Artem_Egorov/iStock via Getty Images

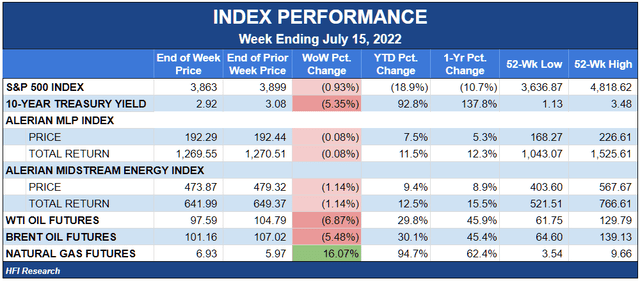

Midstream Sector Performance

Midstream posted a flat week as the (XLE) fell by 3.3% and the (XOP) declined by 2.1%. Midstream also outperformed the S&P 500 (SPY), which declined after headline CPI data released on Wednesday showed inflation rising 9.1% from year-ago levels to hit a 41-year high. The market grew concerned that the data would cause the Fed to hike interest rates significantly and shock the economy even though inflation may have peaked.

For midstream and other energy equities, the big development of the week was the continued fall in oil prices, which posted their second straight week of declines and closed below $100 per barrel for the first time since early April.

A major contributor to the crude price drop during the week related to rising Covid-19 cases throughout the world. China reported 432 new Covid-19 infections, the most in seven weeks, which led to concerns about more restrictions. Nearly 30 million Chinese are already under lockdown as the country pursues a “Zero Covid” policy that we believe will ultimately end in failure. The lockdowns have reduced China’s crude demand, with imports falling to 8.75 million bpd, the lowest in four years.

On Wednesday, Tokyo also raised its Covid alert to its highest level after it reported 16,878 new infections, a 400% increase from July 1. The seven-day moving average of new infections in the U.S. also rose to a six-week high on Thursday.

The other bearish event was a dramatic rise in U.S. inventories and terrible demand data, which we disused here.

As crude plunged, it was easy to miss the week’s bullish data. For one, the physical market was strong. Forties and Nigerian crude cargoes saw unusual strength, refining margins remained elevated, and crude time spreads actually rose amid declining front-month prices.

Political clashes in Libya threaten to reduce the country’s crude output, exacerbating the supply crisis. Crude exports from Libya fell to a 20-month low of 610,000 million bpd. The conflicts during the week may send that figure even lower.

Concerns also spread during the week that Russia may increasingly use energy as a weapon against the West. Russia is heavily incentivized to keep oil prices high, and we wouldn’t be surprised to see Putin resort to extreme measures to do so.

What is clear to us is that the bearish variables are temporary, but the bullish ones are likely to be more protracted. Oil prices remain in the $100 per barrel neighborhood, even though China is not fully open. High prices may have dented demand, but supply has not been quick to respond. Assuming China regains economic momentum later in the year, once U.S. strategic petroleum reserve releases stop, what is now a tight physical oil market will get even tighter. At some point, prices are bound to respond by moving higher.

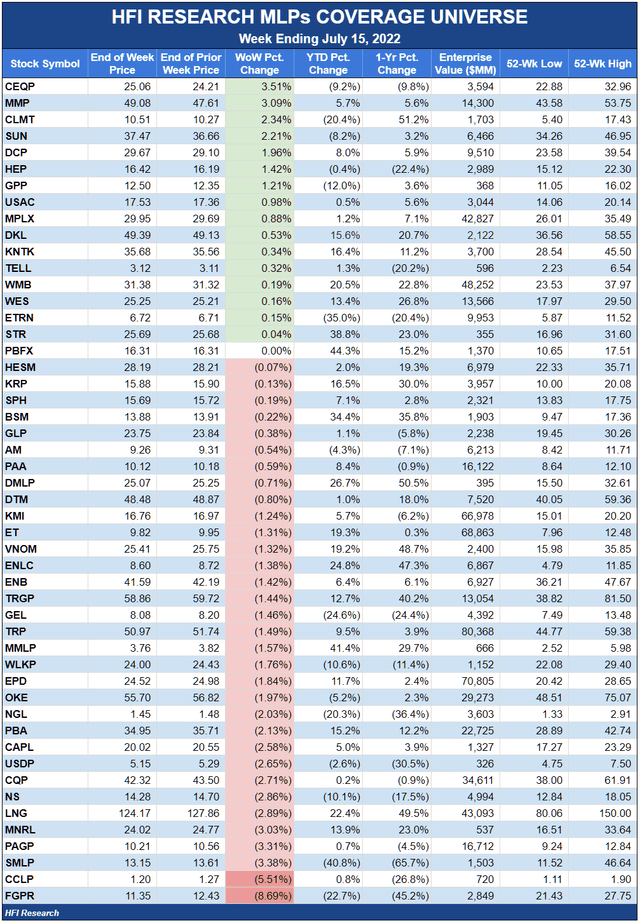

With our bullish medium and longer-term commodity price outlook, we are sticking with our policy of maintaining a heavy weighting in midstream equities with commodity exposure. We believe the recent weakness in energy equities represents an opportunity for investors to load up on our favorite G&Ps and mineral/royalty interest owners, such as EnLink Midstream (ENLC), Targa Resources (TRGP), Kinetik (KNTK), Plains All American (PAA), and Black Stone Minerals (BSM).

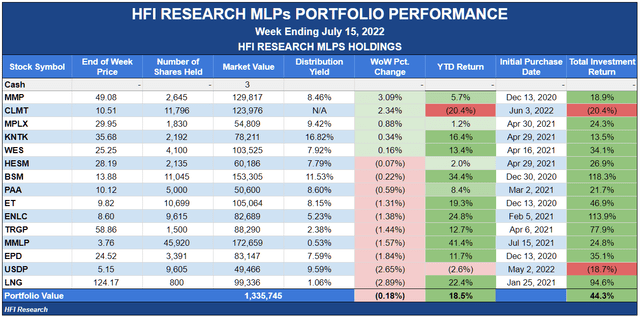

Weekly HFI Research MLPs Portfolio Recap

Our portfolio underperformed its benchmark, the Alerian MLP Index (AMLP), by 0.1% during the week.

In an otherwise light news week, falling prices for crude and energy equities dragged down our commodity-exposed midstream holdings. Again, we believe the price declines are a great opportunity to buy high-quality names that have been beaten down to unduly low levels.

Magellan Midstream (MMP) was our top performer during the week. On Friday, the company extended its open season on its Houston-to-El Paso pipeline expansion. MMP had previously extended the open seas from July 15 to July 24, but it reported that potential shippers have expressed enough interest to warrant a further extension so that commitments can be finalized. The pipeline expansion would increase a portion of the Houston-to-El Paso pipeline by 15,000 bpd.

Cheniere Energy (LNG) was our worst performer due to fears that the company is in regulators’ crosshairs over air pollution. Cheniere’s Corpus Christi and Sabine Pass liquefaction plants use 62 high-emission combustion turbines that drive compressors responsible for super chilling natural gas so that it can be transported as a liquid. The EPA is ordering that firms using these turbines reduce their emissions to meet regulatory limits.

Cheniere pushed back by warning of the consequences to Europe’s energy markets if its liquefaction facilities were shut down. In addition to Cheniere, Williams (WMB), TC Energy (TRP), Duke Energy (DUK), and NextEra Energy (NEE) are also pushing back against the rules. We believe the concerns are overblown and that Cheniere’s operations are unlikely to face serious disruption. The 180-day timetable that the EPA set for violators to comply is unrealistically short, and we expect the agency to extend it. It is more likely that enforcement is delayed, which will allow Cheniere to continue operating as it undertakes compliance measures.

