Justin Paget

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Why Boring Stuff Matters In The End

OK, first the disclaimer. Not the securities disclaimer, you have that already. Different kind of disclaimer. Here at Cestrian Towers, we know nothing about Enphase Energy (NASDAQ:ENPH). You can stop reading right here if you want to. Or join us on a voyage of discovery as we apply our usual fundamental and technical analysis tools to this stock.

Allow us to explain. Based on watching one of our favorite YouTuber’s videos on the stock – yes, yes, we know, but some YouTube stuff is good, ours for instance – we bought into Enphase Energy stock last year, suffered a move down, held, and then sold when it made a new all-time high recently. A nice solid gain, had better, had worse, but gains are gains, and in this environment, they’re not to be sneezed at in our opinion. The “sell” decision was a relatively easy one. Firstly, generally speaking, rips are being sold at present, so why go against the grain; secondly, the stock popped on an unexpected alignment between Sen. Manchin and his own party which lead to the “Nobody Say It’s Actually Inflationary” Inflation Busting Bill getting passed and with it a bunch of clean energy spending made available. So, we said, thanks Sen. Manchin for the gift, we shall cash it in and pocket the gains.

Predictably, the stock continued to move up, but we ignored it on the basis of this not seeming very much like an environment in which to chase stocks up after they make new all-time highs. It will come back, we figured, and we can consider buying back in at that point.

Well, it came back. So we thought we should do some actual work to figure out whether to put money back into this thing. And we thought you might be interested in that work and the opinion we formed. There are many, many smart folks who write about ENPH and clean energy in general, and we make no claim to hold a decarbonized candle to them. But we do know a good business on fundamentals when we see one, and we can read a stock chart as well as the next armchair fund manager. Better yet, ENPH is a technology business really, and that’s our fat pitch extraordinaire. So, here goes.

Bottom line? The company has a weak business model that features relatively little intellectual property, a balance sheet that’s looking thin and thinner, and a vertical integration model achieved through sequential acquisitions. This sounds all meh-so-what, but, vertically integrated business models like this are usually found in early phase markets where customers want a single throat to choke, absent a rich ecosystem of viable vendors across the value chain. And such vertically-integrated plays can work while the market is early, the spending ramp is strong, and nobody is looking too closely at anything much below the revenue line or above the EPS line. But at some point, this stuff does matter, and since has already established we know nothing about clean energy, we slap a Hold rating on the stock and, indeed, we have yet to buy back in with our own money – because we don’t know when sentiment in clean energy will change, and we don’t know when folks will start looking a little closer at companies like this as a result.

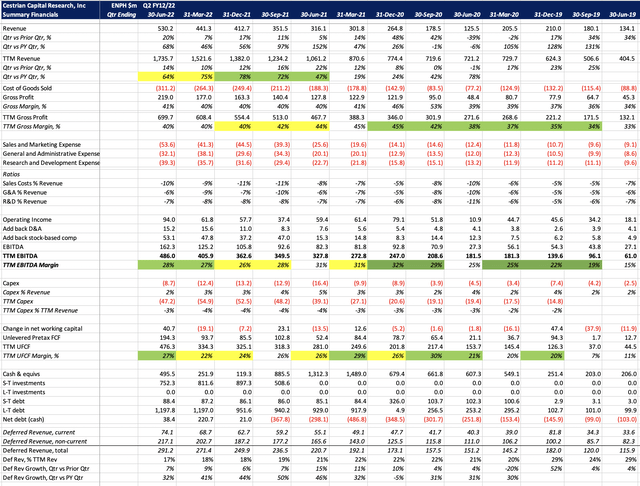

Allow us to explain. Here’s the summary fundamentals.

ENPH Fundamentals (Company SEC Filings, YCharts.com)

Let’s step through the key lines together.

- Revenue growth is very strong – the most recent quarter was +68% on the same period last year. The trend is inconsistent, a result of acquisitions amongst other things, but the slow-burn TTM growth line has shown a slowing in growth in the last two quarters.

- Gross margin is low, very low for a technology business, at 40% on a TTM basis. And this tells a story if you know how to listen. In tech companies, the gross margin % is a very good proxy for “how much of the revenue is achieved by selling products whose intellectual property is owned by the company in question.” Software companies have very high gross margins because their products are almost entirely their own IP, and they also have no bills of materials to worry about (those two factors are not independent of one another, of course). Distribution companies have very low gross margins because they just sell stuff that other people design and make. The range you might think about is, 80% or above is doubleplusgood; 30% or below is doubleplusbad. ENPH sits at 40% and that tells you that much of the revenue is relatively low quality. We’ll come back to this in a moment.

