staticnak1983

A Quick Take On WiMi Hologram Cloud

WiMi Hologram Cloud (NASDAQ:WIMI) went public in April, 2020, raising approximately $26 million in gross proceeds from an IPO priced at $5.50 per share.

The firm provides Augmented Reality-based [AR] holographic services and products in China.

With a lack of further product news, continued drop in revenue and little communication from management, my outlook on WIMI in the near term is on Hold.

Overview

Beijing, China-based WiMi Hologram was founded in 2015 to develop AR-based holographic advertising services and entertainment products.

Management is headed by CEO Shuo Shi, who has been with the firm since February 2017 when his title was Vice General Manager.

WiMi has developed an online holographic AR advertising solution that embeds holographic AR ads into movies and shows by analyzing the underlying video footage at a pixel level to identify ad spaces that can be augmented by 3D objects.

The technology accepts signals through application programming interfaces [APIs] integrated with the company’s systems, consisting of the buyer’s target audience, budgets as well as the 3D models to be embedded in the videos.

According to a MarketWatch publication, WIMI is ‘the leading AI holographic vision company in China’ that has developed ‘the third-generation 6D light field holographic technology product’ with a simulation degree of over 98% that ‘takes the users’ breath away in astonishment.’

Additionally, management claims that the company’s algorithm is superior as “most peer companies may identify and capture 40 to 50 blocks of image data within a specific space unit, [while] the number of data blocks [WIMI] can collect reaches 500 to 550,” or about 80% faster than the industry average, ‘according to Frost & Sullivan.’

The company’s holographic services consist of mobile app payment middleware software, a game distribution platform and holographic mixed reality [MR] software.

Its flagship product is the WIMI HoloVR head-mounted display device.

WiMi acquires customers primarily through its sales and marketing team, which is tasked with making direct office visits, attending conferences and industry exhibitions, as well as word-of-mouth referrals.

According to a 2019 market research report by the International Data Corporation, the China Virtual Reality [VR] and AR market is projected to reach $6.53 billion in 2019 and $65.2 billion in 2023, growing at a CAGR of 84.6% between 2018 and 2023 as compared to CAGR of 78.3% for the global market during the same period.

The training, retail showcasing and industrial maintenance segments hold the largest three spots in terms of commercial applications of VR and AR while VR games, AR games and VR videos take up the top three spots in terms of consumer spending, which is projected to account for $9.59 billion by 2023.

