Drew Angerer/Getty Images News

Investment Thesis

Is “I’m a big Lord of the Rings fan” an appropriate investment thesis for Palantir (NYSE:PLTR)? No? Okay fine, I’ll come up with something else…

In a world where organizations have access to unfathomable amounts of data, Palantir is here to help make sense of it all. The amount of data generated is only going to increase exponentially over the coming years, which should only increase demand for Palantir. The company’s ability to land big customers (both governmental and commercial) and then expand spend with them has propelled them forwards, and puts it in a strong position right now.

Yet the stock itself has been something quite different. Once rightly designated a “hype” stock, Palantir’s shares have found themselves thrown into the stock market equivalent of Mount Doom over the past year – with investors’ gains burning away.

But does Palantir look like an attractive investment right now? I put it through my investing framework to find out.

Business Overview

Palantir is a complex business, there’s no getting away from this. So, what do they do? In the company’s words:

We build software that empowers organisations to effectively integrate their data, decisions, and operations at scale

Founded in the wake of 9/11, Palantir was created with the goal of assisting the US government and its allies in counterterrorism investigations and operations. The company utilises machine learning to identify patterns within large datasets, and then report back any unusual patterns that may warrant further investigation.

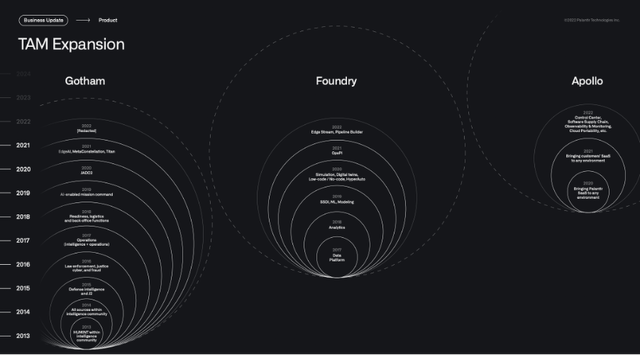

In recent years, Palantir has looked to diversify away from its reliance on governments as customers, as it aims to take a larger slice of the commercial market. It has continuously rolled out additional features in order to achieve this, and the company has three main software platforms that work cohesively with each other:

- Gotham: used predominantly by government agencies, Gotham was Palantir’s original software platform that allows customers to identify patterns hidden deep within datasets, and execute real-world responses to threats that have been identified using the platform. It is also used by some of Palantir’s commercial customers in the financial services industry to assist with fraud investigations.

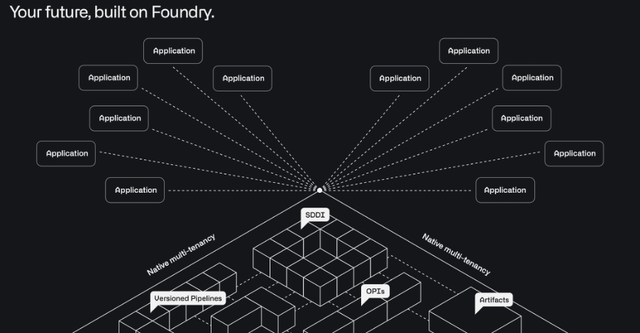

- Foundry: creates a central operating system for a company’s data, allowing individual users to integrate and analyse this data in one place. The aim is to enable commercial customers to work more effectively with their data, resulting in better operational decisions.

- Apollo: enables the rapid, secure delivery of Palantir’s software and updates for customers. It also allows commercial customers to deploy their own software in virtually any environment, providing a single control layer to coordinate ongoing delivery of new features, security updates, and platform configurations.

Palantir Q1’22 Investor Presentation

In order to get more of a feel for what Palantir do, let’s take a look at one example of a customer using their Foundry platform.

PARTNER: Pacific Gas and Electric Company

CHALLENGE: Pacific Gas and Electric (PG&E), a major California utility company, is facing a massive climate threat. To manage the ever-changing risk of wildfires during California’s fire season and optimize how it runs its grid, PG&E needed a central hub that could make sense of the 8-10 billion data points it receives every single day.

SOLUTION: Foundry provides PG&E with a complete operating picture of the grid. Using Foundry, PG&E has developed a model that combines equipment health data, geospatial location, and network topology to help predict when the utility should conduct preventive maintenance on distribution transformers. Additionally, Foundry enables PG&E to protect high-risk parts of the grid by switching parts of its electrical system on and off at critical junctures.

In short, Palantir helps organizations to make sense of massive amounts of data – transforming it from billions of data points into actionable information.

The company has successfully rolled out more and more services within these platforms, and that has helped its continued expansion – particularly among commercial customers. My investment thesis for Palantir revolves around its ability to expand into the commercial sector, and it has been doing this with a lot of success.

