D-Keine

We’re now a little over a week removed from arguably the biggest calamity in crypto this year. And that’s saying something because 2022 has been pretty awful for crypto proponents and Bitcoin (BTC-USD) advocates. We are now 53 weeks past Bitcoin’s cycle top of just under $69,000. Since then, we’ve seen the fall of Terra (LUNC-USD), the collapse of Celsius Network (CEL-USD), and too many insolvencies between the lending and mining companies to list. FTX (FTT-USD) probably hits the hardest because of how big it became. Stadium naming rights, endorsement deals, high profile ambassadors, millions of users, and a lot of exchange volume; it stings in a big way and it’s a black eye on the industry.

But with some time to digest it all, it is imperative that we not conflate the failings of a centralized company in the world of finance with the failing of decentralized crypto networks. They are not the same. With the exception of Terra, which was highly centralized in its operations, every other collapse in the crypto industry this year has been by a centrally controlled and managed business. The calls for regulation are going to get loud. In my opinion, whatever kneejerk decision comes out of the regulatory body will not matter – regulations wouldn’t have stopped FTX. But for the sake of this article, I want to explore the idea that Bitcoin is somehow doomed because of the fall of one centralized exchange. So far, nothing could be further from the truth.

Is Bitcoin Dead?

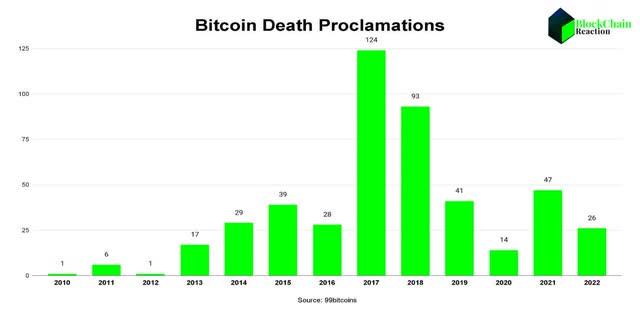

Spoiler, it’s not. There’s actually a webpage dedicated to tracking how many times a notable media outlet or writer has declared Bitcoin dead. So far, Bitcoin has been declared dead 466 times since 99bitcoins started tracking submissions from 2010.

99bitcoins/BCR

Looking at the deaths by year we can see two notable things; the first is there were far more proclamations of Bitcoin’s demise in 2017 than there were in 2021. The second thing we notice is death calls were far more abundant when Bitcoin topped in 2017 than when it bottomed in 2020. Even after a new high several multiples above the 2017 top in 2021, we see far fewer death declarations in 2021 and even less in 2022. However, the 99bitcoins obituary tracker isn’t a perfect science because it’s submission based. Something that might be a bit more actionable could be search data. What do real people actually think? We can get a sense of retail investor sentiment by looking at Google Trends:

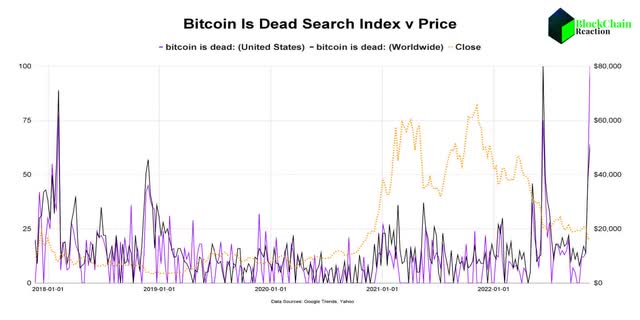

Bitcoin is Dead Index (Google Trends, Yahoo/BCR)

This chart shows the “Bitcoin is Dead” search index for both the United States and Worldwide. They track tightly together for the most part. When overlaying Bitcoin’s price we can see the spikes in the “Bitcoin is Dead” search indices is actually closer to bottoms than tops. Furthermore, in the last bull cycle, there was the immediate surge in death search in January of 2018 followed almost a full year later by another spike in the “Bitcoin is Dead” search index after a big capitulation. While the spikes from this cycle look a bit different, we’re in our second spike now. History indicates when people stop wondering if Bitcoin is dead, that’s when the bull will begin.

