SergeyZavalnyuk

Investment Summary

From the Portfolio Manager’s desk

Here at HB insights, we cover Australian-based miners in depth. Australian commodity majors have enjoyed tremendous upside in FY21/22′ despite the broad selloff in equities. Iron ore, however, hasn’t enjoyed in the good fortune. Names heavily exposed to the resource have been re-rated to the downside this year. Case in point is Fortescue Metals Group Ltd (OTCQX:OTCQX:FSUGY), the Australian iron ore giant that still trades on a c.11% trailing FCF yield, and investors enjoy a 10.84% trailing dividend yield [FSUGY’s dividend is not discussed here, capital appreciation is the focus instead]. FSUGY also recorded its largest quarter of tonnes shipped, potentially explaining its latest relief rally on the chart. Despite this, it’s down 5% this YTD. Note, this article discusses capital appreciation, and doesn’t dive into the company’s dividend.

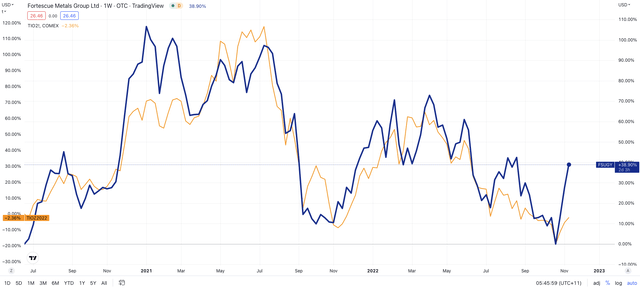

The stock now trades at 6.5x trailing earnings and is heavily correlated to volatility in the iron ore markets, as noted in Exhibit 1. With price visibility on the outlook for raw materials murky looking ahead, we derive fair value estimate of $20.02 for FSUGY. Hence, we rate the stock a hold. A positive change in consensus iron ore forecasts is the key upside risk to the thesis.

Exhibit 1. Tight causal relationship between iron ore market pricing and the FSUGY share price

Data: Refinitiv Eikon, Tradingview

Note: As a reminder, Fortescue is situated in Australia and its FY22 fiscal year ended in June. It therefore reported its Q1 FY23/24′ results for the 3 months ended 30 September, 2022. This corresponds to Q3 FY22 in the US. As such, we will be talking in terms of Q3 FY22 as to avoid any confusion for our readers.

Q3 FY22 Fe shipment record means balance sheet in shape for big step up in investment

FSUGY intends to invest US$6.2Bn [note, all dollar figures from hereafter are quoted in USD, unless otherwise stipulated] to fully decarbonize the company and step beyond its traditional markets by 2030. It claims to save $3Bn in the process, bringing the net investment to $3.2Bn, with additional net savings of $800mm per year from thereon [a deeper review of Future Fortescue Industries (“FFI”), and its decarbonization plans, see: here].

Its Q3 FY22 results were therefore welcomed amid a tight iron ore (“Fe”) market. Prices on iron ore cargoes with 63.5% Fe delivery into Tianjin are down 38.9% off March highs, after peaking in July FY21.

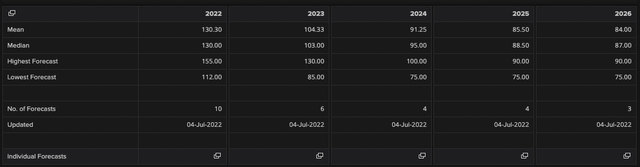

Recent developments have shifted the supply and demand numbers for Fe spot looking ahead. Consensus estimates have stepped back accordingly from $130/tonne at the mean to $91.25 in FY24, as seen in Exhibit 3. Despite this, Fe futures have rallied 20% in November following revised Covid-related travel restrictions from China.

Despite cases rising, Beijing said it will reduce quarantine periods for close contacts. Additionally, it extended a key financing program to its struggling real estate sector, total CNY 250Bn. As default risk and overall defaults rise within the sector, the cost of financing has surged, forcing state intervention to assist the segment. The outlook for iron ore therefore remains mixed.

Exhibit 2. Iron ore 63% Fe, CFR China – 20% rally in November as China potentially relaxes Covid policy, intervenes with CNY250Bn in real estate sector

Exhibit 3. FY22–26′ consensus iron ore forecasts

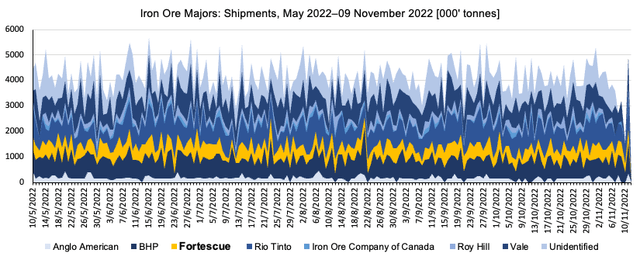

Exhibit 4. Iron ore majors’ shipments May 2022–date

Data: HB Insights, Refinitiv Eikon

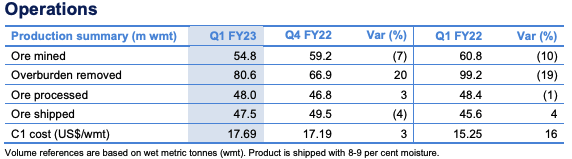

Turning to FSUGY’s third quarter of FY22, it shipped Fe shipments of 47.5 million tonnes (“MMT”), a 400bps YoY growth and record for the quarter.

It clipped average revenue of $87/dry metric tone (“dmt”) with 85% of the Platts 62% CFR index realized for the quarter, and 72% for the calendar year. Note, the company’s 57–58% iron content [lower-grade] resource sees it incur a discount to the 62% benchmark price. Net direct costs [C1 costs] increased 300bps to $17.69/wet metric tonne (“wmt”), driven primarily by fuel costs and other inflation inputs. Costs were offset by a favorable AUD/USD pair that’s pulled back to range over the last 2 months.

Exhibit 5. FGUSY quarterly operations summary [Australian fiscal dates shown].

As a reminder, Fortescue is situated in Australia and its FY22 fiscal year ended in June. It therefore reported its Q1 FY23/24′ results for the 3 months ended 30 September, 2022. This corresponds to Q3 FY22 in the US. (Fortescue Q3 FY22 Trading Update)

CapEx for the quarter was $653mm, or $2.8Bn on the trailing 12 months of expenditure, down from $3.2Bn YoY. The turning point in CapEx reflects timing, and management has retained FY23 CapEx guidance.

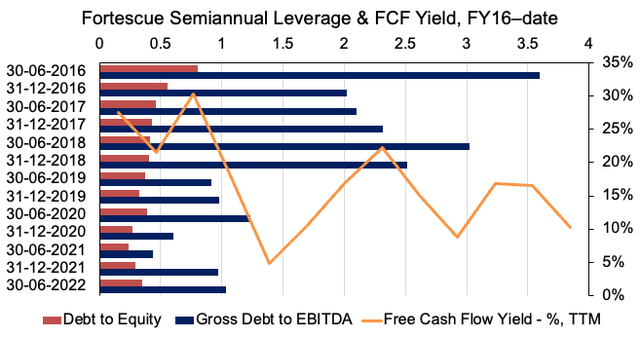

On the balance sheet, gross debt is unchanged at ~$6Bn and FGUSY pulled in CFFO of $3.3Bn for the quarter. This was flat on Q2 FY22, but up from $1.06Bn in Q3 FY21. It left the quarter with net debt of $2.8Bn after paying its previous dividend of $2.4Bn.

As seen in Exhibit 6, the stock still trades on a c.11% trailing FCF yield whereas net-gearing is 40% debt/equity and 1.0x gross debt/EBITDA. Alas, given its run-rate, FSUGY retains balance sheet capacity to fund its future growth in my opinion [including the 10% of net profit allocation to FFI, and retaining a payout ratio of 50–80%].

Exhibit 6. FSUGY still trades on a 11% trailing FCF yield whilst de-leveraging to 40% debt/equity.

