Melting snowflakes Wirestock/iStock via Getty Images

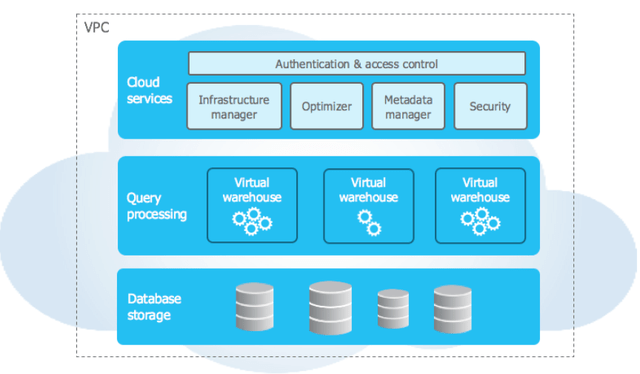

The Data Cloud brought to us by Snowflake Inc (NYSE:SNOW), is a cloud based solution for all things data and is utilized by businesses across the globe. Accessed via the web browser, this Software As A Service [SaaS] based platform does away with the hassles of software downloads, installation, and maintenance within the individual businesses eco systems. Its framework comprises three components: data storage, data querying/computing and cloud services.

Customers are charged for these components based on independent criteria, providing further flexibility of use.

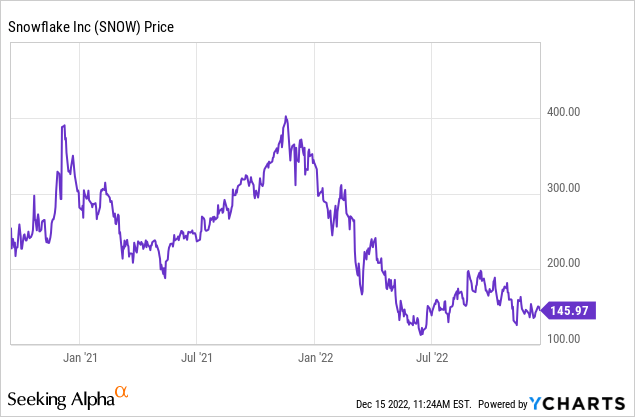

The company had a stunning public debut in September 2020. It opened for trading at more than double the initial public offering [IPO] price of $120. Despite IPOs being embraced across the board during those days, Snowflake stood head and shoulders above the rest when it teleported from the offering price of $120 to $245. After all, it was backed by the Dumbledore of value investors, Warren Buffet. Yes, Buffet’s Berkshire Hathaway Inc (BRK.A, BRK.B) bought 6.1 million shares at $120.

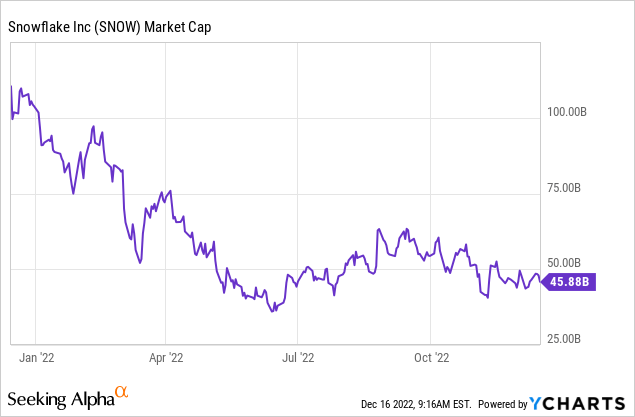

Snowflake is making its inevitable fall after being as high as $400 late last year. What is comforting is that it is not alone. It has the company of several COVID era snowflakes. Today though, we make our coverage debut for this one and throw our opinion in the now overcrowded ring.

Magnificent Growth

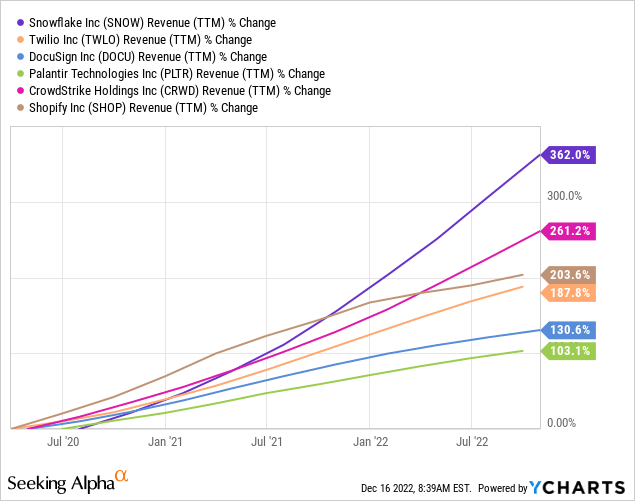

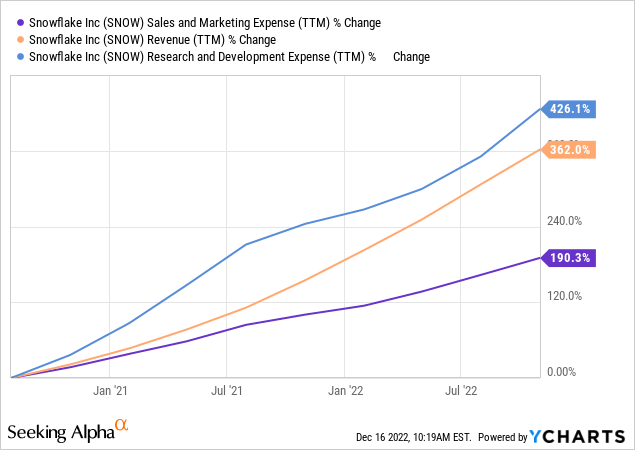

Investors buying into Snowflake for the growth potential have certainly got a fair chunk of it. Amongst the SaaS pack of Twilio (TWLO), DocuSign Inc. (DOCU), Palantir (PLTR), CrowdStrike Holdings Inc. (CRWD) and Shopify Inc. (SHOP), Snowflake stands out for some unbelievable numbers. Below we have shown total change in trailing 12 month revenues over the last 3 years for these companies.

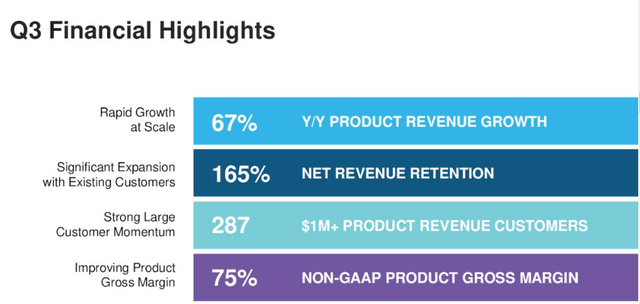

What is more impressive here is that the company’s numbers stayed strong during a phase where most others saw a slowdown in growth. The third quarter of 2022 saw the same trend with a 67% year over year revenue growth.

Investors appeared disappointed with the guidance of just a 50% growth rate in Q4-2022 and the stock continues to struggle even in the face of impressive growth.

How Do You Value It?

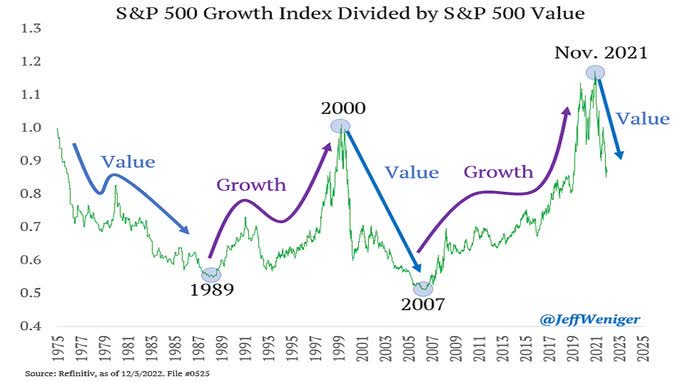

2020 and 2021 were years that birthed many amateur views on investing that ran along the lines of “growth is good”. There was little fundamental support for these stocks. Instead we got a new era of nomenclature with Total Addressable Market or TAM further fluffed by looking out to 2030 or beyond to justify buying today. Those greatest hits have led to investors suffering 80%-90% drawdowns. This should not come as a surprise to anyone who has followed the history of investing. The crowd is always drawn in at the top and logic, common sense and bearish voices are discarded faster than you can say QE. While it is easy to be dismissive of Snowflake now that growth investors have got their growth in tax losses, the company does stand above the rest and one has to wonder whether this is a good entry point.

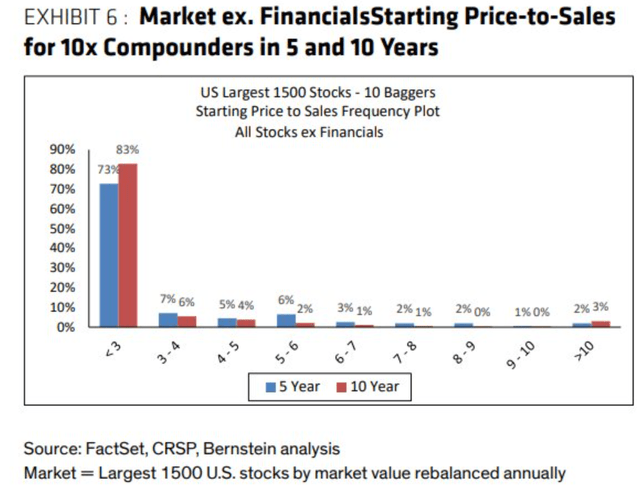

There are 3 aspects for this and we will run you through them and you can then decide if the purchase makes sense. The first is a look at what really delivers those 10-bagger returns in our total stock Universe. Bernstein looked at this, leaving out the financial sector and found that the vast majority of stocks that delivered 10 fold returns had a starting price to sales of under 3!

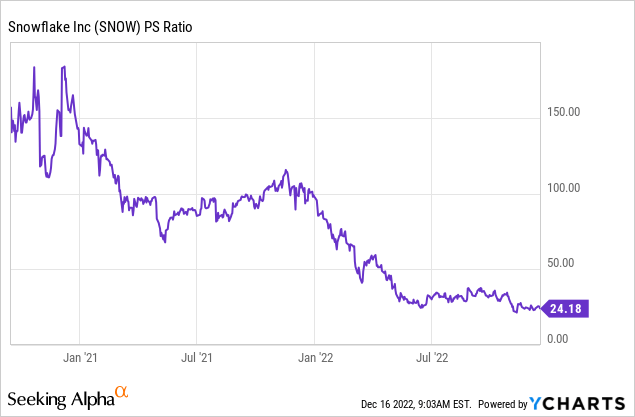

This is a shocking conclusion considering what investors paid for and are still paying for Snowflake.

Even at the secondary peak at $400 in the middle 2021, investors were ponying up 100X sales. Obviously those numbers were not remotely conducive to delivering the returns investors were seeking. The current 24X sales is an improvement, but again runs against the grain of history.

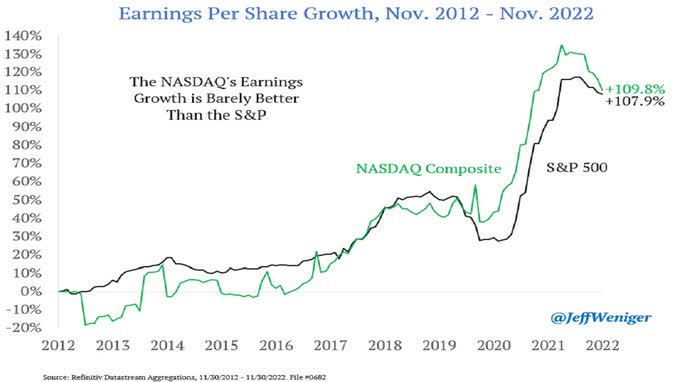

Investors may dismiss these results and do so perhaps because they see technology as special. We hate to break this to you, but collectively there is nothing special about technology.

Jeff Weniger-Twitter

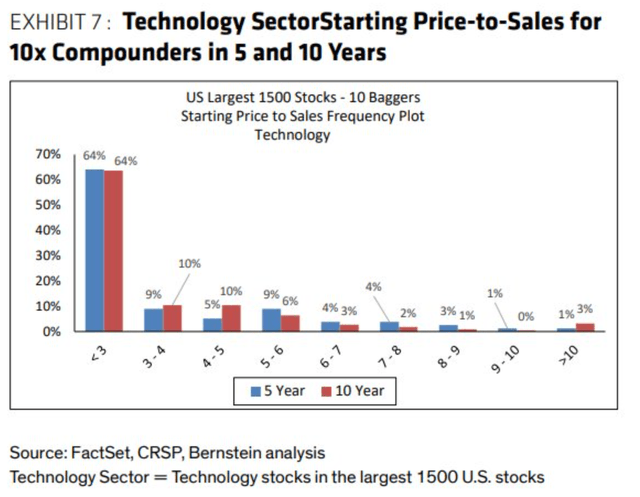

But let’s entertain the idea that technology is special. What would 10 baggers look like if we looked for it only in this sector? Bernstein has an answer for that as well.

There is a definite shift in the curve to the right compared to the overall stock Universe. In other words, technology stocks that deliver 10X returns do tend to be more expensive. Still, on a 10 year outlook level, you would catch 94% of these by scanning under 7X sales. So by math and common sense, one can see that it is going to be incredibly difficult journey for SNOW to deliver those great returns everyone was hoping for.

The third point here is that supercharged growth stocks tend to be small, whereas bubble stocks tend to be large.

SNOW’s $46 billion market capitalization is pretty large to start off with and while it can grow, spectacular returns are highly unlikely from such girth.

The Real Hurdle To Returns

In assessing the company through the price to sales lens we have bypassed the question of profitability. This of course is easy to do as the company is reporting non-GAAP profits.

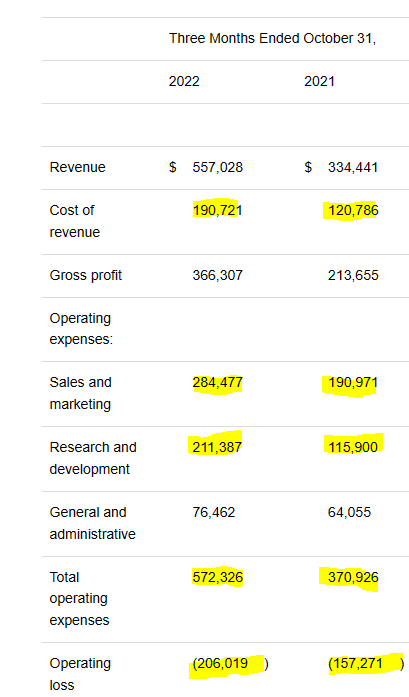

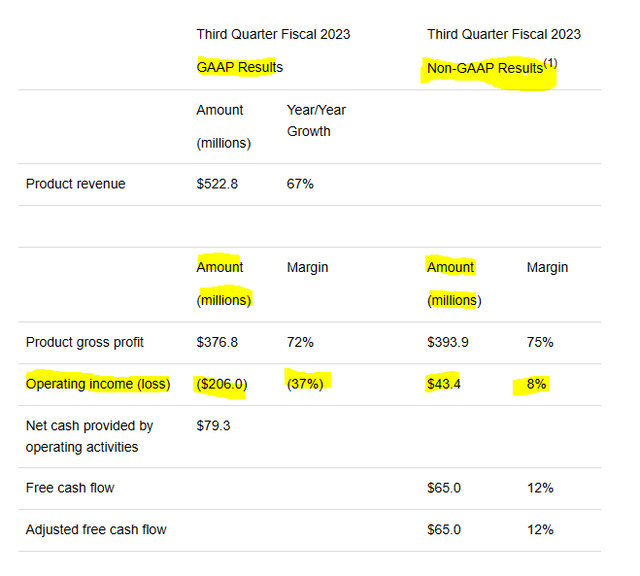

While those numbers are often accepted at face value by investors, it does pay to look at what is driving the difference. In the most recent quarter sales as mentioned previously, increased by about 67%. But what did catch our attention was the large increase in several expense categories. Total operating expenses were up 54% and the run rate is actually higher than the projected revenue growth rate for next quarter.

Q3-2022 Results

Since the IPO, expenses have generally grown at a very brisk pace and that has delayed a lot of profits even further into the future.

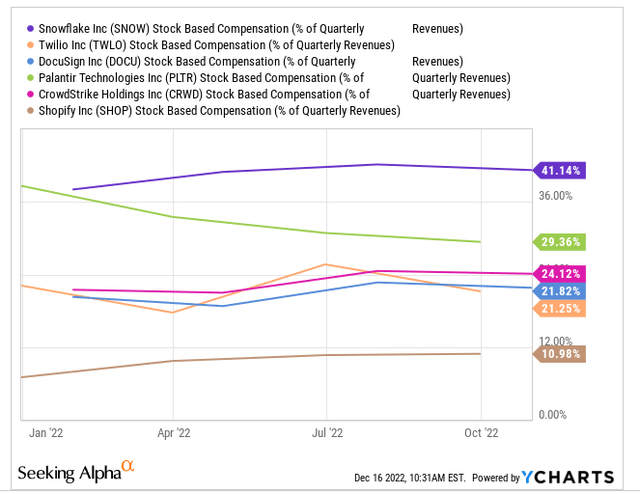

Of course it is possible that they slow that growth rate down, but it creates a worrying context for steady state valuations. The driver behind these expenses has been the stock based compensation growth. Last quarter was at $236 million annualizing at close to $1 billion a year or at about 41% of sales. Snowflake also stands head and shoulders above its SaaS peers in this area.

All of this was thrown under the rug when investors were only interested in it because it was going up, but things have changed today. As we head into an economic slowdown, cloud/data spending is likely to downshift further. While revenues will still grow the speed could fall a lot. Bigger impacts will likely come on margins. We saw recently that Amazon.com’s (AMZN) margins for AWS dropped sharply in Q3-2022. Snowflake will feel the heat from the big guns like Amazon Redshift, Azure Synapse Analytics, Alphabet’s (GOOGL) (GOOG) BigQuery and International Business Machines’ (IBM) Db2. While the market is big enough for many players, you can destroy the long case for Snowflake pretty easily when you are paying 25X sales.

At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero costs of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

Source: Scott McNealy, Sun Microsystems Sep 2000

We remain skeptical here that Snowflake can justify even half of this multiple and the real test will come in the next 12-15 months as battle for market share intensifies. With the Value versus Growth cycle in its early phases, we have a higher degree of confidence in our call.

Jeff Weniger-Twitter

We rate this a Sell.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment