RyersonClark/E+ via Getty Images

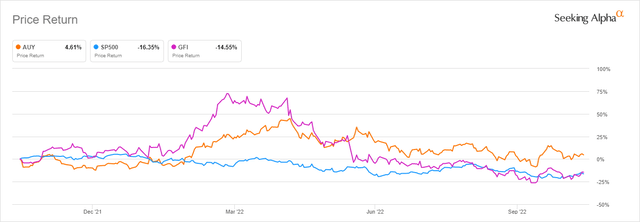

Canadian-based precious metals producer Yamana Gold (NYSE:AUY) is set to be acquired by Gold Fields Ltd (GFI) pending the closure of the shareholder vote on November 22, 2022. The all-share transaction will value the Canadian miner at $6.7 billion despite having a market cap of $4.40 billion at the moment. AUY’s price return over the past year has gained 7.09% and is trading slightly under $5 (that is 26.875% below the 52-week high of $6.40). As per the agreement, Yamana’s shareholders will receive 0.6 of an ordinary share in Gold Fields which should tie AUY’s trading price to more than half of GFI’s stock price. The deal represented a 42% premium to AUY’s price before the announcement. About 75% of Gold Fields’ shareholders are required to approve the deal against 66.67% of Yamana Gold’s.

Thesis

Yamana Gold’s acquisition deal could be detrimental if the share price declines against a gain in Gold Fields meaning that it could be dilutive and overvalue Yamana. Shareholders will also need to consider the aspect of growth over the price of precious metals such as gold which have declined 12.9% (YoY). Further, the deal will give Gold Fields a foothold and a combination of assets in some regions it operates such as South America and Canada which it has sought after for a while for a lower premium. A further point of consideration is the relatively strong Q3 2022 production that indicated a resilient mining company despite the challenging macroeconomic pressures.

Over the past year, Gold Fields’ share price has dropped close to 15% primarily driven by a decline in gold prices. However, since the acquisition announcement was made in May 2022, GFI and AUY share prices have moved almost in sync.

Q3 2022 Highlights

Yamana Gold released its Q3 2022 earnings results on October 27, 2022, reporting $44.5 million in adjusted net earnings. The earnings indicated a decline of 39.62% (YoY) from $73.7 million realized in Q3 2021. There was an increase in cost above its all-in-sustaining cost (AISC) as well as operating costs from Q2 2022 due to rising global inflationary pressures.

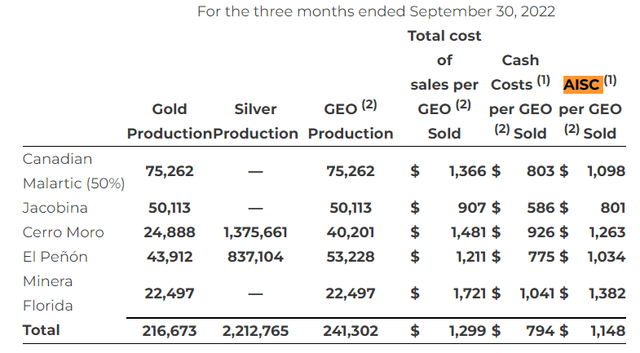

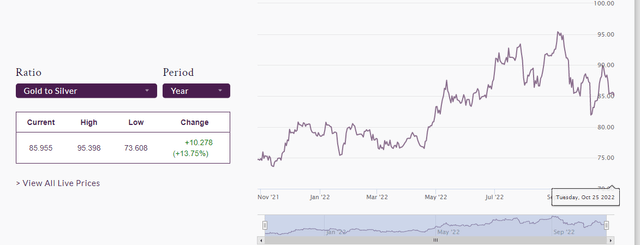

There was a decline in mineral production against an increase in costs with the all-in-sustaining cost (AISC) per gold equivalent ounce (GEO) rising by 10.3% (QoQ). Gold production declined 4% (QoQ) to 216,673 ounces while silver production fell 3% (QoQ) to 2,212,765 ounces. Despite the decline, the production was within the guidance given by the company in Q2 2022 considering the gold-to-silver ratio was edging towards its annual high at 95.398.

A rise in the gold-to-silver ratio especially based on the lower silver-to-gold prices tends to reduce the production of the GEO which stood at 241,302. However, Yamana’s gold production of 216,673 exceeded the company’s guidance fueled by increased production in the Canadian Malartic with 75,262 ounces and Jacobina with 50,113 ounces. These two mines are of special interest since the Canadian Malartic is the largest open pit gold mine in Canada while Jacobina exceeded 50,000 ounces of gold production for the first time in Q3 2022.

Additional points for Gold Fields Shareholders to Consider

Yamana’s Canadian Malartic is set to transition into the largest underground mine in Canada with a lifespan extending past 2035. According to Yamana, the Malartic will begin the underground operation dubbed the Odyssey Project approximately in 2028 and run until 2039. The company is on a growth trajectory as far as production is concerned with the production of gold and silver pegged at about 1 million ounces annually. A look at Q3 2022 earnings shows that gold’s revenue per ounce was more stable than silver’s revenue per ounce.

Yamana’s revenue per ounce of gold declined 3.4% (YoY) to $1,728 while revenue per ounce of silver fell 20.3% (YoY) to $19.31. As expected, there was a 13.6% drop in the cash flows (YoY) from operating activities to $164.7 million with the company promising an increase in Q4 2022. This increase would be driven by increased production which would lead to sequential improvement. Yamana’s operations are in four main countries: Canada, Chile, Brazil, and Argentina with about 88% of its revenue coming from the sale of gold alone. Yamana intends to increase its annual production to 1.5 million ounces. In the near term, the company’s guidance stands at 1.06 million GEO supported by the completion of the phase 2 expansion in Jacobina and a maiden production expected from the Odyssey project in H1 2023.

To support the long-term 1.5 million GEO production guidance, Yamana intends to construct the Wasamac gold mine in Quebec, Canada. This mine is expected to ramp up production to 200,000 ounces in 2027 and raise production to 250,000 ounces by 2028. Jacobina mine (in Brazil) will also undergo a Phase 3 plant expansion intended to increase production to 40,000 ounces of gold. The Argentine mine of Cerro Moro is also expected to be expanded to raise production to 60,000 ounces of GEO. Gold Fields is getting these assets and more without paying a massive premium such as can be expected for a foreign miner seeking to enter exclusive regions such as Canada.

Better Exposure

Gold Fields has 9 operating mines in Australia, Peru, South Africa (parent country), and West Africa with a project in Chile. It also has a joint venture called the Asanko JV with Asanko Gold in Ghana.

Gold Fields’ attributable gold-equivalent (GEO) production in 2021 increased by 5% to 2.34 million ounces up from 2.24 million ounces in 2020. If we combine this production with Yamana’s approximately 1 million ounces then it will mean that Gold Fields will increase their gold production to almost 3.5 million ounces. It will have spread its assets in at least four continents. North and South America, Africa, and Australia.

Gold Fields’ shareholders are tempted to look at the opportunities provided by the long-term projects in Canada, Argentina, and Brazil, areas in which Yamana Gold has capitalized in terms of gold production. It presents a chance to link Yamana’s asset portfolio with Gold Fields’ technical capacity. For example, the Odyssey Project presents a mine that can sustain a 20-year production life span, which in my view is exactly what a miner like Gold Fields needs.

Yamana has an outstanding partnership with mining giants such as Glencore (OTCPK:GLCNF) where they operated the Minera Alumbrera mine in Argentina. This mine was part of the Mara Project after it was integrated with Minera Agua Rica, a wholly-owned project of Yamana. On September 23, 2022, Glencore notified Yamana under the terms of the Mara Joint Venture that it had agreed to acquire Newmont Corp’s (NEM) 18.75% shareholding in the Mara JV. Yamana has 56.25% interest in Mara JV. With Glencore paying Newmont $124.9 million for its stake and $30 a million deferred payment it means Yamana’s stake is worth almost $1 billion. The proven and probable mineral reserves in Mara include 7.4 million ounces of gold and 11.7 billion pounds of copper. These resources are contained in 1.105 billion tons of ore with an initial life span of 28 years.

Risks

Three members of the Gold Fields executive committee resigned just weeks before the planned merger with Yamana Gold. These three Brett Mattison, VP of strategy, planning, and corporate development, Taryn Leishman, VP: of group head of legal and compliance, and Avishkar Nagaser, VP: Investor relations and corporate affairs may cause fear among investors since they hold integral positions in the deal. However, they have all affirmed their commitment to completing the transaction and supporting the new merger up to 4 months before disembarking.

Yamana witnessed a decrease in gold and silver production in Q3 2022 as compared to Q2 2022 coupled with a decline in cash flow from operating activities. The company has raised its annual production guidance to 1,000,000 GEO with AISC expected to fall below 1,148 witnessed in Q3 2022 to raise production and lower the overall production cost.

Bottom Line

Yamana shareholders stand to obtain more than 30% of the combined company after the Gold Fields’ merger goes through. There is an added value proposition since Yamana’s production strategy stands to benefit from Gold Fields’ mining expertise. In turn, Gold Fields will access exclusive mining areas of Canada, Argentina, Brazil, and Chile areas which did not have mining rights at a lower premium. Yamana’s decreased production in Q3 2022 may be of concern to shareholders as well as a drop in cash flow from operating activities. However, the company has raised the production guidance into 2023 with the hope that the gold-to-silver ratio will stabilize from its annual increase. For these reasons, we propose a hold rating of the stock.

Be the first to comment