Alex Wong/Getty Images News

Fisker (NYSE:FSR) has just retested lows around $8 per share before bouncing on broader market strength following the Fed’s largest rate hike since 1994, but the EV manufacturer looks to have solid upside potential as it inches closer to a start of production in November for its flagship Ocean SUV. Fisker’s asset light model and reliance on Magna Steyr (MGA) for production limits internal control over production, but also gives it a key advantage in avoiding the brunt of supply chain difficulties. Ahead of a product launch and a relatively smooth expected revenue and delivery ramp, Fisker’s valuation offers attractive upside, potentially 100% or higher, with limited downside risk which can be managed through hedging.

Supply Chains In The Rear-View Mirror?

Fisker is approaching auto manufacturing from an interesting angle, choosing to source production out to Magna Steyr for the Ocean and Foxconn for the Pear, giving it an asset-light model and access to high volume production without billions in investment.

As the EV industry faces multiple headwinds, ranging from surging raw materials prices driving battery costs higher to lingering chip shortage effects and trucker strikes in South Korea hitting production of vehicles and chip shipments, navigating the supply chain issues is of utmost importance. Notable prominent OEMs have felt impacts to production, such as Toyota (TM), while EV startups Rivian (RIVN) and Lucid (LCID) are among those slashing production guidance for 2022 as impacts from snarled supply chains linger.

On Fisker’s end, supply chain challenges don’t look too troubling. Fisker noted that it and Magna Steyr “created a supply chain task force to ensure each supplier’s launch and ramp plans are aligned with Magna Steyr’s and to proactively address any supply chain challenges.” Given the industry-wide challenges, solving supply chains is critical to ensure high volume when production kicks off, as well as mitigating any instances of cost inflation from securing key parts and materials ahead of time.

Fisker is “seeing a ‘sort of end‘ to its supply chain crisis,” according to CEO Henrik Fisker, as he explained that Fisker “had faced supply chain issues when it was testing and developing its Ocean SUV but made design changes to certain parts to use chips that were more widely available. He elaborated that he was “not worried about scaling up production when it starts in November” as Fisker “had reached out to suppliers to ensure the volumes needed.”

That last statement should not go overlooked — keeping targets on track and ensuring a smooth scaling of production provides a very attractive runway for Fisker to grow into in 2023.

Attractive Growth Story

Although the industry is facing a difficult combination of headwinds for legacy and startups alike, Fisker does have an attractive growth story ahead of itself over the next four to six quarters, as long as there are no adverse impacts to the production schedule.

Fisker has not specifically outlined hard production volume targets similar to other SPAC peers such as Lucid, but did outline that its agreement with Magna Steyr aims to produce 50,000 vehicles in 2023, tripling that to 150,000 units in 2024. Considering that Fisker is outsourcing production to Magna, combined with confidence in securing enough supply to hit production goals, gives Fisker a rapid ramp in revenues as the year moves on.

Fisker noted that it “may potentially sell out capacity through most of 2023 with purchase orders of premium models.” The company has over 50,000 pre-orders for the Ocean, and expects at least 80,000 by year end (as of late April), given the trends in demand and pre-order volumes. Thus, there is a fair amount of confidence that Fisker can reach its 50,000 vehicle target for 2023; remaining on the bearish end, 37,500 units of production will be used to assess growth potential and arrive at a valuation.

2023 Revenue Projection Of $1.9B, 100% Upside Potential

Basing projections off of that 37,500 unit forecast for 2023, which seems to be relatively conservative against the 50,000 unit volume expected under the agreement, and also more reflective of the current headwinds facing the industry. 37,500 units may turn out to be too conservative, or difficult to reach, depending on how the chip shortage and raw material/battery picture looks by Q1 2023; as such, this is a preliminary forecast.

With that in mind, working on the 37,500 unit projections still spells out quite a positive picture for Fisker.

With an average selling price of ~$51,000, slightly lower than Fisker’s targeted mid-$50,000 ASP range for the model (again, assuming a more conservative take on the initial trim mix), 2023’s projected revenues would equal out to ~$1.9 billion. Fisker also noted that prices for at least 40,000 pre-existing pre-orders would not be raised, so it’s unlikely that a higher ASP for the Ocean is realized until 2024 (total ASP likely to be lower once the lower-priced Pear reaches serial production).

While the current market does not care too much for fundamentals or valuation multiples, it still helps to put Fisker’s projected revenue and multiples in perspective to peers.

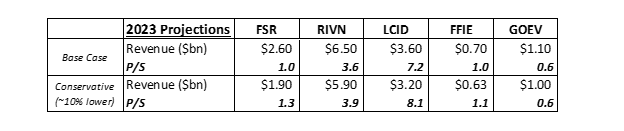

Per Seeking Alpha’s data, peers in production and working towards scaling up through the challenges, Rivian and Lucid, are on par to record ~$6.5 billion and ~$3.6 billion in revenue in 2023. However, downside risk to missing those forecasts is elevated, with a more conservative outlook probably closer to ~10% lower, or ~$5.9 billion and ~$3.2 billion in revenues. Canoo (GOEV) is projected to record just $700 million in revenue, assuming that its production targets and volumes hold, while Faraday Future (FFIE) is expected to crest over $1 billion, though some doubts on that forecast remain.

