kynny

Investment Thesis

XPEL (NASDAQ: XPEL) was a pure software company in the protective film industry providing independent installers access to a library of pre-cut film designs. It gradually expanded into developing its own products consisting of paint protection film and window film. As one of the leading providers of protective film in the U.S., it also expanded to markets like Canada, China, and Europe. They adopt an asset-light and scalable business model as it outsources manufacturing to third parties.

The company had released its 2Q22 result, and it continued to perform well despite multiple headwinds including the COVID lockdown in China and car inventory constraints caused by supply chain disruptions. At the current share price, I believe XPEL is priced at a slight premium.

Product Revenue

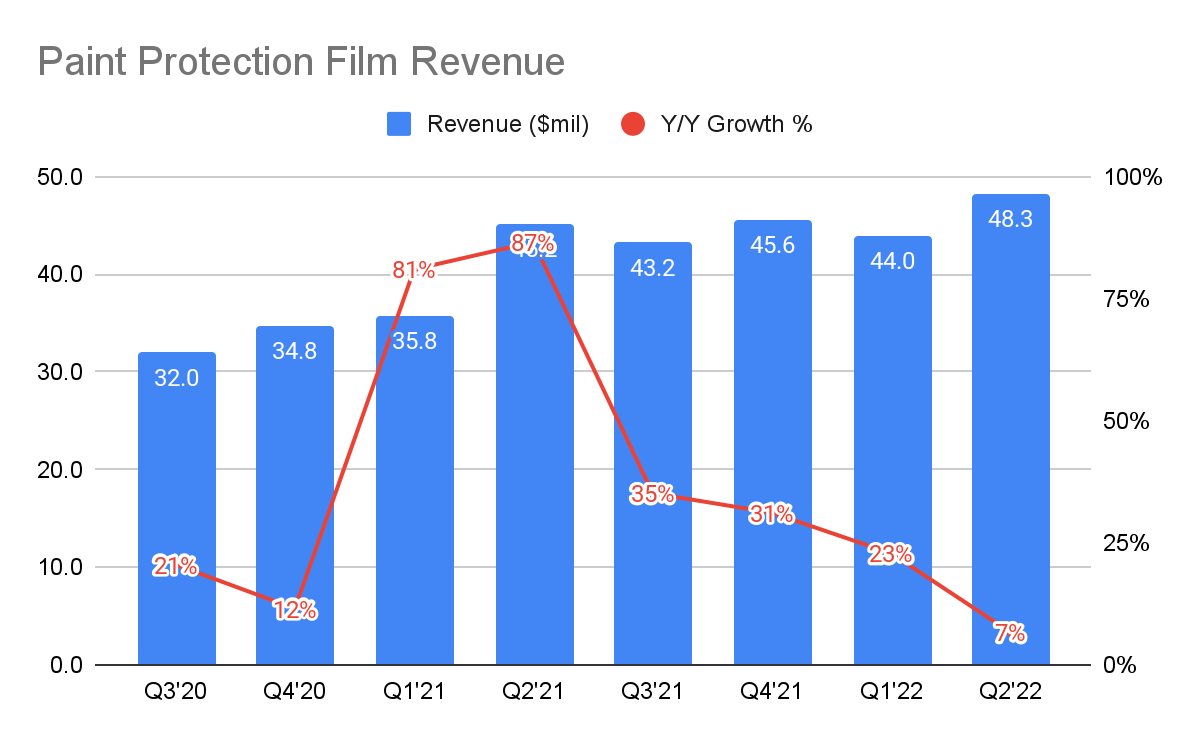

Paint Protection Film

XPEL 10-Q

XPEL’s product revenue consists primarily of 2 product lines – the paint protection film (“PPF”) and window film.

Its PPF business grew at 7% Y/Y, and the declining growth is influenced by the sales reduction in China due to the COVID lockdown and new car inventory constraints due to lower vehicle production. However, according to the management, vehicle production recovery is expected to recover in 2H22. Furthermore, the attach rates of PPF to vehicles have been increasing, indicating increased demand for its PPF, and retail aftermarkets also continue to perform strongly, although not enough to offset the production headwinds. During the quarter, they also struck a partnership with Rivian (RIVN), an electric-vehicle OEM, to become the exclusive PPF supplier. The OEM business is critical as it allows XPEL to reach new consumers beyond car enthusiasts.