Recent Financial Performance

-

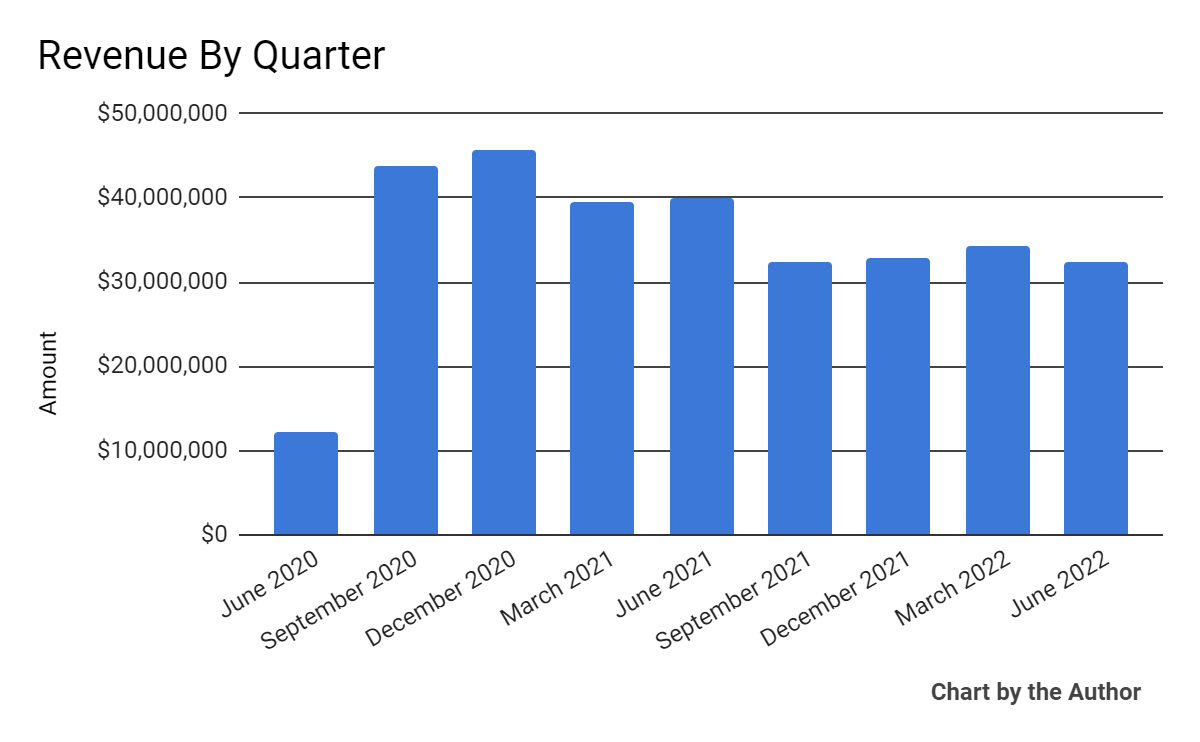

Total revenue by quarter has dropped in recent quarters, as the chart shows here:

9 Quarter Total Revenue (Seeking Alpha)

-

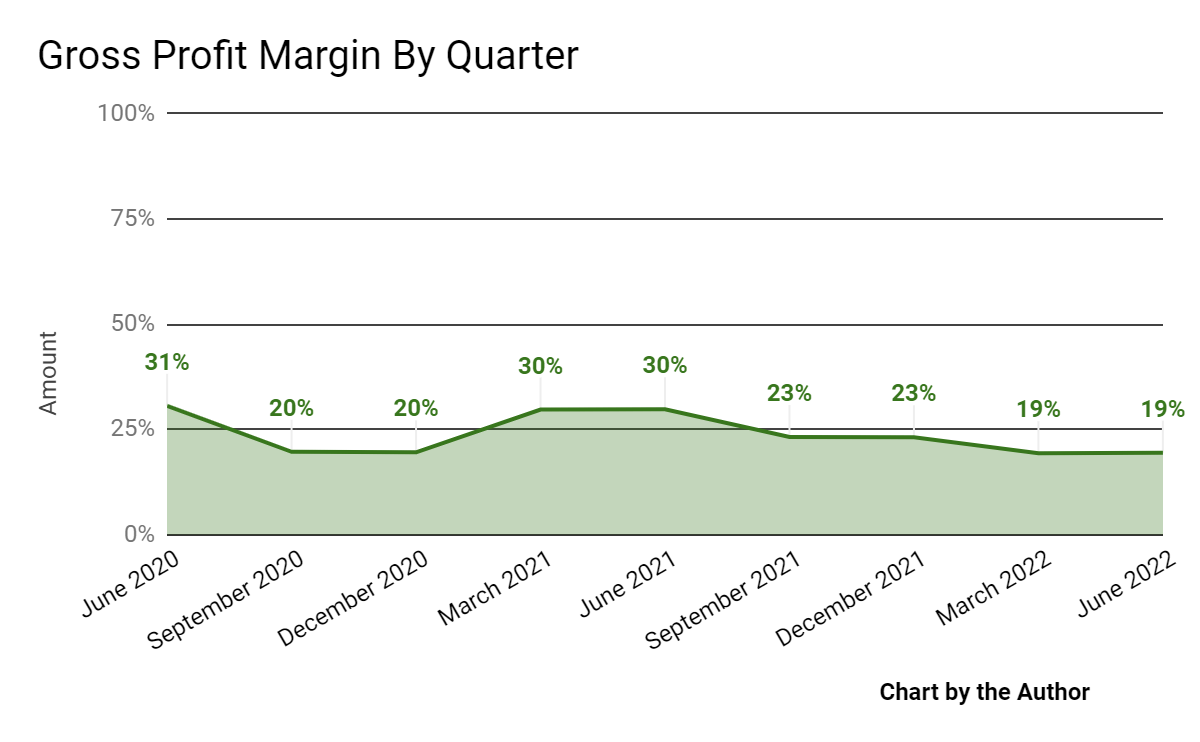

Gross profit margin by quarter has trended lower recently:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