Network activity

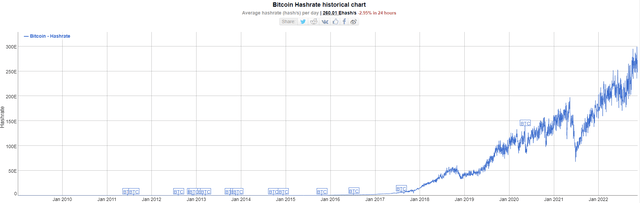

Despite all of the chaos surrounding the collapse of FTX and the terrible sentiment, Bitcoin doesn’t care. It just keeps making blocks and hashrate is still churning out new highs seemingly each week:

BTC Hashrate (Bitinfocharts)

To reiterate, this is a measurement of the computing power that is being committed to securing the network. If Bitcoin were dead, we’d see this figure collapsing. It’s doing the opposite. Also, if Bitcoin were dead we’d probably be seeing BTC inflow to exchanges for dollar conversions rather than exchange outflow. We’re seeing outflow:

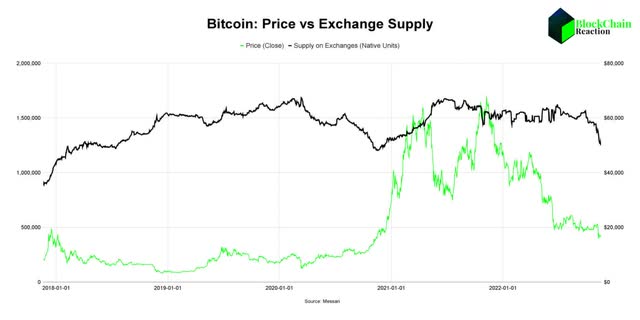

BTC Exchange Balance (Messari/BCR)

Whether you’re in the Bitcoin-only camp or not, the FTX collapse appears to have created new self-custody maximalists. The supply of BTC on exchange has plummeted from 1.56 million at the end of September to 1.26 million today. The exchange supply balance hasn’t been this low since 2020 when the run in BTC price really started to accelerate. To be clear, I’m not suggesting we’ll see a big price move up soon. This time we don’t have the same macro setup that we did in 2020. But if Bitcoin were dead, we’d see more of it coming onto exchange rather than leaving.

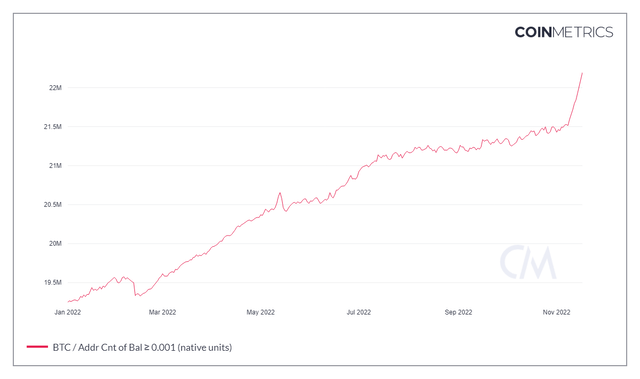

0.001 BTC Minimum Balances (CoinMetrics)

Non-zero BTC balances are quickly approaching 44 million wallet addresses. We can see similar growth trends among a wide range of address balance minimums as well. In the chart above, we can see addresses with at least 0.001 BTC, or roughly $16.5, have spiked from 21.5 million on November 8th to 22.2 million today – a 3% surge in just 10 days. This is a good indicator that even lower stack-value holders are getting the point about self-custody.

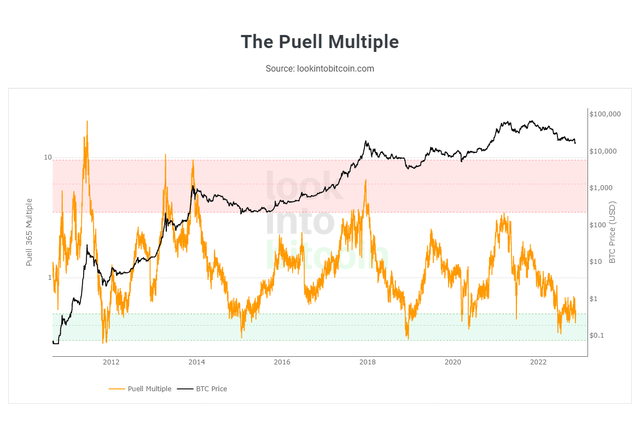

Puell Multiple and NVT Valuation

One of the ways that we can try to guess where Bitcoin’s price will go is with the Peull Multiple. What this chart is measuring is Bitcoin’s daily issuance measured in dollars and dividing that figure by a one year moving average of the issuance value.

