FeelPic/iStock via Getty Images

We have been very cautious about the oil market since June following the disappointing U.S. oil demand data and the sudden shift in the macro markets (following the June Fed rate hike). Since then, energy stocks have taken a hit, and we have redeployed all of the cash we held on the sidelines. While we are now fully invested again, it’s important to look at the variables that could present themselves as hurdles as we go into year-end.

In our view, these are the most important variables going forward:

-

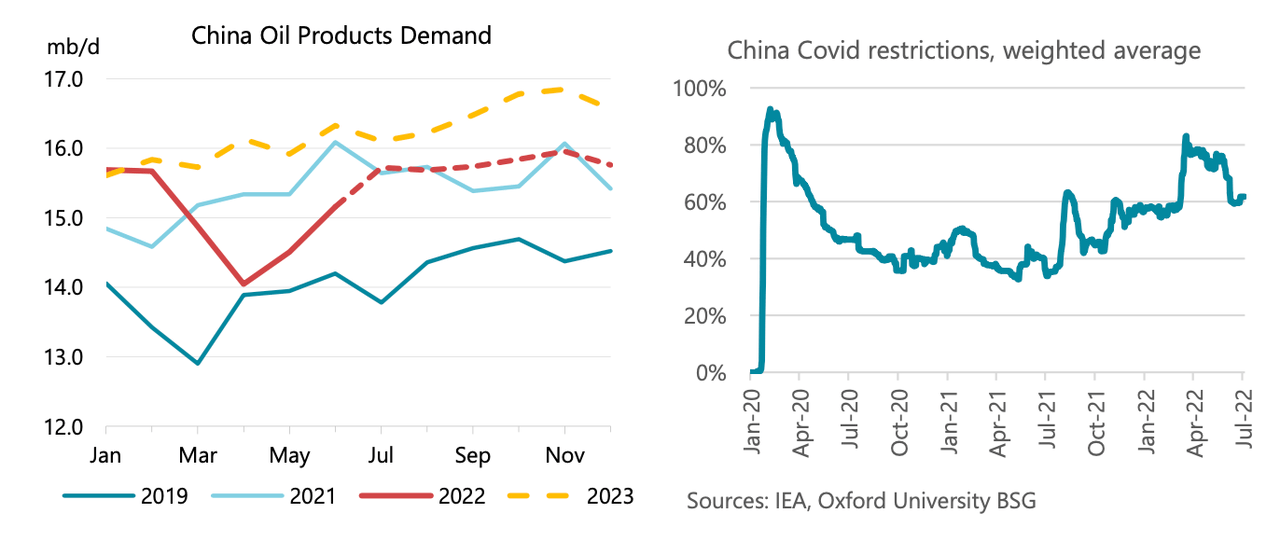

China’s reopening and how it impacts demand. Will China’s eventual full reopening prompt a much higher demand increase? Or is the demand decrease something more structural?

IEA

According to the International Energy Agency (“IEA”), China’s oil demand will return back to being in line with 2021 levels for the rest of the year following the reopening. As you can see on the chart to the right, China is still locked down in aggregate, so demand recovery will take time. On an annual basis, IEA has China’s oil demand falling ~40k b/d in 2022 vs 2021. This makes sense considering the COVID restrictions. The question for the oil market and energy investors will be the pace of the reopening and if the demand weakness is related to COVID or something structural.

One indicator we use is copper and the recent weakness in copper signals to us global growth weakness. Perhaps the market believes the demand weakness to be more structural. One could argue also looking at the U.S. oil demand data that with COVID restrictions nonexistent, the disappointing demand is more of a structural issue than something transitory.

Kpler

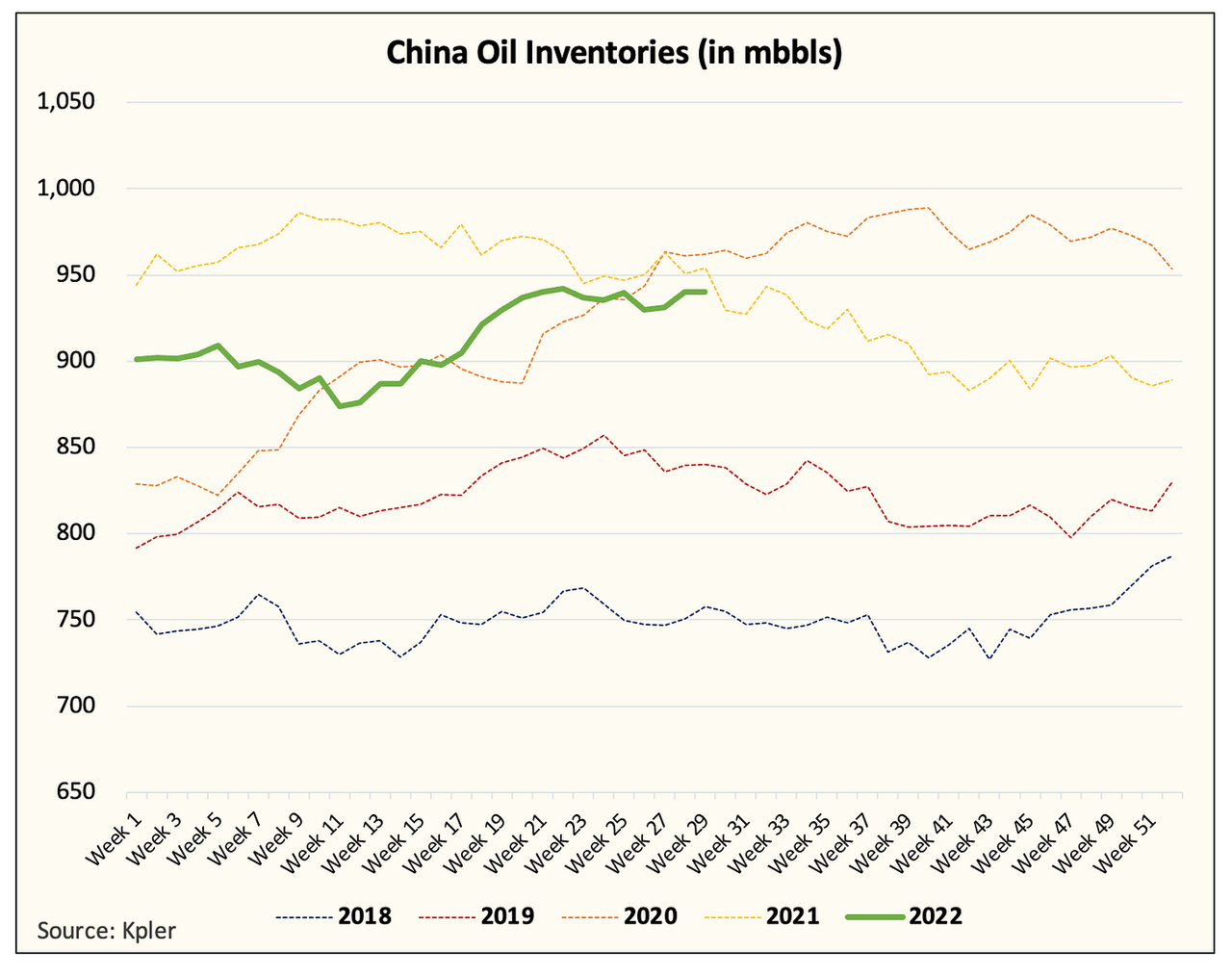

In addition, China’s onshore crude inventories are back to ~950 million bbls. This means that even in the event of a reopening, China could 1) keep buying discounted Russian crude and 2) hold back on buying the full amount needed. This would present a headwind for the oil market or said in another way, a lack of a tailwind.

As a result, if China’s demand does not come roaring back, then the implication for the market will be a double whammy.

