Viktorcvetkovic/E+ via Getty Images

This article was originally published in the CEF/ETF Income Laboratory, a private investment community on Seeking Alpha, on 8/18/22.

Main Thesis & Background

The purpose of this article is to discuss the use of developed market ETFs as an investment option in the short term, with a specific focus on the why behind why I have been adding to this exposure in 2022. I will take a look at relative performance, as well as discuss a few key reasons on whether or not it makes sense to get on holding (or even adding) to these options going into the final stages of the year.

For this review, readers should note I am talking about four countries in particular. These are Canada, Australia, the United Kingdom, and Ireland in order of their exposure weighting in my investment accounts. When I look outside the U.S., I tend to do so with country-specific ETFs, which is the easiest way for me to monitor these holdings. Finding individual names is fine, but as my followers know, I own only a few companies and they are all domestic. So rather than trying to find the “best” few names in each respective country, I opt for the iShares MSCI Canada ETF (EWC), the iShares MSCI United Kingdom ETF (EWU), the iShares MSCI Australia ETF (EWA), and the iShares MSCI Ireland Capped ETF (EIRL). This is not necessarily the “best” strategy or the right approach for everyone, but that is what I do.

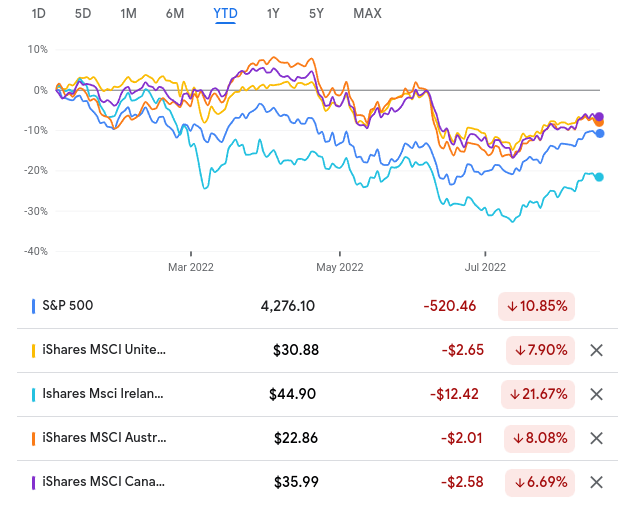

With that in mind, let us consider how these funds have fared in 2022. This is important because I primarily buy these to diversify my holdings and gain some non-U.S. exposure in a way I feel most comfortable. I have held emerging markets and continental European names in the past, but that isn’t the right exposure for me at the moment for different reasons. The focus for me this year has been to capture developed, more stable countries, and also those that are mostly removed from the ongoing Russia-Ukraine military conflict. Through the first seven and a half months of the year, we see that most of the developed countries (as measured by the ETFs I listed and the S&P 500) have moved in a similar trajectory. Ireland has been a big loser, while Canada, Australia, and the U.K. have mildly outperformed the S&P 500:

YTD Performance (Google Finance)

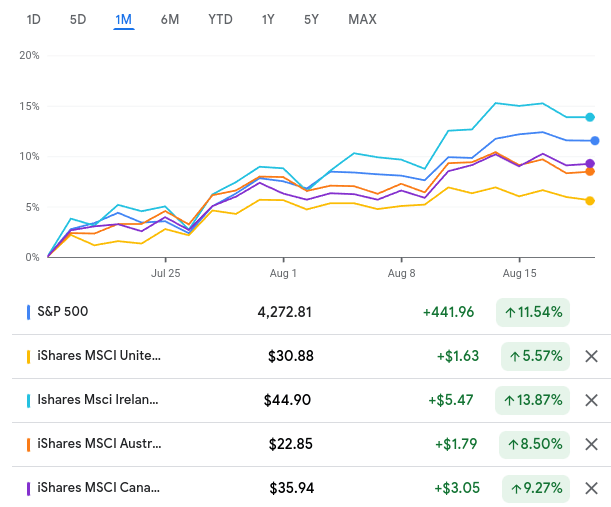

As you can see, the overall performance varies to a degree, but the general moves up and down have been in-sync in terms of moving in a similar trend. Importantly, while the broader equity market has been rising over the past month, this trend also holds. All these funds are in the green along with the S&P 500 and have a similar trajectory, just to varying degrees:

1-Month Performance (Google Finance)

(Of note: I expect more volatility from EIRL. Ireland has fewer large-cap companies and the fund is very top heavy to just three names. As a result, it will see larger moves on a short-term basis based on the fortunes of those companies. The other ETFs (including the S&P 500) are more diverse, leading to small swings on average).

With this broader understanding of performance, I thought it was time to take stock of how I should alter my positioning ahead of Q4 and then 2023. After consideration, I am determined to continue to add to my developed market positions, at the expense of my domestic holdings, and I will discuss why in detail below.

Market Rebound Has Me Taking Some Profits

For perspective, I want to emphasize that I have been taking profits in this environment. This has included mostly selling some S&P 500 exposure, but I have generally been raising cash across the board. I went from a 10% cash position to 25%, anticipating that we will see some volatility and downdays in the next few months. At that time, I will put that cash back to work in the market – in both the S&P 500 and the four countries I mentioned above.

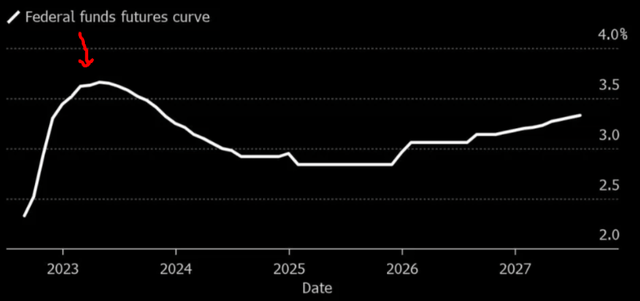

One of the key reasons for this is I am of the belief investors have gotten too optimistic. This is especially true with respect to expectations regarding Fed action. While the Fed has been consistent on raising rates this year and on likely doing so in 2023, the market disagrees. The futures curve for the federal funds rate does show rates continuing higher from today’s levels, but then it shows gradual cuts in 2023 (this is based on investor expectations):

Federal Funds Futures Curve (Bloomberg)

This is significant because I see it as a likely catalyst for the recent rally. The past 10 – 12 years has taught us that equity markets love low interest rates. If we are indeed nearing the end of the rate hiking cycle, that is a positive for stocks. But if we are approaching a rate cutting cycle, that story is even more true. My take on the gains over the past month (which have exceeded 10% for the major U.S. indices) is that these gains are likely being driven in part to the expectation of a more dovish central bank.

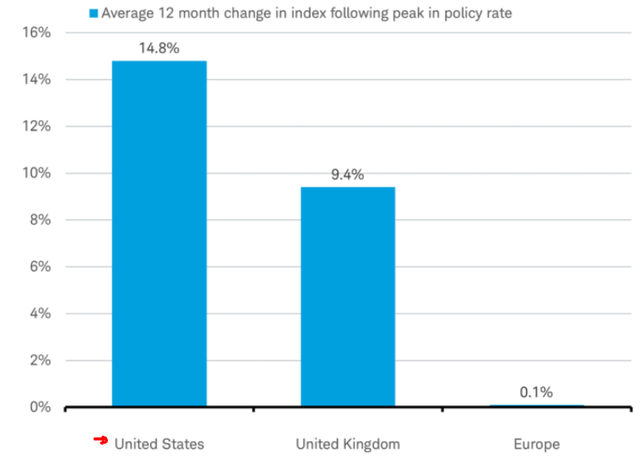

To understand why, let us consider past rate hike cycles and how markets reacted to them ending. With history as a guide, we can see that the S&P 500 will, on average, perform extremely well once the Fed benchmark rate “peaks” – essentially meaning the rate hiking cycle is over. After the rate hits the high of the cycle, stocks will on average return over 14% over the next 12 months:

Past Performance After Fed Rate Hikes Stop (Charles Schwab)

This is one of those self-fulfilling prophecy situations in my opinion. When a trend has happened in the past, market participants often expect it to occur again. Therefore, if investors believe that the Fed has reached, or is about to reach, its peak interest rate level, then they will buy-in on the expectation that stocks are going to perform well going forward. This buying, when done by a majority of the market, fulfills the prediction by sending stocks higher.

This begs the question – why am I concerned? Well, the simple point is that I do not believe the Fed has reached its peak level. Nor do I expect rate cuts in 2023 (perhaps in 2024, but that is much too far out for me to make a reliable prediction at this time. Too much can happen over the next 12 – 16 months).

For support, let us consider a recent statement by Federal Reserve Bank of San Francisco President Mary Daly this past week. In an interview with CNN, as reported by Bloomberg, she is quoted:

We need to get the rate up, up to neutral at least, which is around 3%, but likely to restrictive territory — a little bit above 3% this year and a little bit more above 3% next year. I really think of the raise-and-hold strategy as one that has historically paid off for us.”