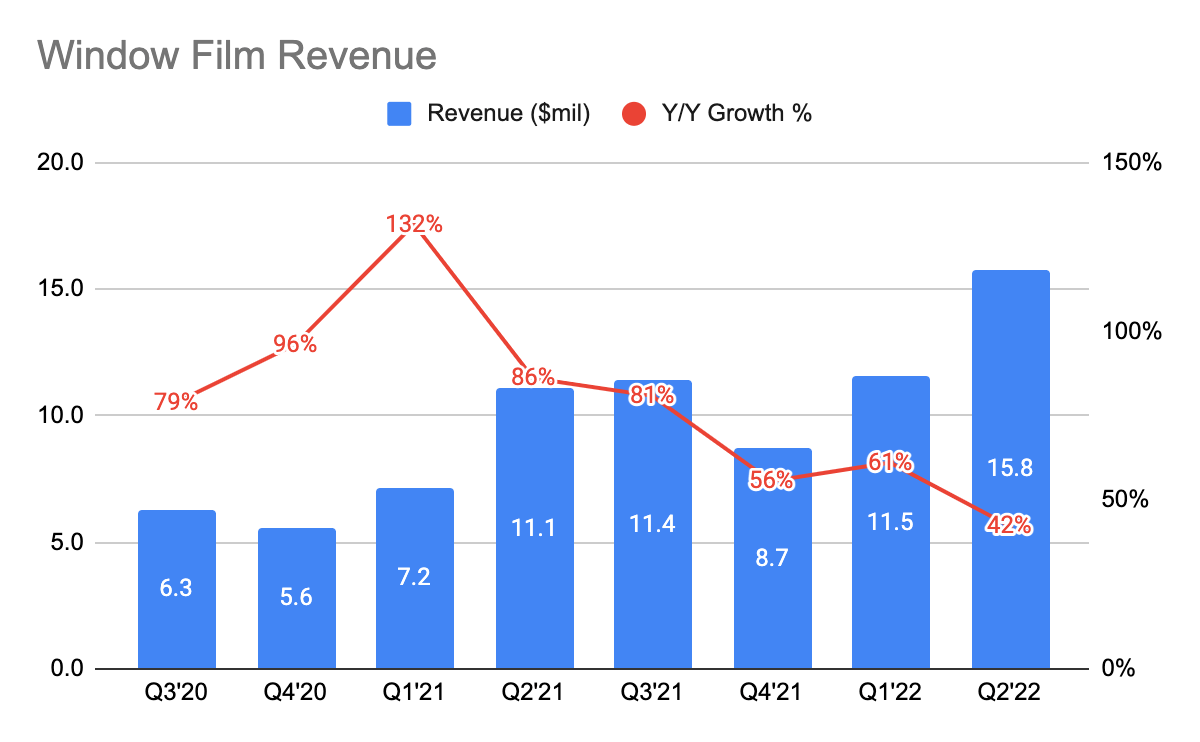

Window Film

XPEL 10-Q XPEL 10-Q

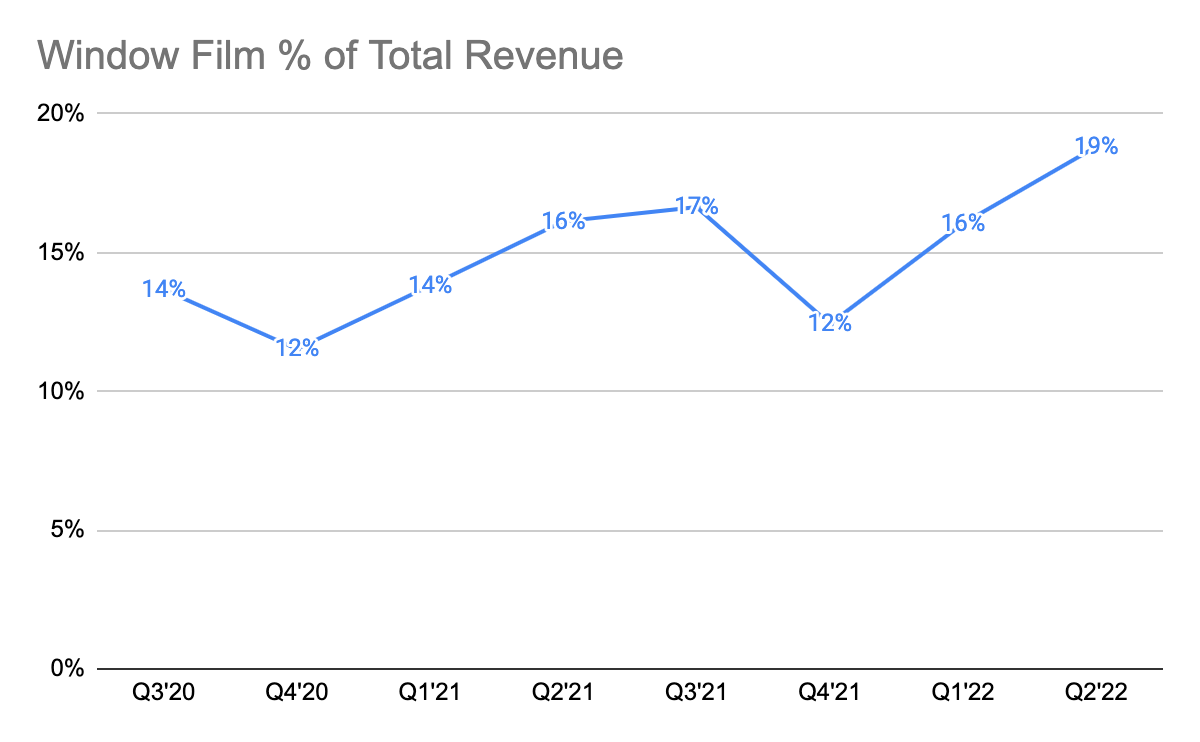

The window film business, on the other hand, grew faster partially due to a lower revenue base, and this is also evident from the fact that it is making up a larger proportion of its total product revenue. As this business is closely tied to dealerships, they are operating at less than 65% capacity due to car inventory constraints. Dealerships are high-margin businesses for XPEL, so as car inventory recovers, this will drive the overall gross margin of the company.

Recall that they did several acquisitions of high-volume window tint dealership businesses in 2021, including PermaPlate and Tint Net, to penetrate the mid-range market, which also represents a new market for its PPF product as its PPF sales are historically coming from luxury vehicles. This indicates the management’s desire to succeed in the market, and during the 2Q22 earnings call, they said to be taking market share away from competitors.

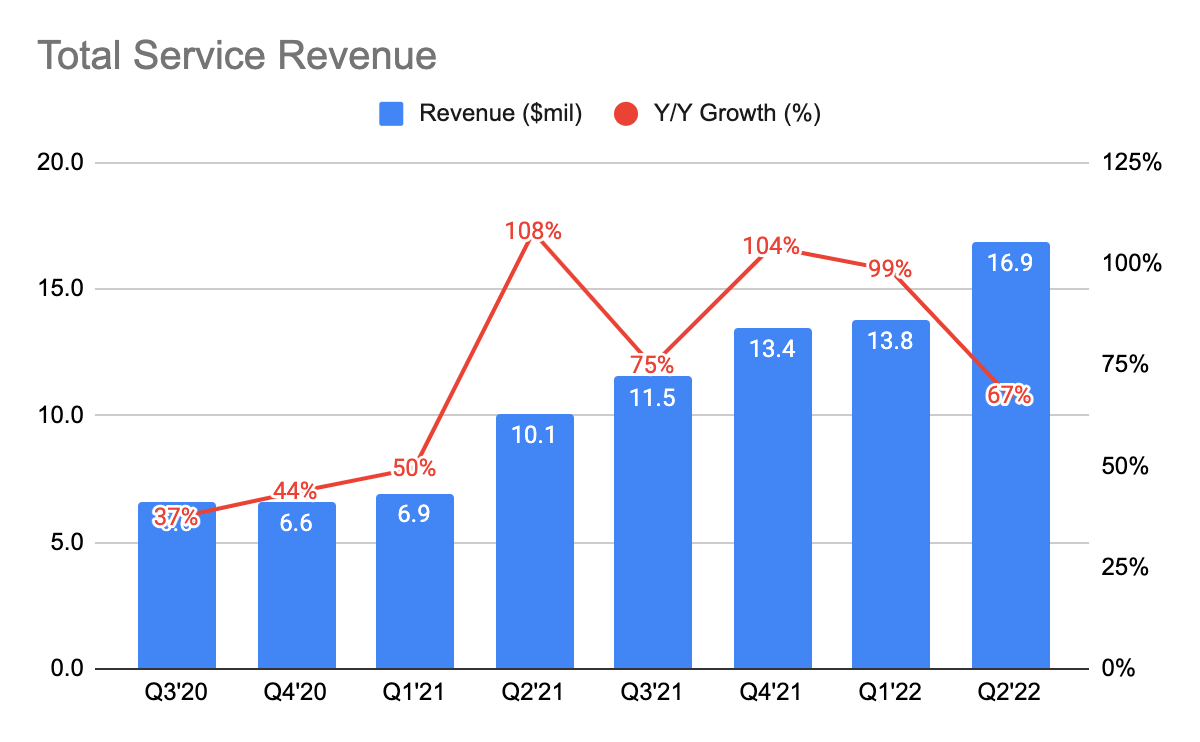

Service Revenue

XPEL 10-Q

Its high-margin service revenue grew 67% Y/Y, primarily driven by the 106% Y/Y increase in installation labor business driven by the acquisitions of PermaPlate and other acquisitions in 2021, the increased demand for its DAP software, and training services provided to installers.

Profitability

XPEL 10-Q XPEL 10-Q

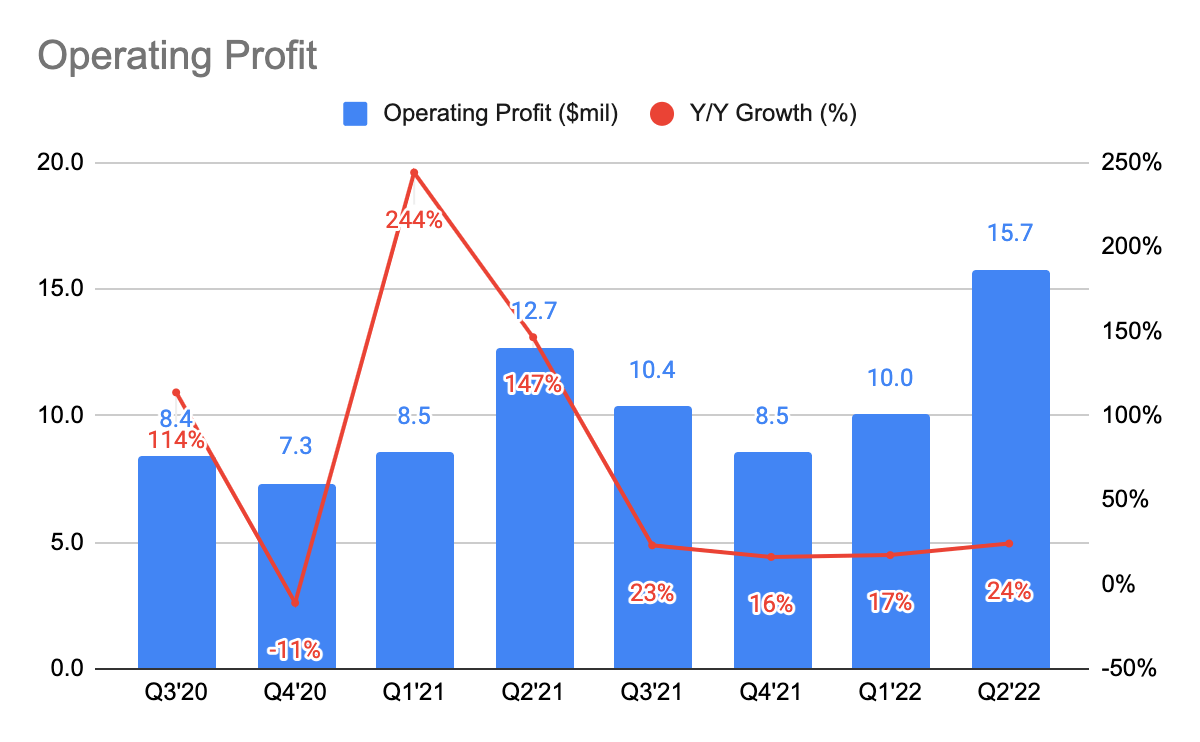

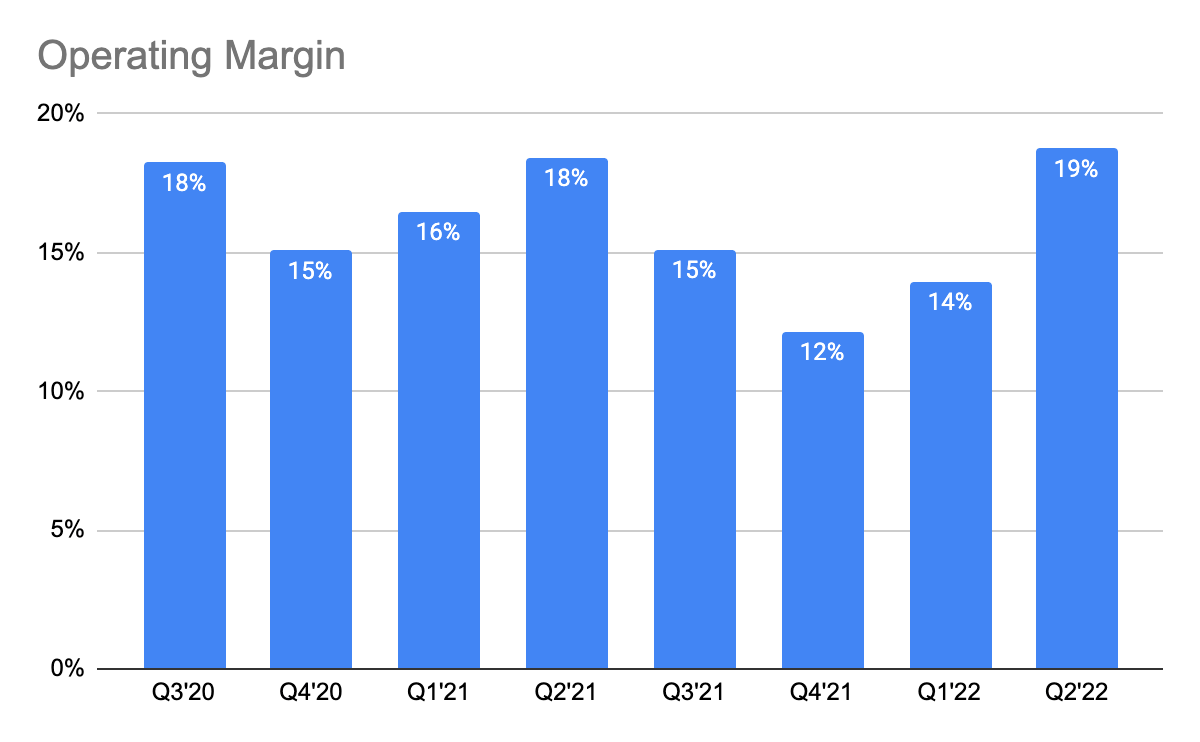

XPEL managed to grow its operating profit by 24% Y/Y, extracting strong operating leverage to achieve a record operating margin of 19% during the quarter. This speaks to its asset-light business model, and this is highly impressive given the macro headwinds, including price increases in raw materials. However, XPEL’s future margin is also likely to be pressured if the price of raw materials continues to rise and vehicle production volume continues to be affected, although, a portion of the cost can be passed on to customers.