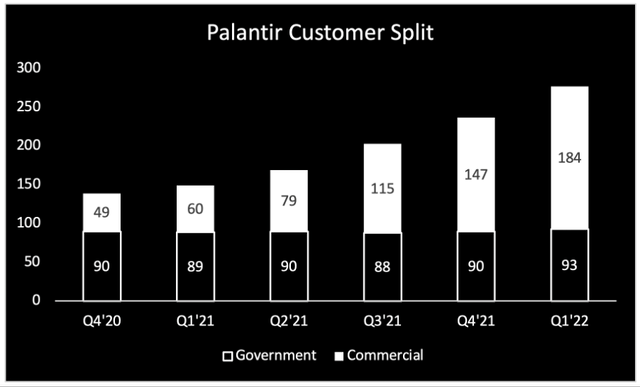

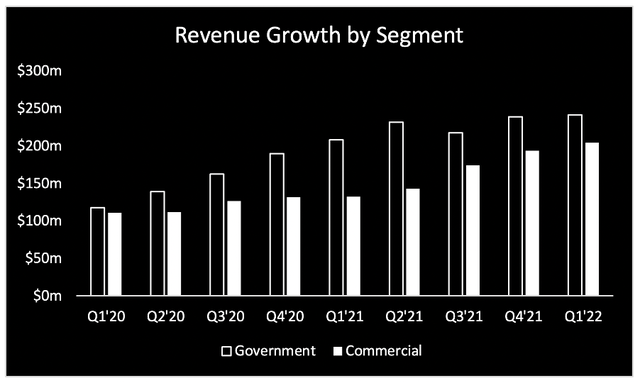

As we can see, the real growth in customer numbers recently has been driven by the addition of new commercial customers – which makes sense. There are a limited number of government agencies, and Palantir already works with a lot of them, so commercial really should be the focus going forward. It’s also worth highlighting the revenue trend between the two:

So despite commercial customers increasing at a rapid rate, the revenue growth hasn’t quite kept up. In fact, over this 2-year period, the government revenue grew at a 43% CAGR compared to 36% for the commercial segment. This is driven first by Palantir’s ability to continually upsell to its customers (hence more government revenue despite customer numbers being basically flat over the 2-year period) and its sales approach of land & expand. It’s currently in the process of landing a lot of commercial customers, but it’s not hit the expand phase quite yet – although if you look at commercial revenues over the past few quarters, it’s clear that some acceleration has begun.

Also, a quick side note: revenue growth can often look lumpy for Palantir, since it works on huge contracts & revenue recognition for these contracts can result in larger or smaller quarterly jumps.

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition.

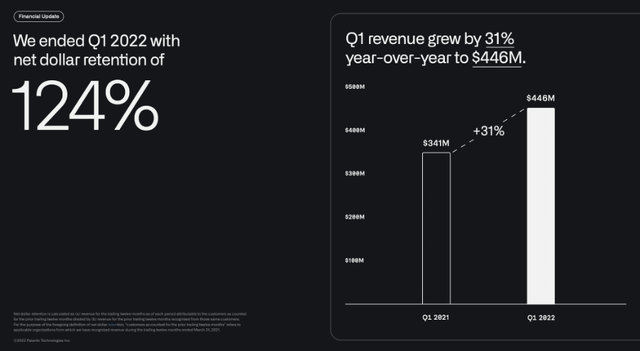

Palantir has one incredibly strong economic moat, and that relates to switching costs. Once a company decides to use Palantir’s software, it becomes so deeply embedded in the business & it is critical to decision making. The fact that Palantir continues to offer new solutions to its customers only further embeds it into an organization, and so it would be extremely onerous and could potentially cause a substantial amount of disruption if an organization were to switch away from Palantir – this is demonstrated by their impressive dollar-based net retention rate of 124%.

Palantir Q1’22 Investor Presentation

I would also say that the company benefits from network effects, as most companies who utilize machine learning do. The more data it takes in from all customers, the more Palantir learns to recognize patterns, the more effective its platforms become, and hence more customers will join, offering more data to learn from.

Another network effect that is becoming more apparent is the increased trust and visibility of Palantir when it comes to commercial customers. This is very much a ‘black box’ company, but more and more businesses are beginning to adopt Palantir’s offerings, which has the knock-on effect of making it more trusted and respected within the industry. An earlier network effect with its government contracts would be this: once a government uses it in one department, it can then expand to more departments. These are not really applicable anymore, but still worth highlighting.

Outlook

Clearly, Palantir is still in full on growth mode, with management guiding for revenue growth of at least 30% annually through to 2025. The company originally said in its 2020 S-1 Filing that it sees the total addressable market as being approximately $190 billion across the commercial and government sectors, but as we can see below, Palantir has consistently introduced new solutions to try and expand that TAM.

Palantir Q1’22 Investor Presentation

Plus, according to Market Research Future, the Global Big Data Market is expected to grow to just under $300 billion by 2030, representing a 14.5% CAGR from 2020 onwards. Clearly this remains a big, growing opportunity for Palantir, with the company’s trailing 12 month revenues totaling $1.647 billion, or less than 1% of its current TAM.

In the short-to-medium-term, there is the looming threat of a recession, and I highly doubt that Palantir will be that impacted. It focuses on larger enterprises and government agencies, both of which will be less hit by a recession, and they also are operating in core parts of these organizations. Deals may slow in the short term, but I believe this to be a recession-proof company that is fairly immune to macroeconomic fluctuations.

Management

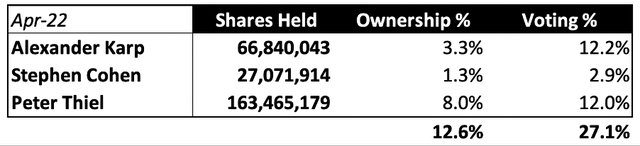

When it comes to fast-paced, innovative companies, I always aim to find founder-led businesses where inside ownership is high. Palantir achieves this through its Co-Founder and CEO Alexander Karp, with the company also including Peter Thiel as a Co-Founder and Board Chairman. Another Co-Founder, Stephen Cohen, also services as the President and Secretary of Palantir, and sits on the Board of Directors.

I want to invest in companies where leadership has skin-in-the-game, and Palantir certainly achieves this through the three Co-Founders, who own a combined 12.6% of all shares outstanding. At Palantir’s current valuation, that equates to ~$2.4 billion worth of wealth that they personally have tied to Palantir’s success. This alignment of management and shareholder incentives is always great to see!

I also like to take a quick look on Glassdoor to get an idea about the culture of a company, and Palantir gets some pretty good scores from the 519 reviews left by employees. Any score over 4.0 is impressive, and Palantir does manage to achieve this in a lot of categories, with particularly high scores in Compensation and Benefits, Career Opportunities, and Culture & Values. I am particularly pleased by that last one, but the indication I get is that this is a fairly intense company to work at – but, employees are rewarded well. The CEO approval rating of 75% is not great, but all in all I think Palantir looks like a good enough place to work.

Financials

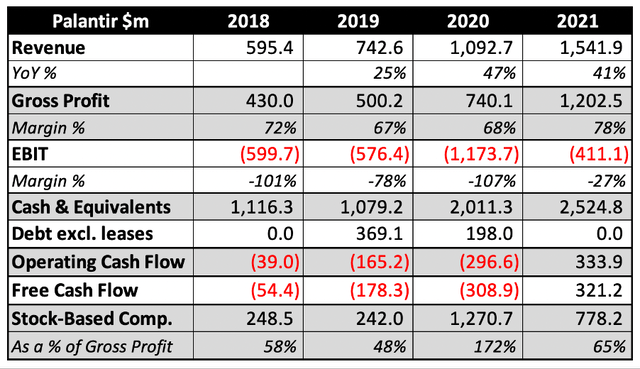

Palantir’s financials are… interesting. There isn’t necessarily a nice trend or pattern that I can see, so I’ll just go through everything in turn.

Revenues have grown by a CAGR of 37% over the past three year, with an acceleration in 2020 and continued strong growth in 2021. Gross profit margins in 2021 expanded substantially YoY, but this is primarily driven by high stock-based compensation expenses in 2020 – as per the 2021 annual report:

In the year ended December 31, 2021, our gross profit was $1.2 billion, reflecting a gross margin of 78%, or 82% when excluding stock-based compensation. In the year ended December 31, 2020, our gross profit was $740.1 million, reflecting a gross margin of 68%, or 81% when excluding stock-based compensation.

So the underlying gross profit margin has always been above 80% – if this is the long-term margin that Palantir can achieve, I will be extremely happy!

Then, we move onto the EBIT margin, which makes me feel slightly sick. I understand reinvesting for growth, but -101%, -78%, and -107%?! Crazy stuff, at least it’s a mere -27% in 2021 – but again, we have stock-based compensation to thank for the bulk of this, and I have no doubt that these margins will flip into positive territory as Palantir expands and SBC eases up.

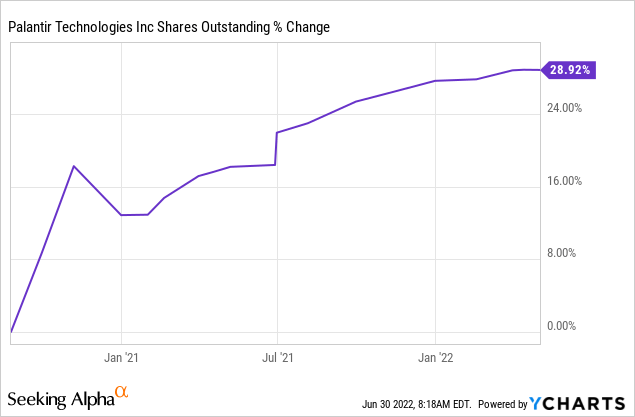

Speaking of stock-based compensation, we can see a huge spike in 2020 (where it was 172% of gross profit!) and a continually elevated figure in 2021. This will be driven in part by Palantir’s IPO, which can often result in substantial SBC charges coming through in that year & in the years that follow.

Clearly elevated SBC also poses a risk to shareholders in terms of dilution. Shares outstanding have increased by ~29% since the company came public, but they have “only” increased by 5.7% in the past 12 months – that is not crazy dilution for a company such as Palantir.

Onto the positives, and Palantir has an absolutely stellar balance sheet, with $2.5 billion in cash & short-term investments and zero debt. This gives me confidence that the losses are not going to be negatively impacting the business anytime soon.

Even better is that fact that it became free cash flow positive in 2021, meaning that it won’t need to try and raise external finance – this company is able to sustain its operations. Obviously, I would love to see the SBC come down, and I think it will over time, but at least the company does not have any financial problems right now.

Valuation

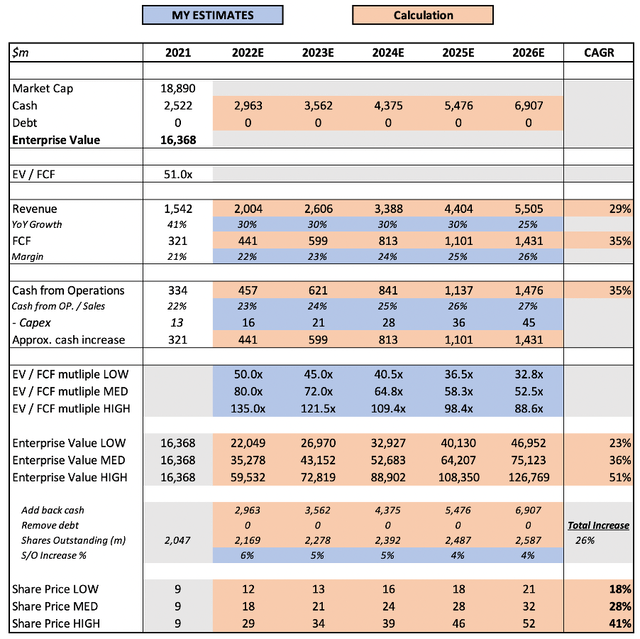

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Palantir is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

In my valuation model, I have used CEO Karp’s repeated assumption of at least 30% annual revenue growth through to 2025. Note that I have only used 30%, and I expect Palantir to actually exceed this, but I would prefer to take a more conservative stance. I have also assumed a gradual increase in free cash flow margins as Palantir continues to add more customers and benefit from its scale.

I’ve assumed further increases in shares outstanding, given Palantir’s (albeit short-term) history of shareholder dilution.

In terms of the EV / FCF multiples, I think that Palantir’s current multiple of 51x is crazy, given the long-term prospects of this business. Clearly this company has a huge growth runway ahead, with the potential to expand FCF margins to even more impressive numbers. The final EV / FCF multiple in my mid-range scenario remains close to this, 52.5x, and I feel that is conservative – Palantir is going after a huge opportunity & has shown its ability to grow and execute, and as such it should trade at a premium multiple.

Put all this together, and I think that Palantir’s shares are capable of achieving a 28% CAGR through to 2026 in my mid-range scenario.

Risks

For me, the greatest risk to Palantir is its customer concentration – not that one individual customer contributes to more than 10% of revenue, but they only have 277 customers, so clearly there is concentration here. That said, it is rapidly growing its customer base, so this gives me confidence that the risk will continue to be mitigated over the coming years.

There is also a potential risk associated with governments, and a change in government could result in a reprioritisation of spending away from Palantir. But as we’ve already seen, the switching costs for Palantir are high – so, this would be no easy feat. We’re also seeing increased geopolitical tension, so I can’t see many governments in a rush to cut their defense spending.

Bottom Line

Before writing this article, I didn’t know what my conclusion would be – now, it is clear. Palantir bridges the gap between an ever-increasing amount of data and the ability to actually make decisions from this, and its growth has been incredible. The company is gaining commercial momentum and adding new customers quickly, which now provides a substantial base for them to upsell to.

Palantir has gone from being a hype stock to a broken stock, whilst the business itself is continuing to execute. All in all, I think the current share price provides long-term investors with an incredible opportunity – I didn’t expect to be saying this, but I think it’s time to pound the table on Palantir.

Be the first to comment