There’s a universal optimism for HeartBeam’s 12-lead ECG smartwatch that can predict heart attacks

FreshSplash/E+ via Getty Images

HeartBeam Incorporated (NASDAQ:BEAT) has a 3-month price performance of +349.22. I think the prudent thing to do is to cash out of this massive six-month gain. If you are in HeartBeam for the long haul, you can hold on to this cardiotechnology-centric company.

The stock currently trades above $5.00. It could bounce higher near its 52-week high of $6.74. BEAT trades higher than its November 11, 2021 IPO day’s closing price of $4.69. I suggest taking your profits now if you don’t think the FDA will soon approve HeartBeam’s AIMI platform and AIMIGo product.

Why is there Prevailing Optimism?

HeartBeam’s Q3 numbers were terrible but the stock still rallied +65% over the past 30 days. This could be attributed to HeartBeam getting a patent for a 12-lead ECG smartwatch that could detect heart attacks and other cardiac problems. The persisting optimism is that HeartBeam could make decent revenue going forward from this ECG watch.

The patent on a 12-lead ECG smartwatch is probably why BEAT touts an 8.28x TTM P/B valuation. My Xiaomi (OTCPK:XIACY) smartwatch and a cousin’s Apple (AAPL) Watch do not have 12-lead electrocardiogram monitoring. The TTM P/B valuation of XIACY is only 1.81x. Xiaomi has TTM revenue of more than $42 billion and yet has a lower valuation than the zero-revenue HeartBeam.

The speculative optimism for BEAT is easy to comprehend. It is due to the hope that a HeartBeam ECG smartwatch could make BEAT a future multi-bagger. I opine that this upcoming 12-lead smartwatch is more user-friendly than the credit card-sized 12-lead AIMIGo ECG vector electrocardiogram product.

heartbeam.com

The AIMI and AIMIGo products will hopefully be approved by the U.S. FDA soon. HeartBeam has already signed an agreement to have Evolve Manufacturing as its partner to mass produce AIMIGo. It is not comfortable to constantly stick that AIMIGo device in front of my chest. On the other hand, HeartBeam became a publicly traded company because it looks like the AIMIGo is better than other FDA-approved products.

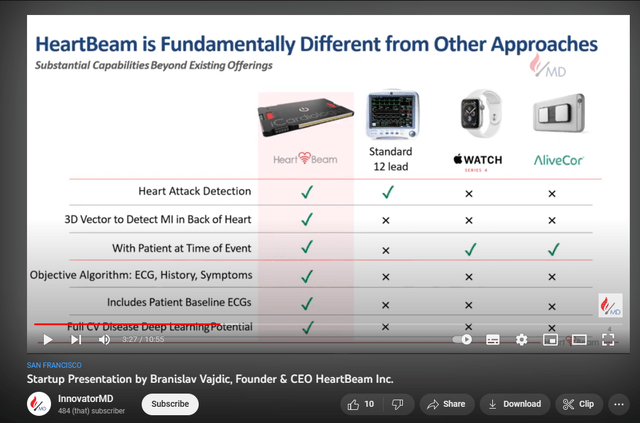

InnovatorMD’s YouTube Channel

The screenshot above shows the AIMIGo product has more cardiac-related monitoring capabilities than the FDA-approved Apple Watch and AliveCor’s ECG card monitoring device. HeartBeam’s 12-lead ECG smartwatch could help it prosper substantially from the 18% CAGR of the $116.2 billion global wearables industry.

The optimism for BEAT could also be attributed to the future probability that its patent on a 12-lead ECG smart watch could be licensed by smartwatch firms like Xiaomi, Apple, Samsung (OTCPK:SSNLF), Huawei, and Lenovo (OTCPK:LNVGY).

I cannot dismiss the future scenario that any of those mentioned companies could also buy out 100% of HeartBeam, Inc. BEAT’s market cap is less than $50 million. HeartBeam could be a takeover target if AIMI and AIMIGo get FDA approval.

Risks

I cannot endorse BEAT as a buy due to its already high 3-month performance. Most investors and traders do not seem to mind that HeartBeam has had no revenue since FQ1 2020. HeartBeam raised a net of $14.9 million from its IPO in November 2021. No revenue means HeartBeam’s net losses could eventually lead to a cash deficit.

