meshaphoto/E+ via Getty Images

Introduction

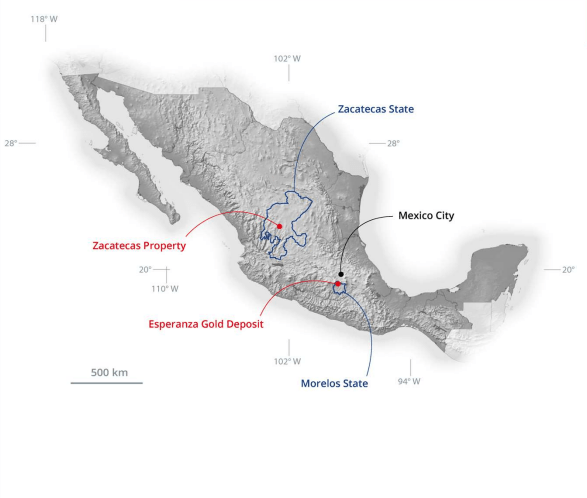

I like to write about companies that lack coverage on SA and today I’m taking a look at Zacatecas Silver (OTCPK:ZCTSF) (TSXV:ZAC:CA). It’s a Mexico-focused silver and gold mining company with a primary listing on the TSX whose trading volume and market valuation have soared over the past few days. In my view, its Esperanza flagship project has decent economics, and the recent resource estimate was in line with expectations but investing in the stock seems dangerous at the moment. Let’s review.

Overview of the business and financials

Zacatecas Silver is led by Papua New Guinea-focused gold miner Papua New Guinea gold miner K92 Mining (OTCQX:KNTNF) (KNT:CA) co-founder Bryan Slusarchuk and half of its board members have ties to this company. K92 managed to put into production the mothballed Kainantu gold mine and the company now boasts a market capitalization of over $1.4 billion as of the time of writing.

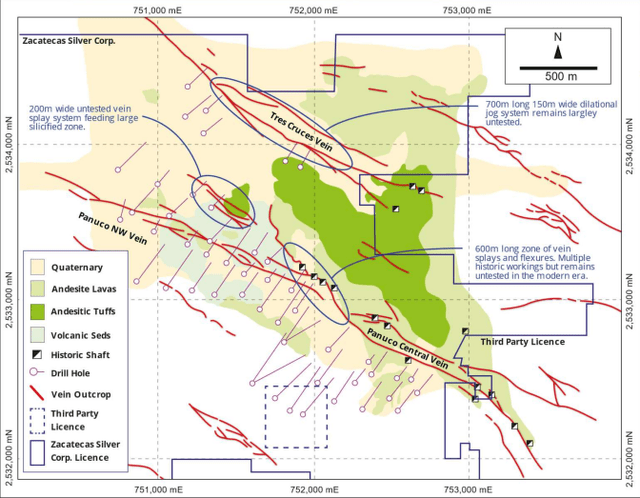

In 2020, Zacatecas Silver bought a portfolio of 149 mining concessions in the Fresnillo Silver Belt in Mexico which has produced over 6 billion ounces of silver so far. The company paid $1.5 million in cash and issued 5 million shares and today these properties are known as the Zacatecas silver project (hence the name of the company). The project is home to the Panuco deposit, and it currently has 16.4 million ounces of silver equivalent in inferred resources. While the mineralization is open in all directions and there are over 10 kilometers of largely untested veins, I think Zacatecas is not worth much in its current state as the relatively low amount of silver makes it unfeasible from an economic standpoint.

Zacatecas Silver

In April 2022, Zacatecas Silver completed the purchase of the Esperanza Gold project from Alamos Gold (NYSE:AGI) and this is now the flagship project of the former. I think this was a good deal for Zacatecas Silver considering the initial payment included $5 million in cash, a $6 million silver stream, and the issue of 12.14 million shares.

