dan_prat/iStock via Getty Images

Introduction

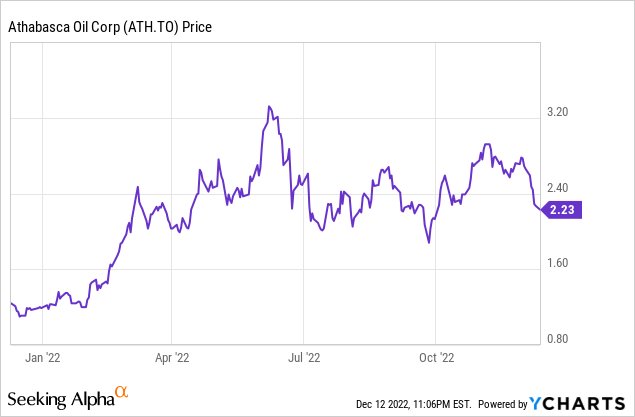

Athabasca Oil (OTCPK:ATHOF) (TSX:ATH:CA) is a Canadian oil producer, generating about 83% of its oil production from heavy oil sales with the remainder of its oil-equivalent production contributed by light oil and natural gas from its light oil fields. The share price is currently still trading more than 280% higher (after reaching a 493% return within fifteen months after the publication of my initial article) than when I wrote my initial bullish article in March 2021 but the low WCS prices on the market may be a headwind going into 2023.

The third quarter and 9M 2022 results were excellent

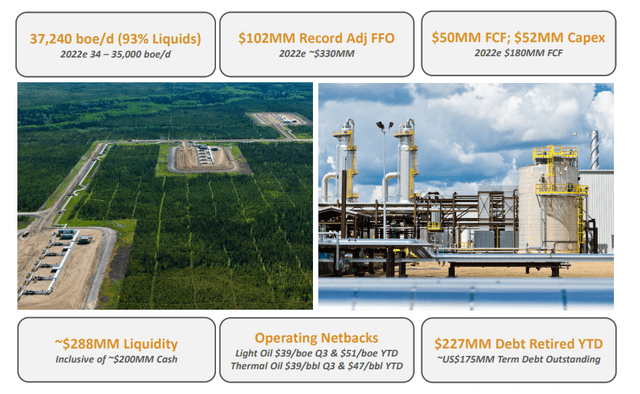

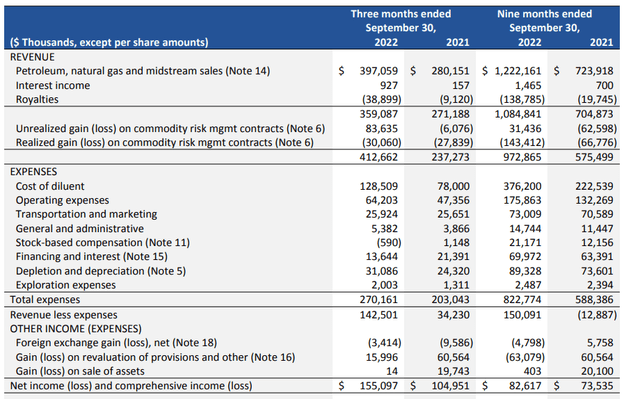

During the third quarter, Athabasca Oil received on average C$90 per barrel of heavy oil and C$113 per barrel of light oil and condensate. The total revenue during the third quarter was approximately C$397M before making the royalty payments and about C$359M after deducting the royalties.

Athabasca Oil Investor Relations

Athabasca Oil also reported a net C$53M unrealized gain on its hedging positions, resulting in a total pro-forma revenue of C$413M including the impact of the hedge book.

Athabasca Oil Investor Relations

The total amount of operating expenses was approximately C$270M with about half of the operating expenses related to the cost of diluent. Despite these relatively high operating costs, the pre-tax income was C$142.5M and the net income came in at C$155M on the back of a small FX loss and a large C$16M revaluation of provisions (the non-cash change in the value of a warrant liability).

The EPS was approximately C$0.27 which is great, but keep in mind this includes C$53M in hedging gains and about C$12.5M in non-recurring other gains. On a normalized basis, the net income would have been just over half that for an EPS of C$0.16.

If you don’t want to believe me, believe the cash flow statement.

