pinstock

The Financial Services Sector Rallied on Increased Confidence in The Banking System

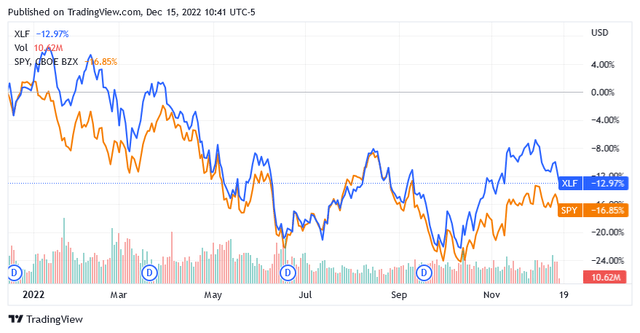

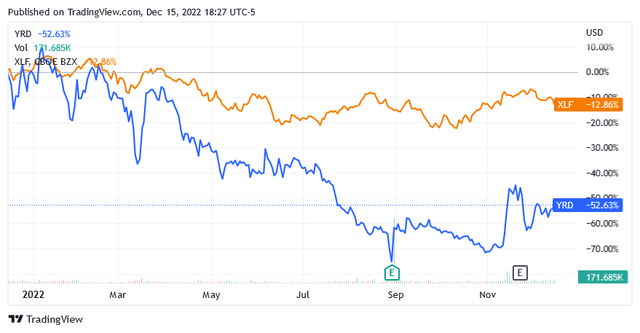

The financial stocks sector has rallied faster than the broader US stock market since October, and overall has been less affected by recession fears and the impact of the war in Ukraine on the global economy. In fact, the Financial Select Sector SPDR ETF (XLF) is down 13% over the past year, while the SPDR S&P 500 Trust ETF (SPY) fell by nearly 17%.

The better performance of the financial sector likely came as central banks raised interest rates to curb runaway inflation, leading traders to believe that financial firms will benefit from a normalization of monetary policy after several quarters of accommodative rates.

This sentiment strengthened among traders after clear signs of a slowdown in the annual inflation growth rate from 8.2% in September to 7.7% in October. Now, traders seem to not only see the hawkish stance on interest rates as effective, increasing confidence in the work of the entire banking system, but also seem to see the current context as less uncertain for banks.

Caution Is the Watchword in The Financial Services Sector, Especially with Stocks Like Yiren Digital Ltd

As a result of effective monetary policy, it should now be easier for banks to classify loans according to their risk and anticipate losses on loans that may not fare well in 2023 and beyond if a recession hits, as economists predict.

On the other hand, this situation could lead to an underestimation of the investment risk in the financial services sector. Investors should exercise great caution anyway. When even companies with strong balance sheets and good profitability need to be very careful in assessing future risks, it is easy to imagine the impact the current economic slowdown could have on less proactive financial stocks.

One such vulnerable stock in the financial services sector could be Yiren Digital Ltd. (NYSE:YRD).

This is a Chinese credit services operator, whose revenue and earnings are on a sharp downtrend amid a gloomy Chinese outlook for securities investment and consumer and business credit.

Yiren Digital Ltd in The Financial Services Sector

Yiren Digital Ltd., based in Beijing, People’s Republic of China, operates an online consumer finance marketplace that facilitates connections between borrowers and investors in mainland China.

Essentially, around 58-60% of total revenue comes from credit technology solutions sold to businesses.

While around 35-36% comes from comprehensive wealth management solutions offered to middle-class Chinese households.

Sales and Earnings Are Declining

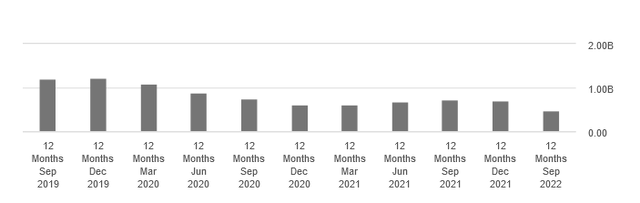

Total revenue is down significantly on a 12-month and quarterly basis.

The chart below illustrates the downward trend in 12-month total revenue over the past few quarters.

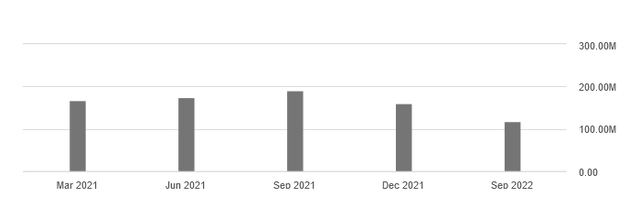

For the third quarter of 2022, total revenue was $118.2 million, down nearly 32% year over year.

Revenue from credit-tech solutions for businesses fell 45% year over year, driven by product optimization the company highlighted in its third-quarter 2022 earnings report.

While revenue from the holistic wealth business segment declined nearly 13% as investment products saw a drop in sales volume.

Within the holistic wealth business, the company expects the insurance intermediation sub-segment, which is enjoying positive momentum, to grow significantly in the current quarter as it is on track to become a key pillar of Yiren Digital Ltd.’s overall revenues.

Regarding the credit technology business, the company says that this segment has higher operational efficiencies and lower borrowing costs after business optimization and expects strong lending volume growth in the current quarter.

Company forecasts are optimistic, but the environment will not be favorable at all as the Chinese economy appears to be decelerating worryingly based on some very important economic indicators.

The economic picture differs significantly from the scenario forecast by the company in the earnings report for the third quarter of 2022.

Recent data on the Chinese economy is not good and the recent fall in the price of various commodities suggests markets are taking this information very seriously.

China’s economic slowdown is signaled by industrial production and retail sales data. Year-on-year, Chinese industrial production rose 2.2% in November 2022, significantly less than the 5% increase in October. This was the weakest growth in the past 7 months, partly due to China’s zero tolerance for the COVID-19 virus and partly due to a downturn in the real estate sector.

The sharp fall in industrial production could be a sign that companies are cutting back on investment, leading to lower demand for credit, and could also hurt consumption if accompanied by job cuts.

Also, year-on-year, Chinese retail trade fell 5.9% in November 2022, deteriorating dramatically after posting a modest 0.5% decline in October. This was the second straight decline and the sharpest downtrend since May.

This index suggests that Chinese consumption is falling sharply, which cannot be reflected in an improved outlook for consumer credit demand.

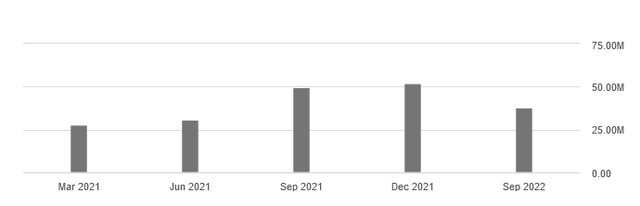

The bottom line is also going down. Net income decreased to $38 million in Q3 2022 [down 84% year over year], Adjusted EBITDA decreased to $51.3 million [down 25% year over year] and net income per American Depositary Shares [ADS] decreased to $0.4 [down 33.3% year over year].

From a financial strength standpoint, Yiren Digital’s financial condition could be much better since the Altman Z Score of 2.05 indicates there could be a slight risk of bankruptcy, although the probability is not high.

The Stock Valuation

Yiren Digital has left shareholders with very bad taste as shares have fallen sharply over the past 12 months, giving away more than 50% of their value.

As of this writing, the stock traded at $1.35 per unit for a market cap of $111.80 million and a 52-week range of $0.67 to $3.15.

Yiren Digital’s 14-day relative strength index of 54.62 shows that the stock is likely not yet oversold despite this year’s plunge.

This means the stock has room to decline amid strong downward pressure from headwinds from the slowing Chinese economy.

The stock could also recover from current levels, but as of today, that chance is slim. The severe crisis in China’s real estate sector and the introduction of overly restrictive measures against small surges in COVID-19 virus infections may have laid the groundwork for long-term troubles in China’s economy that will affect demand for consumer credit and investment together with other activities.

Conclusion

Chinese credit services company Yiren Digital is highly exposed to expected strong headwinds from the economic slowdown in China.

Revenue and earnings are on a sharp downtrend, while China’s outlook for middle-class wealth, consumer and corporate credit looks bleak. I think the share price probably won’t recover from the current level therefore.

Be the first to comment