Justin Sullivan

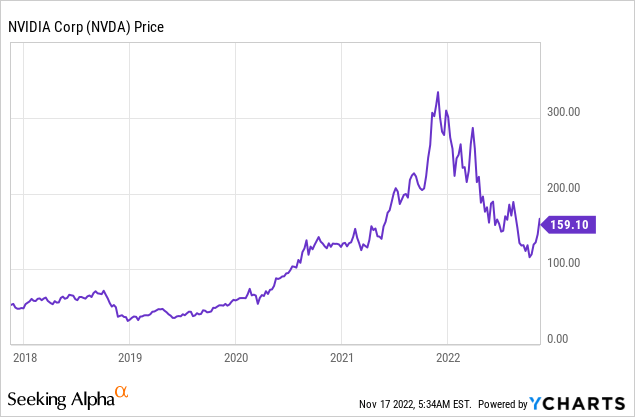

Nvidia (NASDAQ:NVDA) is a global leader in graphics cards for PCs, Data Center AI, self-driving technology, and visualization. The global Artificial Intelligence [AI] industry was worth ~$60 billion in 2021 and is forecasted to grow at a blistering 39.4% CAGR, reaching a value of $422 billion by 2028. Nvidia is poised to benefit from this trend and has recently generated strong data center revenue growth of over 30% year over year. However, declining gaming revenue and higher expenses have squeezed the company’s profit margins. Thus in this post I’m going to break down Nvidia’s third quarter earnings in granular details and reveal its valuation, lets dive in.

Mixed Third Quarter Results

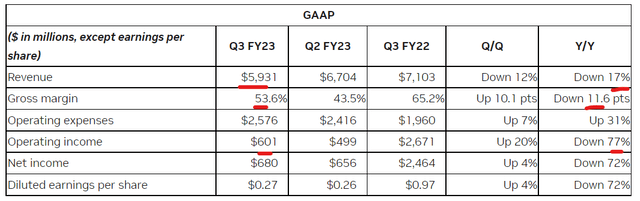

Nvidia generated mixed financial results for the third quarter of 2022. Revenue was $5.93 billion, which beat analyst expectations by $144.74 million. However, Revenue declined by 12% quarter over quarter and 17% year over year. Nvidia operates across four main business segments; data center, gaming, professional visualization (Metaverse) and automotive, lets dive into each segment in turn and the drivers of revenue.

Data Center Strength

Starting with the largest segment of the business, Data Center generated $3.83 billion or 64% of total revenue in Q3,22. This metric increased by just 1% Q/Q but a huge 31% year over year. This was driven by the ongoing digital transformation of enterprises as they move their IT to the cloud. The Cloud value proposition is strong, it offers enterprises greater flexibility, while also reducing costs long-term due to scalable computing resources. Therefore its no surprise that the data center industry is forecasted to grow at a blistering 22% CAGR up until 2026. Nvidia’s data center products include its A100 and its H100 Tensor Core GPU’s, which have been dubbed the “engine of the data center”. Nvidia’s unique selling point in the market is its super high performance, specifically with Artificial Intelligence or AI workloads. Recently (November 16th) the company announced a multiyear partnership with hyperscaler Microsoft Azure to build an AI supercomputer to help enterprises train and deploy AI at scale.

In the third quarter of 2022, Nvidia started to ship its new H100 GPU to server makers such as Dell, Hewlett Packard Enterprise and Lenovo. In early 2023, H100 cloud instances will be available on all major hyperscaler platforms (AWS, Google Cloud, Azure). Oracle also announced an expanded partnership to help scale AI for enterprises, using tens of thousands of NVIDIA GPUs which include the A100 and H100.

Nvidia H100 data center GPU (Nvidia website)

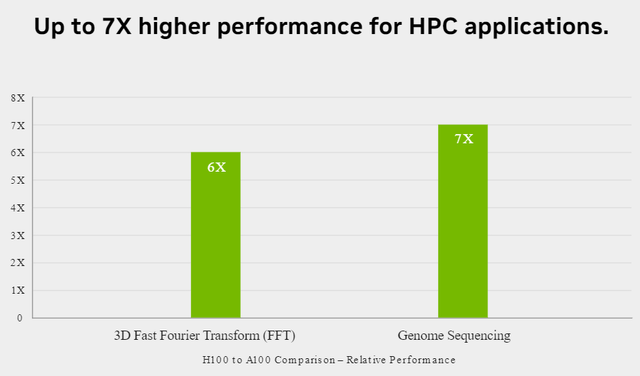

The reason the H100 is so popular among cloud infrastructure providers is it offers high performance but with a 3x lower total cost of ownership than prior models. It also uses 3.5x less energy, which will be a major selling point as cloud providers aim to reduce their running costs and increase margins. The chart below also shows that Nvidia’s H100 GPUs have up to 7 times higher performance for high-performance computing [HPC] applications such as Genome sequencing. Thus it’s no surprise that Nvidia is reported to power 90% of the Top 500 supercomputers.