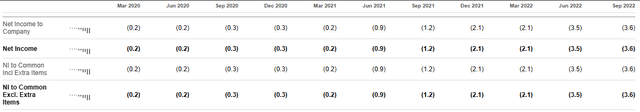

The chart below is ominous. As of most recent quarter,

Seeking Alpha Premium

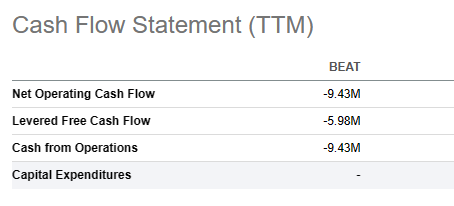

As of the most recent quarter, HeartBeam’s remaining total cash is now only $6.55 million. The biggest downside risk that could probably force BEAT to go below $3 again is its -$9.43 million net operating cash flow. Unless the company issues and sells more BEAT shares, it might soon run out of cash. The other option is to find a bank that could lend it money. It is hard to lend money to a company that has no recorded revenue to date.

Seeking Alpha Premium

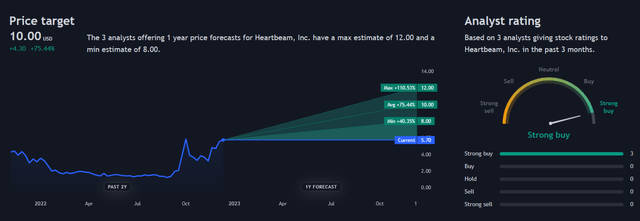

The projected December 2023 revenue is only $2.3 million. This is just bad because Q3 2022’s net loss was already $3.6 million. This unattractive current scenario is why I’m surprised three Wall Street analysts have a strong buy rating for BEAT. Their average price target is $10. This is higher than the $9 average price target of two Seeking Alpha-tracked Wall Street analysts who also have a strong buy rating for BEAT. I cannot estimate a price target because HeartBeam has zero revenue. There’s no assurance that FDA will also approve its products for sale.

Tradingview.com

The lack of revenue and projected profitability make evaluating BEAT nearly impossible. Even the algorithm of Seeking Alpha Quant can only use the Price/Book on HeartBeam. This company’s TTM P/B valuation is 8.28x. This is much higher than the Health Sector’s average P/B multiple of 2.06x. I hate to say it, but you should really take profits on BEAT. It is relatively overvalued against its peers. HeartBeam still has no FDA-approved product on the market.

BEAT could suffer if the FDA takes too much time in approving HeartBeam’s AIMI platform and AIMIGo ECG card.

Indicators Are Still Bullish

The Relative Strength Index, or RSI, score of BEAT is still 69.23. It has not yet breached the oversold score of 70. Most investors are still optimistic about HeartBeam. Aside from the bullish RSI indicator, BEAT’s fast stochastic is 91.16. This stock has a short-term bullish trade signal called Stochastic Overbought Buried. It means BEAT’s fast stochastic score is above 80 and has been so for the past five trading days.

The Exponential or Emotional Moving Average indicator is also bullish on BEAT. This stock’s most recent closing price is $5.70. This is higher than its 5-day EMA of $5.64. The 5-day EMA is higher than its 13-day EMA of $5.18. The 5-day and 13-day EMAs are higher than BEAT’s 20-day EMA of $4.89.

The Fibonacci trend chart also denotes that BEAT’s short-term and long-term retracements are below 38.2%. Fibonacci is saying the general upward trend of BEAT might continue.

These technical/emotional indicators are still optimistic despite BEAT’s 4% decline yesterday.

Conclusion

I cannot endorse BEAT as a buy. Take profits now or hold on if you think HeartBeam can still rise. A 90-day gain of more than 300% is already enough gain in my book.

You could use the profit from BEAM to buy more XIACY or XIACF. The much lower 1.81x P/B valuation ratio of Xiaomi makes it more investment worthy than HeartBeam.

The lack of revenue and the little cash left are risks for BEAM. My forward bet is that bullish stock technical indicators might reverse if management issues and sells more shares to raise cash. HeartBeam is losing more than $3 million per quarter, and it has less than $7 million in total cash.

A tiny startup like HeartBeam must find a partner to manufacture its patented 12-lead smartwatch. I will buy one if it ever becomes available on Amazon (AMZN) or Lazada.

Be the first to comment