Michael Loccisano/Getty Images News

Scholastic Corporation (NASDAQ:SCHL) is a defensive business that has shown an ability to maintain strong gross margins despite COVID disruptions and soaring inflation. The company also used the pandemic as a catalyst to restructure its business, structurally improving operating margins. Going forward, there is still upside to the company’s financials, if book club and fair volumes return to pre-pandemic levels. However, I think the shares are fairly valued at 15.9x Fwd P/E with downside risks if revenues do not increase as management expects.

Company Overview

Scholastic Corporation is the world’s largest publisher and distributor of children’s books and media. Scholastic operates school-based book clubs and book fairs, as well as selling directly to schools and libraries. It also sells books through physical and online stores.

The company organizes and reports its business in three main segments: Children’s Book Publishing and Distribution, Education Solutions, and International.

The Children’s Book Publishing and Distribution segment entails school-based book clubs, book fairs, and sales through online and physical book stores. It is the company’s largest segment, and contributed 58% of F2022 revenues. Education Solutions sells books directly to schools and libraries and accounted for 24% of revenues. International includes publication and distribution of books and media outside of the United States.

COVID Was A Big Hit To Scholastic

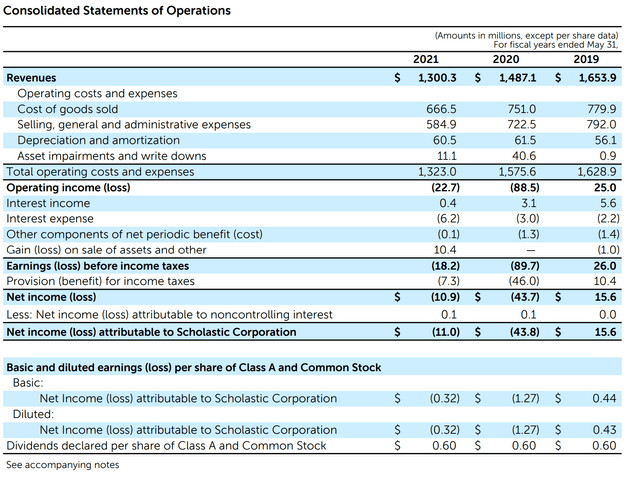

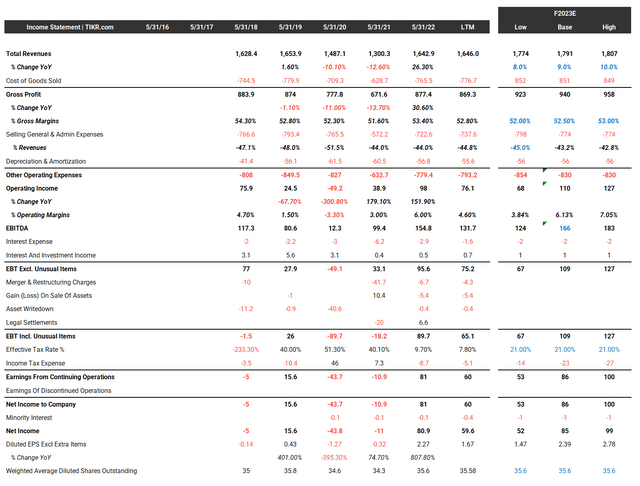

The COVID-19 pandemic in early 2020 was a big hit to Scholastic’s business, as physical schools were effectively shut down due to government lockdown measures. From fiscal 2019’s $1.65 billion in revenues, Scholastic’s revenues plummeted 21% to $1.3 billion in fiscal 2021 (note, Scholastic has a May 31st fiscal year-end). Earnings likewise fell, from $16 million in net income in fiscal 2019 to a net loss of $11 million in fiscal 2021 (Figure 1).

Figure 1 – SCHL financials deeply impacted by COVID (SCHL F2021 10K Report)

The impact to earnings was less than the revenue reduction as Scholastic was able to rein in costs, with SG&A as a % of revenue falling from 48% in fiscal 2019 to 45% in fiscal 2021. The company also received approximately $20 million in government subsidies that helped with fiscal 2021 margins.

But Now Business Is Back To Normal

With COVID restrictions lifted across the U.S. and most of the world, business has returned to normal for Scholastic, with the added benefit of structural cost improvements due to cost cut initiatives put in place during the pandemic.

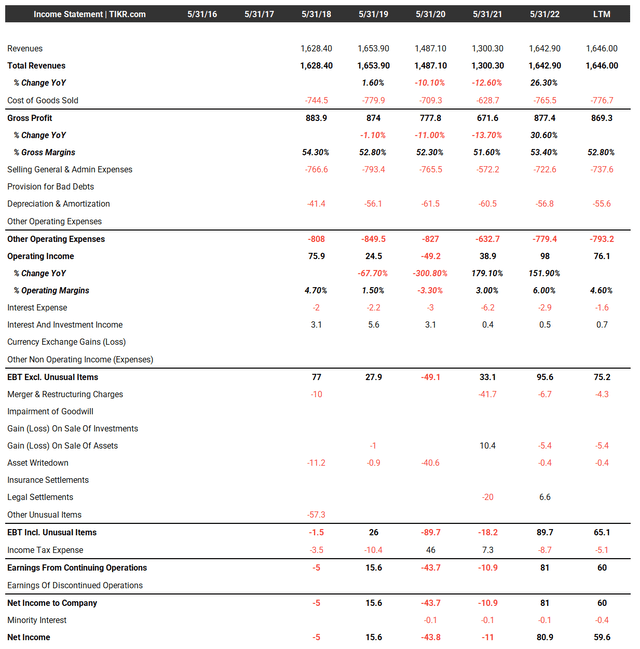

LTM revenues to August 31, 2022 have recovered to $1.65 billion, essentially inline with fiscal 2019, while operating income actually improved to $76 million vs. $25 million in fiscal 2019. The profit improvement is primarily driven by SG&A declining from 48% of sales in fiscal 2019 to 45% of sales in the last twelve months (Figure 2).

Figure 2 – SCHL Financial Summary (tikr.com)

COVID Recovery Has Proven Scholastic’s Pricing Power

Historically, the topic of monopoly has come up with regards to Scholastic’s book fairs and clubs business. Technically, Scholastic’s book fairs and clubs do not fit the description of a monopoly, since if the company raise the price of books too high, students and parents can simply buy books through other channels, such as Amazon.

However, looking at the COVID episode and the subsequent recovery, one of the most remarkable things have been Scholastic’s stable gross margin of 52-53%. Even though there has been soaring inflation in the past year due to wage pressures, energy costs and commodity prices, Scholastic’s margin has remained stable.

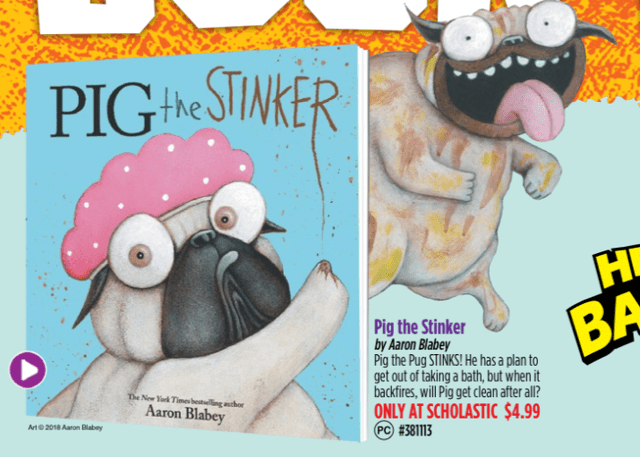

When input costs have risen, Scholastic have been able to raise prices to offset the increase and maintain product margins. For example, from a Spring 2019 book fair flyer, we can see ‘Pig the Stinker’ had a list price of $4.99.

Figure 3 – Illustrative book price, Spring 2019 (Scholastic book fair flyer)

However, an equivalent children’s book, ‘Pig the Rebel’ is priced at $7.99 in a Fall 2022 book fair flyer, an increase of 60%. The fact that children’s book prices have increased so dramatically without causing an outrage proves the price-inelasticity of Scholastic’s customer base (I am one of them, as my children regularly buy books from Scholastic book fairs. It is hard to say no when your child circles 10-15 books she would be willing to do anything, including chores for a week, to get).

Figure 4 – Illustrative book price Fall 2022 (Scholastic book fair flyer)

What Now?

With the re-opening thesis largely played out, the question for Scholastic investors is, what now?

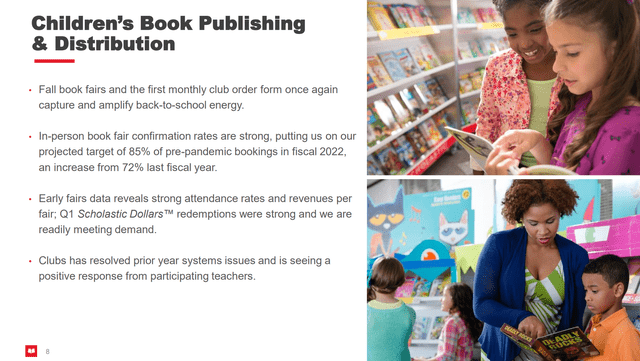

According to Scholastic’s management team, there is still plenty of room for improvement in the company’s results. For example, in-person book fair bookings have only recovered to a projected 85% of pre-pandemic levels from 72% in fiscal 2021 (Figure 5).

Figure 5 – SCHL Q1/F23 Children’s Book Publishing & Distribution Commentary (SCHL Q1/F23 Investor Presentation)

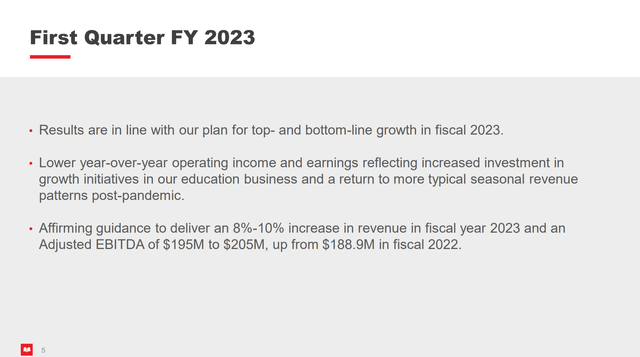

What this means is that if volumes are able to recover to 100% of 2019 levels without excessive increase in SG&A, there is potential upside to revenues and operating profits. For fiscal 2023, management is guiding to revenue growth of 8-10% and EBITDA improvement of $6 – 16 million (Figure 6).

Figure 6 – SCHL F2023 guidance (SCHL Q1/F23 Investor Presentation)

Using management’s guidance above, I estimate EPS for F2023 of $2.39 / share (Figure 7). In the base case, I model revenues increasing by 9% to $1.79 billion. I conservatively model gross margin of 52.5% of revenues. Management estimates an $11 million improvement in EBITDA at the midpoint, which works out to $166 million in EBITDA and $110 million in operating income. EPS works out to $2.39 / share, if Scholastic’s effective tax rate is 21% in F2023 (note, the effective tax rate has bounced around the last few years due to government stimulus measures and tax loss carryforwards).

Figure 7 – SCHL F2023 estimates (Author created using historical data from tikr.com)

In the low case, I model a lower revenue growth rate of 8%, a lower gross margin of 52%, and SG&A as a % of revenues of 45%. This leads to $68 million in operating income and $1.47 in EPS.

In the high case, I model 10% revenue growth, 53% gross margin, and SG&A constant with the base case. This translates to $127 million in operating income and $2.78 in EPS.

Valuation

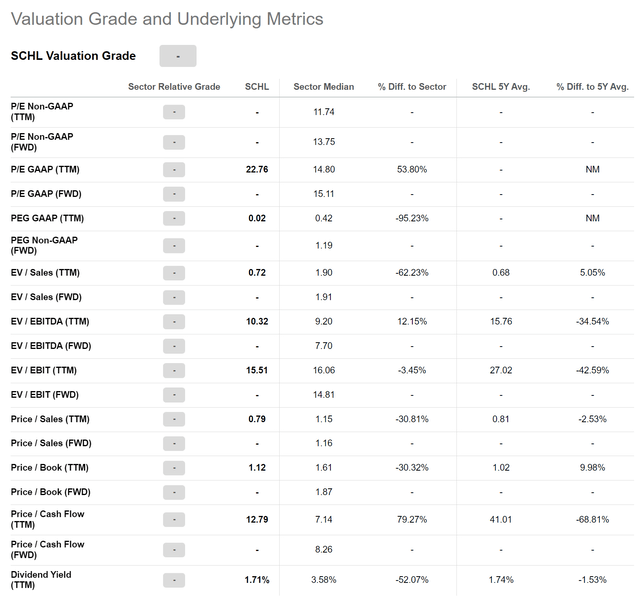

SCHL does not have any Wall Street coverage, so there are no analyst estimates to compare to. Based on management’s guidance and my base case model above of $2.39 in F2023 EPS, SCHL is currently trading at 15.9x Fwd P/E. This is a slight premium to the Communications Sector median of 14.8x.

Figure 8 – SCHL Valuation (Seeking Alpha)

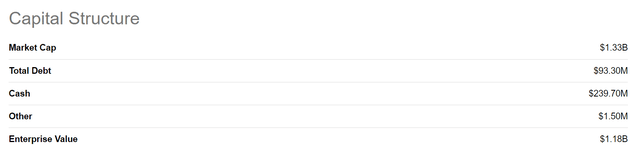

However, with a $1.3 billion market cap and minimal debt, SCHL has a $1.2 billion enterprise value, and trades at a 7.2x Fwd EV/EBITDA multiple based on my $166 million EBITDA estimate, a small discount vs. the sector median at 7.7x.

Figure 9 – SCHL Enterprise Value (Seeking Alpha)

Scholastic also pays a quarterly dividend that was recently raised from $0.15 / quarter to $0.20. The current dividend yield on SCHL is 2.1%.

Risk

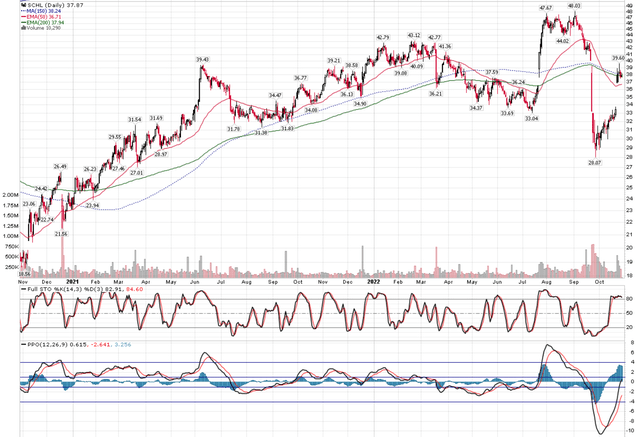

The biggest risk to Scholastic is the weakening economy, which could lead to revenues and earnings falling short of management’s expectations. For example, the stock took a large tumble recently in September when it released Q1/F23 results that were materially weaker than the same quarter last year (Figure 10).

Figure 10 – SCHL stock price tumbled in September (stockcharts.com)

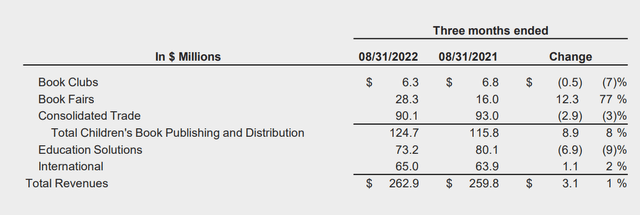

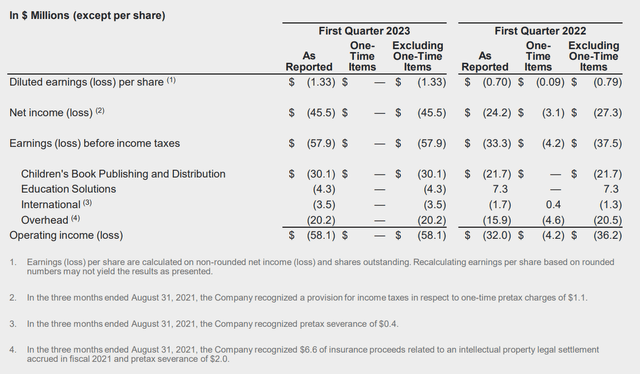

Although revenues were flat YoY (Figure 11), earnings took a big hit from a loss of $0.79 / share in Q1/F2022 to a loss of $1.33 / share (Figure 12). The higher losses in the first quarter was explained by lower sales in the Education Solutions segment which led to a $12 million delta in operating profit, as well as higher COGS.

Figure 11 – SCHL Q1/F23 revenues (SCHL Q1/F23 Investor Presentation) Figure 12 – SCHL Q1/F23 EPS (SCHL Q1/F23 Investor Presentation)

There is now higher expectations for the upcoming Q2/2023 quarter, which needs to show marked improvement for Scholastic to remain on track for 8-10% revenue growth and $6-16 million improvement in adj. EBITDA.

Conclusion

In conclusion, Scholastic is a defensive business that has shown its resiliency by maintaining strong gross margins despite COVID disruptions and recent commodity inflation. The company also used the pandemic as a catalyst to restructure its business, structurally improving operating margins. Going forward, there is still upside to the company’s financials, if book club and fair volumes return to pre-pandemic levels. However, I think the shares are fairly valued at 15.9x Fwd P/E with downside risks if revenues do not increase as management expects it to.

Be the first to comment