VladimirFLoyd/iStock via Getty Images

Where smoke exists, fire often follows. In this article, we will look at how AMMO, Inc. (NASDAQ:POWW) offers investors an intriguing defense play. Politics will be involved (of course), but my intent is to keep the tone neutral. On the flip side, a Board of Directors legal case is pending and could bring unknown Black Swan events (covered later).

Rumors

A recent smoky rumor has cropped up: the Biden Administration is going to ban the US government owned Lake City Army Ammunition Plant (LCAAP) from selling civilians 5.56 ammo (Something the White House presently denies but is only an executive order away from).

If this were to pan out (and it seems possible given recent legislative attempts) the ammo industry would have an amazing opportunity. Estimates place LCAAP as supplying a full 30% of the 5.56 market in the United States. If the U.S. government were to pull out selling to civilians, a supply void would follow: A void that AMMO, Inc. is primed to fill.

National Sports Shooting Foundation Update

Concerning the rumor of an ammo ban via the government ran facility:

|

The White House was rather quick to deny such information. Lots of smoke; will legislative fire follow?

Government Action Creates Opportunity

Once again, the 2nd amendment is in the sights of various politicians. I will avoid getting into the legality of such politics, other than to say that we might see an increase in gun sales due to recent proposed actions. In the US, the Democrats are testing the waters via comments by the Biden Administration and actions in the house to pass new restrictions. To the north, in Canada, legislation is being explored to ban handguns. However, this presents an opportunity for the common investor. Expect an increase in panic ammo buying.

AMMO, Inc. is building a new ammo facility that could fill some of the void left by the rumored exit of the Lake City plant. AMMO, Inc. also owns a brass manufacturing facility in a vertical integration endeavor. It would also be nice to see them get into the primer industry to avoid any potential supply chain disruptions and keep production rolling along.

AMMO, Inc. Expands Production

Currently, the company has a 50,000 sq ft facility in WI that makes brass casings and ammo. The new plant being constructed is 165,000 sq ft which is “expected to triple current manufacturing output” and is estimated to be completed this summer according to the company. For those curious, drone footage of the new facility is available.

AMMO, Inc. Finances

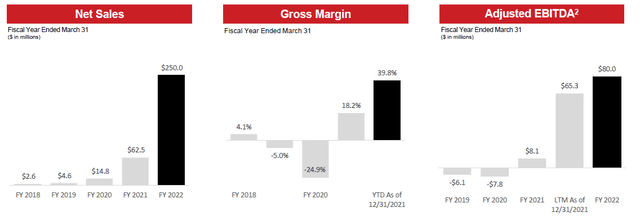

Reviewing company numbers presented in June of 2022, we see:

AMMO, Inc. Financials (AMMO, Inc.)

Net sales growing: $2.6 million as of 2018 to presently $250 million. Gross Margins (once negative but now turning positive) at 39.8%. Adjusted EBITDA of -$6.1 million as of 2019 to now $80 million.

10-K Analysis

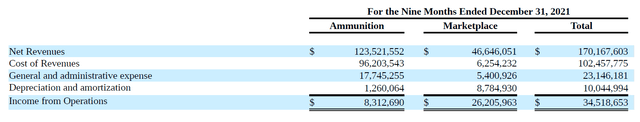

Looking at the Dec 31st, 2021 10-K we see:

Nine Months Ended Dec 31, 2021 (AMMO, Inc.)

It appears that ammo sales yield a 6.7% operating income. Gunbroker.com, who AMMO, Inc. acquired, yields 56.1% operating income. The interesting part is by acquiring Gunbroker.com, AMMO, Inc. can sell its ammo directly on the website, and thus increase margins for the ammo side.

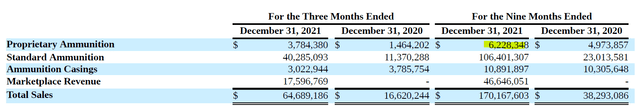

Equally intriguing is to note how ammo sales break down. We can see on page 29 that the majority of the company is selling what is basically a commodity on the ammo side: A mere $6.2 million in sales comes from special ammo sales.

Breakdown of AMMO sales (AMMO, Inc.)

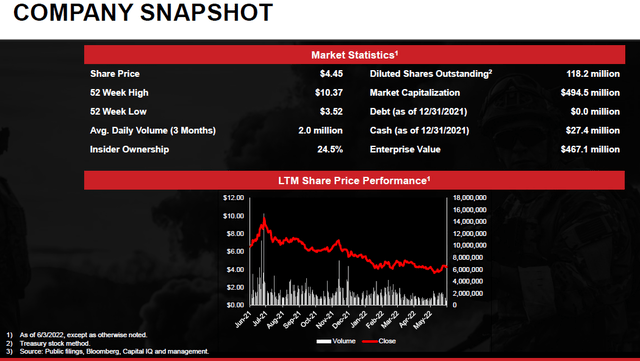

Right now, AMMO, Inc. is supply constrained due to the ammo factory operating at 95% capacity. Once capacity triples, this should let AMMO, Inc. fill backlog and list ammo on Gunbroker.com to raise margins. Additional company details include:

AMMO, Inc. Snapshot (AMMO, Inc.)

The Good, The Bad, The Ugly

The biggest red flag with the company is the Board of Directors. A Board of Directors is akin to a sports team. This team should be upgraded with better backgrounds and credentials as the company evolves. I would urge anyone to go to Ammoinc.com and click on Board of Directors. Read the backgrounds of each person and ask, “Does this make sense for an ammo company?” Some of the people are logical fits; some need to be upgraded.

Lawsuit – The Ugly

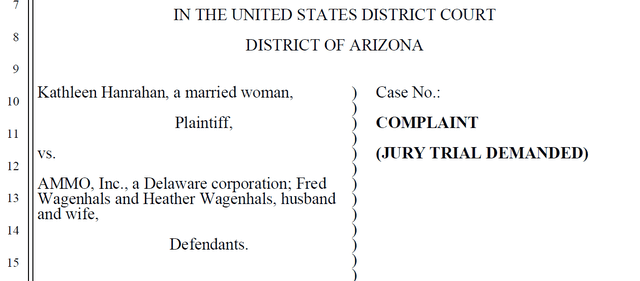

Looking over Pacer Legal, we see a rather spicy lawsuit filed by a former Board of Directors member. Case 2:22-cv-00247-DGC – Document 1 Filed – 02/16/22

Case Name (Pacer Legal) |

Every story has two sides, but I caution everyone to read the lawsuit and ponder it. Given the ammo production expansion, I still view the risk as worth it, but it does make me keep my investment weight in check. Many Black Swan events could come from this. Hence, the word of the day is “caution”.

Conclusion

The rumor may or may not pan out concerning the government sales of 5.56 stopping. The tripling of ammo production, however, will allow AMMO to start reducing that backlog and increasing profit margins by selling ammo directly on Gunbroker.

I do have some concerns about the Board of Directors as well as management. The lawsuit adds further concern.

AMMO, Inc. is a sleepy stock that might awaken given time. A proposed ban of the government ran Lake City ammo plant from selling to civilians along with proposed legislation could impact AMMO, Inc. in a positive manner. This is not a complex story. In fact, it is rather simplistic: When times get hard people flock to protection. AMMO, Inc. might be a good investment to protect your account in this environment. On the flip side, it comes with risk as we pointed out. The company has room to improve in areas as covered.

Overall rating: Cautious buy while keeping the overall weight of the buy small relative to account size.

Be the first to comment