupt our lives.

The total return of all three funds over that 31-month period ranges from about 2%-4%. If you paid an advisor to buy you one of these, you broke even or lost money. And as noted above, this does appear to be anything close to the bottom of this market cycle.

The Fed isn’t likely to pivot – but you can

I would characterize the current market climate for stocks and bonds as “the end of the beginning.” The first eight months can be summarized as follows: the stock market fell, then rallied, but gave back the rally. And it never truly challenged the series of lower lows and lower highs that have occurred in the S&P 500 Index since the top on Jan. 4 of this year.

Meanwhile, bond yields have spiked, particularly at the short end of the yield curve. While there is an argument to be made that rates have gone too far, too fast, the Fed appears committed to stopping inflation from being persistently high at all costs. My chart work tells the same story: Rates can always pull back down temporarily after such a sharp upward move. However, the weight of the evidence from my view is that higher rates, and probably much higher rates, are in store before this cycle ends. In other words, do not expect some Fed “pivot” where they see the economy cracking and step in again to save the day.

Instead, the pivot you should be focused on looks as follows.

Profit from down stock and bond markets

It annoys the heck out of me when I hear big Wall Street pundits say things like “all you can do is raise some cash.” I have been using a variety of “bear market” ETFs for many years and stress-tested them thoroughly. The results? I am confident that there is wide variety of moves investors can make in portfolios to defend against bear markets in stocks and bonds, and even exploit sustained market declines for their benefit. I call it “flipping the script.” Simply put, if the market is going down all year for this year and perhaps much of next year, why not consider owning ETFs that by their mandate and prospectus, exist to profit from such a scenario?

My suspicion is that the main reason so many investors do not know about these instruments, or don’t know how to use them, is that there are too many folks in the advisory industry whose livelihood depends on “set it, forget it, and rebalance quarterly” to continue making a fat living. Seeking Alpha is an ideal place to research and learn to understand an array of “bear market beaters.”

Tactical management

As I noted above, the balanced portfolio mix is complicated by the change in the mix of market participants. I can remember back about 25 years ago when I too was a devoted “strategic asset allocator.” But tactical management – i.e. rotating more rapidly among different types of ETF sectors, themes, and between offensive and defensive positions – is entering its golden era. The markets simply don’t allow you anyone but the very patient and risk-tolerant to invest without regard to short- to intermediate-term market volatility.

60/40 could be a “buy” again, but from what level?

There will reach a point in this market cycle where bond rates are sky-high and showing signs of topping out. That might occur in the vicinity of when the stock market is carving out the lows for this cycle. But rather than count on that happening, as so many investment pros with crossed fingers are currently doing, be proactive in meeting the bear where he lives. After all, he might stay a lot longer than you think. It’s one thing to start the next bull cycle with 90 cents of the dollar you started with. It’s another to do so with only 70 cents, perhaps much less.

Markets have changed. Change with them.

Don’t make the critical error that so many investors in past market cycles have made. Do not just sit there and wait for “the bottom.” The last two sustained market declines each saw the S&P 500 fall roughly 50% from peak to trough. And it was years before they even recovered to where they started.

Now, with bonds joining in the festival of red ink, there exists the possibility that the recovery of 60/40 and other balanced portfolio mixes could take much longer than in past recoveries. And to repeat, we are likely at the end of the beginning of this cycle. Sadly, for some investors this was the easy part. The next phase could be the one that takes the existing portfolio storm and turns it into a category 4 hurricane.

The tools are there – learn to use them

There are ways to not only defend but capitalize on whatever happens from here. Investors simply need to avail themselves to the modern tools made available to them, in large part through innovative ETFs that have already been stress-tested in bear markets.

But, above all else, the first step is to acknowledge that this is a regime change in the way markets work. It is a psychological hurdle that some investors will leap over, while others continue in a state of denial. Choose wisely, get educated, and act with conviction. These are not the markets of yesteryear. And your 60/40 portfolio is no longer your friend.

Be the first to comment