ASMR/E+ via Getty Images

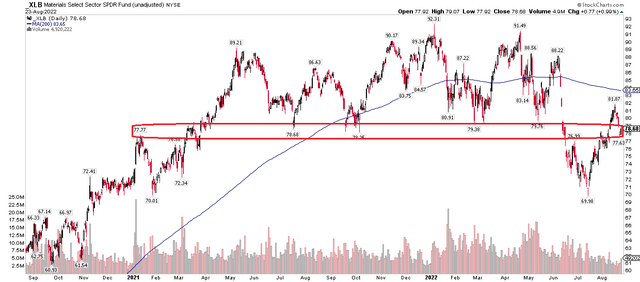

Parts of the Materials sector were hot during the first half of 2022. Amid broad market volatility and geopolitical tensions, commodities were seen as a safe haven despite a surging U.S. dollar. Longer-term price action told a less bullish narrative, though. The Materials Select Sector SPDR ETF (NYSEARCA:XLB) went nowhere from Q2 2021 through early July this year. That broad period proved to be bearish distribution, as technicians would say. XLB went on to break down below the key $77 to $79 zone during the commodity crash a bit more than two months ago.

Recent price action shows a recovery and then a pullback to this key range on the chart. It’s make or break time for many parts of the market after a strong summer rally. While the SPDR S&P 500 Trust ETF (SPY) thrust back up toward its 200-day moving average last week, XLB did not quite approach that key long-term trend indicator. Both funds are now back at important support levels.

XLB: Shares Throwback And Hover At Pivotal Support

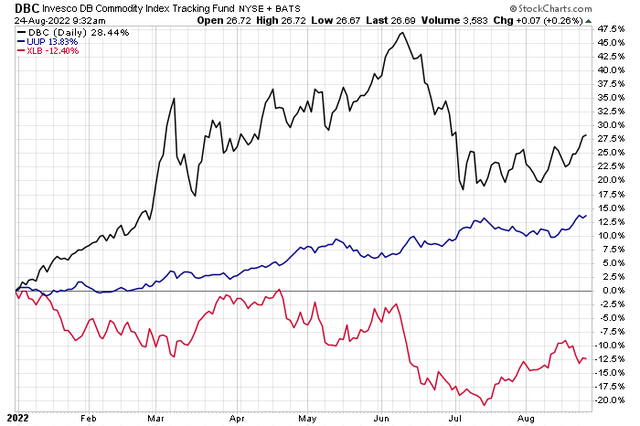

For XLB, the current retracement’s strength depends on a few factors. For starters, what happens with commodities is of course paramount. What’s interesting about this year is that higher prices for raw goods has coincided with a stronger greenback – the textbooks say that when the USD rises, commodities should come under pressure. This year’s Russia/Ukraine war and general ‘risk-off’ behavior have meant both commodities and the DXY have moved up and down at the same time. The popular dollar ETF is the Invesco DB USD Bullish Fund (UUP).

2022: Commodities & The Dollar Impact Materials Equities

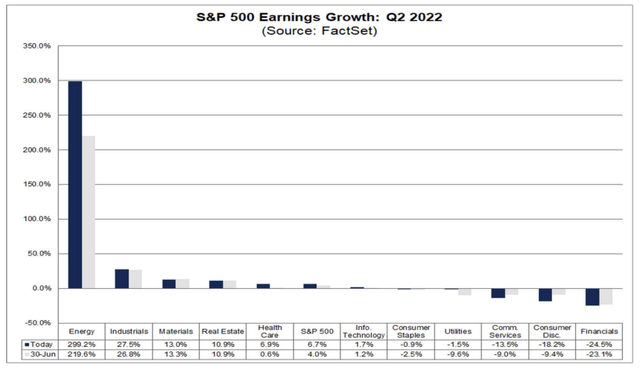

Another factor to weigh is what happens with Materials company earnings. The second-quarter reporting season was generally stronger than expected. The Energy sector got the most attention with its incredible year-on-year EPS growth rate. Back out that small part of the market, and net profits would have been negative from the same quarter a year ago for the S&P 500.

According to John Butters at FactSet, the Materials sector reported the third-highest (year-over-year) earnings growth rate of all eleven sectors at 13%. At the industry level, all four industries in this sector reported year-over-year earnings growth. Three of the four industries reported earnings growth above 10%: Containers & Packaging (15%), Metals & Mining (13%), and Chemicals (13%).

Investors should be on the lookout for important earnings pre-announcements and investor conferences in the coming weeks ahead of the Q3 reporting period.

Earnings Season In The Books: Materials EPS Growth Solid At +13%

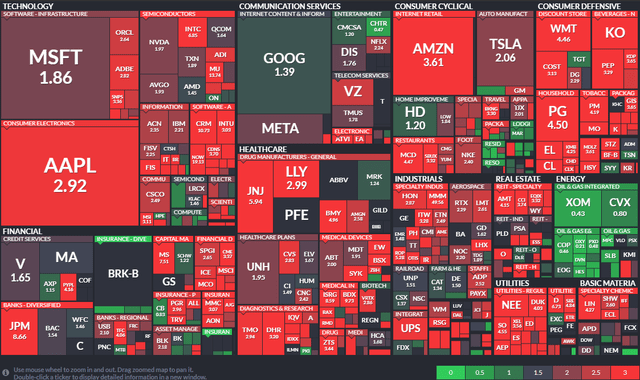

A third factor to consider is what happens with valuations. The Materials sector is interesting in that it consists of several diverse industries – all of which have different earnings growth outlooks and current P/E ratios. The largest stocks in the group have elevated PEG ratios which could pressure returns over the longer term.

PEG Ratios: Materials Stocks Pricey?

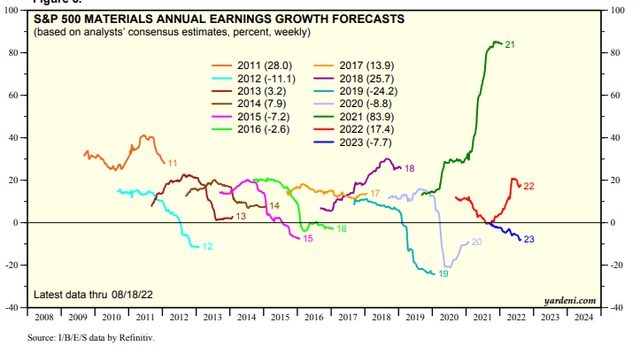

On earnings growth, data from Yardeni Research show that this year’s EPS growth rate is strong but estimates for 2023 profit growth are on the decline and are now sharply negative. Though XLB’s 3-5-year EPS growth rate is listed at 9.69% as of August 23, so that is the optimistic long view.

Materials Sector Earnings Growth Forecast Turns Negative For 2023

The Bottom Line

The Materials sector moves with ebbs and flows with geopolitical events (and the U.S. dollar) and features big cyclical swings. The group could be pressured in the coming months as earnings estimates continue to retreat. Shorter-term, XLB’s chart illustrates that the current price is at a critical technical support point. A bearish breakdown could lead to a retest of the July lows.

Be the first to comment