- EBITDA margins however are very strong at 28% on a TTM basis, and this is mainly because the company spends little on HQ, sales or R&D costs. By the way, the low R&D spend (7-8% of revenue most quarters) is a further tell that much of the revenue is achieved by reselling third-party products.

- Unlevered pretax FCF margins are also strong at 27% on a TTM basis. There’s scant capex, and in addition, the working capital profile appears to be managed fairly well.

- The balance sheet is not much of a fortress. There’s $1.25bn of cash and short-term investments, which is good of course, but including short- and long-term loans the company is very slightly in a net debt position rather than the net cash position it occupied for much of its life in recent years.

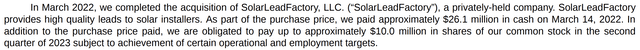

So what we have here is in essence a high-growth technology integrator with some of its own intellectual property, but a penchant for buying companies in the sector even at a relatively low scale and which have low scalability business models themselves. See for instance this from the company’s Q2 10-Q. $22m plus stock to buy a lead-gen dial-for-dollars business? That’s not the mark of a high-quality shop in our view. The acquisition is too small to move the needle (or should be) and lead gen is not even really revenue unless the underlying provider is paying commissions and if the underlying provider is Enphase Energy which now owns the lead gen business… you see the problem.

Extract from ENPH Q2 10-Q (Company SEC Filings)

In normal markets, you can expect to pay low multiples for low gross margin companies like ENPH. This is not however a normal market – despite the overall selloff hitting growth companies hard, the clean energy sector has the wind at its back, which is keeping multiples high for names in the sector. In our software company coverage, you will find us not shy of calling a Buy for companies trading at huge multiples of revenues – as long as they have the business model strength to get them through the bad times. At ENPH we do have high growth, but we don’t have high gross margins, we do have thin R&D spending which will probably come home to roost at some point, we do have very low revenue visibility (remaining performance obligations even looking several years out amount to just 17% of TTM revenue, according to the company’s most recent 10-Q), and we do have a balance sheet moving into a net debt position.

So should you consider buying ENPH? The answer isn’t no, because trends with the winds in their sales can keep stocks moving up for way longer than their fundamentals suggest they should. Let’s turn to the stock chart for a view on this.

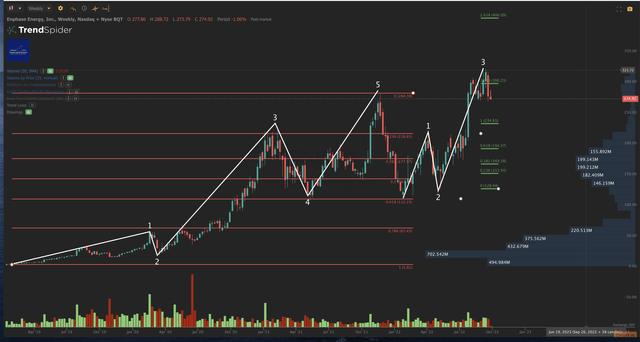

The stock looks in a risky position to us. You can open a full page version, here.

ENPH Stock Chart (TrendSpider, Cestrian Analysis)

After a strong 5-wave upcycle from the 2018 lows to the 2021 market highs – forming a larger degree Wave One – the stock then put in a larger degree Wave Two troughing at a textbook 0.618 retrace of the whole 2018-21 move up. It then has put in a 1 up, 2 down, 3 up move and currently sits a little over the textbook Wave 3 termination level of the 1.618 extension of the Wave 1 that ended in April 2022. This looks like a good place to put in a Wave 4 drop to us. It could move higher from here – larger Fibonacci extensions are certainly compatible with this chart pattern – but with the weak fundamentals and the overall shaky market environment, we have to ask ourselves – do we feel lucky? Do we want to chase this? And our answer is, we do not want to chase this. And so we have not bought back into the stock, and we rate the name at Hold for now. It wouldn’t take much for us to call it a Sell by the way, but trends are trends and clean energy is probably a long-run trend for a while yet, so, Hold it is.

Cestrian Capital Research, Inc – 26 September 2022.

Be the first to comment