Douglas Rissing

The Federal Reserve did raise its policy rate of interest by 50 basis points this week.

The signal from the Fed was that although it diminished the amount of increase in the range for the Federal Funds rate, the Fed was still planning on continuing to raise its policy rate for a fairly long period into 2023.

Investors were happy with the 50 basis point increase.

Investors were unhappy with the idea that the Fed would continue raising the policy rate well into the next year.

The Standard & Poor’s 500 Stock Index (SP500) closed down 99 points for the day.

The S&P was down another 50 points by noon on Friday.

The Bigger Picture

Here we go back to the part of the Fed’s policy program that I keep trying to emphasize.

Yes, the Federal Reserve is raising its policy rate of interest.

But, the Federal Reserve is also reducing the size of its securities portfolio at the same time.

I believe that the Fed will continue to raise its policy rate of interest in a way that is consistent with the amount it wants to reduce the size of its balance sheet.

After all, the Federal Reserve is in the position it is in because of all the reserves it pumped into the banking system over the past two years or so. The Fed must remove a lot of these reserves if it is going to have any hope of controlling inflation in the future.

It’s not the level of the policy rate that matters.

It is the size of the reserves the Fed wants to leave in the banking system. The Federal Funds rate is determined by a supply and demand situation. The Fed controls the supply of funds in this market through the movement in its securities portfolio. The ultimate level the rate goes to will depend upon the supply and demand situation in the money market.

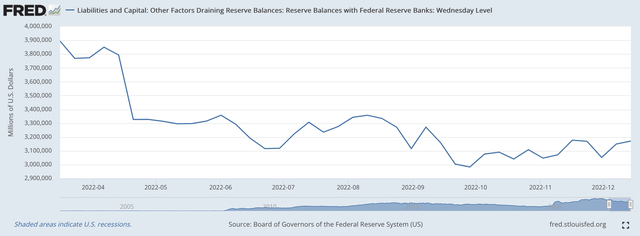

Reserve Balances With Federal Reserve Banks

Since the middle of March, the Federal Reserve has overseen a reduction in the line item on its balance sheet titled “Reserve Balances with Federal Reserve Banks.”

This account can be used as a proxy for excess reserves in the commercial banking system.

Since, March 16, 2022, Reserve Balances with Federal Reserve Banks have declined by $722.6 billion.

This represents a tightening up on commercial bank reserves and puts upward pressure on the policy rate of interest.

This is the way that the Fed is underwriting the increased pressure on its policy rate of interest.

Reserve Balance with Federal Reserve Banks (Federal Reserve)

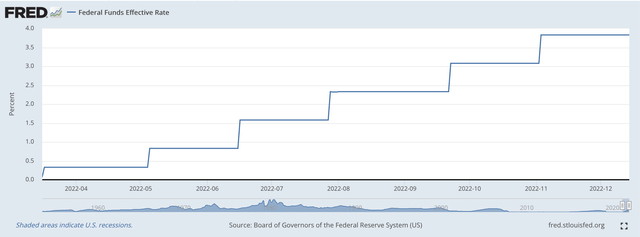

One can see the inverse movements of the effective Federal Funds rates when compared to the movement in reserve balances.

Federal Funds Effective Rate (Federal Reserve)

The effective Federal Funds rate will, over time, be heavily dependent on the level at which the Federal Reserve reduces reserve balances. It cannot be otherwise.

So, if the Fed keeps reducing its securities portfolio, reserve balances will continue to go do and the effective Federal Funds rate will have to go higher.

Federal Reserve Statement

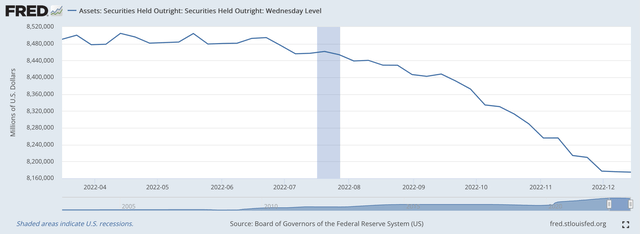

The Federal Reserve reconfirmed its commitment to reducing the size of its securities portfolio in its FOMC statement, released the past Wednesday.

In the statement, the Federal Reserve confirms:

“The (Federal Open Market) Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’s Balance Sheet that was issued in May.”

Overall, the Federal Reserve has “reduced the size of its holdings” by $353.0 billion since March 16, 2022. This averages to just a little over $39.0 billion each month since the effort began.

The rest of the reduction in reserve balances has come from “administrative changes” such as those coming from the U.S. Treasury Department’s management of its General Account at the Fed.

The Treasury Department has actually added reserves to the banking system since the middle of March, as it paid down its operating accounts at the Fed.

The rest of the adjustment of Reserve Balances with Federal Reserve Banks has come from the account Reverse Repurchase agreements, which account for very short-term “sales” of securities under an agreement to repurchase them.

Deposits with the Fed, which include the U.S. Treasury account, have declined by just under $350.0 billion since March 16.

Reverse Repurchase Agreements, however, have risen by almost $690.0 billion since then.

Net, the factors absorbing reserve funds (other than reserve balances) have risen by $357.2 billion since March 16, 2022, draining the banking system of reserve balances.

Securities Held Outright (Federal Reserve)

Just as the Federal Reserve “pumped” reserves into the banking system in 2020 and 2021 by buying, on a monthly basis, a regular amount of securities, titled, “quantitative easing,” the Federal Reserve is trying to reduce its securities portfolio by a regular amount every month, titled, “quantitative tightening.”

The question is, how long does the Federal Reserve plan to continue its “quantitative tightening”?

This, to me, will be the factor that determines just how long the Fed will continue to raise its policy rate of interest, and it will also determine how high the Fed will have to raise its policy rate of interest.

The Future

One of the concerns that some analysts have about how far the Federal Reserve will go to “remove” the excess liquidity it pumped into the banking system in 2020 and 2021, centers here.

The securities portfolio has been reduced by $353.0 billion.

But, between January 1, 2020 and January 6, 2022, the Federal Reserve added more than $4.5 trillion in securities to its securities portfolio.

In order to restore “working order” to the banking system, the Fed may need to take out quite a few dollars.

But, what will continuing to let securities run off the Fed’s balance sheet do to the policy rate of interest, the banking system, and the financial markets?

Can the Fed, seriously, take enough securities off its balance sheet to really “beat” the inflation that it initially started?

Yes, there are still a lot of questions to be answered.

Be the first to comment