metamorworks/iStock via Getty Images

Investment thesis

When I perform a fundamental analysis of a company, I like to check its mission statement and want to see a simple, inspirational, yet actionable statement. Within a couple of words, the mission statement is giving me a very clear notion of the company’s ability to focus its commitment and strategy to achieve its goals. Within two words “Empowering others” Microsoft’s (NASDAQ:MSFT) mission statement is so powerful and it resonates with all that the company has achieved and continues to offer.

Our mission is to empower every person and every organization on the planet to achieve more.

Microsoft is creating an edge not only for its customers, but also for its investors. The company is aggressively investing in its business segments to create long-term value and expand its established leadership in many product categories. With stellar returns for its investors in the past, Microsoft is now setting the milestones for the next round of great achievements in huge secular growth trends. While some investors are mostly focusing on finding the cheapest stocks, I prefer to look at companies that can consistently create massive value for their investors and have stellar growth prospects. Microsoft is one of them, and my rather conservative valuation model prices the stock’s fair value at $366, with a 25% upside potential from its last closing price.

A quick look at Microsoft

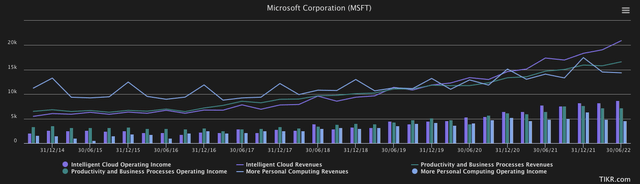

Microsoft Corporation is a worldwide leader in software development, and licensing and offers services, devices, and solutions through its three segments, Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. The Productivity and Business segment comprises Office subscriptions and Office license on-premises products such as Exchange, SharePoint, Microsoft Teams, Office 365 Security and Compliance, Microsoft Viva, LinkedIn including Talent Solutions, Marketing Solutions, Premium Subscriptions, and Sales Solutions, as well as Dynamics business solutions, Dynamics 365, composed by cloud-based and on-premise Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) applications, Customer Insights, Power Apps and Power Automate. The Intelligent Cloud segment consists of server products and cloud services such as Microsoft SQL, Windows Server, Visual Studio, System Center and related Client Access Licenses, Microsoft Azure and GitHub, as well as Enterprise Services comprising support and consulting services. The More Personal Computing segment comprises Windows and Windows OEM licensing, Windows cloud services, Windows Commercial, Windows Internet of Things (IOT), MSN advertising, as well as devices such as Microsoft Surface PC, PC accessories, Xbox gaming, and entertainment consoles, Xbox software, games and services, subscriptions and advertising, third-party video game royalties, as well as Bing and Microsoft advertising. The company was incorporated in 1975, went public on March 13, 1986, at $21.00 per share, is headquartered in Redmond, Washington, and employs about 221,00 employees worldwide, with 122,00 in the US.

The company’s product mix implies a certain seasonality, with typically the last calendar quarter, or Q2 in the company’s fiscal year, ramping up in sales in the More Personal Computing segment, as devices, gaming but also advertising-related spending, typically see their best quarter towards the end of the year.

Microsoft’s growth drivers

Gaming without surprise could grow significantly during FY 2021, where lockdowns, work from home, and other pandemic-related restrictions, generated massive demand in that industry while slowing in the last quarter as the industry experiences a consolidation in sales. Microsoft announced the acquisition of Activision Blizzard (NASDAQ:ATVI) at the beginning of 2022, in a deal valued at $69B, and is expected to receive regulatory approval in the coming months, despite concerns raised by competitor Sony (NYSE:SONY) who claims that the company could abuse their dominant position with popular games such as Activision’s Call of Duty, which has been available on multiple platforms for early 20 years, and its title Call of Duty Modern Warfare generated over $1.9B in revenues in 2020.

