Justin Sullivan/Getty Images News

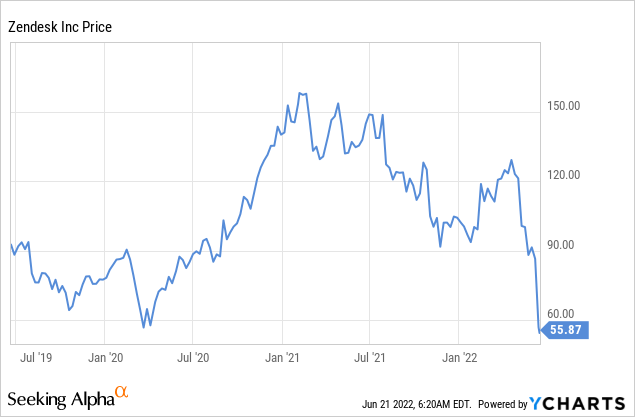

Zendesk (NYSE:ZEN) investors have had a lot to endure these past few months. Between the general market rout, and Zendesk rejecting a private-equity offer to acquire the company for between $127 and $132 a share. Not to mention the company trying to acquire Momentive Global, the parent company of SurveyMonkey, for $4.1 billion, a move shareholders voted down. Shares went down even more after the company concluded a strategic review and decided to remain independent. This clearly means it is a lot less likely that the company will sell itself now. While the news might be disappointing to many investors, we decided to take a look at the company’s fundamentals to see if after such a large price correction the company has become undervalued.

Company Overview

As one of the leaders in customer service and engagement software, the company has a long runway for growth. Both within its existing set of clients, as it continues to improve the software and add new features, and from adding completely new customers.

It competes with the likes of Microsoft, Oracle, and Salesforce, to name a few, but it has so far defended its niche well, and even expanded to other solutions like CRM and marketing automation. It has a high dollar retention rate, which means in general its customers are happy with the service and willing to spend more.

Competitive Advantages

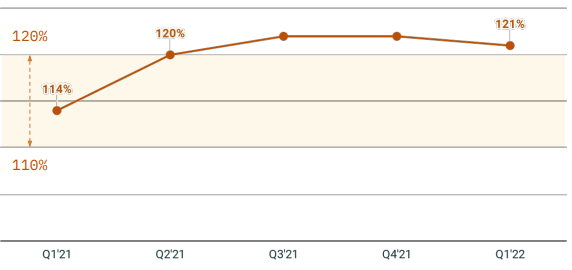

The main source of Zendesk’s competitive moat is high switching costs, since customers are not likely to want to disrupt their operations even if they find a slightly cheaper alternative to Zendesk’s products. Still, judging from the high Net Expansion Rate, it would appear that customers are happy to not only continue using Zendesk, but to purchase additional functionality from the company.

Zendesk Shareholder’s Letter

Financials

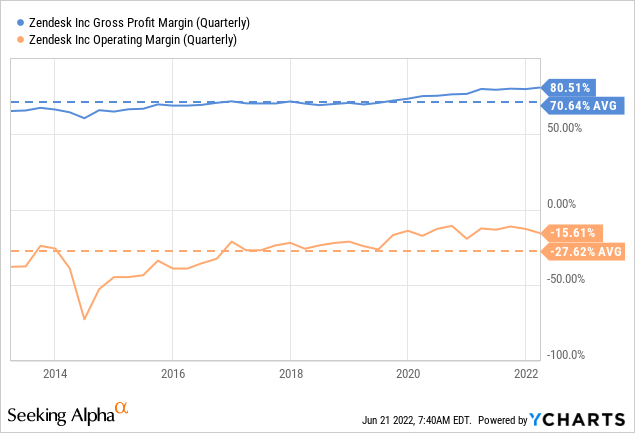

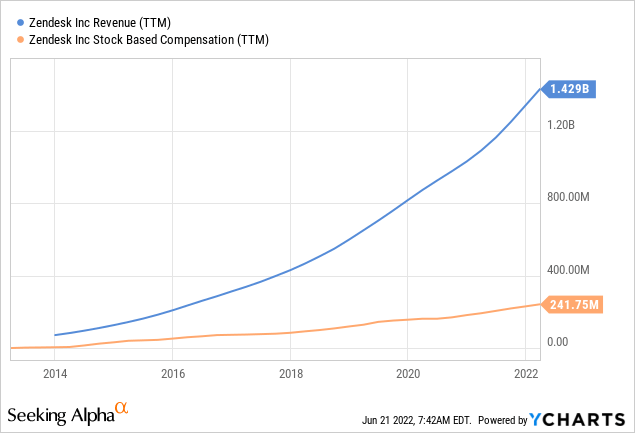

Zendesk has been displaying a good amount of operating leverage as revenue has increased, but the operating margin remains negative. A large part of the reason why is that the company has been overly generous with stock-based compensation. That is also why there is a big difference between GAAP and Non-GAAP earnings for the company.

Revenue has been growing fast for the company, but we worry that as revenue has grown, so has the amount of stock-based compensation the company is giving out. At some point they have to moderate this, or it will be very difficult for the company to achieve real profitability.