Taking into account the projected revenues for peers, as well as a more conservative estimate, assuming difficulties to production, delivery, scaling, or a combination of unforeseen factors, Fisker still looks attractive.

FSR peer multiples/projected revenues (SeekingAlpha)

In Fisker’s base case target of 50,000 units, revenues of $2.6 billion would be slightly higher than Fisker’s current $2.4 billion market cap, suggesting that the market is either a) concerned that Fisker will be unable to scale to that degree, or b) attaching lower multiples to the EV industry as a whole (a theme that has been seen already). With the 37,500 unit target, Fisker’s $1.9 billion projected revenues still comes out to a cheap 1.3x multiple, far below peers in production. As such, it’s generally fair to assume that as Fisker nears launch, a smooth launch with relatively few adverse impacts should translate to quick revenue ramp up, and its multiple re-rating higher as growth begins to be realized.

Giving a 2.5x multiple to Fisker’s 2023 revenues, still below Lucid and Rivian (and above Canoo and Faraday, who face potentially greater risks to production and scaling), offers an attractive $4.75 billion valuation to Fisker, or about 100% upside to Thursday’s close. This also assumes that Fisker does not dilute via shares over the next four quarters, given its recent $350 million ATM raise; however, with its ~$100 million cash burn rate, and expected expenditures of ~$700 million (prior to the raise), Fisker may need to raise more cash during 2024.

2024 Projection – 300% Upside? If All Goes Well

Moving on to 2024, Fisker aims to be producing 150,000 units volume of the Ocean SUV with Magna, while starting production of the Pear with Foxconn during the year as well, its second vehicle launch. As such, growth in 2024 is expected to be well above +100% y/y for deliveries and revenues.

Again, confidence does diminish in forecasts out this far, as it is still uncertain whether Fisker will be able to scale up to that degree, whether industry headwinds abate, or if Fisker will face challenges to production from battery/raw materials prices, or if a sub-$30,000 EV will not be possible. Again, the past two years have shown just how fragile the auto industry is when it comes to disrupted production, so treading with caution in forecasts is key.

Projecting into 2024, sticking with a more conservative production volume target (~40% lower than Fisker’s), likely can account for any risks to production volumes stemming from industry headwinds. As such, this would put Fisker’s Ocean volume at ~90,000 units, still a substantial jump from the ~37,500 units forecast for 2023. Keep in mind that this level of growth may still be a bit difficult to achieve, as peers like Nio (NIO) grew from 43,000 vehicles in 2020 to 91,000 vehicles in 2021.

For the Pear, a preliminary estimate of 10,000 units will be used, given an unclear start-of-production date (only known in sometime in 2024). Project Ronin, Fisker’s third vehicle, a GT sports car, is projected to start production in late 2024 as well, but assumptions will disregard the vehicle as sales volume may either be minimal, or delayed.

Working with 90,000 units volume for the Ocean and 10,000 units for the Pear, at an ASP of ~$53,000 and ~$32,000 respectively, Fisker’s 2024 revenue projection comes out to $5.1 billion. At a 2x sales multiple, still quite cheap for the ~170% y/y revenue growth delivered (with net losses and negative EBITDA), Fisker could be worth ~$10.2 billion. A valuation of that degree represents about 300% upside from Fisker’s current levels near $8.40. However, dilution risk is possible during 2024, meaning that upside could become more limited should Fisker sell shares.

Hedging Against Downside

Again, while a smooth ramp in 2023 and solid growth in 2024 could generate substantial triple-digit upside for patient Fisker investors, hedging against downside risk in this environment could be in an investor’s best interest. A combination options play on a long share position could result in cheap downside protection — something such as buying a Feb. ’23 $7.5 put for ~$180, and entering a Jan. ’24 covered call for ~$120 protects against further near-term downside for ~$60. Hedging is not necessary, nor viable for everyone, but given risks to the sector and peers such as Electric Last Mile (ELMS) heading to bankruptcy, it may be an option to consider.

Outlook

As Fisker approaches its start-of-production date for the Ocean, limiting disruptions and adverse impacts to scaling up in 2023, preparing for 2024’s volume is key for the company to be able to generate meaningful returns for investors — any delays are likely to not be received well, given Fisker’s confidence in supply levels and broader industry trends.

Revenue generation is just around the corner, starting in about two quarters, with substantial growth projected in 2023 as Fisker aims to quickly scale volume higher. 2024 is expected to bring more growth as Fisker works to roll out two more models.

Even so, maintaining conservative levels in forecasts protects against unforeseen risks while still offering upside for shares. For 2023, a more conservative 37,500 unit projection works out to ~$1.9 billion in revenues (compared to Fisker’s 50,000 units and analyst expectations for ~$2.1 billion). The more conservative take still comes out to about 100% upside when using a 2.5x sales multiple. For 2024, projecting about 40% below Fisker’s intended 150,000 unit volume for the Ocean along with some sales from the Pear can generate ~$5.1 billion in revenue, or ~300% upside on a 2x sales multiple.

These revenue projections do not include leasing, as that will be difficult to estimate in early production and early scaling of delivery volumes. Leasing revenue is likely to become more pronounced as Fisker’s scale matures.

Although the upside potential looks quite promising for Fisker, the macro environment has shown signs of weakening, and broader conditions within the market are not quick to pass. As such, hedging bets in a more speculative, pre-revenue loss-generating company such as Fisker may be of high importance.

Be the first to comment