sweetym/E+ via Getty Images

The bedrock of financial economics is that there should be a tradeoff between risk and reward: An investment with low risk should have a low expected return, while one that could make you rich also should be one which could lose you a lot of money. A lot of research in finance is focused on finding deviations to this risk-reward tradeoff, which are called “market anomalies” in deference to the idea that they are exceptions to this fundamental law of finance. Discovery of an anomaly is usually followed by frenzied debate and research that tries to explain it away as: 1) a statistical fluke, 2) compensation for some hitherto overlooked risk, or 3) some friction in the market which when fixed will make the anomaly go away.

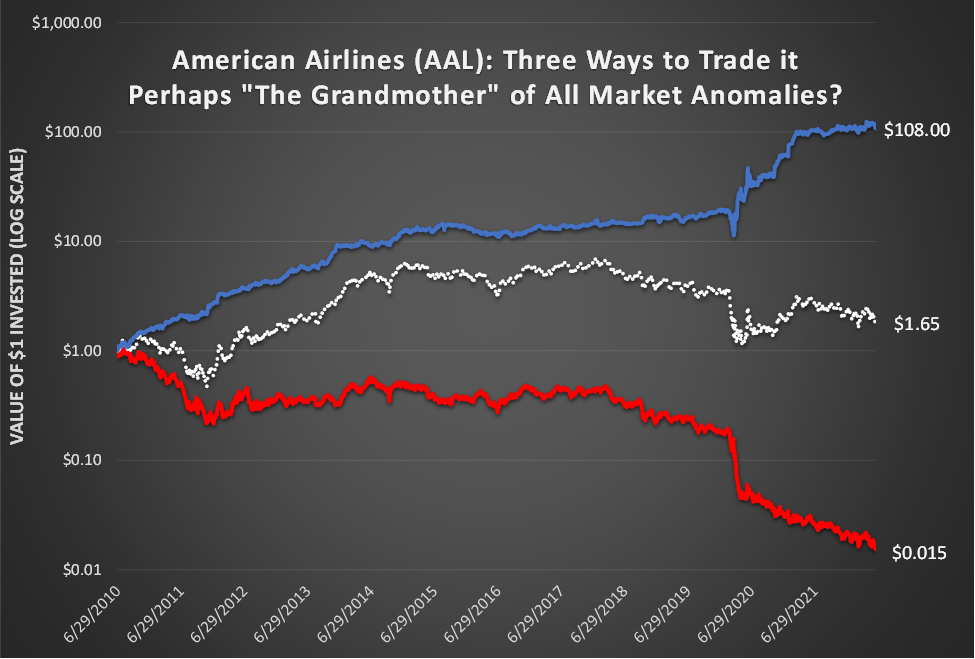

The chart below illustrates one such anomaly, which is large and relatively lightly researched, and the debate about it is still raging. What we see in the chart is the performance of three different ways an investor could have taken exposure to American Airlines (AAL) stock (ignoring transactions costs and frictions, and data from Yahoo Finance). The white line shows the value of $1 invested at the start of the period and held to the end.

Three ways to invest in American Airlines (AAL) (Yahoo Finance)

Can you guess what the other two lines are?

One dollar invested in the blue line combined with a short position in the red line would have turned $1 into $7,020, a roughly 100% annual return. It has a high Sharpe Ratio too (again, without accounting for transaction costs or other trade frictions). Many other popular stocks displayed similar characteristics over the past several years, such as Alaska Air (ALK), AMC Entertainment (AMC), Boeing (BA), Carnival (CCL), Caesars (CZR), Delta (DAL), GameStop (GME), JetBlue (JBLU), Lyft (LYFT), MGM Resorts (MGM), Moderna (MRNA), Norwegian Cruise (NCLH), United Airlines (UAL), ARK Innovation ETF (ARKK), SPDR Biotech ETF (XBI), and Grayscale Bitcoin Trust (OTC:GBTC).

What do these stocks have in common?

If you are intrigued, stay tuned for our forthcoming research note which we hope to publish this coming Thursday, in which we try to explain this phenomenon and discuss its potential significance for investors and regulators.

Elm Wealth does not offer the strategy discussed above. Elm Wealth charges 0.12% per annum to manage highly diversified portfolios, primarily of low-cost ETFs, for high net worth families and individuals. This article does not represent an offer to invest. Neither the discussion above, nor anything else that Elm Wealth presents research on, should be interpreted to suggest that past returns are indicative of future performance.

Be the first to comment