sankai

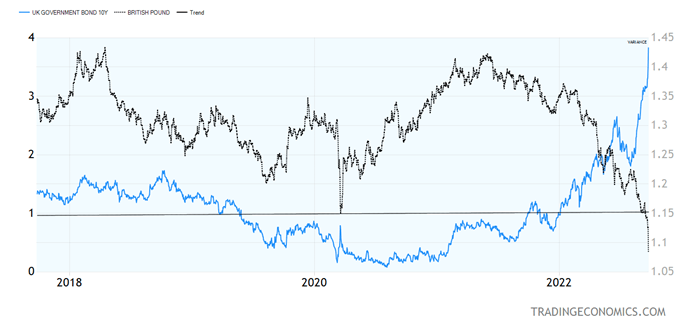

The British pound UK gilts – the equivalent of U.S. Treasuries – had outsized moves on Friday with 10-year gilts surging as much as 50 basis points in a single day, while the pound cratered. This is a good example of how too much QE followed by a sharp QT and too much deficit spending in a short period of time can backfire. In this case, the new UK government wants to subsidize energy prices for consumers – in effect, creating a surge in fiscal spending at a time of double-digit inflation, which could get worse.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

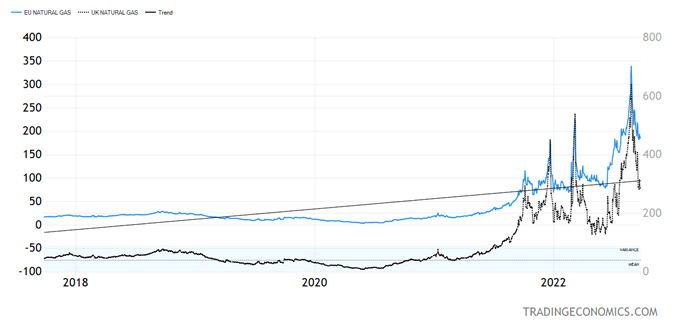

It does not help that Vladimir Putin announced a partial mobilization of 300,000 reservists, which shows he has no intention of withdrawing from Ukraine, despite steep losses in September. The Ukraine war affects the UK quite a bit more, due to its huge economic relationship with the EU. The UK does not have any natural gas storage, so it is forced to buy natural gas on the open market, which is driven by the same dynamics as that in the EU, which means it is prone to further spikes as the winter approaches

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

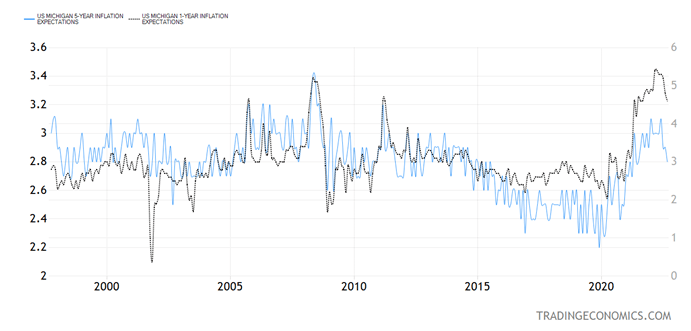

The outsized Fed rate hikes in the middle of all this volatility are adding to the problem. It looks like Fed Chair Jerome Powell is about to make the same mistake on the other side. He was too easy in 2021, resulting in higher-than-otherwise inflation, so he is now slamming on the brakes too quickly in 2022, resulting in a bigger-than-needed spike in interest rates and the U.S. dollar this year.

All market-driven measures of inflation in the U.S. are trending lower, and even inflation expectations have rolled over. It would not be a stretch to say that if we had current and five-year inflation expectations at 4.8% and 2.8% back in May, we would not have seen a 75-basis point Fed fund rate hike to begin with. But recent CPI reports have been elevated. Even though they are backward-looking, they are forcing the Fed’s hand, but too quick a rise in U.S. interest rates is reverberating to global currency and bond markets, promising higher volatility in the immediate future.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

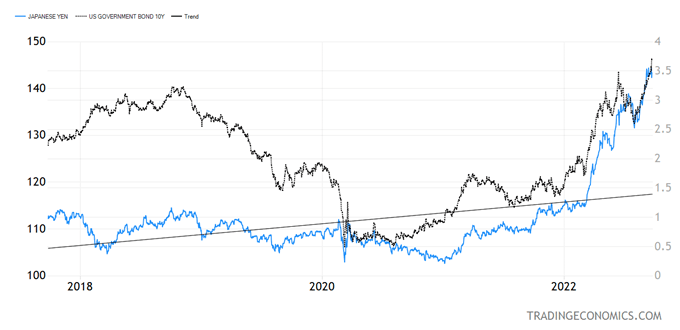

Why Interventions Cannot Stop the Yen from Sliding Further

Another currency with serious issues is the Japanese yen, which saw an intervention by the Bank of Japan last week in order to stem the yen’s slide. That would be hard to do as the Bank of Japan is hell-bent on sticking to its zero-rate monetary policy and yield curve control, while U.S. rates are moving higher.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

As U.S. rates began to drift higher, so is the yen beginning to move lower (more yen per dollar or the yen chart going up means weaker yen). The problem is huge institutional carry trades, where banks borrow yen at near-zero interest rates in Japan and sell the yen to buy dollars for short-dated U.S. Treasury paper, with the 2-year U.S. Treasury note now yielding over 4%. (This is on a currency-hedged basis).

Carry trades are a bit of financial alchemy as they are available only to financial institutions with access to Japanese and U.S. interbank markets. They make money using borrowed money and no equity in the transaction other than that necessary to operate a big financial institution.

Carry trades would not have any risk if done on a currency-hedged basis and so the downside pressure on the yen grows and the upside pressure on the dollar continues. When U.S. rates top out and begin to drift lower, the slide in the yen will stop, but Powell’s “higher for longer” attitude and indications that he is not done raising rates virtually guarantee the yen is not done sliding.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment