evgenyatamanenko/iStock via Getty Images

Investing for income has been made much easier over the past couple of months, as the rout in the prices of many REITs have pushed up their dividend yields. However, simply looking at yield isn’t enough, as some REITs currently have low payout ratios. As such, valuation also matters, and this brings me to the beaten down Kite Realty Group (NYSE:KRG). This article explores why KRG is a good investment for growing income, so let’s get started.

Why KRG?

Kite Realty Group is an Indianapolis based REIT that has 60 years experience in developing, acquiring, and operating real estate. It’s been public since 2004, and at present, owns open-air shopping centers and mixed-use assets primarily centered around the growing Sun Belt region of the U.S.

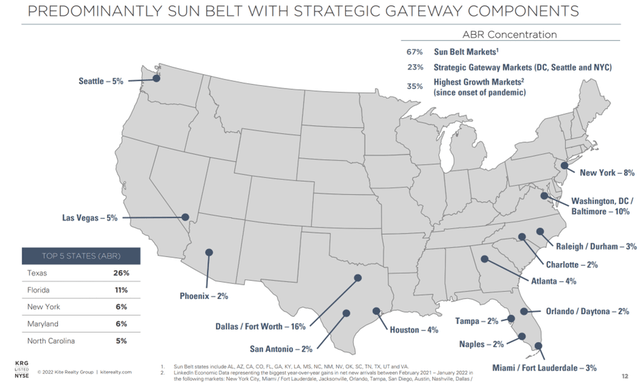

As shown below, 67% of KRG’s annual base rent comes from the Sun Belt region, while the remaining 33% comes from prime gateway and Tier 1 markets such as New York, Washington D.C., and Seattle.

KRG Locations (Investor Presentation)

Like some of its shopping center peers, such as Kimco Realty (KIM), KRG has been increasing its exposure to grocery-anchored centers, which are more economically essential and resistant to e-commerce growth. At present, 75% of KRG’s annual base rent is derived from grocery anchored centers, putting it just below the 80% of peer Kimco Realty.

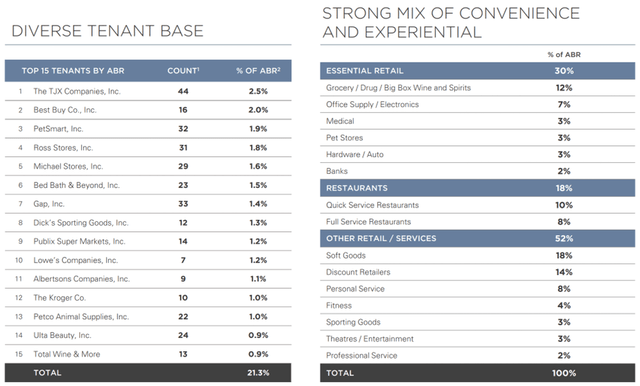

Moreover, management continues to evolve the tenant profile towards stores that resonate with today’s consumers. Its top 5 tenants include the well-known TJX Companies (TJX), Best Buy (BBY), PetSmart, Ross Stores (ROST) and Michaels Companies (MIK). Beyond groceries, the tenant base is also well-diversified across drug stores, electronics, quick service restaurants, and discount retailers, as shown below.

KRG Top Tenants (Investor Presentation)

Furthermore, recent additions to the tenant roster include discount grocers like Aldi, and trendy offerings such as Total Wine, Five Below (FIVE), and Ulta Beauty (ULTA), replacing out of fashion brands such as Office Depot and Pier 1.

KRG New Tenants (Investor Presentation)

Meanwhile, KRG’s portfolio has performed rather well, with a healthy 93.6% occupancy rate. It also grew same property net operating income by a robust 5.9%, inclusive of legacy RPAI properties, which it acquired in the fall of last year.

This was driven by strong leasing trends, as reflective of high demand for KRG’s properties, with a 16.1% blended cash leasing spread (new and renewal leases combined) during the first quarter. Given the strong trends, management is now guiding for full year FFO per share of $1.77 at the midpoint, up from $1.72 previously.

Looking forward, KRG appears to be well-positioned to fund its acquisition and development pipeline, as it maintains nearly $1 billion in available liquidity and is safely leveraged with a net debt to EBITDA ratio of 5.7x. This also comes with investment grade credit ratings of BBB- and Baa3 from S&P and Moody’s (MCO).

In addition, shopping center REITs are often referred to as “land banks”, given the large amount of undeveloped land they have in their parking lots. Management intends to make use of these assets, as noted during the recent conference call:

We’ve also made progress on the development front all of our active developments are coming along on time and or under budget. That’s for the entitled land bank, we’ve unearthed additional value propositions as promised, and we’re taking a bespoke approach to every single parcel. Over the course of 2022, we look forward to sharing our creative vision for maximizing value and minimizing risk. The best thing about the entitled land bank is the investor community historically attributed very little value to the land. And we certainly didn’t put a price tag on it when we were underwriting the merger but we see excellent opportunities ahead.

Meanwhile, KRG recently raised its dividend by 5% to $0.21 per share, resulting in an expected payout ratio of 47% based on the midpoint of its 2022 FFO/share guidance. As such, I see plenty of room for KRG to return to its pre-pandemic dividend rate of $0.3175, which would still equal a modest payout ratio of 72%.

Risks to KRG include higher interest rates, which could raise its cost of debt. In addition, a recession in the near term could place pressure on KRG’s tenants. It appears that these risks are more than baked into the share price, however, as KRG appears to be cheap at the current price of $18.03, with a forward P/FFO of 10.2.

This translates to an earnings yield of 9.8%. Management appears to agree on how undervalued the stock is, as it upsized its share repurchase program from $150M to $300M. This sentiment is perhaps best articulated by the CEO, John Kite, during the recent conference call:

Finally, I want to address the change to our share buyback program. The primary purpose is to properly size this critical capital allocation tool in light of our post-merger market capitalization. With that said, we are keenly aware of the disconnect between our stock price and our underlying fundamentals. We have great real estate a best-in-class platform, and we will continue to outperform until that disconnect resolves itself. Whether you’re a value investor or growth investor, I can’t think of a name in our space that screens more attractively.

Sell side analysts have a consensus Buy rating on KRG with an average price target of $26.30. This translates to a potential one-year 51% total return including dividends.

Investor Takeaway

Kite Realty Group is a well-run REIT that’s seeing strong portfolio fundamentals. It has a strong tenant base, and maintains the balance sheet flexibility to continue growing in the portfolio. Meanwhile, KRG sports a growing dividend supported by a low payout ratio. The recent share price weakness makes KRG a solid buy for growing income.

Be the first to comment