Henrik5000

As I mentioned in the bullets, every investor has different personal circumstances and investment goals. Personal factors such as age, income, sources of income (pensions & social security versus royalties & rental property income, for example), and long-term goals such as estate planning and philanthropy, can lead to significant differences between investor “A” and investor “B”. Today, I’ll present a sample portfolio to demonstrate how investors might view some year-end portfolio management considerations given that portfolio. Now, before Seeking Alpha users go haywire and leave condescending comments about this sample portfolio, please note: it is a sample portfolio simply to promote discussion and it certainly not my goal to push such a portfolio on any investor. With that as background, let’s take a look at some year-end considerations given the sample portfolio.

The Sample Portfolio

Again, for purposes of discussion, let us pretend a hypothetical investor, Natasha, has a top-down portfolio allocation strategy as shown below:

| Category | Allocation % |

| S&P500 | 30% |

| Technology Stocks/Funds | 15% |

| Dividend Income Stocks (primarily energy stocks) | 15% |

| Dividend Income Funds | 10% |

| Sector Specific ETFs | |

| Consumer Staples | 5% |

| HealthCare | 5% |

| Utilities | 5% |

| Speculative Growth Opportunities | 5% |

| Cash | 10% |

Now, given the bear-market of 2022, and the market rotation out of growth and into value, it is quite likely that Natasha’s allocation percentages in her top-2 categories (the S&P500 & Technology) have dropped below her long-term allocation percentage.

On the other hand, given the relative out-performance of Natasha’s dividend income investments, the allocation to those investments may have risen above her allocation targets.

That being the case, going into year-end it might be a good idea for Natasha to re-balance the portfolio in order to maintain her long-term allocation targets and goals.

Meantime, and if you are like me, you likely had a “speculative growth” investment turn bad this year and now have a loss. While in general many advisors say that making investment decisions based on solely on taxes is not a good idea, there are times when investors should simply admit they made a mistake, not get “married” to an investment, and sell it – not only to reduce his or her’s tax exposure, but also to generate funds to deploy in a better prospect. For instance, Natasha made some really good money in her “speculative growth” investment in the Grayscale Bitcoin Trust (OTC:GBTC), and luckily sold the majority of her stake at a significantly higher level, but she wound-up with a few hundred shares that just recently fell below her initial cost-basis. She sold those shares, took the loss, and used the proceeds to help top-off her core portfolio holding in the Vanguard S&P 500 ETF (VOO).

Likewise, Natasha took some profits in one of her dividend income stocks – specifically ConocoPhillips (COP), which was +84% over the past 12-months – and which greatly exceeded her allocation level, and incrementally increased her stake in beaten down technology stocks such as Google (GOOG), Broadcom (AVGO), and the Fidelity MSCI Information Technology Index ETF (FTEC) – all of which had fallen below significantly below her long-term allocation level. Note that Broadcom has actually been one of the best dividend-growth stocks in the entire S&P500 and is currently paying a $16.40/share annual dividend, which is good enough for a 3.2% yield). Also, note the narrative-breaking “Q3 Surprise” I reported on: Google Generated $3.7 Billion More FCF Than Chevron. That said, Natasha believes Chevron (CVX) is the best integrated international oil-major and it is a key holding in here “dividend income” category.

Defensive Positions

Meantime, the relatively small allocation to relatively defensive sector ETFs like the SPDR Consumer Staples ETF (XLP), the SPDR Utilities ETF (XLE), and the SPDR Health Care ETF (XLV) all punched above their weight during the bear-market and, once again, proved why building and holding a well-diversified portfolio is a great strategy to help smooth-out – and prop-up – a portfolio during times of broad market volatility.

Cash Management

As for cash management and allocation (an often over-looked but important part of portfolio management), Natasha had sold some stock last year and earlier this year such that her cash position had risen significantly above her long-term personal allocation target. Some of that was in anticipation of higher interest rates and the general “don’t fight the Fed” manta. Having a higher-than-typical cash allocation enables the investor to take advantage of market volatility and excellent entry points.

Natasha’s cash position also enabled her to top-off her core VOO ETF position when the S&P500 dropped down to ~3,600 last month. That seemed like a real bargain as compared to the high of near 4,800 back in January.

During the year, and as interest rates jumped higher, Natasha laddered into some CDs (4.9% in a relatively risk-free two-year CD sure beats ~2.7% in a money market fund) and she has been dollar-cost-averaging into her allocation in the Schwab U.S. Dividend ETF (SCHD) and the Vanguard Mega Cap Value ETF (MGV). Speaking of MGV, Natasha also sold some Vanguard Value ETF (VOOV) for short-term losses and moved those proceeds to MGV after realizing it was a much better performing – and more concentrated – value portfolio. These were all relatively minor tweaks in the portfolio but, over-time, a couple of percentage points of performance here and there really add up.

Also, check your local regional bank where you have your linked checking and savings account. Over the past decade or so, you didn’t really get penalized for having a relatively high savings account balance at your local bank. However, don’t be surprised if that “savings” account is now paying a less than 1% interest rate while a standard money-market account at your brokerage firm is likely paying more like 2.6-2.8% (and its rising).

Rigid “Strategies”

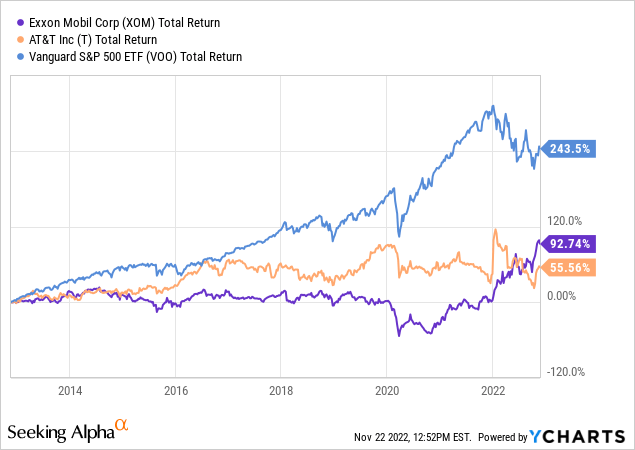

The well-diversified portfolio clearly has advantages over more rigid “strategies”, like over-emphasizing dividend income. I have noticed that many Seeking Alpha contributors have seemingly brainwashed retired investors into over-emphasizing dividend paying stocks like Exxon (XOM) and AT&T (T), with article after article on the Seeking Alpha homepage touting both these two stocks. Yet, as we all know, Exxon suffered a “lost decade” by actually delivering a negative total return to investors while the stock of AT&T is down 26%+ over the past 10-years. The following chart compares the total returns of these two stocks against that of the S&P500, and as the old saying goes, a picture is worth 1,000 words:

As you can see, despite the bear-market mauling of the S&P500 this year, the index – as represented by the VOO ETF – has severely trounced both of these supposed “value” dividend paying stocks over the past decade. If you haven’t already read it, please consider reading one of my most popular articles ever on Seeking Alpha: Retirees Beware: Dividend Investing Is Overrated, in which I attempted to “un-brainwash” retired investors – many of which can live just fine off the income from their pensions and social security – that they don’t need to massively over-emphasize dividend income just because they are “retired”. That is a sure way to lag the returns that the market is more than willing to give them if they would simply hold a more well-diversified portfolio.

Happy Thanksgiving!

So, as you are laying around on the couch after gnawing on a turkey leg and eating too much pecan pie, take some time to review your portfolio, your goals, and your capital allocation to make sure the bear-market of 2022 has not knocked you off track. And let me take this opportunity to thank all my followers and readers for tuning in, and I wish you all a Safe, Happy, and Peaceful Thanksgiving!

Summary & Conclusion

The basic point of this article was to remind ordinary investors, who often can get caught up in short-term volatility, to take a step-back and view their portfolio in the bigger picture, and to take a top-down toward asset allocation and to make sure the bear-market didn’t totally drive them into the ditch and off their long-term strategy. Consider making some strategic tax-loss sales, and redeploying those assets to top-off your allocation levels in the most important and significant categories within your portfolio. In addition, remember that research shows:

- The vast majority of ordinary investors (and professional money managers …) would likely achieve higher returns simply putting their investment dollars in a low-cost S&P500 fund and staying in the market, through the cycles, in order to reap the gains the market is more than willing to give you. Consider reading Bogleheads.org about the 100% S&P500 Retirement Account.

- The vast majority of ordinary investors (and professional money managers …) are awful at timing the market. Generally, that’s because you have to be right twice: when to get out, and when to get back in.

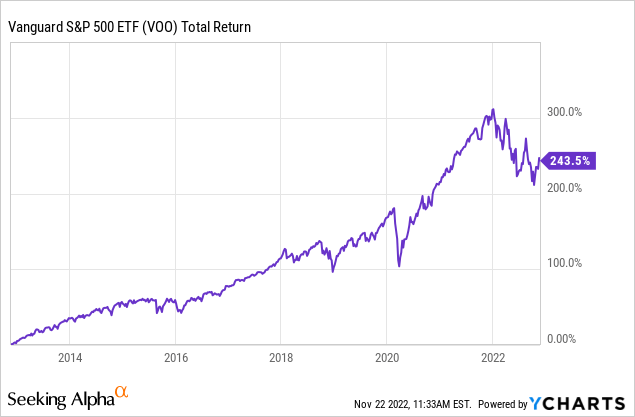

I’ll end with a 10-year chart of the total returns of the S&P500 as represented by the Vanguard VOO ETF and note that the only way you likely would have reaped those gains was to have bought 10-years ago and simply held onto the investment:

Be the first to comment