Source: Bloomberg News

This is implying that the Fed may actually keep raising rates in 2023, and there is little willingness to cut rates at this juncture. Of course, a lot can change between now and then – that much is certain. But for me, it highlights a growing disconnect between market expectations and Fed projections. If the market is right, then perhaps buying in now does make sense. But if the market is anticipating strong gains to continue on the back of a dovish Fed in 2023, that disappointment could be costly. Therefore, I want to be very selective on buy-in points over the next few quarters. This is leading me to take some profits here, to deploy later on when stocks drift south. My prediction is that they will between now and year-end.

Stock Buybacks Likely To Slow In The U.S.

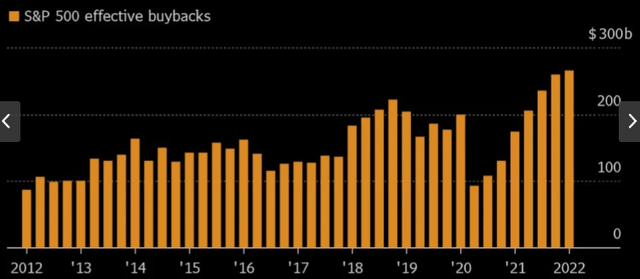

The next point looks at a catalyst for stock gains that is uniquely being targeted in America. This is important because it highlights one of the reasons why I see merit to being in developed markets outside the U.S. – there are always unique risks in each country. In this case, I am concerned about the pace of corporate buybacks in the U.S. going forward, especially next year. The reason being is political. A Democratic-controlled Congress and U.S. President just passed and signed a major legislative bill over the last week. This “Inflation Reduction Act” has a provision in it that will apply a 1% excise tax on corporate stock buybacks for U.S. companies. While the merits of this legislation can be debated, the reality is it adds a disincentive for companies to buy back their own stock. This could be good or bad, but it absolutely shrinks the degree to which corporate stock buybacks can support market prices.

In fairness, this is not an apocalyptic scenario. Corporate buybacks are sure to continue, albeit at a smaller degree. The 1% tax is not a dire situation to start panic selling anything. I am not suggesting that. However, it is an important consideration right now given how significant buybacks have become. What I mean is, corporate buybacks for large-cap U.S. stocks have been soaring in the past few years. While the debate on whether or not this is a good use of capital is one we can have, the net result is that all this buying supports share prices. In fact, the last three years have seen record levels of buybacks:

S&P 500 Stock Buybacks (total volume by year) (Yahoo Finance)

The conclusion I draw here is that the U.S. is targeting a supportive market catalyst (buybacks) while other nations are not (currently). This decision in isolation is a negative for U.S. markets in relative terms. This political decision, and broader political climate in the U.S., is key to my decision to look outside our borders to supplement my domestic equity holdings.

Why Not Emerging Markets? Too Much Risk For Me

As I mentioned, I own foreign ETFs and plan on continuing that strategy in 2023 and beyond. However, just because one wants to invest outside of the U.S. doesn’t mean they are going to agree with me on where to park those dollars. After all, I have left out continental Europe, as well as Japan and the emerging market world. This includes the Middle East, Asia (including China), and South America. This leads me to my next topic – why I’m focused on developed markets and not emerging ones.

As my followers know, I have held emerging market exposure in the past through ETFs. But in the current climate I just do not see the value. Specifically, I think there is too much risk in escalating U.S.-China tensions, escalating Taiwan-China tensions (see a pattern here), as well as a rising U.S. dollar, rising inflation, and food insecurity. All of these factors are global, but impact emerging economies disproportionately. In that respect, I see more risk than is worth the upside, and will commit my capital to more stable, developed countries.

For support, let me explain a number of factors. With respect to central Europe, the Russia-Ukraine conflict is a no-brainer. I would generally avoid eastern Europe anyway, but the risks of the spillover impact from the conflict is making me avoid neighboring nations that would otherwise be safe. These include Germany, France, Italy, Austria, among others. Even if these countries are not brought in to a military incursion, there are supply-chain risks and challenges for meeting energy demand. To me, I don’t see a resolution in this conflict any time soon, and this will remain an “avoid” for me for a while.

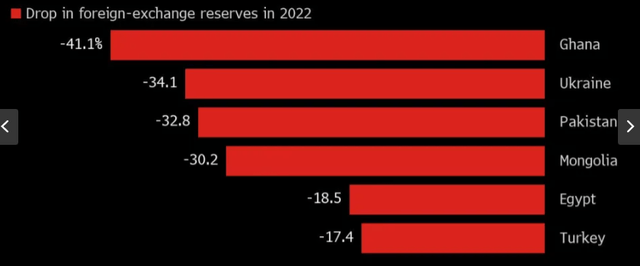

With emerging markets, there are more factors at play. One is that inflation is crippling consumer spending, and this is amplified by the rising value of the U.S. dollar. Since the U.S. dollar is the world’s reserve currency, when it rises, it often pressures the purchasing power of less stable, emerging market currencies. This has been the case in 2022 for certain. Below are some of the most flagrant examples:

Currency Valuation Drops (Select Countries) (World Bank)

This is generally not a positive. It makes servicing debt harder, contributes to an inflationary environment, and reduces investor and business confidence. The end result is that I see the trends that contributed to this reality continuing in the short term, keeping emerging nations as an “avoid” for me also.

Beyond some of the more at-risk nations, I am also lukewarm on China, which dominates many popular emerging market ETFs. This is important because even if one was bearish on nations like Ghana or Ukraine, they could find value in an emerging market ETF that has limited exposure to those areas and is heavily weighted towards China and India. However, in this climate, China is not where I want my money either.

In the long term, Chinese exposure is not inherently a bad thing. But I have no inclination to invest in the country in this environment. In particular, tensions have been rising between China and both the U.S. and Taiwan very recently. This clouds the investment outlook and I do not see diplomatic relations improving dramatically any time soon. If anything, they are likely to get worse.

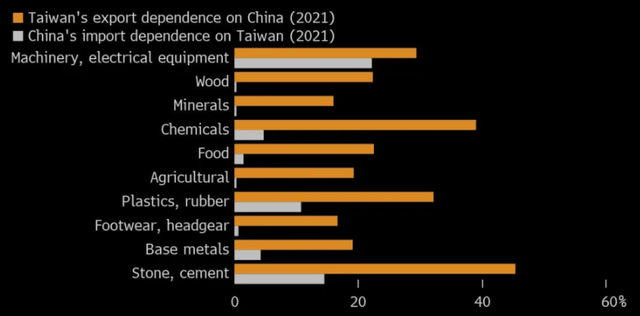

Expanding on that point, even if a military conflict between China and Taiwan is unlikely, a trade dispute (similar to the U.S.-China trade dispute in recent years) could end up being mutually disadvantageous. The reason being is that trade between these two territories is very intertwined. For perspective, consider the following graphic:

China-Taiwan Trade (International Monetary Fund)

What I see here is two territories that are heavily reliant on each other. If there is a tit-for-tat trade dispute, or worse, both are going to feel the pain. This isn’t good for either country, or the companies within them.

Developed Markets Have Attractive Attributes

The overall theme here is I see reasons to stay long and add to my developed markets exposure. However, as the year-to-date and 1-month performance results showed at the beginning of the review, this is not a “cure all”. Does it offer diversification? Yes. Does it help investors avoid some political risks here in the U.S? Yes. Are there tailwinds for each of the nations I mentioned above? Also yes, as follows:

- All of these nations are well removed from the Russia-Ukraine conflict and the China-US/Taiwan conflict (to a reasonable degree)

- The Australian economy has been one of the beneficiaries of the Ukraine conflict, given its position as a gas and wheat exporter.

- The Canadian economy benefits from high commodity prices and EWC is overweight Financials, which will benefit from higher interest rates.

- The FTSE 100 (British index) is a top performing equity market this year and has an above-average dividend yield. The U.K.’s labor market is also seeing historically low unemployment.

- Ireland’s index (through EIRL) is overweight chemicals and materials, which have benefited from higher inflation (input costs have risen – and they provide the inputs). This ETF also has a large amount of exposure to online gaming and sports betting through Flutter Entertainment (OTCPK:PDYPY). This is an area that is growing in the U.S. and their FanDuel brand has a lot of customer penetration domestically.

The takeaway here is that each of these regions has some merit and is isolated enough from both Ukraine and Taiwan for my comfort. Heading into Q4 and 2023, there are enough catalysts to keep me interested in all of them.

Bottom line

Equity investors, whether domestic or international, have gotten a big boost over the past five weeks. This has led me to raise my cash level by locking in some profits. It also has me considering portfolio positioning, and whether or not I want to maintain my non-U.S. holdings. After review, I will indeed be holding and adding to those names when a market correction presents itself, which I expect. I see plenty of merit to diversifying away from the U.S. with a percentage of my assets, and the countries of Canada, Australia, the U.K., and Ireland are all positioned well enough for me. This is in no way a “cure all” for potential equity losses, but it should provide some level of hedge against the S&P 500, and also add to my sector diversification since these nations have index weightings vastly different from the Tech-heavy S&P 500.

All things considered, I see a short-term pullback given how strong equity gains have been of late. However, the longer-term, broader story is positive to me for developed markets. In relative terms they are more attractive than EM, and while the U.S. will be a dominant force most likely in the year ahead, I don’t want all my eggs in one basket. Therefore, I will be keeping a close watch on EWC, EWA, EWU, and EIRL, and adding to them on weakness in the weeks and months ahead.

Be the first to comment