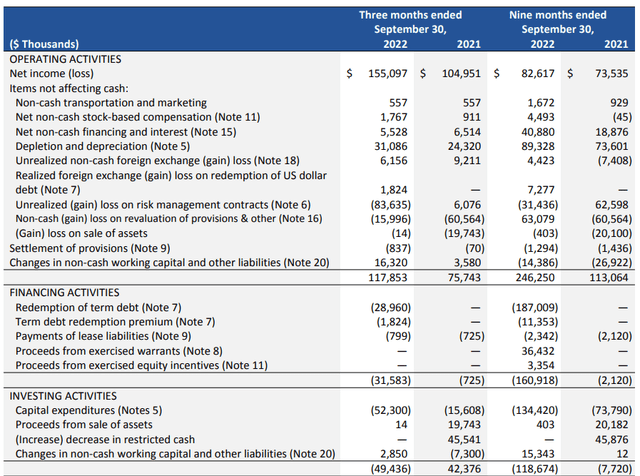

As you can see below, the reported operating cash flow was C$118M, which includes a C$16.3M working capital contribution and excludes the C$0.8M in lease payments. On an adjusted basis, the operating cash flow was C$101M.

Athabasca Oil Investor Relations

The total capex was C$52.3M resulting in a free cash flow result of approximately C$49M. Knowing the sustaining capex is approximately C$125M per year, the normalized quarterly capex would be around C$32M, resulting in a normalized adjusted sustaining free cash flow of C$69M. That’s C$0.12 per share. This however does include a C$30M realized loss on the hedge book, so we shouldn’t be too harsh on Athabasca Oil. But after adding back that C$30M in realized hedging losses, the underlying free cash flow result would still have been just C$99M or… C$0.169/share.

Bottom line: don’t be fooled by the reported net income of C$0.27 per share.

The leverage on the oil price works both ways

It goes without saying the strong performance on a YTD basis is mainly thanks to the very strong oil price, so it is always important to have a look at how the cash flows will fluctuate if one would use a lower oil price as base case scenario.

The 2023 guidance released by Athabasca Oil is very interesting. The company anticipates a total adjusted funds flow of C$415M based on an US$85 WTI price and a US$17.5 WCS differential, resulting in a realized price of US$67.5 for its heavy oil. While the US$17.5 differential is not unreasonable, there’s one problem right now: the differential currently is approximately $30/barrel, and that is the main reason why Athabasca’s share price has been under severe pressure. Looking at the futures market a WCS barrel for delivery in August 2023 currently trades at just US$49/barrel.

Fortunately Athabasca also provided a sensitivity analysis: for every US$5 change in the oil price, the cash flow will decrease by C$50M. For every US$5 change in the differential, the cash flow will move by C$80M. So a realized WCS price of $50/barrel would reduce the cash flow by 3.5 * C$50M = C$175M, in which case the adjusted funds flow will come in at C$240M.

Keep in mind this should still be sufficient to cover the C$140M capex (consisting of C$125M sustaining capex and a few small non-sustaining items), but the free cash flow of C$100M at US$50 WCS is hardly anything to get excited about. With 586M shares outstanding, the FCF per share would be just C$0.17. But for every dollar the oil price increases above that US$50 level on a WCS basis, the FCFPS will increase by C$0.017.

While the company will clearly remain FCF positive at US$50 WCS, it would put pressure on its plans to repurchase 10% of its shares on an annual basis. At the current share price of C$2.25, buying back 10% of its shares would cost C$131M. Perhaps the continuous efforts in the Carbon Capture and Storage space will help to smoothen out the impact of volatile oil prices.

And of course, should both the WTI oil price and the WCS differential move in the right direction and reach the company’s base case scenario, the FCFPS would come in at C$0.46, making the current share price pretty attractive.

Investment thesis

Athabasca Oil was an excellent call option on the heavy oil price in March 2021 but unfortunately the torque works in both ways. The company should hope for the WCS differential to improve substantially from the current US$30/barrel or its 2023 results will be pretty poor. In any case, I expect the Q4 financial results to be a wake-up call for the market, as the average price for WCS will likely be just US$55/barrel. Thanks to the weakening Canadian Dollar this will likely still represent roughly C$70/barrel but it would be dangerous to expect too much from the fourth quarter.

I remain invested in oil, but Athabasca Oil isn’t at the top of my list. The bonds are trading above par for a YTM of less than 7% which clearly indicates the debt market isn’t worried about Athabasca’s credit profile (neither am I for that matter) but I have no position in the 9.75% 2026 bonds either.

Be the first to comment