Data: HB Insights, FSUGY SEC Filings

Guidance retained amid uplift in capital budgeting cycle

FSUGY retained its C1 guidance for hematite at $18–$18.75/tonne with a AUD/USD exchange rate assumption of $0.70. This falls in range with our expectations. It projects FY23′ Fe shipments of 187–192mm tonnes, including 1mm tonnes from its Iron Bridge site. Noteworthy is that every $0.01 [1 cent] delta in the AUD/USD pair impacts C1 cost by ~$0.15/tonne.

It guides CapEx of $2.7Bn to $3.7Bn [excluding allocation to FFI] which we feel is a reasonable estimate. We forecast a FY23 unit costs of $18.60 for current operations, not including Iron Bridge.

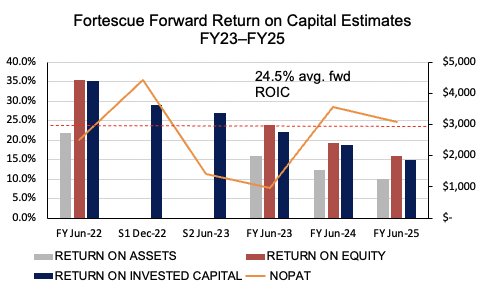

It’s not unreasonable to foresee FSUGY retaining a double-digit ROE, ROA and ROIC into the next 3-years, seen in Exhibit 7. Our forward estimates have the company producing a 24.5% ROIC pre quarter, resulting in $15.9Bn in cumulative NOPAT over this time.

Exhibit 7. Estimated return on capital to grow incremental tax-adjusted income into FY25

Data: HB Insights Estimates

Steelmaking margins [particularly in China] are also key to the upside case looking ahead. As practice, steel mills will minimize OpEx by switching to lower grade, cheaper ore, when their operating margins tighten. Being in the top-3 low-cost producers of iron ore, should this occur, this bodes in well for FSUGY. Note, BHP Group is currently the lowest cost producer at ~$12/wmt, vs. FSUGY’s Q3 FY22 $17.69/wmt].

Therefore, with the strong start to Q3 FY22 we estimate FSUGY is well capitalized to meet the guidance above. A trending broad market and the latest relief rally in Fe spot are also supportive of the same.

Valuation and conclusion

With the downside in Fe markets this year, iron ore spreads have compressed. Until a revisal of Fe spot forecasts, or market pricing curls back towards previous highs, this will impact FSUGY’s FCF and EPS upside into the coming years, by estimate.

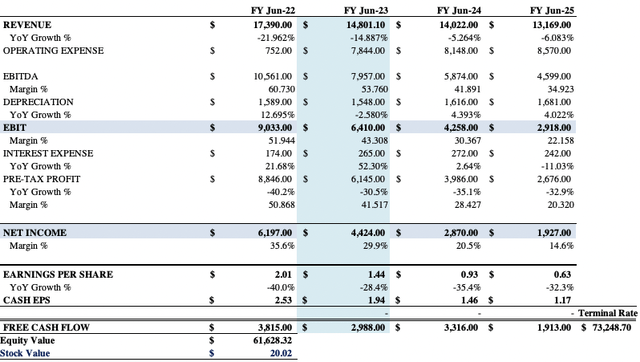

As seen in Exhibit 8, we see a slowdown in earnings and FCF growth into the next 3-years. This is backed by a lower forecasted revenue print of $14.8Bn in FY23, as we also project lower realized average prices for 63.5% fe cargoes this year.

As such, our FCFE NPV of $20.22 is reflects a cost of capital of 7.29% and a terminal rate of 5%. We also see FGUSY trading on a 4.1% quarterly FCF yield across FY23 [8.3% annualized from semiannual].

Exhibit 8. FGUSY forward estimates, FY23–FY25 with corresponding NPV.

Note: Dates shown correspond to US FY (Data: HB Insights Estimates)

Net-net, FSUGY remains a market leader in Fe production and has benefitted immensely from the latest supercycle in commodities. The outlook appears softer, however, as Fe markets have normalized in FY22, resulting in heavy downside. Despite this, there’s equal opportunity for investors to re-rate the stock in the event of a substantial uplift in commodity pricing once more. This is a key upside risk to the investment thesis. With our DCF deriving a price target of~ $20, we rate FGUSY a hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment