Karl Weatherly/DigitalVision via Getty Images

Co-produced with Treading Softly

Humans are naturally inclined to seek immediate gratification of needs without concern for the larger reward if we waited. A study on this skill placed children in a room with a marshmallow. The promise was if they waited and did not eat it, they’d get rewarded by getting a 2nd marshmallow. Many of the children ate the marshmallow the moment the instructor left their sight. Others struggled with their intense desire for immediate gratification and received the reward if they succeeded.

The ability to willingly deprive yourself of a reward today for a larger future reward is a learned skill. It is a very valuable skill to have for retirement saving. People who are willing to live in a cheaper home, drive an older car, and keep their personal debt low can set aside more for the future.

It isn’t always easy! Especially with technology making so much instant gratification available to us. Amazon prime, instant streaming of shows and movies, and the internet have caused us to return to our baser nature and seek immediate gratification more swiftly.

With commission-free trading, flashy brokerage phone apps, and cell phones, we’ve seen the barriers to trading come crashing down. This means a few taps on the phone to place a buy or sell in a heartbeat, with no commissions to consider.

How many of you remember waiting for the morning paper to see what happened in the markets yesterday? If you lived in a rural area, you might have received yesterday’s newspaper telling you what the market did two days ago. Do you remember having to call your broker on the phone, wait on hold, and have them manually place your buy or sell order? Even dialing was slower on those rotary phones; how many 9s are in that number? The bottom line is that placing a knee-jerk trade was impossible. Buying or selling took a lot of action and time on your part.

Investors are becoming more reactive, not proactive. They see a share price drop a few percent and sell. It rises again, and they rush in to buy. Sometimes on the same day.

The market has driven many to panic and sell. Now is the time to be a wise, careful, and prudent bargain hunter.

Let’s look at two excellent bargains.

Pick #1: RQI – Yield 7.3%

Cohen & Steers Quality Income Realty Fund (RQI) is a CEF (closed-end fund) that invests in equity REITs (eREITs, a.k.a. property REITs). These are REITs that own real estate and generate the bulk of their income from rent.

Inflation is great for REITs. Why? Guess what landlords do in an inflationary environment. They raise the rents. REITs benefit from rent growth under existing contracts, which often reflect inflation, and they benefit from new rental contracts.

Yet there is another way that REITs benefit. REITs are borrowers. When they buy a property, it is very common to finance the acquisition with debt that is 40-60% of the acquisition costs. The average REIT has much higher leverage than the average corporation, thanks to the attractiveness of real estate as collateral for lenders. An inflationary environment is a positive for companies that borrow a lot of money.

They bought the property years ago with dollars that are now being inflated. Inflation means that a dollar tomorrow will be worth less than it is today. So highly leveraged borrowers benefit from inflation, reducing the overall value of the debt they owe.

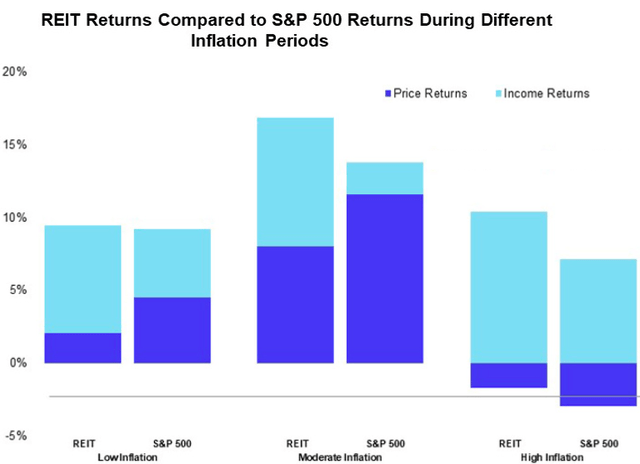

When we look at history, we can see that REITs have, in fact, outperformed during periods of moderate and high inflation. (Source: Nareit)

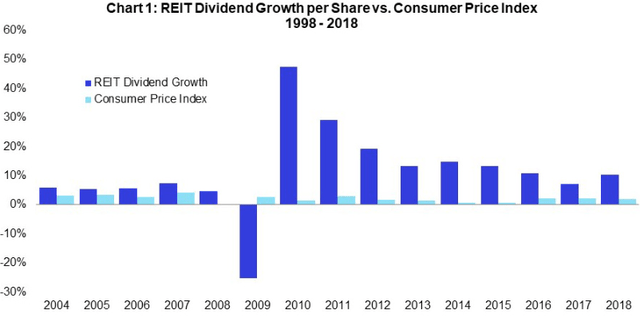

That outperformance was primarily due to the large amounts of dividends. REIT dividend growth has consistently been much higher than CPI, except for 2009.

