luza studios

Arista Networks (NYSE:ANET) recently reported a very strong Q2, with revenue beating expectations by ~7% and EPS easily coming in above estimates. Despite ongoing gross margin headwinds, the company has done a great job managing their operating expenses and thus has seen operating margin expansion.

Guidance for Q3 also came in above expectations and even with management noting ongoing gross margin headwinds, efficient operating spend has resulted in stronger than expected operating margins.

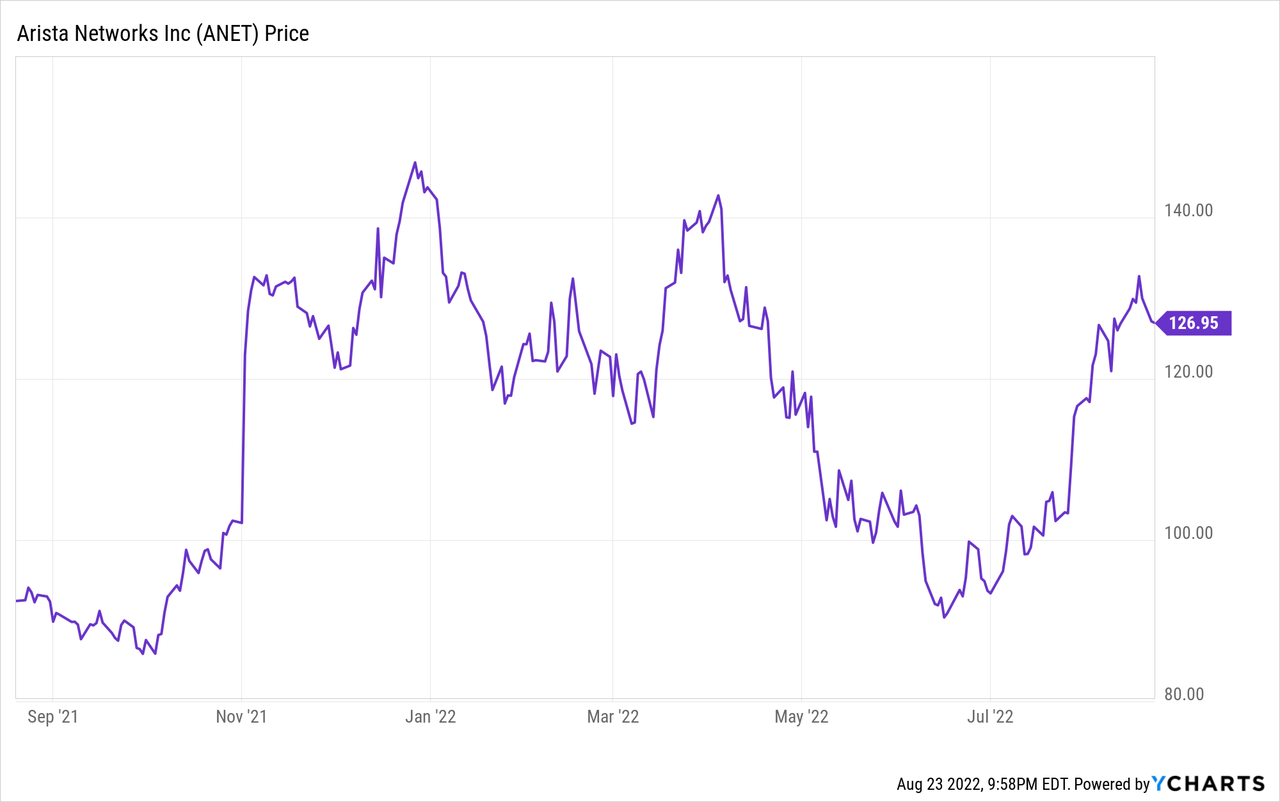

Even though the stock is up around 10% since the company reported earnings, ANET does remain down over 10% year to date.

Ongoing beat and raise quarters continue to drive investor confidence that ANET is a market share gainer and there remains a long runway left of growth opportunities. As laid out in their late-2021 investor day presentation, management sees long-term revenue growth remaining in the mid-teens CAGR, which compares to the ~40% revenue growth they have seen so far in 2022.

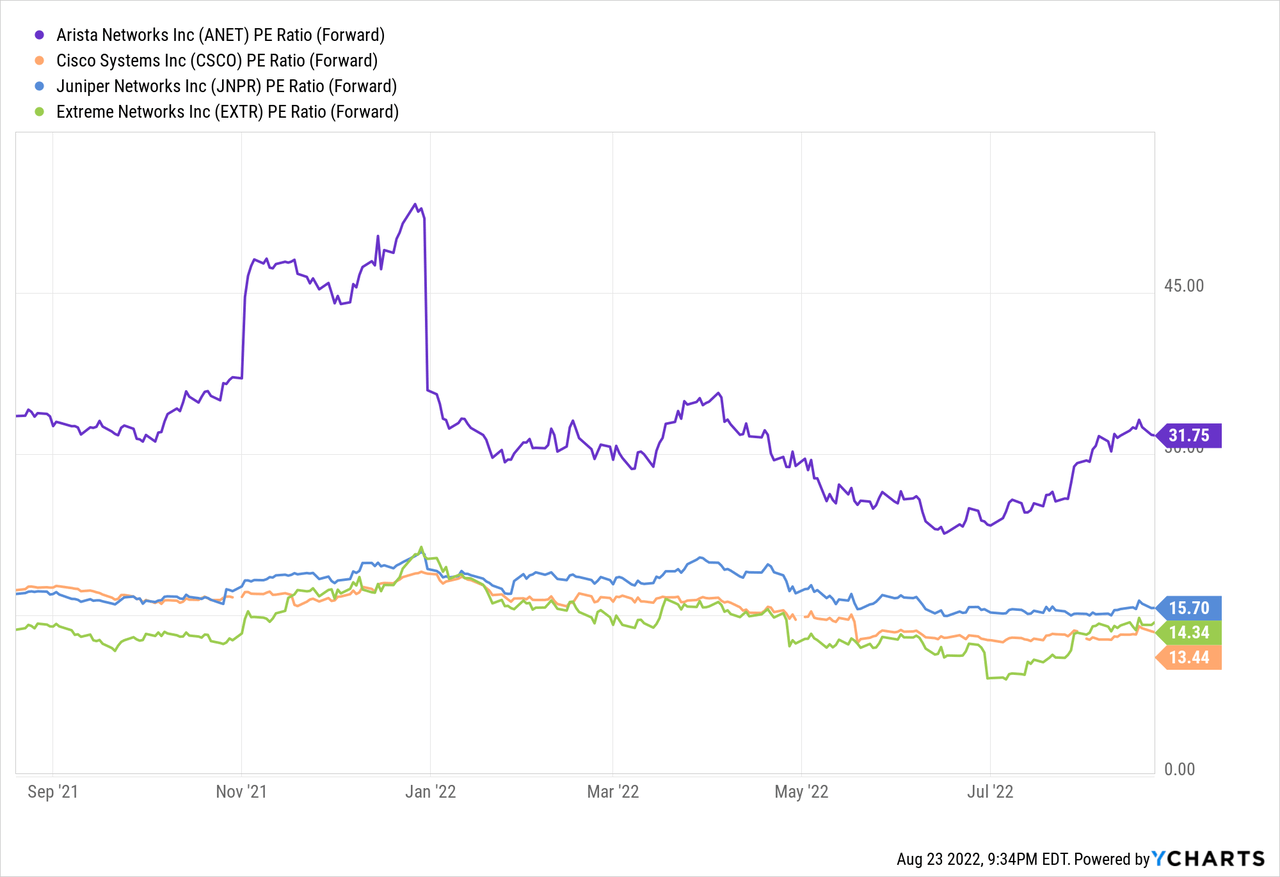

From a valuation standpoint, the stock currently trades ~28x 2023 P/E, which remains at a nice premium relative to their peer group. However, ANET’s growth profile is much stronger and when looking at 2024, we could see EPS reach $5.50, resulting in a current valuation of ~23x 2024 P/E, which does not seem overly aggressive for a market-leading grower.

For now, I continue to remain bullish around the company’s outlook and would expect ongoing beat and raise quarters, despite the challenging macro environment. ANET has a premium growth profile and is deserving of a premium valuation multiple.