Author

Microsoft’s huge investments in the gaming industry are an evident sign that the company sees potential growth in the coming years. With about 25M subscribers in 2022 and an over 58% Compound Annual Growth Rate (CAGR) over the past two years, Microsoft’s Game Pass, introduced in June 2017, will now likely gain access to Activision Blizzard’s 361M active monthly users from 190 countries. Although the company lost around 47M users YoY, its pipeline is advancing well, and it is expected to launch the long-awaited Call of Duty: Modern Warfare II, Call of Duty: Warzone 2 experience, World of Warcraft: Wrath of the Lich King Classic, World of Warcraft: Dragonflight, and Overwatch 2 in the second half of the year, with Diablo IV expected to be released in 2023.

Gaming is a very strong secular growth driver, and successful companies such as Logitech (NASDAQ:LOGI), NVIDIA (NASDAQ:NVDA), or Advanced Micro Devices (NASDAQ:AMD), and Meta (NASDAQ:META) are all greatly investing in shaping the next generation in that industry. Although in the shorter term some headwinds could partially affect revenue and margins, the long-term prospects are intact and even expanding in terms of opportunities, as I wrote about in my last article AMD Is Likely Set For Many Years Of Growth. The global video game market, valued at $221B in 2022, is expected to expand at 12.9% CAGR to $584B through 2030, led by mobile gaming which is already estimated to account for 45% of global market revenues, advanced technologies in real-time graphics rendering, augmented reality (AR) and virtual reality (VR) applications, and the growing internet penetration rate which facilitates the availability of games across the society. Despite offline gaming still representing 62% of the total market share in 2021, online gaming is projected to grow at the highest rate. The emergence of subscription-based gaming and cloud gaming will most likely be a major growth driver for Microsoft, but it comes with increased competitive pressure from Sony, with its revamped PlayStation Plus offer, Google’s parent company Alphabet’s (NASDAQ:GOOG) (GOOGL) cloud gaming service Stadia, despite the fact that it still seems to be struggling to convince its audience, and Tencent (OTCPK:TCEHY, OTCPK:TCTZF) the world’s largest game publisher by revenue, who recently announced its intention to aggressively increase its stake in French video game group Ubisoft (OTCPK:UBSFY) (OTCPK:UBSFF).

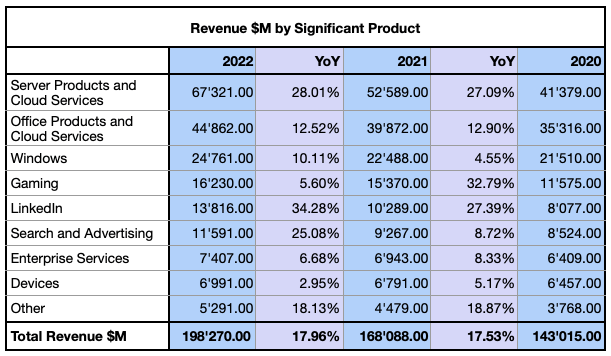

Among the most important revenue drivers, the Server and Office products as well as the related Cloud services generated about 57% of Microsoft’s total revenue in FY 2022, with significant growth rates on a Year-over-Year ((YoY)) basis. The global productivity software market is forecasted to grow at 14.24% CAGR to $98.39B through 2026, while the cloud-based office productivity software market is expected to grow much faster at 25.5% CAGR, reaching $50.7B by 2026. Microsoft is considered the market leader with Gartner (IT) estimating its dominance at over 89% in 2020, followed by Google Workspace with 10.3%, while Google was estimated to take 1% to 2% of market share yearly from Microsoft in the last few years, through aggressive spending. After 10 years without changes in pricing, the company adjusted the prices for the Microsoft 365 products on March 1, 2022, increasing on average by about 15% of its list price.

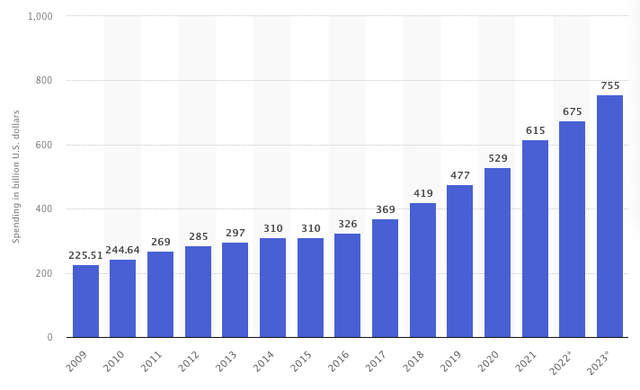

In 2022 global IT spending on enterprise software is expected to reach $675B, accelerating by 11% YoY, and the global enterprise application market, where Microsoft is the major forerunner with approximately 13% market share, is forecasted to reach $530.41B by 2030, growing at 9.12% CAGR, with companies in the healthcare, pharmaceutical, banking, financial services and insurance (BFSI), but also in the retail industry, expected to further integrate and increase the usage of such technologies.