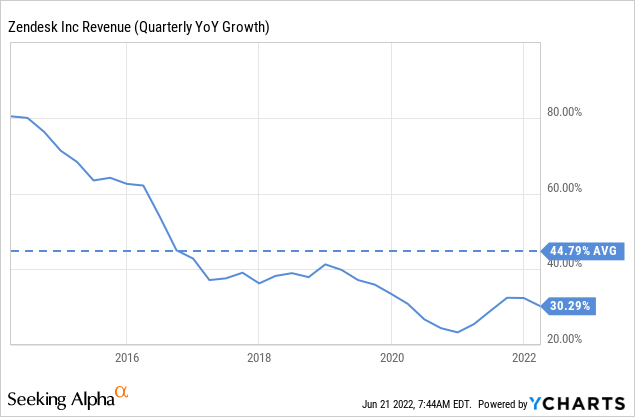

Complicating things further, revenue growth has decelerated. While still at a very decent level ~30% year-over-year, this is no longer the hyper growth company it once was.

Valuation

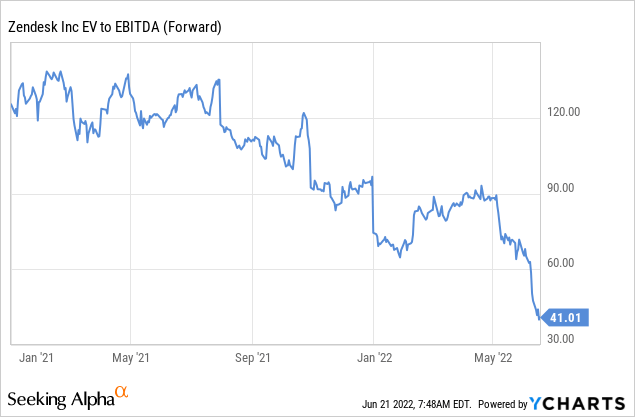

Despite the massive share price correction, the valuation multiples remain elevated. For example, forward EV/EBITDA is at ~41x. Which is a lot better from the triple digits at which it previously traded, but it is difficult to call a 41x multiple cheap.

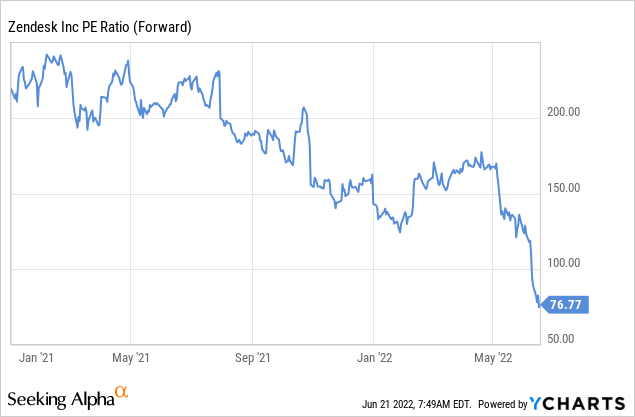

We see a similar thing with the forward price/earnings ratio, which is still quite elevated at ~76x. It can be argued that even at ~30% revenue growth, if the company shows some cost discipline, then earnings will grow very nicely bringing that multiple down. We therefore believe the best way to decide whether the company offers value at current prices is to estimate a net present value for the company based on earnings estimates.

Building a simple model, we get a net present value of $61.09, which is a little over 10% higher compared to where shares are currently trading. We used analyst estimates compiled by Seeking Alpha for the next three years, and a 20% earnings growth rate thereafter. Given that revenue is currently growing at ~30% and there should be some operating leverage, we believe we are being cautious and compensating for a possible deceleration in the latter years by using 20% instead of 30%+. These earnings are Non-GAAP, so the company could destroy a lot of the value if they don’t moderate stock-based compensation in the next few years.

| EPS | Discounted @ 10% | |

| FY 22E | 0.73 | 0.66 |

| FY 23E | 1.06 | 0.88 |

| FY 24E | 1.60 | 1.20 |

| FY 25E | 1.92 | 1.31 |

| FY 26E | 2.30 | 1.43 |

| FY 27E | 2.76 | 1.56 |

| FY 28E | 3.32 | 1.70 |

| FY 29E | 3.98 | 1.86 |

| FY 30E | 4.78 | 2.03 |

| FY 31E | 5.73 | 2.21 |

| FY 32 E | 6.88 | 2.41 |

| Terminal Value @ 5% terminal growth | 137.59 | 43.84 |

| NPV | $61.09 |

To Buy Or Not To Buy

We believe Zendesk’s valuation is no longer absurd, and that current prices offer value with some caveats. The two most important ones are that the company is assumed to continue growing at a rapid pace, and the second one is that the company is expected to moderate stock-based compensation. If both of these conditions are met, we believe current prices can offer 10%+ annual returns going forward, maybe more if growth re-accelerates, or if the company delivers good operating leverage by controlling costs better.

Risks

Zendesk has a “sticky” product, many satisfied customers, and a strong balance sheet. We therefore do not see any immediate risks to the company’s viability. The risks we see have more to do with valuation, cost control, and longer-term potential competitive products, especially if a company like Microsoft (MSFT) were to integrate the Zendesk functionality into one of its product suits such as Microsoft Teams.

One important risk in the short term would be that of finding a good new CEO, as it appears at the moment that the current CEO might leave soon.

Conclusion

Zendesk is an attractive business growing at a rapid pace, and with a narrow competitive moat derived from the high switching costs for its products. That said, to become more attractive the company has to improve its cost controls, in particular stock-based compensation, which has been rising very quickly. According to our net present value estimation, shares are somewhat undervalued, but that assumes stock-based compensation is moderated so that GAAP earnings and Non-GAAP earnings start approaching each other.

Be the first to comment