putilich/iStock via Getty Images

Last month, I recommended Teradyne (NASDAQ:TER) as a strong buy, citing these main reasons:

- Its pole position in the duopolistic ATE (Automated Testing Equipment) industry used to test semiconductors.

- The strong growth potential of the $700Bn semiconductor industry, which would provide sustainable revenue and profits.

- Superb profit margins of 21-23%

- High anticipated growth in its industrial automation (robots) segment.

Teradyne beat Q3-22 top and bottom line guidance, provided higher guidance for Q4-22 and is on track for higher growth in 2023-2024.

Quarter 3-2022 Analysis

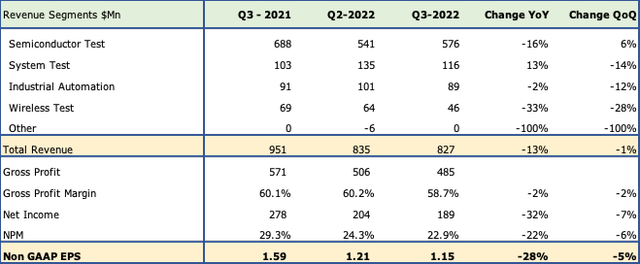

Teradyne Q3-2022 Analysis (Teradyne)

Hits and Balloons

Teradyne had guided for $800Mn in Q3 revenues, which it did beat by 3% at $827Mn on the strength of supply chain improvements in its largest segment – Semiconductor Testing. They cleared supply bottlenecks and added about $100Mn in revenues.

Earnings also beat by a solid 10% coming in at $1.15 against estimates of $1.04 per stub.

Teradyne’s top line dropped 13% against Q3-2021 as anticipated, mainly because its largest customer, Taiwan Semiconductor (NASDAQ:TSM) postponed its 3nm launch to 2023. However, total revenue was flat sequentially over Q2-2022, as supply chain bottlenecks eased.

Teradyne auto testing segment performed better, with demand for ADAS (Automatic Driver Assist Systems) processors, silicon carbide drive and charging ICs and battery management devices. This vertical has grown to $100Mn from nothing three years ago. This is a potentially huge market, industry leader, Nvidia (NASDAQ:NVDA), alone has a forecasted auto pipeline of $11Bn over the next five years. Teradyne expressed confidence that this growth would continue strongly in 2023.

Teradyne’s largest customer Taiwan Semiconductor expressed confidence in its 3nm node production ramp up during its Q3-2022 earnings presentation.

“Our N3 is on track for volume production later this quarter with good yield. We expect a smooth ramp in 2023, driven by both HPC and smartphone applications. Our customers’ demand for N3 exceed our ability to supply, partially due to the ongoing tool delivery issues, and we expect N3 to be fully utilized in 2023. We expect N3 revenue in 2023 to be higher than N5 revenue in its first year in 2020 and for N3 to contribute mid-single-digit percentage of our wafer revenue in 2023, as our overall revenue base is much larger today than in 2020. N3E will further extend our N3 family with the enhanced performance, power and yield, and offer complete platform support for both smartphone and HPC applications. N3E development is progressing ahead of plan, and volume production is now scheduled for second half 2023.

Despite the ongoing inventory correction, we observed a high level of customer engagement at both N3 and N3E with a number of tape-outs more than 2x than that of N5 in its first and second year. We are working closely with our tool supplier to address delivery challenges and prepare more 3-nanometer capacity to support our customers strong demand in 2023, 2024 and beyond. Our 3-nanometer technology will be the most advanced semiconductor technology in both PPA and transistor technology when it is introduced. We are confident that N3 family will be another large and long-lasting node for TSMC.”

Teradyne’s CEO, Mark Jagiela, confirmed TSM’s production ramp for N3 testing on its earnings call.

“We expect the semiconductor industry to begin to transition to 3-nanometer technology and our largest customer to grow from less than 10% of company sales in 2022 to more than 10% next year. However, we expect them to be at a lower than historical past peak level as 3-nanometer will not hit full stride until 2024.”

Misses and Anchors

Industrial Automation – The IA (Industrial Automation) segment did underperform and not just because of currency headwinds. Compared to the prior year quarter, currency headwinds cost it a full 9%, otherwise Teradyne would have improved revenues by 7% in constant currency, instead of the 2% drop.

However, the 12% sequential drop from Q2-2022 was also because of weaker demand in Europe and labor scarcity in its distribution channels. In constant currency, the 9 month IA revenue increase was 19% which decreased to 11% as reported. And because of sluggish conditions, IA will come in only 14% higher for the full year even in constant currency and 6% after conversion. This is way below their 20% growth plan

Europe – Europe remains a challenge for Teradyne, IA’s biggest market is Europe and with slowing industrial activity, inflation and a never ending war, this is going to be a drag on earnings. Still, management pointed to a few bright spots such as more customers engaging larger fleets of robots, which helps as Teradyne also provides fleet management software. Additionally, spares and service revenues also doubled compared to the same period in 2021.

Weaker Cloud Demand – Yesterday, I wrote about another capital equipment supplier ASML, (NASDAQ:ASML) highlighting the challenges it faced with huge end users of semis such as cloud, hyper scalers and data center slowing down. Meta Platforms (META), Alphabet (GOOG) and Microsoft (MSFT) all reported weaker than expected quarters. Today, Amazon (AMZN), the largest data center provider, not wanting to be left behind, followed suit with an only 27% increase in AWS revenue, its lowest growth so far; It left the unkindest cut to its Q4 guidance, where it expects revenue between $140B and $148B, well short of the $155.37B consensus estimate. Inventory digestion from end users will take time and effect Teradyne.

China Sanctions – Deliveries to China are going to be effected to the tune of $75-$100Mn in 2023 because of sanctions. Most of this would be memory.

Looking Ahead

Staying on Track – Overall, Teradyne hasn’t made any changes to its long term forecast. There would be incremental differences in Q4-2022 and all 2023 quarters could get lumpy. Lags due to poor PC demand and a softer Europe get mitigated with N3 ramping up later in the year, new client wins and additional complexity required for testing in higher end mobile phones and high-performance computing.

They do expect gross margins to stay stable around 59% to 60% and net margins also to stay within the 22-23% range. Operations and Capex spending has increased trying to add production capacity to solve supply chain problems, but these are incremental and easily mitigated by fulfilling additional demand and spending controls.

Teradyne re-iterated its forecast of $7-9 EPS for 2024, and I’m also confident with my forecast of $7 for 2024 and maintain a strong buy rating.

Be the first to comment