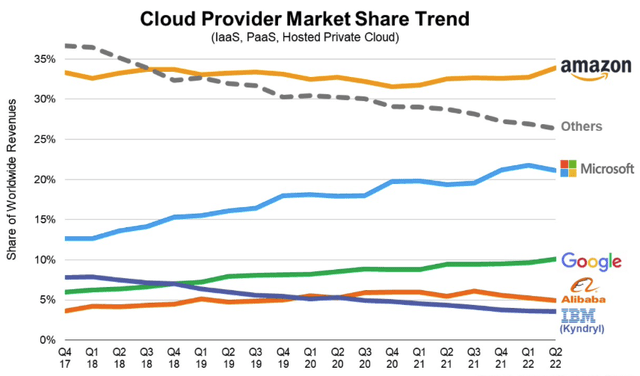

Cloud-based deployments held the majority of the market share with 57% in 2021, while on-premises software is still seen as the preferred solution, when it comes to business-critical data such as financials, corporate trade secrets, and employee privacy-sensitive data, requiring full and constant control over the software and a higher degree of security. Microsoft is the second largest cloud infrastructure provider, including Platform as a Service ((PaaS)), Infrastructure as a Service ((IaaS)), and hosted private cloud services, with a 21% market share recorded in Q2 2022, followed by Google with 10%, while Amazon (NASDAQ:AMZN) leads the market with 34% share.

The market grew at 29% YoY in Q2 2022 with the three major providers collectively covering 65% of the $205B market and leading also in terms of growth rates over their smaller peers. In the last quarter of its fiscal year, Microsoft could increase its cloud revenue by 28% YoY, surpassing $25B, despite unfavorable foreign exchange rates and a tense macroeconomic environment, with server products and cloud services increasing by 22%, driven by Azure and other cloud services up 40%. The underlying momentum in the cloud space can also be tracked in the data center segment sales of some key suppliers to hyperscale data centers. AMD’s data center segment grew 83% YoY in Q2 2022, with strong sales of its EPYC server processors notably used in both AWS and Microsoft’s Azure, and NVIDIA’s revenue from its data center segment, which is generating 40% of the company’s total sales, grew 66% CAGR over the past 5 years.

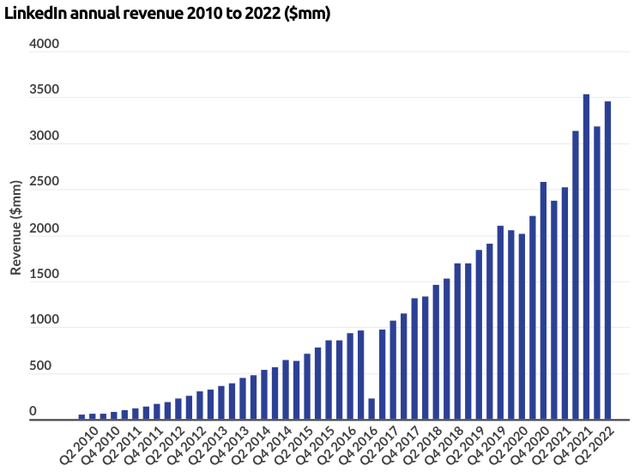

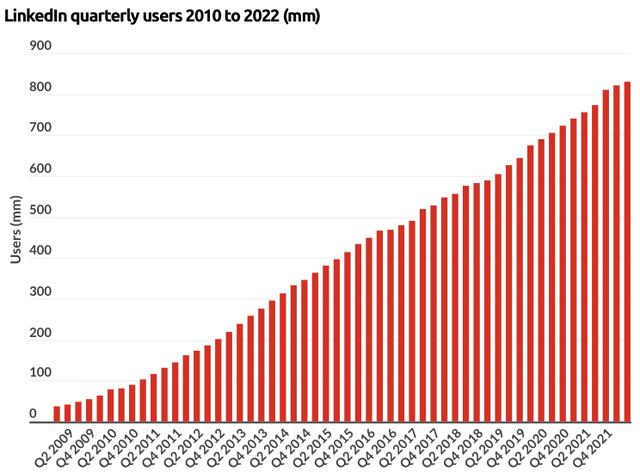

After its acquisition for $26.2B in 2016, LinkedIn has turned to be a major growth driver for Microsoft, with 26% YoY increased revenue in Q4, accelerating to 34.28% growth in FY2022. LinkedIn’s business model is based on four revenue stream segments, led by the Talent Solution segment, which generated over $6B in revenue in FY 2022, up 39% YoY, and LinkedIn Marketing Solutions which surpassed $5B in revenue for the first time, while the rest of the $13.81B in revenue was generated by LinkedIn Business Solutions and Premium Subscriptions.

Given the momentum in engagement, described by Microsoft at record levels among the 850M members of LinkedIn, the company has introduced some new functionalities supporting creators in establishing stronger connections with their audience. In particular, after the introduction of LinkedIn Live and Newsletters features, the company recently added improved content analytics and updated profile video options, as well as expanded its creator accelerator program.

What’s up next for Microsoft

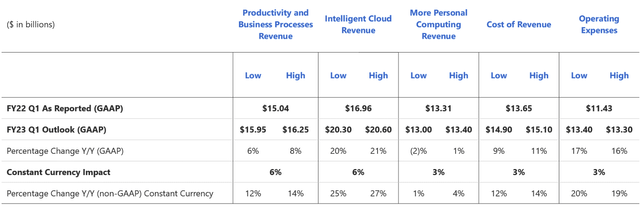

In its FY 2023 Q1 outlook the company outlined a rather surprising guidance, while the CFO Amy Hood declared:

We continue to expect double-digit revenue and operating income growth in both constant currency and U.S. dollars.

Besides the mentioned possible positive catalyst in its Gaming segment coming from the ongoing acquisition of Activision Blizzard, other major milestones are expected to be set in the coming months. Windows 11 22H2 is expected to be released in late September 2022, and is the first feature update for the latest operating system. SQL Server 2022 among other new features will provide various Azure support enhancements, and the support for Kerberos authentication could be released at Microsoft’s next Ignite event, scheduled from October 12 to 14th. Gartner predicts that by 2026, 30% of the organizations worldwide will have products and services ready for the metaverse. Microsoft Mesh for Teams is the company’s most expected Metaverse contribution that will project digital collaboration to a new level, including personalized avatars and 3-D environments. Also, Microsoft Teams Connect is rolling out into general availability, and Microsoft Loop is bringing more innovative features to its collaborative components.

By 2026, 25% of people will spend at least one hour a day in the metaverse for work, shopping, education, social and/or entertainment.

Gartner press release February 7, 2022

The Intelligent Cloud segment is expected to significantly lead the company’s revenue growth, although Azure revenue is projected to be sequentially lower by around 3%, with the company expecting growth driven by strong consumer demand and the Microsoft 365 suite momentum. Flexera’s annual State of Cloud Report 2022 reported that today’s organizations are over budget for cloud spending by an average of 13%, and expect cloud expenses to increase by 29% over the next year. 57% of the 753 surveyed IT executives reported that migrating more workload to the cloud is one of their top strategic targets for the year, along with optimizing existing cloud spending, as it is estimated that organizations waste 32% of cloud expenses. 42% of the respondents declared moving from on-premises software to Service as a Software ((SaaS)) as one of their top priorities. The report underscored also that despite Amazon being the market leader in terms of market share, the percentage of companies using Azure surpassed for the first time its main competitor in several instances. Interestingly, a survey by Nutanix in 2021 surveyed 1,700 IT decision-makers worldwide and revealed that 65% of the enterprises are expecting to be operating in a multi-cloud environment within the next 3 years and that 91% moved one or more applications to a new IT environment over the last 12 months, which underscore the importance of interoperability among multiple cloud environments. Workload distribution, security concerns, and risk diversification amidst different cloud providers as well as efficient cost management are among the main challenges addressed by a hybrid multi-cloud environment that could also alleviate some competitive headwinds.

