alvarez

Thesis

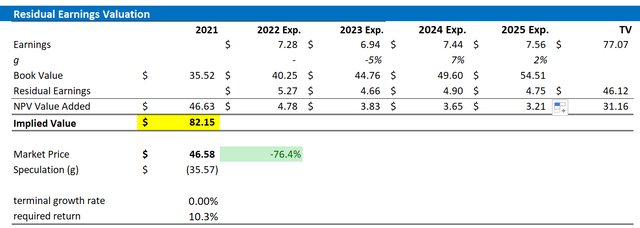

It is hard to find a comparable company that is trading so cheap versus fundamentals as ZIM Integrated Shipping Services Ltd. (NYSE:ZIM). The company’s stock trades at an estimated one-year forward (2023) P/E of x1.15, EV/Sales of x0.6 and EV/EBIT of about x2. Although I acknowledge that the current high shipping fees are likely unsustainable long term, I argue the risk/reward profile for ZIM is too favorable to ignore. I anchor my argument on a residual earnings model, which calculates more than 75% upside based on analyst consensus estimates. My target price is $82.15/share.

ZIM’s Profit Windfall

ZIM Integrated Shipping is one of the world’s largest container shipping companies, with headquarters in Israel. As of late 2021, ZIM operated 113 vessels across five key shipping routes- Transpacific, Atlantic, Cross Suez, Intra-Asia and Latin America. ZIM serves customers worldwide.

On the backdrop of global supply congestions, ZIM Integrated Shipping has benefitted enormously. For the past twelve months, the company generated total revenues of $13.7 billion, more than triple the $$4.0 billion in 2020. ZIM’s net income increased tenfold: from 500 million in 2020 to $6.2 billion for the trailing twelve months. The profitability push was driven by both higher sales levels and a net-profitability margin expansion of about 33 percentage points. Arguably, these numbers are not sustainable long-term, but the company’s June quarter implies that the profitability windfall will likely continue long enough for shareholders to make a material profit.

According to analyst consensus, revenues are expected to slow gradually and for 2023 and 2024 are estimated at $13.45 billion and $9.27 billion. Respectively, EPS is estimated at $14.29 and $5.52 (Source: Bloomberg Terminal, August 17)

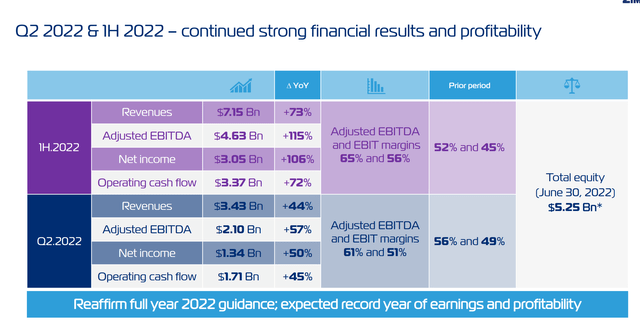

A Strong June Quarter

ZIM reported results for Q2 2022 on August 17 and beat analyst consensus estimates on all metrics. During the period from April to the end of June, ZIM generated total revenues of $3.43 billion, representing an increase of about 43% year over year. EBIT jumped by 52% to $1.76 billion and net income by 50% to $1.34 billion, or §11.07/share. Also, I would like to highlight that ZIM is not reluctant to distribute the profit windfall to shareholders. Following Q2 2022 results, ZIM has announced to pay $571 million, or $4.75 per share, of dividends – which is approximately 30% of the quarter’s net income. ZIM closed the quarter with $4.82 billion of cash and cash equivalents and total debt of $4.3 billion.

CEO Eli Glickman commented:

We reported today strong Q2 results … as well as our best ever first half-year results with standout margins, among the highest of our liner peers.

Although Glickman highlighted, that:

Over the past several weeks, we have seen a gradual decline in freight rates, including in the transpacific trades, despite continued port congestion and resilient demand, driven by macroeconomic and geopolitical uncertainties

The company reaffirmed guidance for FY 2022. Revenues are expected to reach approximately $13.5 billion and adjusted EBIT is estimated between $6.3 billion to $6.7 billion.

Residual Earnings Valuation

Let us now look at the valuation. What could be a fair per-share value for ZIM stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on ZIM’s cost of equity at 10.3%.

- I model a dividend payout ratio of 35% of net income.

- To derive ZIM’s tax rate, I extrapolate the 3-year average effective tax rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply 2 percentage points to reflect growth in line with nominal GDP growth.

Based on the above assumptions, my calculation returns a base-case target price for ZIM of $82.15/share, implying material upside of more than 750%.

Analyst Consensus; Author’s Calculation

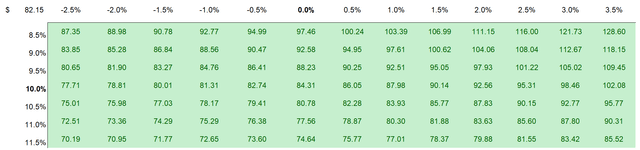

I understand that investors might have different assumptions with regards to ZIM’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus Estimates; Author’s Calculation

Risks To My Thesis

ZIM is a global shipping company whose business fundamentals are closely correlated to the health of the global economy. Accordingly, a slowing macro-environment might negatively impact ZIM’s financials. Moreover, and perhaps more notable, ZIM has benefitted enormously from the global supply chain congestions and an improvement/worsening of supply chain would negatively/positively impact ZIM.

Conclusion

Every company for which a residual earnings model indicates more than 75% upside is a Strong Buy. Accordingly, I advise investors to consider taking advantage of this enormously favorable risk/reward and consider accumulating a position. My personal base-case target price for ZIM is $82.15/share.

Be the first to comment