-

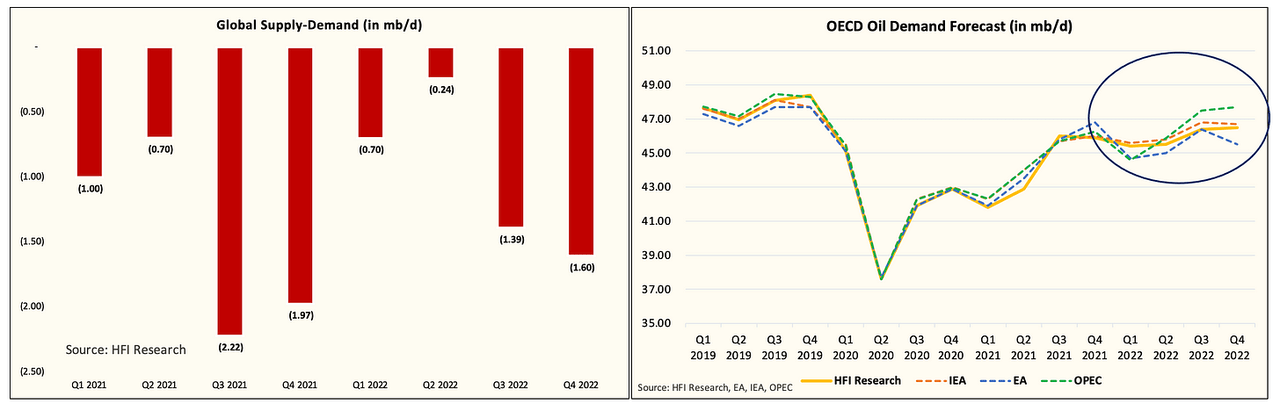

OECD oil demand and what price will start prompting a demand response.

Aside from China, all eyes are on where the lower band of the price range is for oil + refining margin. The market has successfully tested the upper band, in our view, and that price was between $170 to $180. In turn, we need to start seeing a response to the recent drop in price. It is very important for energy investors over the coming weeks to pay attention to the implied oil demand data. By the end of July, May monthly oil demand data will come out of the EIA PSM. That will be one of the most important data points as it presents demand following the spike in refining margins.

-

Oil market supply and demand balance implications.

HFIR

Here is our base case assumption for supply and demand into year-end. There are 4 key variables:

-

Russian oil production drops by ~1 million b/d at year-end.

-

Iranian sanctions are not lifted.

-

US oil production reaches ~12.5 million b/d by year-end.

-

OPEC unwinds production cut and Saudi reaches ~10.75 million b/d by year-end.

For energy investors, if any of these variables change, then the path and price trajectory change. If Iranian sanctions are lifted, that will add an additional ~1.4 million b/d to the market, which will result in the deficit materially shrinking given the backdrop of disappointing demand.

If U.S. oil production surprises the downside, then that will add to the deficit. Vice versa is also true.

If the big 3, Saudi, UAE, and Kuwait, decide to produce all out following the OPEC agreement, the balance also materially changes.

The line in the sand is ~1.5 million b/d. That’s the “margin of safety” for energy bulls. If this margin of safety is lost in any way, you can expect oil prices to drop. But keep in mind, if prices drop too much, then demand will respond, so it’s not as straightforward as you think.

In essence, if the status quo takes place, you can expect the oil market to remain in deficit.

Conclusion

Demand is disappointing to the downside. This is going to cap the upside of how high oil can go. But investors must also realize that there are other important factors at play. We think the better you understand the main drivers of the oil market, the better you can manage the risk going forward. Our base case assumption is that Q3 and Q4 should see inventory draws of ~1.5 million b/d under a depressed demand scenario. But things can change, and we will be updating this frequently. For now, we are back to being fully invested and we think the lower band ($140 to $150 crude + refining margin) is here. Let’s now await a demand response.

Be the first to comment