Oriaz

This article was published on July 17 for subscribers of Reading The Markets and was updated on the morning of July 18.

Boeing’s (NYSE:BA) stock has recently shown some positive trends on both a fundamental and technical basis. Now options traders are betting the stock continues to climb through the middle of August.

The company received more good news when it announced that Delta (DAL) purchased 100 737 Max 10 planes.

Boeing’s Fundamentals May Be Turning

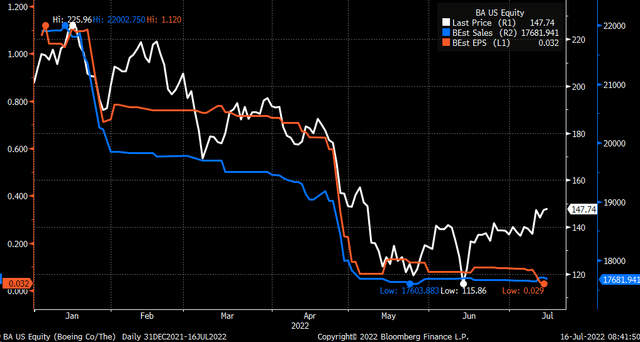

The company is expected to report second-quarter results on July 27 before the start of the trading session. Analysts estimate that the company grew revenue by 4% to $17.7 billion and earned $0.03 per share. Additionally, operating cash flow is expected to have fallen by $299 million, with free cash flow falling by $520 million, along with the delivery of 129 planes.

The company noted on July 12 that it delivered 51 airplanes in June, which helped push the stock sharply higher. Sales and earnings estimates for the second quarter have fallen significantly but have bottomed out starting in May. At the beginning of the year, analysts had forecast second-quarter sales of nearly $22 billion and earnings of more than a dollar per share.

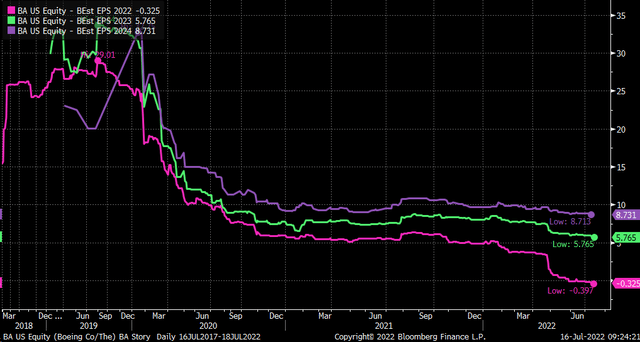

While full-year 2022 earnings are forecast to show a loss of about $0.33, analysts estimate this may be a turning point for the company. Analysts estimate that the company will earn $5.77 per share in 2023 and grow earnings by 51.4% to $8.73 per share in 2024.

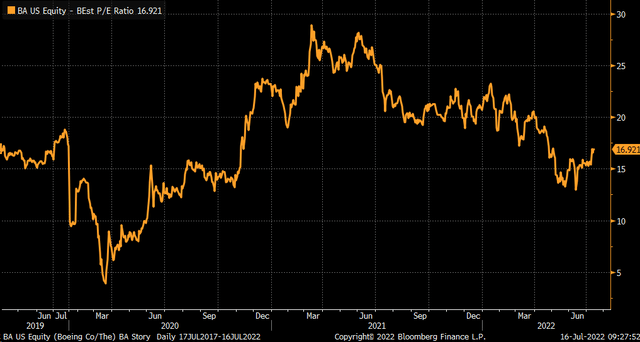

If the 2024 earnings estimates turn out to be correct, then the stock may not be that expensive, trading at 16.9 times 2024 earnings estimates, primarily if the company can deliver on that earnings growth rate.

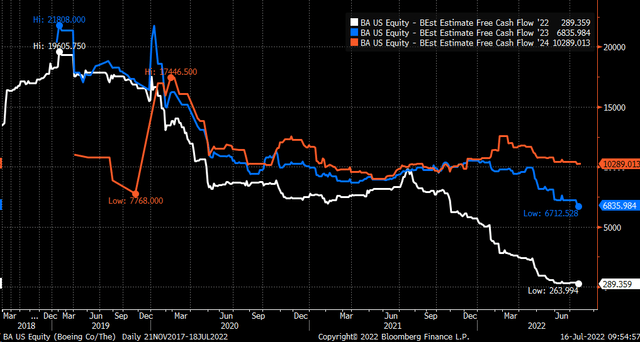

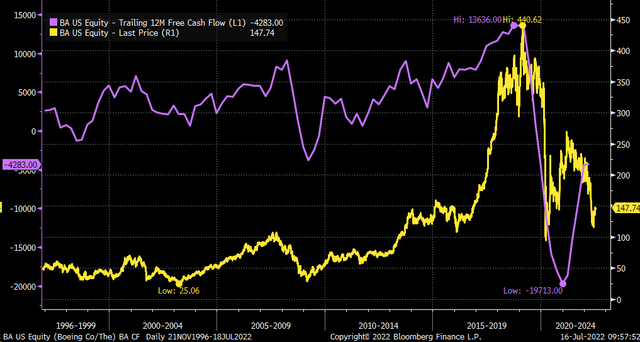

Additionally, there are signs of operational improvement, as free cash flow on a trailing twelve-month basis is on the cusp of turning positive, potentially before the end of 2022. At the end of the first quarter, the company saw free cash flow decline by -$4.2 billion over the trailing twelve months. But analysts see that number turning positive by year-end to almost $290 million and more than $10 billion by the end of 2024.

A positive turn in free cash flow could be a massive boost to the stock because, historically, the stock’s price appears to have a strong relationship with free cash flow. So if the company can turn the corner on free cash flow, as analysts estimate, the stock could be on the cusp of making a significant move higher, longer-term.

Betting On Improvement

An options trader appears to be betting the company will deliver positive results when it reports earnings at the end of July. The open interest level on July 14 increased by roughly 12,000 contracts each for the August 19 $145 puts and calls. The data shows the calls were purchased on the ASK for $9.95 per contract, while the puts were sold on the BID for $10.15 per contract. It means the trader is betting the stock is trading above $145 by the expiration date.

Price May Lead Fundamentals

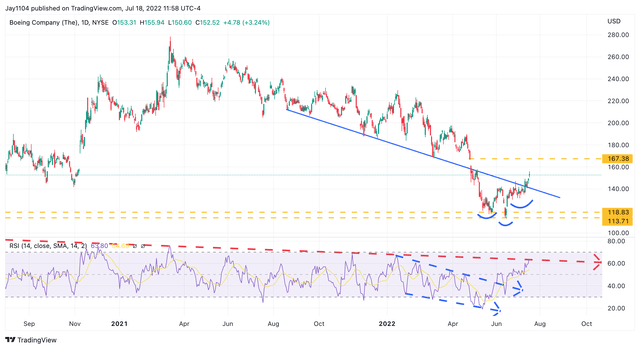

Now, the technical chart supports the stock rising too. The stock recently fell to as low as $113 per share in mid-June. As a result, all downside gaps from the post-covid-recovery have now been filled. Additionally, there is now a gap that needs to be filled up around $167, which was created in April following Boeing’s disappointing first quarter results. But more importantly, the stock recently rose above a downtrend, which may lead to that more significant upside and the potential gap fill.

It is also possible that an inverse head and shoulders pattern has formed, a bullish reversal pattern. A projection of that bullish pattern also would indicate the shares could rise to around $170.

Finally, the stock has now broken above a short-term downtrend in the relative strength index, signaling that Boeing’s momentum may now be bullish. The RSI is also quickly approaching a major long-term downtrend which started in June 2020. If the RSI can cross above that longer-term downtrend, it would likely indicate that a new and longer-term uptrend has formed, suggesting an even higher price for the stock, then the gap at $170.

Boeing has a lot riding on its second-quarter results. If the company can report results that align with analysts’ forecasts, then the path forward remains one of a company that may have finally turned the corner. Of course, poor results would be a significant setback and derail the entire rally and the longer-term prospects.

Be the first to comment