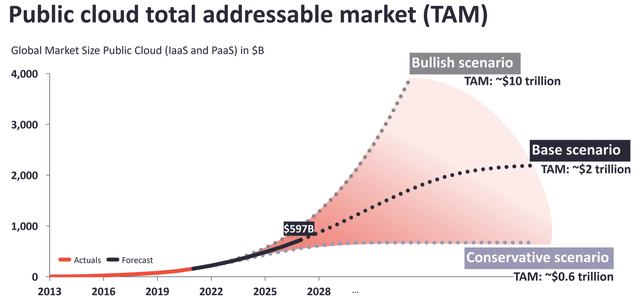

While there are different scenarios estimating the total addressable market (TAM) for public cloud services spending, it is reasonable to say that the industry experiences a huge momentum and likely will see further acceleration during the next decade. According to Gartner, worldwide IT spending will top $4.5T in 2022, with cloud end-user spending to reach $500B, experiencing the strongest growth of all segments. One of the main advantages of relying on third-party cloud services is to free up resources otherwise deployed privately in each company, such as expenses in terms of trained workforce, rent, security, infrastructure, maintenance, and insurance. Such operational expenses could make up 30-40% of the Total Cost of Ownership (TCO) breakdown, while it’s estimated that a vast majority of the computing resources are wasted, as overcapacities and suboptimal architectures and infrastructures are a common issue. The accelerating transition of that spending into cloud-related services, can further expand the TAM and increase the still relatively low 12% market penetration of cloud services compared to the total spending in IT, while at the same time optimizing energy consumption and adjusting to the real utilization of computing resources.

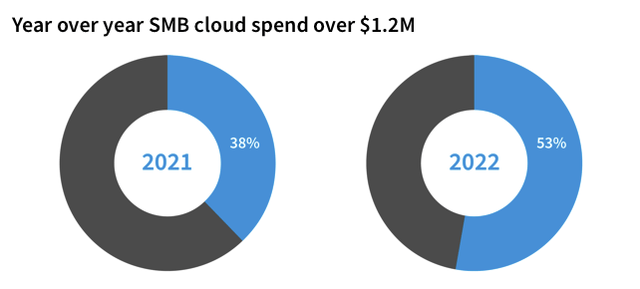

As described in my article Nvidia Is The Stock Every Investor Should Consider, investments in the cloud and data center industry are seeing massive inflows, with new revolutionizing technologies offering new opportunities, driven by the rise of emerging secular growth trends such as remote work and remote learning, the fast expansion of data-intense technologies such as IoT, Machine Learning (ML), AI, blockchain, and decentralized technologies, new consumer behaviors and rich media experiences, the digitalization of business processes and the industrial digitalization as well as, the faster adoption of digital technologies by Small and Medium-size Businesses (SMBs) which overall spending in cloud services has grown significantly and will likely be one of the growth drivers in the coming years.