Zacatecas Silver

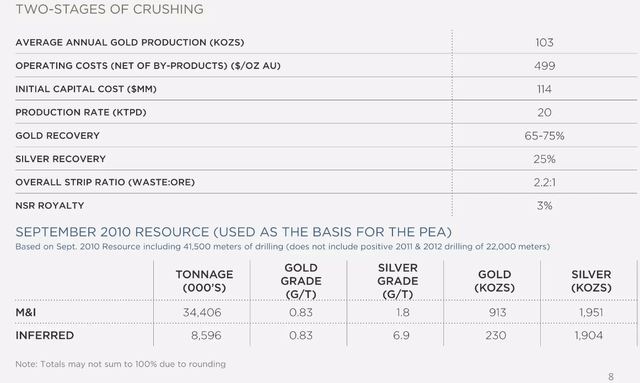

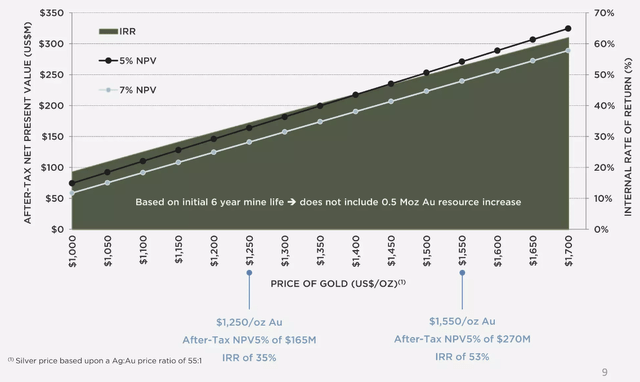

You see, Esperanza is a low-cost bulk gold project that can be developed into an open pit heap leach mine and it formed part of a company named Esperanza Gold that Alamos bought in 2013. In 2011, Esperanza Gold completed a preliminary economic assessment (PEA) that showed compelling financials. Thanks to a low strip ratio and near-surface mineralization, operating costs were expected to stand at below $500 per ounce of gold despite low recovery rates. This would put it among the lowest-cost gold mines in the world. In my view, the initial CAPEX looks modest for a mine with an annual output of just over 100,000 ounces of gold, and heap leach mines are simple from a technical point of view which means that little can go wrong before reaching commercial production. While the mine life was expected to stand at just 6 years, Esperanza’s net present value (NPV) at $1,700 per ounce was over $300 million.

Esperanza Gold

Esperanza Gold

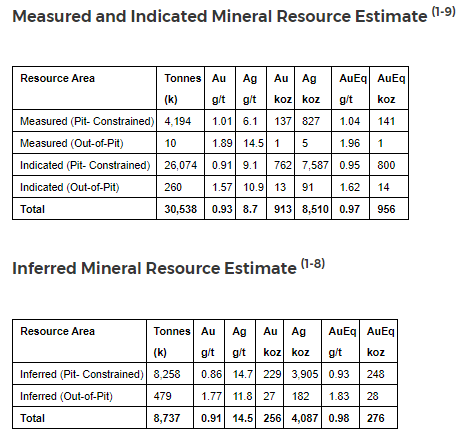

Following the purchase, Zacatecas Silver immediately started working on a resource update based on re-logging of the historical drill core and the results were released on November 16. As you can see from the table below, the figures are close to the ones from the 2010 resource estimate although I find it encouraging that the grades saw a modest improvement. This should improve operating efficiency.

Zacatecas Silver

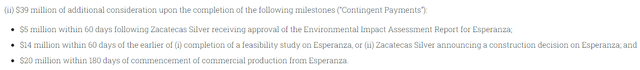

Zacatecas Silver is now working on a preliminary feasibility study (PFS) for which it has allocated a budget of $1.5 million. The company also plans to invest $1.5 million in 5,000 meters of step out drilling as well as $0.75 million in 2,500 meters of reconnaissance drilling in the near future. Overall, the purchase agreement with Alamos includes a commitment to invest $7.5 million in the development of Esperanza over a 3-year period. In addition, the company will have to pay another $39 million as the project advances to the production stage.

Zacatecas Silver

In my view, the initial CAPEX and the NPV in the PFS are likely to be slightly worse than the ones in the 2011 PEA due to inflation but Esperanza is likely to remain a compelling gold project from a financial point of view. It’s really rare to find a gold mine with operating costs of below $800 per ounce these days and it’s likely that Esperanza will have a positive NPV even at $1,200 per ounce.

Development-stage gold mining companies usually trade at about 0.3-0.5x NPV and Zacatecas Silver seems undervalued considering its market capitalization stands at just $59 million as of the time of writing. However, there are several red flags that make me want to avoid this company for the time being. First, the Government of Mexico is trying to put an end of open pit mining due to environmental concerns and few such projects have received a green light over the past year. If Esperanza needs to be redesigned as an underground mine, I think that the NPV is going to look underwhelming due to the relatively low grades. Second, Zacatecas Silver had just C$3.6 million ($2.6 million) in cash as of September which means that the company needs to carry out a capital increase in the near future to fund the PFS and drilling program at Esperanza. Third, the share price and the trading volume have been soaring over the past few days and I can’t think of a good reason why this is happening. It’s been occurring both on the OTC:

OTC Markets

and the TSX:

TMX Money

There have been no catalysts over the past two weeks, and it doesn’t seem to be significant retail investor interest. Sure, there are several posts on Twitter and on Reddit but those can’t explain why the daily trading volume over the past few days is in the millions of shares. Overall, I don’t think this irrational exuberance is likely to last for long.

Investor takeaway

K92 managed to become a significant gold producer by developing a mine that one of the major miners had mothballed and it seems that its directors want to do something similar with Esperanza. Overall, I think that it’s a good project with low costs and modest initial CAPEX, but I’m concerned about whether it can get a green light from regulators as an open pit heap leach operation. In addition, it’s likely that significant stock dilution might be coming as Zacatecas Silver is low on cash. And if this isn’t enough to make you cautious, the market valuation and trading volume have been soaring over the past few days for no apparent reason. Overall, I think that it could be best for risk-averse investors to avoid this stock.

Be the first to comment