A major headwind against Nvidia’s data center segment has been the new U.S government restrictions on shipping A100 and H100 products to China. The estimated hit on revenue last quarter was $400 million, and this quarter it is estimated to be similar as demand in China remains broadly soft.

Cyclical Gaming Declines

Nvidia’s gaming segment generated $1.57 billion in revenue which declined by an eye-watering 51% year over year and 23% sequentially. This decline was mainly driven by a cyclical decline in gaming which has been seen across many companies in the industry such as Microsoft with Xbox. The company noted solid product channel “sell through” in the Americas and Europe, but softer demand in Asia due to COVID lockdowns on China. I personally feel this is a slightly strange reason as one would assume lockdowns result in increased gaming revenue as we saw in 2020. However, I believe Nvidia may be referring to general economic demand and uncertainty which has slowed down distributor orders. The good news is that Nvidia’s management believes Channel inventories will approach “normal levels” at the end of the fourth quarter.

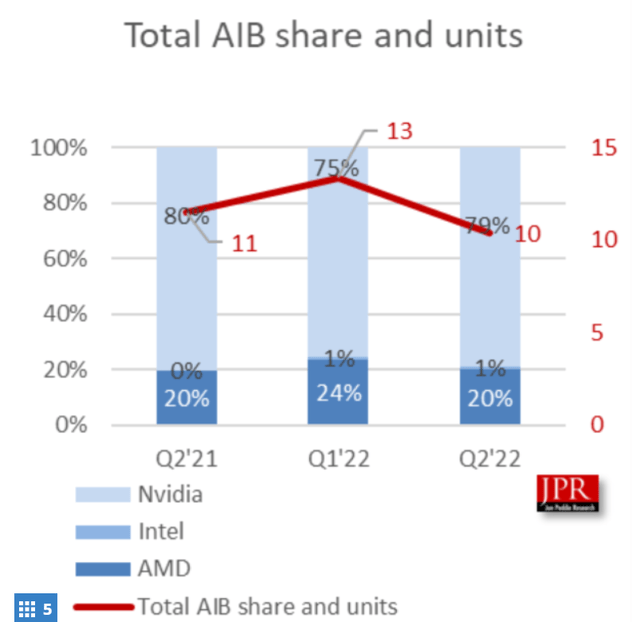

Nvidia is still the market leader in high-performance Graphical Processing Units [GPUs] and the company has ~80% market share of the Add-in board type.

Nvidia GPU Market share (JP Research)

Nvidia has recently announced its new Ada Lovelace GPU architecture which is part of the GeForce RTX 4090, launched in mid-October. The company has received tremendous feedback from the gaming product and it has sold out in many locations. Nvidia’s cloud-based gaming service Steam has also continued to grow and hit 30 million simultaneous users in the quarter, a new record for the company.

Metaverse (Pro Visualization)

Nvidia’s pro visualization segment generated revenue of $200 million which has plummeted by 65% year over year. This was driven by lower industry demand and the alignment of inventory with channel partners, the company expects this to continue into the fourth quarter. The good news is this business segment is poised to benefit from the long-term secular growth (and excitement) surrounding the Metaverse. Nvidia’s “Omniverse” Cloud offers a platform for developers and teams to build and access metaverse-style applications. For example, Deutsche Bahn, the German National Railway operator is using Nvidia’s Omniverse to create digital twins of its rail network. This customer is training AI models to monitor the network, in order to increase the safety and reliability of the service.

Strong Automotive Growth

The automotive segment generated revenue of $251 million, which has increased by a rapid 86% year over year and 14% sequentially. The company has partnered with many major automakers from Volkswagen to Mercedes in order to help power self-driving technology features. Volvo recently launched its new all-electric Volvo EX90 which is powered by the NVIDIA Drive Orin platform.

Profitability and Expenses

Nvidia has seen its overall profitability decline during the third quarter. Operating Income plummeted by 72% to $601 million, as operating expenses increased by 31% year over year. The increase in expenses was mainly driven by higher compensation expenses related to headcount growth. Data center infrastructure expenses also increased, but management is forecasting it to stay flat in the upcoming quarters. Management returned $3.75 billion in cash to shareholders via buybacks and dividends. In addition, the company still has a staggering $8.3 billion of share repurchases authorized. Nvidia has a strong balance sheet with $13.1 billion in cash and short-term investments. The business does have $9.7 billion in long-term debt, but only $1.2 billion in short-term debt which is manageable.

Nvidia stock financials (Q3 earnings)

Advanced Valuation

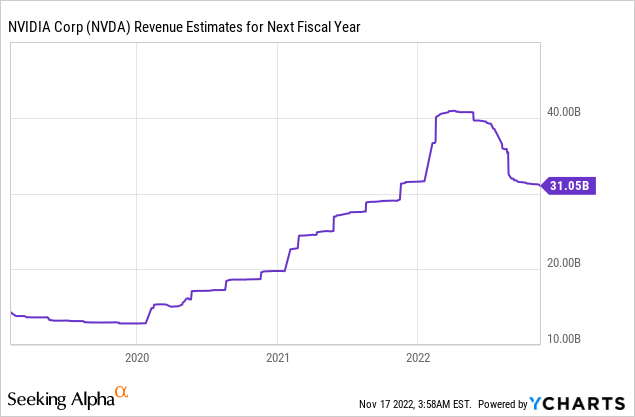

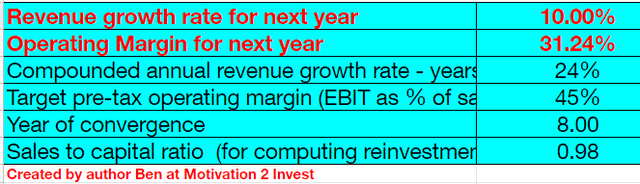

In order to value Nvidia I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 10% revenue growth for next year and 24% revenue growth over the next 2 to 5 years. I forecast the cyclical gaming industry to rebound and the Datacenter segment will continue to grow.

Nvidia stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have capitalized R&D expenses, which has boosted the operating margin to 31.24%. I have also forecasted a target pre-tax operating of ~45%, driven by the leveling of costs associated with the data segment, as management has forecasted. In addition, to the increasing growth in the automotive segment and even the Omniverse long term.

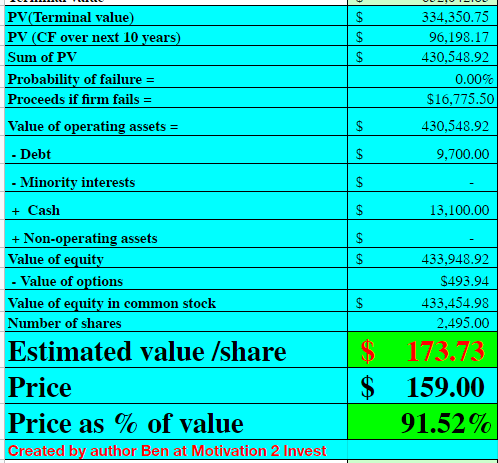

Nvidia stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $173 per share, the stock is trading at $159 per share at the time of writing and thus is ~9% undervalued.

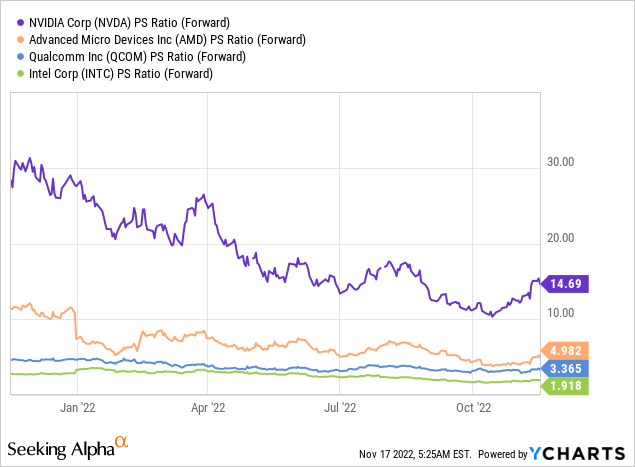

Nvidia also trades at a Price to Sales ratio = 13.4 which is 20% cheaper than its 5 year average. The company does trade at a higher valuation than industry peers but it is the market leader in High-performance GPUs and has grown its business at a faster rate historically.

Risks

Bitcoin Mining Exposure

During 2020, a portion of Nvidia’s gaming revenue actually came from customers which purchased the GPUs for Bitcoin mining as crypto prices boomed. This segment of revenue may not bounce back given, the transition of Bitcoin mining to ASIC (Application Specific Integrated Circuits) and of course the super low crypto prices. Ethereum has also changed from a compute-intensive proof of work model, to a proof of stake model which will impact the need for computing resources globally.

Recession/Cyclical Gaming Revenue

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. Therefore tepid consumer demand and longer sales cycles are expected at least for the next year or two.

Final Thoughts

Nvidia is a technology titan which still dominates the high-performance GPU industry. The company is vulnerable to cyclical gaming but its data center segment is still growing strong. The stock is undervalued intrinsically at the time of writing and thus could be a great long-term investment. However, do expect some short-term volatility as the macroeconomic headwinds are strong.

Be the first to comment