Flexera 2022 and 2021 State of the Cloud Report Data

An insight into the industry

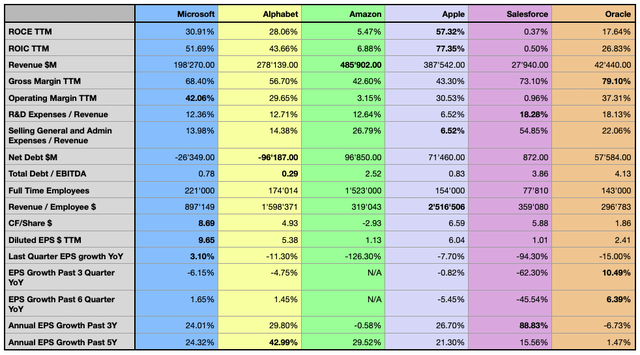

The company reported an increasing gross margin, accelerating from 16.83% CAGR over the past 5 years to 17.81% CAGR over the past 3 years and standing at 68.40% Trailing Twelve Months (TTM), outperforming the average gross margin of the analyzed peers which stands at 59%. Oracle (NYSE:ORCL) reported the highest gross margin, but could only grow it by around 2% over the past 3-5 years. In terms of operating profitability, Microsoft reported a great improvement of 23.24% CAGR over the past 5 years, growing 24.74% CAGR over the past 3 years, establishing its margin at 42.06% TTM, significantly over the peers’ average which stands at 20.32%, with Amazon and Salesforce (NYSE:CRM) reporting the weakest margins. While Amazon’s AWS business segment operating margin was on average around 27.80% in the past 5 years, it’s still significantly lower than Microsoft’s Intelligent Cloud segment margin, averaging at 39.20% and increased to 43.57% over the past four quarters.

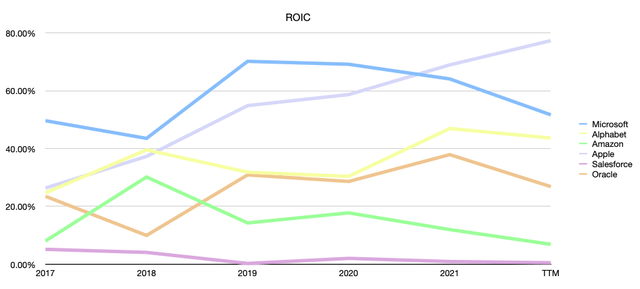

In terms of capital allocation efficiency, Microsoft saw its Return on Invested Capital (ROIC) dropping in the last 12 months to 51.69% from 64.11% one year before and from its average of 59.33% in the past 5 years. Despite that, the company significantly outperforms the majority of its peers’ metrics, with only Apple (NASDAQ:AAPL) reporting an even greater capital efficiency. It’s worth mentioning that Alphabet, Apple, and especially Microsoft could even improve their capital allocation efficiency by employing their large idling cash positions, as the spread between their ROIC and the Return on Capital Employed (ROCE) suggests. Those are two metrics I particularly observe when pondering an investment decision, as a company must be able to consistently create value to be a sustainable investment. Salesforce and Amazon are instead consistently lagging behind the peer group when considering their ROIC, and Oracle struggles to report a consistent capital efficiency while hugely relying on debt.

Investments in Research and Development ((R&D)) are of primary importance for companies in the technology industry, Microsoft is spending a relatively fair amount of 12.36% when compared to the average of its competitors at 13.66%, with Salesforce and Oracle reporting the highest investments. The company reported relatively low leverage of 0.78, with only Alphabet being even more conservative and unsurprisingly Oracle reporting the highest debt exposure.

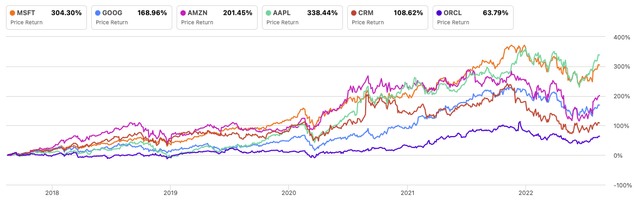

Considering the stock performance of the past 5 years, Microsoft had a stellar performance compared to the analyzed peers, with only Apple outperforming the stock, as it significantly rallied in the past month. Oracle is the worst performer in the group, as the company struggles to convince in terms of innovation and returns for investors.

Author, using SeekingAlpha.com

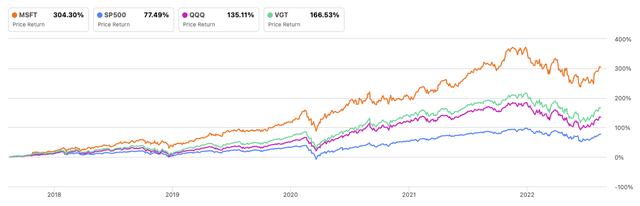

Microsoft outperformed significantly the Vanguard Information Technology ETF (NYSEARCA:VGT), as well as both the QQQ (NASDAQ:QQQ) and the S&P500 in the last five years, with significant relative strength, greatly rebounding from each pullback or market downturn.

