Design Cells

Shares of Iovance Biotherapeutics (NASDAQ:IOVA) have fallen by nearly 50% over the past 3 years. So far in 2022, they sport a 50% loss after the company’s pivotal data readout in melanoma disappointed Wall Street (29% objective response rate versus prior Cohort 2 ORR of 35%).

A million-share purchase by company director Wayne Rothbaum in June certainly caught my attention, so I jotted down a mental note that I wished to revisit this one in the future after the valuation had sufficiently rerated.

Recently, the company submitted its rolling biologics license application (BLA) to the FDA for lifileucel in advanced melanoma (should be completed in Q4). With enterprise value having decreased to $1.1 billion, I think Iovance is of interest at current levels and worth bringing to the attention of my readers.

Chart

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares hit a high of $50 as peak euphoria permeated investors’ sense of the vast market opportunity awaiting Iovance’s TIL (tumor infiltrating lymphocytes) across the indications of melanoma, cervical cancer and lung cancer. From there, the bio bear market coupled with disappointing clinical developments led to share price falling to the mid-single digits. While they’ve since rebounded to nearly $10, I am wary of providing an initial opinion as I need to better understand present prospects before I can suggest potential positioning to readers of this article. If the story is truly getting better, a logical approach could be accumulating dips below the $10 level ahead of regulatory update for lung cancer and progress in pivotal study for cervical cancer.

Overview

Founded in 2007 with headquarters in California (319 employees), Iovance is an immuno-oncology & cell therapy company looking to deliver on the early promise of TIL therapy and extend its benefits to patients across multiple types of solid tumors.

In my May 2020 update, I provided the following keys to bullish thesis:

- The company’s exclusive focus on cell therapy for solid tumors was intriguing, as was the history of its TIL technology. While CAR-T has made much headway in hematologic cancers, it was worth noting that of the 1.7 million new cases of cancer diagnosed annually in the US, 90% are solid tumors. Advantages of the TIL approach included the ability to target multiple antigens and a much-improved safety profile.

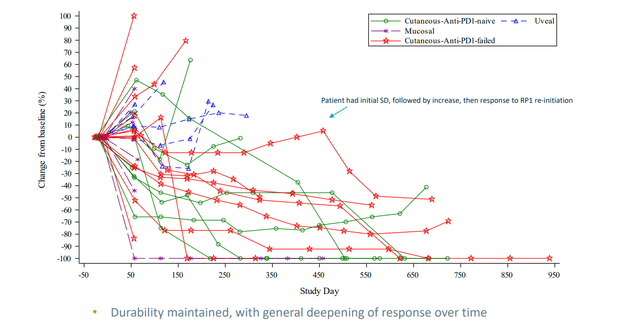

- Lead candidate LN-144 (lifileucel) had yielded positive results in patients with metastatic melanoma. Responses observed thus far had been incredibly durable and gone out to multiple years. This was impressive considering that patients had 3.6 median prior lines of therapy and over 50% of them had elevated LDH (very poor patient population). In most instances, a response was observed by the first assessment (at week 6). Updated results at 8.8-month median follow-up in advanced melanoma patients showed median duration of response had not been reached and Cohort 2 demonstrated ORR of 38% in 66 consecutively dosed post-PD-1 patients with Stage IIIC/IV unresectable melanoma (mean of 3.3 lines of prior therapy including anti-PD1 blocking antibody and the patients had a high baseline tumor burden). Disease control rate was 80%. There was a clear pathway to market here, as completion of Cohort 4 would allow for Biologics License Application to be filed in 2020 (this obviously got delayed by a couple years).

- Potential in additional indications was evident given positive data from two phase 2 open-label trials in head and neck and cervical cancers utilizing lead TIL candidate LN-145. For head and neck cancer, I thought ORR of 38% with three partial responders was encouraging given patients had median of four prior treatments and all had received anti-PD-1 therapy prior. As for cervical cancer, updated data at 7.4-month median follow-up in patients with advanced cervical cancer showed 11% complete response rate (median duration of response had not been reached). Of 27 patients with recurrent, metastatic or persistent cervical cancer, objective response rate was 44% with disease control rate of 85%. Cervical cancer indication also appeared to have a clear pathway to market, as sample size for the current phase 2 study was being increased and primary endpoint modified to Objective Response Rate or ORR.