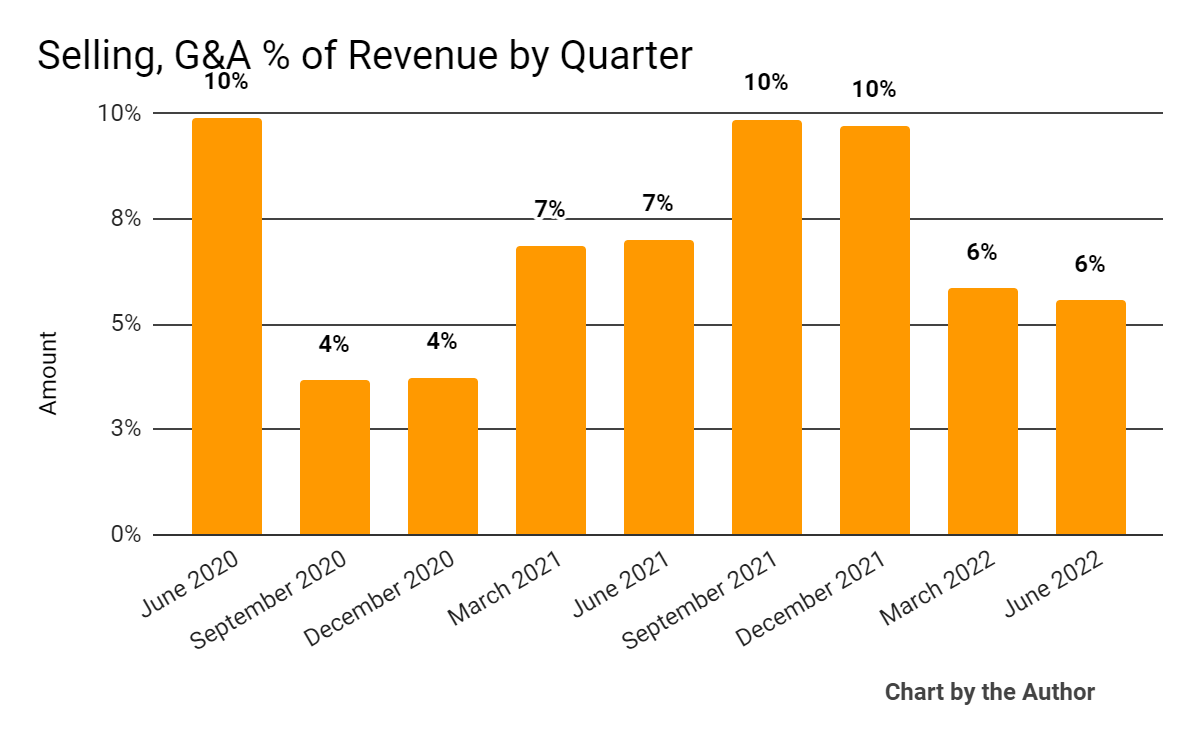

Selling, G&A expenses as a percentage of total revenue by quarter have varied within a narrow range:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

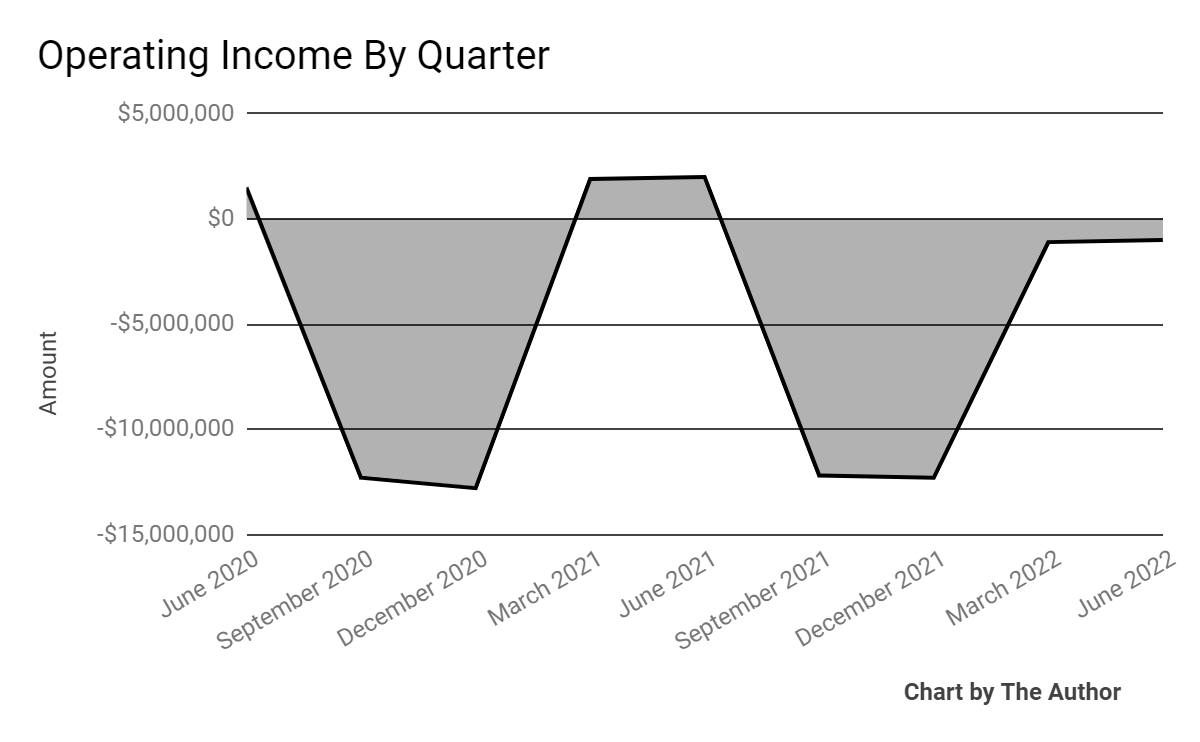

Operating income by quarter has generally remained negative:

9 Quarter Operating Income (Seeking Alpha)

-

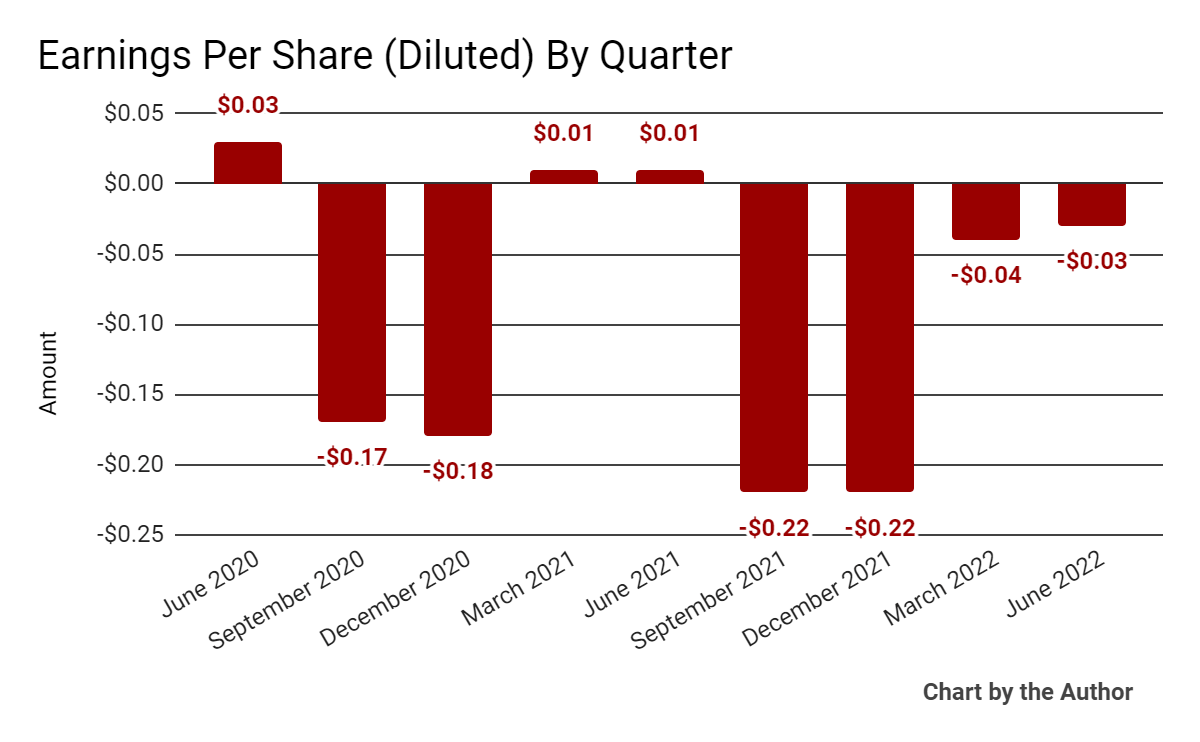

Earnings per share (Diluted) have also varied materially in negative territory:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

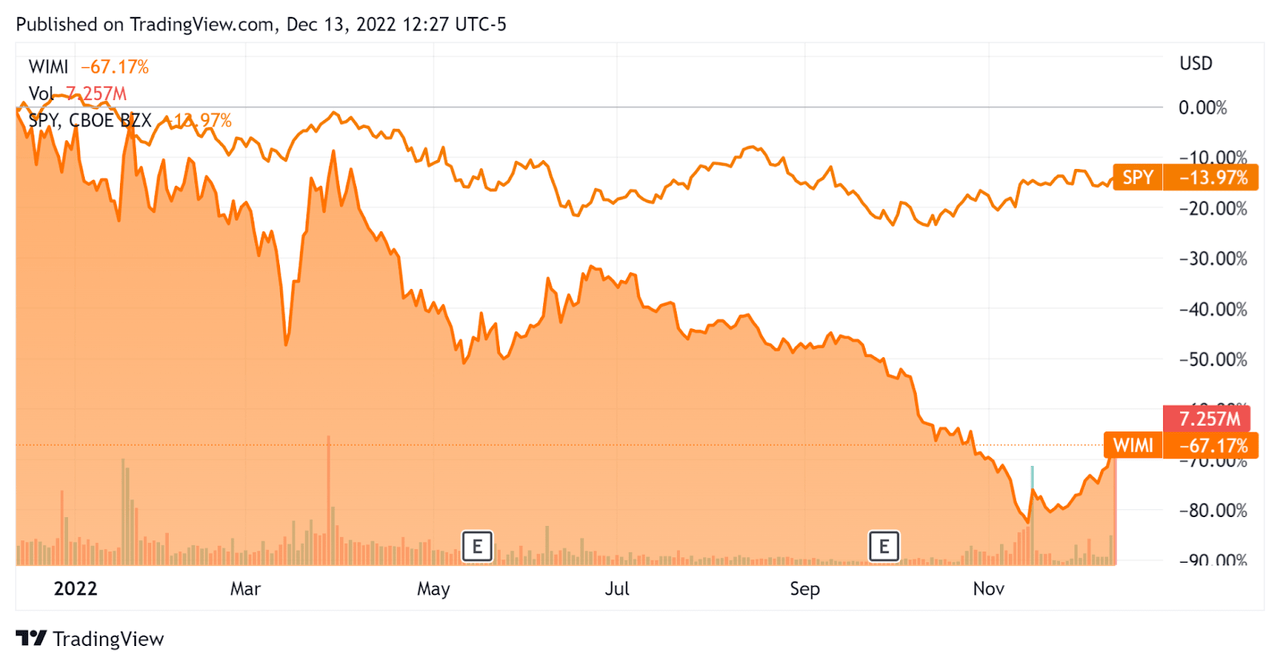

In the past 12 months, WIMI’s stock price has dropped 67.2% vs. the U.S. S&P 500 index’s drop of around 14%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Price / Sales |

0.7 |

|

Revenue Growth Rate |

-23.4% |

|

Net Income Margin |

-33.2% |

|

GAAP EBITDA % |

-18.4% |

|

Market Capitalization |

$88,383,400 |

|

Enterprise Value |

-$8,107,027 |

|

Operating Cash Flow |

$7,817,411 |

|

Earnings Per Share (Fully Diluted) |

-$0.51 |

(Source – Seeking Alpha)

Commentary On WiMi Hologram Cloud

In its last earnings publication (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted its attempts to ‘maintain a relatively stable market share.’

The firm launched a performance-based advertising service earlier in 2022, ‘expanding holographic technology into more segmented application fields.’

Management added, ‘The Company expects to continue magnifying the value of this holographic AR technology and expand to more application scenarios.’

As to its financial results, total revenue dropped 19% year-over-year, while gross profit margin fell 11 percentage points, from 30% to 19% during the same period.

Operating income and earnings per share remain at times heavily negative and highly volatile.

For the balance sheet, the firm ended the quarter with cash and equivalents of $110.6 million and total debt of only $2.2 million.

Over the trailing twelve months, free cash flow was $7.6 million, of which capital expenditures accounted for $200,000.

Regarding valuation, the market is valuing WIMI at a Price/Sales multiple of only 0.7x.

The primary risk to the company’s outlook is its continued contraction in revenue despite receiving FCC approval for its HoloVR product in March of 2022.

A potential upside catalyst to the stock could include a successful launch of its device to niche markets in the U.S.

Also, the firm recently announced its subsidiary VIYI Algorithm’s intentions to list its stock on Nasdaq ‘through a transaction valued at $400 million’ on December 13, 2022 after a merger with a SPAC vehicle.

However, there has been a lack of further product news, continued drop in revenue and little communication from management.

The stock price performance of such SPAC deals in recent periods has generally been poor.

Accordingly, my outlook on WIMI in the near term is on Hold.

Be the first to comment