Author, using SeekingAlpha.com

Microsoft has demonstrated to be consistently a technology and market leader in its business segments and is now greatly positioned to lead in strong secular growth markets, its relative strength compared to its reference indexes and peers, as well as its filled pipeline and ambitious roadmap, are elements that could likely continue to contribute to the outperformance of its stock, with high potential returns for investors.

Valuation

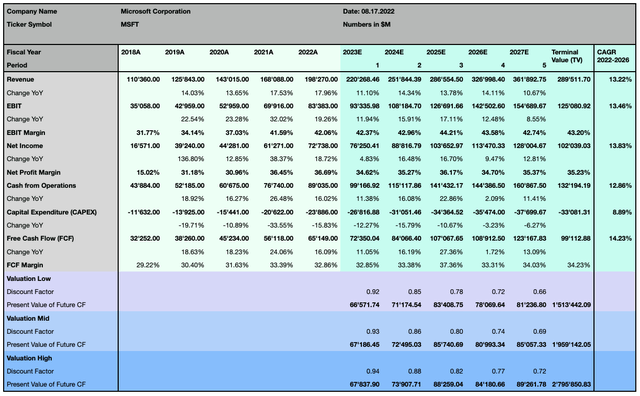

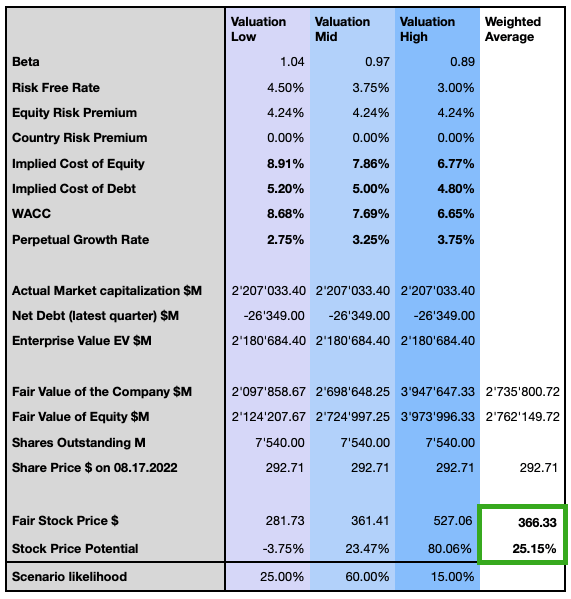

To determine the actual fair value for Microsoft’s stock price, I rely on the following Discounted Cash Flow (DCF) model, which extends over a forecast period of 5 years with 3 different sets of assumptions ranging from a more conservative to a more optimistic scenario, based on the metrics determining the Weighted Average Cost of Capital (WACC) and the terminal value. As forecasted by the street consensus, the company is anticipated to generate a consistent, solid 14.23% Free Cash Flow (FCF) CAGR over the coming 5 years, with increased net profitability at 13.83% CAGR, while its revenue is forecasted to grow at 13.22% CAGR.

Author, using data from S&P Capital IQ

The valuation takes into account a tighter monetary policy, which will undeniably be a reality in many economies worldwide in the coming years and lead to a higher weighted average cost of capital.

Author

I compute my opinion in terms of the likelihood of the three different scenarios, and I, therefore, consider the stock to be significantly undervalued with a weighted average price target with 25.15% upside potential at $366.33. Investors should consider that those forecasts are based on relatively higher discount rates and the recent trend in increased interest rates, which reflects the actual situation and forecast possible scenarios. An inversion of this trend would change this perspective and value the company at a significantly higher price.

Risk discussion

Headwinds from unfavorable foreign currency exposure could further put pressure on the company’s performance, but I see them likely to ease significantly from 2023. Coming out from two years of pandemic-driven sales in gaming and remote work, some street expectations and targets were likely set too high, not least because of a relatively difficult benchmark analysis, therefore negative revisions could further affect the stock price in the short term, but should not significantly change the bigger picture of its long-term potential. Increased competitive pressure will likely continue and despite its leading position in its business segments, Microsoft will have to continue to significantly invest in R&D and stay competitive in its pricing, especially when comparing Azure to AWS, and Google’s Workspace offer, the latter even if not entirely comparable to Microsoft’s plans, is generally more affordable. The acquisition of Activision Blizzard is still not completed with pending antitrust consent, and a reverse termination fee was set between $2B to $3B, depending on the moment at which an injunction arising from antitrust law would cause the takeover agreement to be terminated. Microsoft is also constantly exposed to security risks, as the company recently confirmed being hacked in March 2022 by the Lapsus$ hacking group and was confronted with other security breaches in the past.