News of the Week

July 13. Tellurian (TELL) announced the acquisition of EnSight IV Energy Partners in the Haynesville shale for $125 million of cash. EnSight’s acreage is 100% natural gas and produces 45 MMcf/d. TELL has long sought an E&P deal to secure natural gas reserves to back its Driftwood LNG facility. As of March 31, TELL had $296 million of cash on its balance sheet, so this deal won’t strain its liquidity. However, the company has yet to receive financing for Driftwood. Until it does, the shares remain high risk, and we recommend that investors avoid them.

July 13. Kinder Morgan’s (KMI) Tennessee Gas Pipeline suffered explosions that prompted the company to declare force majeure on natural gas supplies in Pennsylvania and Alabama. The pipeline is one of KMI’s crown jewel assets, and the explosion marks another instance of damage to natural gas infrastructure in which no cause has been identified. The event will not have a material impact on KMI’s results. KMI shares have fallen 17% from their recent highs. The shares, which yield a safe 6.7%, are attractive at current levels.

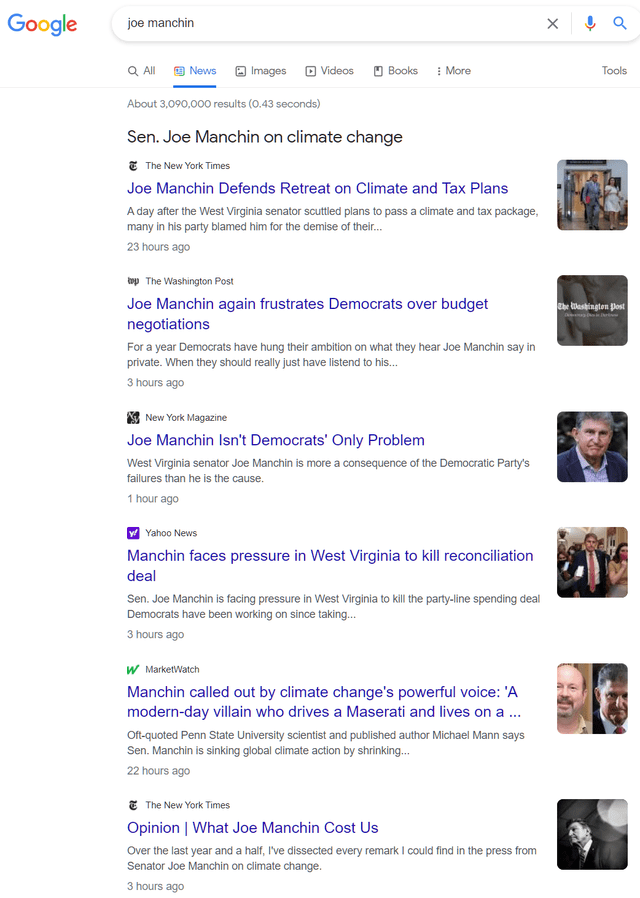

July 14. West Virginia Senator Joe Manchin said he would not back tax hike measures and emissions-reduction incentives passing through Congress. Manchin’s opposition effectively kills the measures. This unequivocably is good news for midstream. For years now, vital midstream infrastructure has faced opposition stemming from the climate lobby. In response to Manchin’s decision, President Biden vowed to take “strong executive action” to pass the administration’s climate change agenda.

We’re astounded at how the powers that continue to push this climate agenda despite the disastrous consequences of doing so, which are on display in Europe. The lessons from Europe about the risks of pursuing a climate-centric energy policy are lost on many. For example, the media’s outrage over Manchin’s decision is palpable, even though the Senator is keeping the U.S. from following Europe’s lead to energy supply scarcity and soaring energy costs. Look no further than a Google news search on “Joe Manchin” to see how the media frames the event.

Source: Google news search, July 16, 2022.

We just hope that sanity and moderation prevail in Washington, to ensure climate policies weigh their near-term economic, humanitarian, and geopolitical impacts against their longer-term environmental goals.

Capital Markets Activity

None.

Be the first to comment