But what about their debt? Many on Wall Street have a knee-jerk reaction that when interest rates rise, they sell REITs. After all, they carry a lot of debt. So since the Fed will fight inflation by increasing rates, will that make REITs bad? No.

For the past two years, quality REITs have refinanced every debt they could at historically low-interest rates. Refinancing and extending their maturities at historically low-interest rates, using bonds that don’t mature for 5, 10, or even 30+ years. This provides REITs with a lot of runways, as most have little debt maturing in the next few years. The benefits of increasing revenues from inflation are coming immediately, while the costs of higher interest rates won’t be felt for many years, and then only if rates remain high.

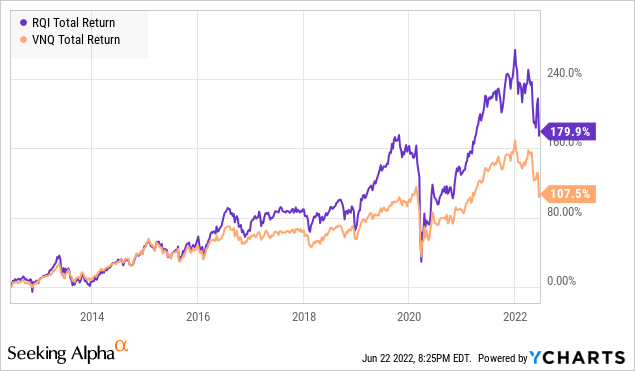

Cohen & Steers is one of the best managers in the REIT space, and RQI has consistently outperformed REIT index funds like Vanguard Real Estate ETF (VNQ).

REITs will outperform in the coming years, and RQI is a great option for instant diversification and a healthy yield.

Pick #2: UTF – Yield 7.8%

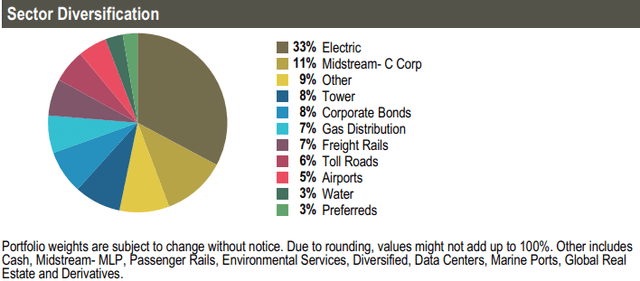

Cohen & Steers Infrastructure Fund (UTF) is more than your average utility CEF. Certainly, UTF has exposure to utilities like electric companies, which provide a great defensive income in any environment. Then UTF adds in several other sectors that would fall into the “infrastructure” category.

Factsheet as of March 31, 2022

UTF buys Midstreams, tower REITs, freight rails, toll roads, and more. They buy the infrastructure responsible for getting fuel to your car, natural gas to your furnace, electricity to your computer, and your Amazon (AMZN) order to your door. UTF is an excellent defensive pick with exposure to picks that will benefit from inflation in energy and transportation. Two sectors where inflation has been very high.

UTF pays investors a high monthly dividend today and is a holding that can comfortably be held through market volatility.

Shutterstock

Conclusion

With RQI and UTG, we can lock in excellent bargains on these two world-class CEFs. UTG doesn’t cut its dividend but grows it. An income investor’s dream that’s on sale. RQI invests in excellent REITs which will benefit from rising inflation and can see your portfolio through rate hikes without fears of losing income.

When the market decides it’s time to panic and sell, it’s time to suit up in camo, whip some mud on your face and go hunting, not for deer or hogs, but for bargains.

For income investors, a bear market creates an outstanding opportunity. By nature, we are long-term investors. We’re not looking for the instant gratification of a quick flip. We can delay gratification to see constant recurring returns from every dividend we receive.

When others are panicking and looking to exit the market, I can approach the flea market of the stock exchange and pick up bargains from those looking to hit the exits ASAP. Afterward, I can sit back and enjoy the income flowing into my portfolio month after month, year after year. My portfolio balance will swell to new heights as investors who panicked decide to return and have to pay more for their shares than I had to.

That’s how income investors win on both fronts.

Be the first to comment