Puell Multiple (LookIntoBitcoin)

Generally when we see the multiple find the green zone it means there is more pressure on miners to sell the issuance. The multiple has been in the green for essentially 5 consecutive months. When the multiple is this depressed for this long, it has typically been an indicator a bottom is close or in and miners no longer need to sell issuance to pay the bills. History doesn’t repeat but it might rhyme.

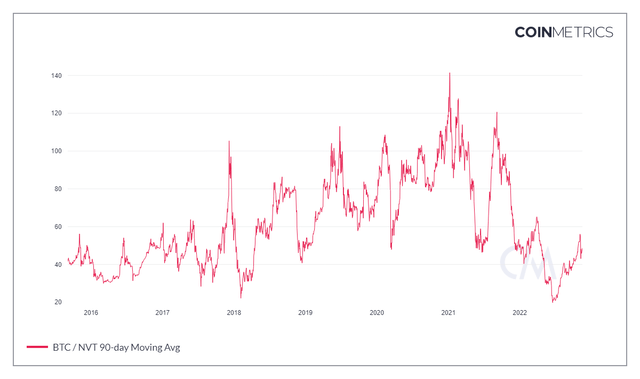

NVT 90 Day MA (CoinMetrics)

Something else to consider is the NVT ratio or the Net Value to Transactions ratio. This ratio was created by Bitcoin analyst Willy Woo and has often been a strong buy indicator when the ratio is very low. What this ratio aims to show is the valuation of Bitcoin based on how much it is being used for transactions.

During the June selloff, the NVT ratio actually went below 20 – which did not happen following the 2018 selloff and was actually the lowest the ratio had been since 2011. None of this means these ratios can’t go lower, but if one wants to be strategic with purchases, buying when the ratio is as low as it is now has yielded good results in the past.

Risks

The biggest risk to Bitcoin is criminalization by decree. Even that won’t kill Bitcoin but it would be a significant blow and would likely severely damage consumer interest in acquiring and holding it. There is precedent for the US government doing something like that with Gold. In 1933, FDR signed Executive Order 6102 making the hoarding of Gold illegal. Of course, US citizens are allowed to hold Gold once again but that came after a significant re-pricing.

Importantly, the US is just one jurisdiction and there are certainly reasons why other countries have and may continue to take a more opportunistic approach to BTC.

BTC: Country Holdings (BuyBitcoinWorldwide)

The other major risk to Bitcoin is that it is reliant on the internet to be used while other traditional fiat escape assets like Gold and Silver are not. There is no denying that fact. But if a significant enough portion of the world loses electricity to the point that Bitcoin’s ledger is no longer available, humanity would have far bigger problems than debating investment assets.

Summary

With respect to Charlie Munger and his abysmal take on Bitcoin, if a currency that helps kidnappers should be avoided I have some bad news for him about USD. BTC can’t simultaneously be worth nothing and also be used for facilitating crime. Which is it? Bitcoin antagonists have to choose. Is it worth nothing or is it potentially so valuable to non-western nations that it threatens to end the dollar system as we currently know it? Maybe a better question is does a network of decentralized computers tasked with maintaining a public ledger care what anyone thinks?

If you’re bearish Bitcoin long term, fine. I’m not going to try to sway you. If you’re bullish Bitcoin long term, keep dollar cost averaging and you’ll do just fine. Are we at a bottom in Bitcoin? I doubt it. But I think we’re much closer to the bottom than the top and I think this Bitcoin bear cycle is closer to the end than the beginning. The network is still strong. Be calm and stack sats.

Be the first to comment