- As for a challenge with a complicated manufacturing process, I highlighted the promise of the Gen 2 approach as the necessary five to six weeks had been shortened to just 22 days (infrastructure in place with two manufacturing sites in US and PharmaCell taking care of EU manufacturing). Also, manufacturing success rate with Gen 2 approach was over 90%.

Let’s move on to recent news and how it’s affected the company’s upside prospects in the near to medium term.

Select Recent Developments

On November 9, Iovance announced publication of abstracts with clinical data for TIL therapy in combination with pembrolizumab in patients with advanced cancers and for TIL therapy in relapsed/refractory lung cancer. CMO Finckenstein noted that these results supported the broad potential of the TIL platform and provided evidence that pembrolizumab combination could increase response rates as an early line treatment across cervical cancer, melanoma and head & neck cancer. Pembro combo achieved 33% ORR in advanced melanoma and 17% ORR in HNSCC. Cervical cancer cohort reported ORR of 50% (5 of 10 patients with confirmed objective response including one CR). Metastatic melanoma cohort achieved 87.% ORR including three CRs. HNSCC cohort achieved 42.9% ORR including one CR and one unconfirmed CR. On the con side, while results could be seen as encouraging, the stock sold off post SITC so the bar for success was higher here than the results the company achieved and presented.

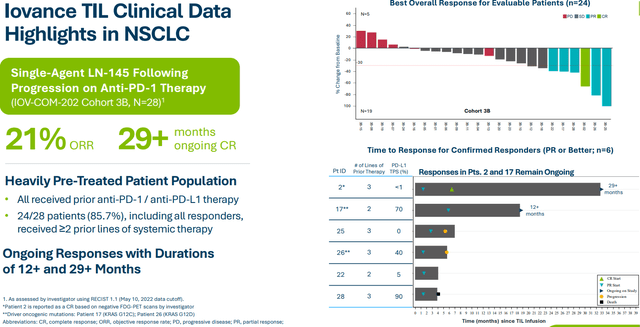

Taking a more detailed look, on November 12th, LN-145 data in patients with metastatic NSCLC enrolled in Cohort 3B as part of basket study was reported. Trial investigator Schoenfield provided context that these were the first results for TIL monotherapy to show benefit in NSCLC and importantly achieved responses following multiple prior therapies, including tumors resistant to anti-PD-(L)1 blockade. The plan is to move forward in 2nd line disease where there’s potential to see increase in ORR and durability in patients who are earlier in disease and improve a landscape dominated by chemotherapy.

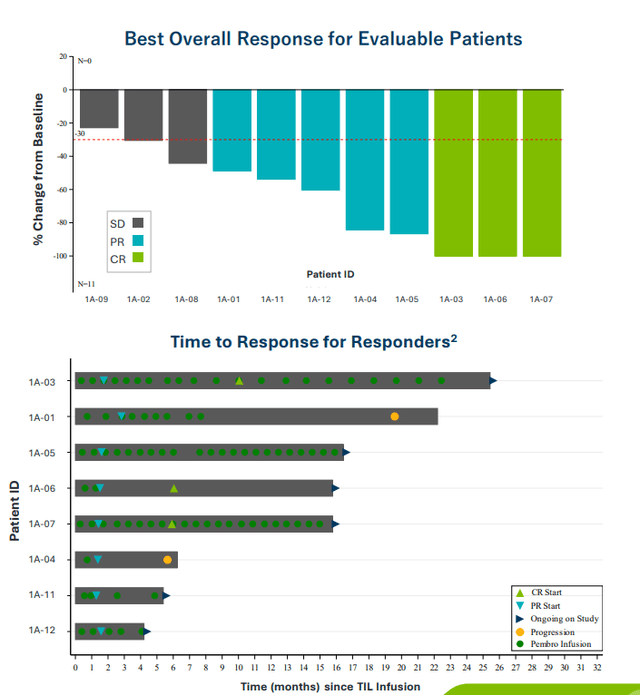

On November 13th, the company announced lifileucel data in combination with pembrolizumab in patients with advanced cancers. A key highlight was the 57.1% ORR (8/14 patients) achieved in cervical cancer, including 1 CR, 6 PRs, 1 uPR and 5 patients with stable disease. 71.4% (5/7 patients) had ongoing confirmed responses at median follow up of 7.6 months. 60% ORR was achieved in melanoma Cohort 1A including a promising 30% CR rate. Importantly, these results compared quite favorably to 33% ORR (6% CR rate) for pembrolizumab monotherapy in metastatic melanoma. Thus, it makes sense that Iovance chose to expand this cohort.

Moving on to 2022, on January 10th, the company announced a key leadership appointment with Raj Puri, MD., Ph.D., joining as EVP Regulatory Strategy and Translational Medicine. Dr. Puri served prior as the director of the Division of Cellular and Gene Therapies (DCGT) in the Office of Tissues and Advanced Therapies at the United States Food and Drug Administration (FDA) in its Center for Biologics Evaluation and Research. He is also a Chief of Tumor Vaccines and Biotechnology Branch within DCGT. I see this experience as highly complementary to the company’s efforts especially in regard to upcoming regulatory filings.

On March 15th, Iovance announced that the FDA allowed an IND to proceed for its first genetically modified TIL therapy (IOV-4001) for the treatment of unresectable or metastatic melanoma and stage III or IV NSCLC. IOV-4001 incorporates gene editing TALEN technology licensed from Cellectis (CLLS) to inactivate the gene coding for the PD-1 protein. By doing so, this removes a barrier for T cells to attack cancer and potentially results in a superior next-generation TIL program to address several solid tumor cancers. The ability to deliver TIL and immune checkpoint inhibition within a single genome-edited TIL therapy sounds quite fascinating, but as always burden of proof is on clinical data to determine if this approach manages to raise the bar higher than the company’s lead program.

Moving onto May 26th, the stock took a hit when the company reported clinical results from the C-144-01 study in patients with advanced (unresectable or metastatic) melanoma who progressed on prior anti-PD-1/L1 therapy, and if BRAF mutation positive, also on prior BRAF or BRAF/MEK inhibitor therapy. In registrational Cohort 4 (n=87), the objective response rate (ORR) was 29% with three complete responses and 22 partial responses. Median duration of response was 10.4 months with a median study follow-up of 23.5 months. The market reacted negatively as prior results from Cohort 2 had a higher response rate at 35% and median DOR not reached with median follow-up of 36.6 months. However, management notes that these differences are accounted for by the fact that Cohort 4 patients had higher baseline disease burden than those in Cohort 2, including higher proportion of patients with elevated LDH (well-known negative prognostic factor) and greater number of tumor lesions at baseline. Also, Cohort 2 patients had half the cumulative duration of anti-PD-1 therapy before lifileucel therapy as compared to Cohort 4 patients. Chief Medical Officer reminds us of benchmark comparison, stating that chemotherapy for patients failing PD-1 results in 4% to 10% ORR with very short median DOR.

In June, the company announced a key appointment to the board of directors in the form of Wendy Dixon (served prior as Chief Marketing Officer and President, Global Marketing for Bristol-Myers Squibb).

Finally, on August 25th the company initiated rolling BLA submission to the FDA for lifileucel in the above advanced melanoma indication for which there are currently no FDA approved therapies. They aim to complete BLA submission in Q4, and it’s worth noting the FDA previously granted them RMAT (regenerative medicine advanced therapy) designation which allows for continuous communication with the agency.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $430M as compared to net loss of $99M. Research and development costs rose to $73M, while G&A increased to $26M. For R&D, the company notes that the increased expenses were attributable to growth of internal team as well as facility-related program costs (partially offset by lower clinical and manufacturing costs driven by completion of enrollment of pivotal studies). Management is guiding for operational runway “into 2024”, but given current resources and burn rate, I am concerned that the company decides to do a dilutive secondary offering at lows before the end of this year. Accumulated deficit stands at a whopping $1.2 billion.

As for the conference call, management addresses manufacturing, which is one of my primary concerns given how CAR-T launches got off to a rough start due to bottlenecks associated with complicated process. They note that Iovance Cell Therapy Center consists of 12 core suites and four Flex suites with projected capacity to treat more than 2,000 patients per year. Within the existing structure, available shelf space allows them to double the number of core suites and increase annual capacity to provide for more than 5,000 patients annually (if I assume conservative $300,000 price tag, that equates to $1.5 billion in annual revenues). Longer term, they expect to reach sufficient TIL manufacturing capacity to treat over 10,000 patients annually via additional of new facilities and further streamlining. Much like CAR-T where 50% of patients are treated in the top 10 centers and 80% are treated at the top 40 centers, launch for a company of Iovance’s size could be feasible as their goal is to onboard and train at least 40 authorized treatment centers within 90 days of launch.

As for their leadership in the TIL space and strong IP portfolio, Iovance currently owns more than 50 granted or allowed US and international patents, including Gen 2 patent rights that are expected to provide exclusivity into 2038.

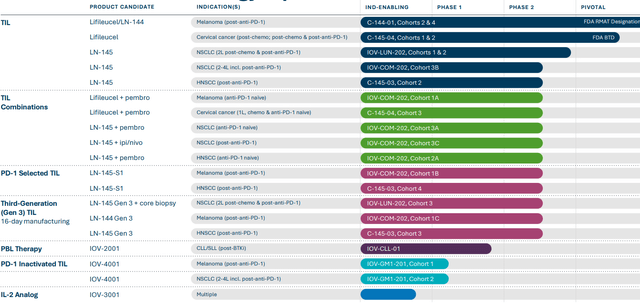

While the last time I revisited this story my focus was primarily on registrational phase programs, it’s nice to see the company’s progress with expansion efforts and next generation products. They continue to develop TIL in combination with pembrolizumab in checkpoint inhibitor naive patients with various tumor types (will start a phase 3 study in frontline melanoma later this year, to serve as confirmatory trial). As of Q2, TALEN gene editing technology is being used for IOV-4001 to combine TIL and interruption of PD-1 signaling within a single therapy (preclinical data in murine model suggested superiority to non-edited TIL product whether alone or in combination with anti-PD-1 antibody). First cohort of patients includes advanced melanoma previously treated with anti-PD-1 therapy, while second cohort is recruiting metastatic non-small cell lung cancer patients whose disease has progressed after up to 3 prior lines of therapy including anti-PD-1 and also patients with EGFR out for activating mutation. Data from unmodified TIL trials in comparable patient populations provides a clear benchmark to determine whether this is significant differentiation or not for this next-gen product. For NSCLC, the short term goal is to enroll 6 cohorts across three IOV studies which are now enrolling patients in various stages of disease and using multiple treatment modalities. These include genetically modified TIL IOV-4001, three cohorts treated with LN-145 TIL monotherapy after progression on chemo and PD-1 and two additional cohorts receiving pembrolizumab combination in PD-1 naive patients and TIL+ ipilimumab/nivolumab in patients who progressed after PD-1 monotherapy.

As for efforts in cervical cancer, we are reminded that they plan to enroll additional patients who progressed after PD-1 therapy into Cohort 2. This is an area of high unmet need, as chemotherapy achieves ORR of 3% to 15% and median duration of response of just 4.4 months. Cohort 2 is registrational in nature and should support regulatory submissions for treatment of cervical cancer after chemotherapy and immune checkpoint inhibitor therapy. Primary endpoint is objective response rate.

Next generation efforts look quite robust including several targets for genetic modification now in preclinical studies including double genetic knockout programs. Using additional technologies, the company hopes to increase TIL potency via CD39/69 double negative TIL and gene knock in target as well as IND-enabling studies of their novel interleukin- 2 analog.

As for prior financings, May 2020 equity offering took place at $31/share representing nearly a triple from current levels.

Management’s presentation at Goldman Sachs Healthcare Conference was a worthwhile listen. Here are a few nuggets that stood out to me:

- For lifileucel, Cohort 4 data shows the drug candidate will be a useful treatment option for melanoma patients who have failed on anti-PD-1 therapy and are out of options. Cohort 4 is the registrational cohort, but it’s important to understand that both Cohort 2 and 4 have same eligibility criteria, treated with the same product and these were sequentially enrolled 2017 to 2019 for Cohort 2 and 2019 to 2021 for Cohort 4. Management argues that you have to look at the results of both cohorts as a pooled analysis. KOLs stated they wanted to look at an aggregate of the 153 patients, which had 31% ORR at 27.6 months median follow up and median DOR not reached.

- For Cohort 4 by itself, everyone got fixated on the DOR at 10.4 months. This measure is very sensitive to how even a few patients perform. Updated data showed at 12-month mark 44% of patients are still responding. Longest duration of response was 26.3 months. Many patients are on that tail of the curve and continue to maintain response. There is a stable tail similar to what they saw in Cohort 2. It’s possible that numerically the height of the curve is better than Cohort 4, but Cohort 4 patients had slightly more advanced tumor biology (higher % with high LDH, % with more than 3 metastatic lesions, double the prior anti-PD-1 exposure). Regardless, the bottom line is that the Cohort 4 study met its primary endpoint and rejected the null hypothesis.

- Confidence intervals for the two studies are overlapping. Slide at ASCO shows Cohort 2, 2+4 and other options available for physicians to treat patients today. Statistically, Cohorts 2 and 4 not dissimilar from each other. Long PD-1 duration does not influence ORR, but amongst responders is negatively correlated with duration of response. It’s possible that the surviving tumor has different mechanisms of resistance after prolonged exposure to PD-1. Once lifileucel comes to market in a solid 2nd line indication, we should see a change of practice where it’s offered to patients as a 2nd line instead of the alternative which is recycling checkpoint inhibitors.

- In JCO publication in Cohort 2, they saw patients primary refractory to PD-1 had numerically higher ORR compared to aggregate of Cohort 2. Biologically, it’s possible these patients have a different biology and more likely to respond to lifileucel versus patients who respond to PD-1 and then are relapsing. They don’t have a large number of patients who’ve received lifileucel as a 2nd line therapy, so once they start seeing that in the commercial landscape it’s possible they won’t see this effect of prolonged anti-PD-1 because patients will respond, progress and come in with lifileucel.

- For regulatory submission in melanoma, management states that FDA has communicated that Cohort 2 is supportive for safety analysis. Iovance will include pooled efficacy analysis as well, they will try to get Cohort 2 efficacy on the label but there’s no telling whether the FDA will do so. As for additional data update from Cohort 4 (2H 22), management has not provided public guidance as to what conference they will present at.

- As for launch readiness (alludes to slow start and bottlenecks in BCMA CAR-T space), management states they have engaged with leading US cancer centers to train them. They will have at least 40 treatment centers online at launch. They have all the manufacturing component up and running, producing clinical batches for time being and will be ready for commercialization. Idea is to have most of the capacity coming from internal manufacturing, though some will come from contract manufacturing. Goal is to reach every metastatic melanoma patient and refer patients from community to authorized treatment center. Alternative is to figure out a means to deliver TILs without IL-2 (possible barrier), but keep in mind they are not using single agent 18 to 20 doses as one would think. They are using 6 planned doses and median IL-2 dose is 5 to 5.5 across cohorts so far. IOV-3001 is an asset they are working on now and hope to get that in the clinic (will have improved safety profile and allow them to move away from IL-2).

- Moving on to earlier line melanoma prospects, most updated data in 12 patients showed 66% ORR with 25% CR rate. Many of these patients are now beyond 1 year mark and doing well without progression. They need to increase the N to increase the confidence to ensure ORR holds up. Plan is to take TIL + pembro combination into phase 3 study to try and get in front line setting. They continue to enroll as fast as they can in Cohort 1A. Initial results including high CR rate is very enthusiastic for them. They have not publicly disclosed what control arm will be. RELATIVITY registrational trial (relatlimab LAG-3 PD-1 combo) had a very different focus (target population of patients ideal for single agent PD-1, give them nivo + rela to enhance response rate). This is different versus patients who need to be TIL eligible. Landscape is changing in melanoma and management is watching that clearly. Analyst thinks the control arm should be physician’s choice PD-1, PD-1 combo.

- Outside of melanoma, NSCLC is an interesting indication. Cohort 3b data at SITC showed TIL therapy was feasible in lung indication. They saw a signal, but duration of response was not optimal. They have different strategies ongoing in lung cancer. One question via LUN-202 study is whether moving TIL therapy to solid 2nd line versus late line changes the outcome. Recent amendment (pre-progression resection) allows TILs to be ready on shelf and answers several important scientific questions. In that way, when progression happens, they can immediately react. Cohort 3A in checkpoint naive NSCLC (combining with pembro) continues to recruit. PD-1 inactivated TIL program also has a NSCLC cohort (post-checkpoint). Thus, they have multiple shots on goal in lung cancer.

- Moving on to gene activated (PD-1 activated) TILs, devil’s advocate points to Caribou Biosciences’ (CRBU) data which showed great response rate that was not durable. Allogeneic CAR-T has separate concerns, but there’s also the debate that PD-1 knockouts might cause exhaustion. Management responds that they’ve got TIL + pembro data showing numerically higher ORR than pembro alone (gives confidence that TIL + blocking PD-1 pathway does have benefit). Cell therapy solution allows both to be packaged into one. If you knock out PD-1, does it create a separate set of problems? Preclinical data showed knockout efficiency in the range of 50% to 70%, essentially they are giving a hybrid product (part of it is not PD-1 edited at all, while a subset is). So, they might get the best of both worlds where PD-1 knockout product gives that good tumor kill and is not as exhausted, whereas the product without PD-1 activation could be more susceptible to exhaustion. There is no good animal model to do this.

- As for when NSCLC data sets could be reported, management states they want to showcase data when there is a clinically meaningful number with mature DOR data (sounds like this will take a while).

- The combo PD-1 knockout TIL product would mean they don’t have to keep giving pembrolizumab, PD-1 knockout cells persist in peripheral circulation, provide more active tumor surveillance and they don’t need more on point therapy. IF that is the case, it realizes the dream of a one and done therapy even in checkpoint naive setting.

- As for cash and operational runway, they continue to guide to 2024 but note that at some point they are in need of more capital.

As for the market opportunity in advanced melanoma, consider the 9,000 or so deaths per year in the US or even more specifically the over 6,000 patients in 2nd line and nearly 5,000 patients in 3rd to 4th line (progressing after checkpoint inhibitors and BRAF/MEK inhibitors). Bar is quite low here with ORR of 4% to 10% for retreatment with checkpoint inhibitors or chemo.

For the cervical cancer program, the market is smaller than melanoma at 4,000 deaths per year in the US. Data to date has been compelling with TIL ORR doubling that for PD-L1+ patients post chemo receiving Keytruda.

As for head and neck cancer, the market opportunity is about the same size as melanoma. 31% ORR compares very favorably to mid-teens for anti-PD-1 immunotherapy in 2nd line.

As for competition in melanoma, consider that another ROTY holding Replimune’s (REPL) oncolytic immunotherapy candidate RP1 has potential advantages including “off the shelf” manufacturing, low COGS, stimulates both adaptive and innate immunity with attractive safety profile so far. Importantly, in their most recent data update for melanoma, we see ORR going up over time (now at 37.5% response rate in PD-1 failed melanoma). They are also seeing good durability and distant responses from injections (signs of abscopal activity).

As for cervical cancer, consider that Merck’s Keytruda was formally approved in October 2021 for combination use with chemo +- bevacizumab in metastatic disease with CPS score equaling or greater than 1. Superior overall survival (the gold standard endpoint) was observed (HR=0.64, p=0.0001) as was progression-free survival (HR=0.62, p<0.0001) compared to chemotherapy. Also, more patients responded to Keytruda combo with ORR totaling 68% and median duration of response at 18 months.

Moving on to institutional investors of note, Perceptive Advisors has been adding to its position and owns a 6.5% stake. Avoro Capital owns 5.5% stake as well.

String of insider purchasing behavior in June appears to be a green flag, including Director of the board Merrill McPeak who owns ~218,000 shares. Wayne Rothbaum (Quogue Capital) bought a whopping 1 million shares and now owns over 8M shares.

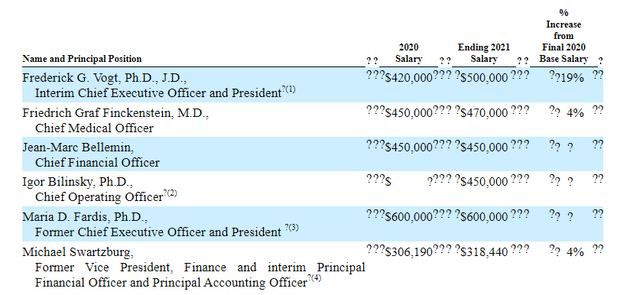

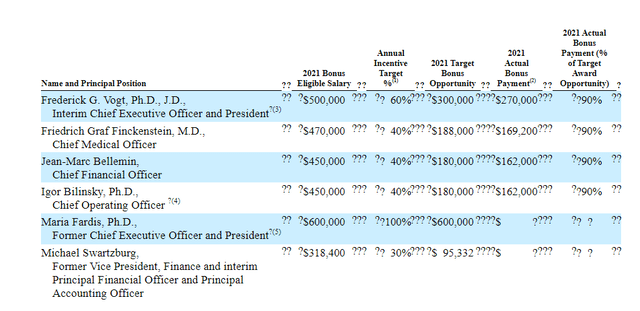

As for leadership lineup, keep in mind Frederick Vogt became interim CEO after prior CEO Maria Fardis abruptly left the company in May of last year after a regulatory setback (fact that they are taking so long in the search for a permanent CEO and had so much trouble with potency assay is a cause for concern). Chief Medical Officer Friedrich Finckenstein served prior as Global Head of Oncology Translational Medicine at Roche. Chief Financial Officer Jean-Marc Bellemin served prior as SVP Market Access at Actelion Pharmaceuticals until it was acquired by Johnson & Johnson for $30 billion. I already mentioned the highly relevant experience of Raj Puri (new EVP Regulatory Strategy).

Chairman of the Board of Directors is Iain Dukes (currently Venture Partner at OrbiMed Advisors and prior SVP Head of Business Development at Merck Research Laboratories). Also, we find Athena Countouriotis (President and CEO of Turning Point Therapeutics, just acquired for $4.1 billion by Bristol Myers Squibb).

As for executive compensation, cash portion of salary appears reasonable as does the annual increase. Unfortunately, for a company trying to conserve cash for launch and late-stage studies, I think the cash portion of bonus is excessively high. Option and stock awards (not attached, see Proxy filing) including ~$4.7M worth for CEO is reasonable compared to other companies of this size that we’ve reviewed together.

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

As for IP position, Iovance has developed its own patent portfolio based on internal research and development activities. As a result, they now own a number of pending patent applications and granted patents in the fields of TIL therapy, MIL therapy, and PBL therapy, TIL, MIL, and PBL manufacturing processes, and TIL, MIL, and PBL expansion methods. For example, they own over 35 US patents related to TIL therapy including those directed to compositions and methods of treatment in a broad range of cancers. Over 30 patents are related to Gen 2 TIL manufacturing processes with expirations in January 2038 or later.

As for other useful nuggets from the 10-K filing (you should always scan these in your due diligence as many companies like to sweep undesirable elements under the rug), the company is required to pay royalties based on percentage of net sales in the mid-single digits to the NIH. Moffitt collaboration for certain technologies for improving TIL therapy also resulted in Iovance being responsible for low single digit royalty on net sales. The Cellectis collaboration for TALEN-modified TIL products also involves milestones and royalties on net sales. Likewise, Novartis collaboration for IOV-3001 (antibody cytokine engrafted protein) involves low to mid-single digit royalties. Iovance also notes that they could compete with academic research institutions and governmental agencies along with private research institutions, such as a current phase 3 study comparing TIL to ipilimumab in patients with metastatic melanoma currently being conducted in Europe by the Netherlands Cancer Institute, the Copenhagen University Hospital at Herlev, and the University of Manchester.

Final Thoughts

To conclude, prior setbacks especially with regulatory efforts (assay and continual delays) kept me away from this cell therapy pioneer, but recent progress on multiple fronts makes it appear the company is back on track. While it’s true that ORR and DOR in pivotal data in melanoma were not as promising as prior Cohort 2 results, it still represents a big step up from currently available options for patients and Iovance finally began its BLA submission. Similarly, while cervical cancer indication was not moving forward as efficiently as I’d like, they are enrolling more patients in Cohort 2 with registrational intent. Also, they have quite a few shots on goal for lung cancer and are employing multiple next-gen approaches to TIL to improve response rates and durability (such as PD-1 knockout and CD39/69 double negative TILs). I think these combined efforts are not appreciated by Wall Street, but insiders appear to be bullish including significant purchasing behavior in June.

Another tailwind for the company could be that commercial stage CAR-T companies are finally starting to see traction with accelerating sales (BMY Abecma US full year 2022 sales of up to $300M, Yescarta and Tecartus seeing 66% to 78% year over year growth). As Wall Street and big pharmaceutical companies see sales for these products get closer to achieving blockbuster status, it will serve as a reminder that Iovance could do the same for cell therapy in the solid tumor space.

For readers who are interested in the story and have done their due diligence, IOVA is a Buy and I suggest initiating a pilot position in the near term. From there, my strategy of choice would be to wait until the expected secondary offering and dilution is taken care of (overhang is cleared) before adding further exposure.

From an ROTY perspective (focus on next 12 months), I’m not in a rush to buy this one as key data catalysts are more likely to take place in 2023. However, I also think that sentiment is extremely negative here, and we’ve seen time and again how management execution can cause the pendulum to reverse.

From a Core Biotech perspective (emphasis on next 3 to 5 years), IOVA is not appropriate as they are not yet commercial stage. It will likely be 2024 or 2025 before this one would qualify for Core Biotech as we’d need to see sales ramping up in melanoma indication first.

As for risk rating (1=low, 5= high), I assign this one a 3 as we have significant downside cushion and derisking via data sets generated to date across lead indications. Melanoma and cervical cancer data is a big step up from currently available treatment options in these later line patients where the bar is set quite low in terms of durability and ORR. A key risk would be negative regulatory developments such as if the FDA does not accept melanoma BLA filing or timelines extend for cervical cancer indication even further. Disappointing data including in lung cancer or for next gen TIL product candidates would reflect poorly on the company being able to address larger opportunities. Devil’s advocate is, much like autologous CAR-T companies, Iovance has a hard time ramping up to meet demand and is relegated to being merely a niche player. Increasing competition for certain indications such as melanoma (Replimune comes to mind with oncolytic viral candidate RP1) is also a cause for concern.

Be the first to comment