Market Timing

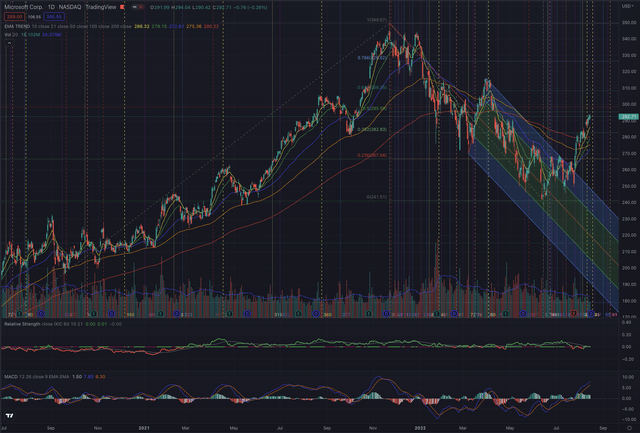

The stock reached its ATH (All-Time-High) at $349.67 on November 22, 2021, after a sustained rally since the Covid-19 pandemic low at $132.52 on March 23, 2020. The stock successively corrected until its 50% retracement level, but still mostly outperformed the NASDAQ Composite, a very similar pattern to some of the company’s peers, as many companies in the technology sector lost massively in value since the beginning of 2022 after peaking in November 2021. From a technical analysis point of view, the stock recently rebounded significantly at $241.51, a very strong-mid term support level. The last rally in stocks since mid-June was an ideal setup for swing and momentum traders, although Microsoft’s stock showed little relative strength compared to the Nasdaq, the stock could break out from its downtrend, overcoming the most important resistances, and significantly confirm its price level over the EMA200. The coming market sessions will show if the resistance levels between 295.59 and 298.42 will be surpassed or the stock will return, testing its closest support at 282.83 and the now turning EMA200. It’s important to note, that the stock hasn’t consistently broken the EMA200 since its last short-term rally in March 2022, despite this recent encouraging movement, in my opinion, the stock could struggle to significantly extend its rally and I likely see some space for consolidation towards the EMA200, before a possible higher leg can be confirmed. For long-term investors, this price level is instead surely interesting as my rather conservative valuation model shows significant upside potential.

Microsoft can count on great institutional support among its shareholders with 71.28% of the outstanding shares owned by institutions, a very low short interest of only 0.51%, and 1.4 days to cover. The Street consensus given by 48 analysts prices the share on average at $333.71 with a strong buy rating, with the lowest estimation at $280.52 and the highest at $411. The Seeking Alpha Quant Rating is instead more conservative and qualifies the stock as hold, with a particularly negative F grade in terms of valuation, D and D+ grades for respectively its growth prospects and the revisions, but qualifies the stock as A+ grade for its profitability, and a B+ for its momentum.

The bottom line

Microsoft has massive long-term growth prospects in its business segments and other than growing organically, is also aggressively expanding through significant acquisitions. I consider the stock price to be attractive despite the recent rally. From a trader’s perspective, in my opinion, the stock could now face some technical obstacles which could lead to some relative weakness in the near term, but for the moment, the stock broke out of its downtrend and confirmed important technical price levels. Fundamentally the company is setting up multiple growth drivers for the next decade of disruptive technologies in secular growth trends. Although the company is subject to heavy competitive pressure, Microsoft will likely continue to be a technology and market leader with a potentially significant growing market share in the coming years. I consider the actual upside potential of over 25%, pricing the stock at $366, as attractive and rank the stock as a buy, but I am aware of the higher market volatility and the downside risk in this tense macroeconomic environment, and I always do set an appropriate stop-loss, based on my contingency plan.

Be the first to comment