Free Cash Flow

XPEL 10-Q XPEL 10-Q

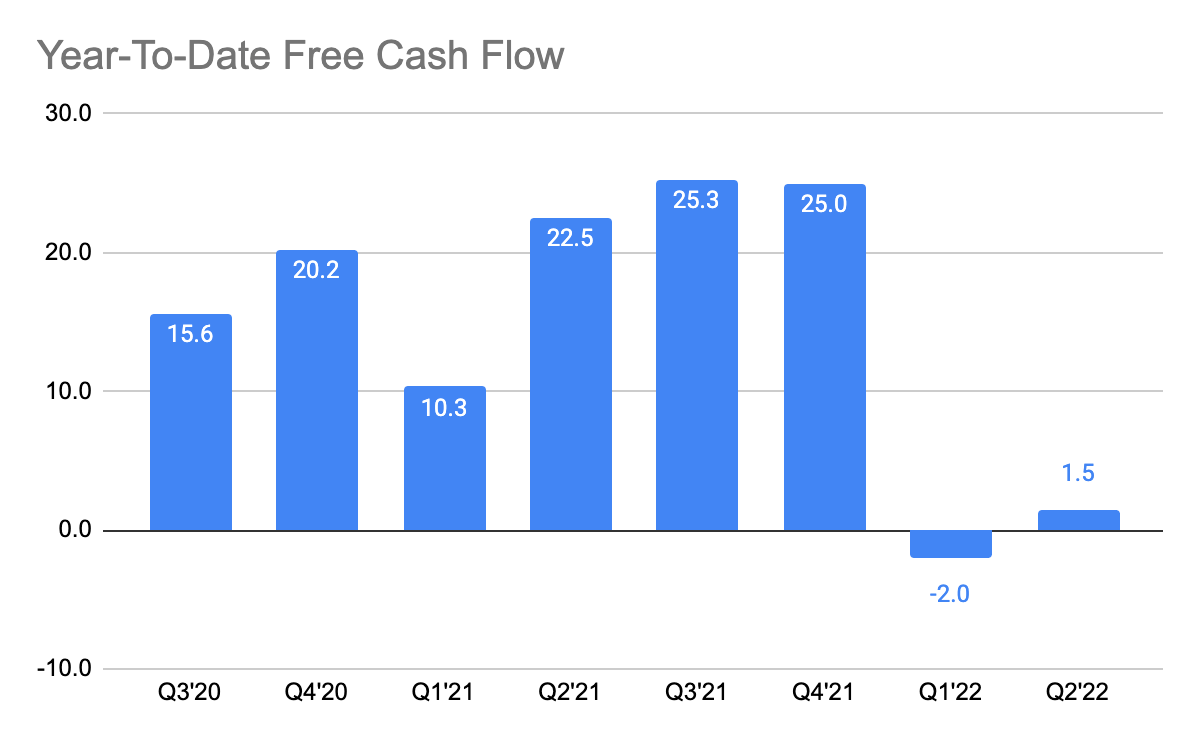

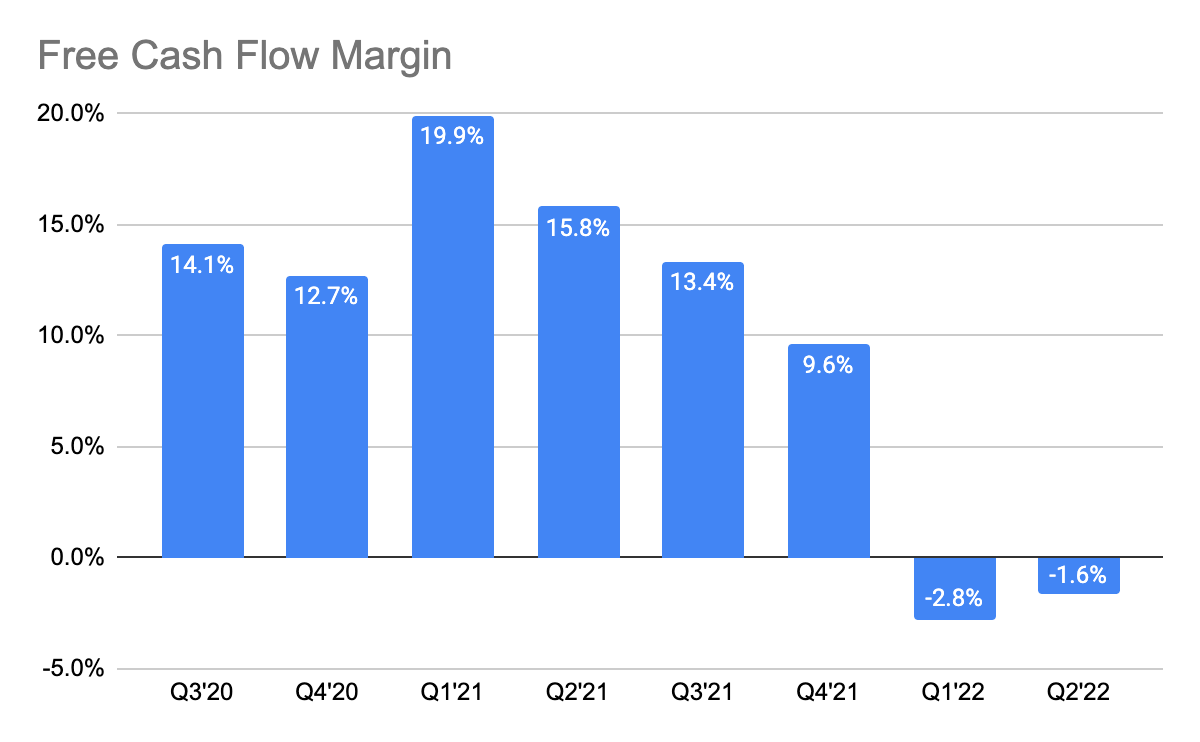

Historically, XPEL was free cash flow (“FCF”) positive only to see it decline to negative FCF in the most recent quarters. This is primarily because cash was used to purchase inventory to hedge against supply chain risks, and inventory levels will peak going into 4Q22. As of 1H22, they have already spent $22 million on inventory as compared to $2 million last year. This tells us that its normalized year-to-date FCF margin is likely to hover around 12% to 13% excluding the purchase of inventory. According to the management in the 2Q22 earnings call, they are using its cash flow to do more acquisitions.

Valuation

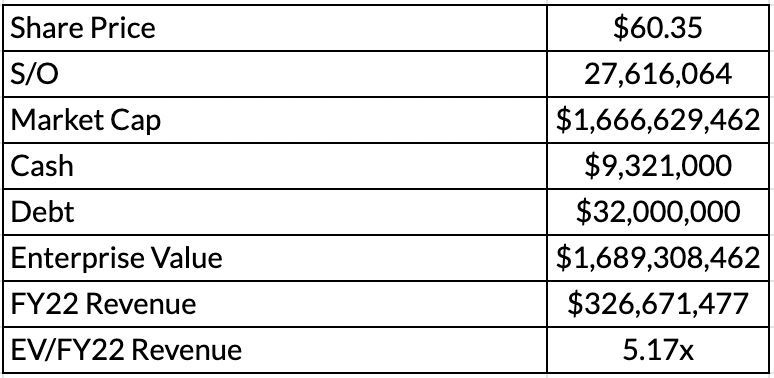

Author’s Image

Given the management guidance for FY22, taking the enterprise value of $1.69 billion will give us a multiple of 5.2x. Assuming that its normalized FCF margin is 13% as mentioned earlier, this means the EV/FCF is around 40x. I believe this is at a slight premium, although, it is not too absurd given that a reacceleration may happen if macro-environments improve in the future (which we have no visibility of) and taking into consideration that more acquisitions will be done.

Conclusion

All in all, I do believe this was an overall great quarter for XPEL as demand for its PPF and window film continues to grow despite the tough macro-environment. More remarkably, it managed to achieve a record operating margin given its asset-light business model. I also believe 1H22’s negative FCF margin is distorted due to the pull-forward demand for inventory. I believe the current valuation is priced at a slight premium even though this can be reasonable in the long term once the macros improve and reacceleration happens.

Do you agree with my analysis? Let me know in the comment section below!

Be the first to comment