Khanchit Khirisutchalual

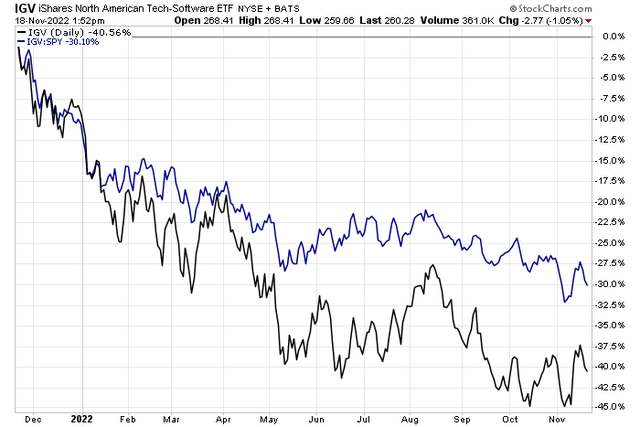

Software stocks just cannot seem to catch their footing. It’s one of the market’s niches that fell below the June lows and features consistent relative weakness to the S&P 500.

One small software has battled FX headwinds, but I see evidence for optimism in 8×8.

Software Stocks Slump

Stockcharts.com

According to Bank of America Global Research, 8×8 (NASDAQ:EGHT) offers a cloud-based solution for business communications and collaboration on a unified platform spanning voice, video, contact center, and desktops, that replaces legacy and expensive on-premise systems. It is delivered as an application that follows the user regardless of device (office phone, smartphone, desktop, tablet). Features include voice, video, conferencing, integration with CRMs, and recent expansion into communications platform APIs.

The California-based $476 million market cap Software industry company within the Information Technology sector does not have positive trailing 12-month GAAP earnings and it does not pay a dividend, according to The Wall Street Journal.

The stock has a high 18.8% short interest. It also rallied earlier this week on takeover chatter, but shares remained confined to a recent range. EGHT also beat earnings estimates in its most recent quarterly report issued on October 27. So, some bullish headlines are going on with the small software stock despite dreadful year-on-year performance.

8×8 is a strong Unified Communications as a Service (UCaas) and Contact Center as a Service (CCaaS) firm via its cloud platform, targeting middle-market companies. Of course, this is a niche that has been treated poorly by investors over the last year as borrowing rates have increased.

Uncertain overall direction from its management team, as evidenced by lower guidance in its most recent earnings report, are bearish risks. Still, operating earnings are expected to turn positive, and free cash flow is already in the black.

Downside risks include problems as EGHT attempts to move up-scale and increasing competition pressuring margins. The company’s services are also susceptible to cuts from businesses looking to reduce operating expenses. Upside potential includes better efficiencies and strategic executions.

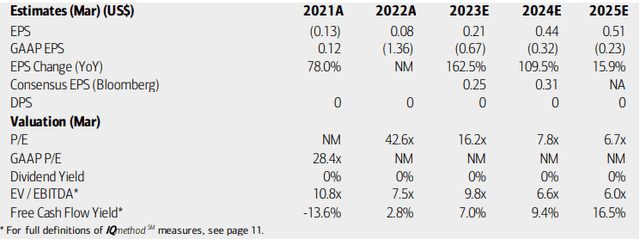

On valuation, analysts at BofA see non-GAAP per-share profits climbing sharply in the coming years. As-reported GAAP earnings should remain in the red, however. The Bloomberg consensus forecast is slightly weaker than what BofA expects. Dividends are not expected to be paid out from this high-growth firm, but its FCF yield is impressive. The EV/EBITDA multiple is also reasonable for this A+-rated growth company. The forward PEG ratio is high near 4.0 while the price-to-sales ratio looks good at 0.63. Overall, it is a mixed valuation picture.

8×8: Earnings, Valuation, Free Cash Flow Forecasts

BofA Global Research

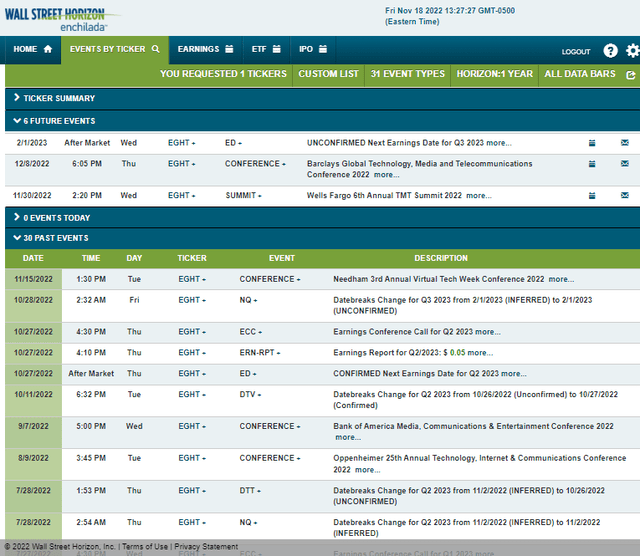

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q3 2023 earnings date of Wednesday, February 1. Before that, however, the company is expected to speak at two industry conferences. The Wells Fargo 6th Annual TMT Summit 2022 takes place from November 28 through December 1. Then the Barclays Global Technology, Media and Telecommunications Conference is hosted on December 7 and 8. There could be industry-moving news shared at these events.

Corporate Event Calendar

Wall Street Horizon

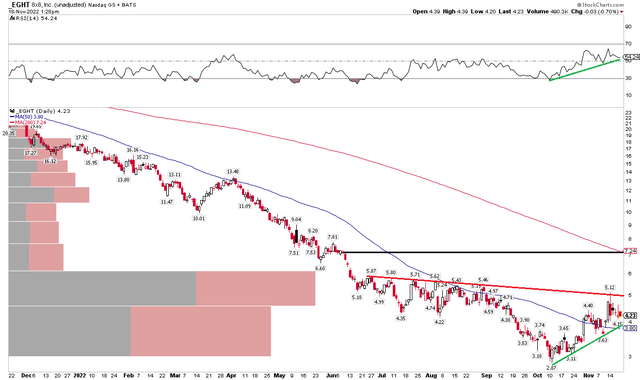

The Technical Take

EGHT bottomed out under $3 per share in mid-October after peaking with so many high-duration equities in early 2021. After a more than 90% fall, it might be tempting to nibble at shares now. I see a reasonable technical case to be made for doing so. Take a look at how the stock has rallied hard off the decade-plus low, but then paused at a key downtrend support line. If EGHT can break above that line, it would trigger a bullish price objective to near $7 – right near where the falling 200-day moving average comes into play as well as a key breakdown point from this past June.

Also, momentum is on the incline, helping to confirm the move higher in the stock. I would like to see shares hold the uptrend line off the October low. Overall, this stock has bullish technical potential, but we must wait for the breakout.

EGHT: Shares Consolidating After A Major Downtrend, Improving RSI, Watching $5

Stockcharts.com

The Bottom Line

Trading just 0.6 forward sales and with positive free cash flow, I think the stock is worth a look here fundamentally. Technically, we aren’t quite there yet, but the chart, too, suggests upside could be in the works.

Be the first to comment