Financial Review and Guidance

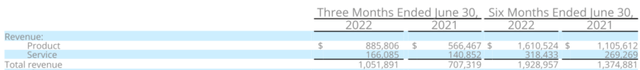

During Q2, revenue grew 49% yoy to $1.05 billion, handily beating expectations for around $980 million, representing a 7% revenue beat. Despite a more challenging macroeconomic environment, ANET continues to post very strong revenue growth, and I believe part of this is because they continue to take market share away from legacy players.

Product revenue grew 56% yoy and represented nearly 85% of total company revenue, while Service revenue grew 18% yoy.

Regarding the Q2 revenue strength, management attributed this to their differentiated cloud networking platforms.

In Q2 2022, we achieved our first billion-dollar revenue quarter, despite the challenges of an uncertain supply chain environment. This record milestone further validates the customer value of Arista’s differentiated cloud networking platforms, now adopted by many of the largest cloud and enterprise customers around the world.

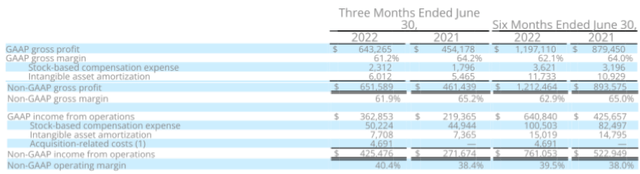

Similar to Q1, the company continued to see some pressure on their gross margin, with non-GAAP gross margin of 61.9% being well below the 65.2% margin seen in the year-ago period. Most of this gross margin is due to increased costs related to a constrained supply chain as well as a higher cloud titans mix, with management noting that they expect these trends to continue throughout the remainder of the year.

However, and impressively, non-GAAP operating margin came in at 40.4%, representing a 200bps yoy margin expansion compared to 38.4% in the year-ago period. Ongoing operating expenses control has significantly helped the company expand their margins, even with the incremental headwinds they have seen with gross margins.

The combination of strong revenue beat and ongoing operating margin improvement led to non-GAAP EPS of $1.08 during the quarter, easily beating expectations for $0.92.

Part of the ongoing strength ANET has seen is due to ongoing success with larger deals. In addition to strong trends seen from the cloud titans, ANET also recently closed the acquisition of Pluribus Networks, which gives them ongoing momentum in this growth area.

In late Q2, we closed the acquisition of Pluribus Networks, led by former CEO, Kumar Srikantan. Pluribus pioneered a new class of unified cloud fabric networking endorsed by our partners, Ericsson for telco and 5G cloud, and NVIDIA for DPU-based networking. Our Q2 2022 results reinforce Arista’s customer relevance in cloud titan, specialty cloud providers and mainstream enterprises. As I mentioned previously, our million-dollar logos have doubled in the last 3 years in all categories, greater than 1 million, greater than 5 million, greater than 10 million and significantly greater than 25 million customers.

Also on the earnings call, management noted that Microsoft and Meta are each expected to be over 10% of revenue for the full year, another testament to the company’s focus on cloud titans. Yes, this does add some concern around customer concentration with two large customers representing 20%+ of total revenue, but these are very strong companies who continue to grow their cloud exposure.

Arista Networks

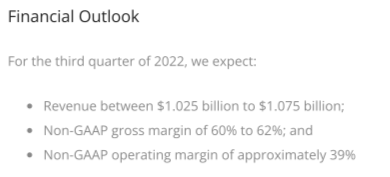

Given the ongoing macroeconomic challenges, management continues to take a more cautious approach to guidance. For Q3, they expect revenue of $1.025-1.075 billion, which is above consensus expectations for around $1.0 billion. In addition, non-GAAP gross margins are expected to be 60-62% and non-GAAP operating margins are expected to be ~39%. On the earnings call, management talked about some of the moving pieces around their guidance.

While demand metrics have remained strong across the business, attempts to predictably scale shipments have been somewhat hindered by ad hoc supplier decommits. Our Q3 outlook assumes some improvement in ship volume but reflects a balanced view of the remaining supply chain uncertainties. We expect gross margin pressure to continue with some need for broker purchases and expedite fees, combined with a healthy revenue contribution from our cloud titan customers. As to spending and investments, we expect to continue to grow our investments in R&D and sales and marketing, in line with our baseline investment plan. However, we are cognizant of the broader macro risks, and we will continue to monitor spending carefully.

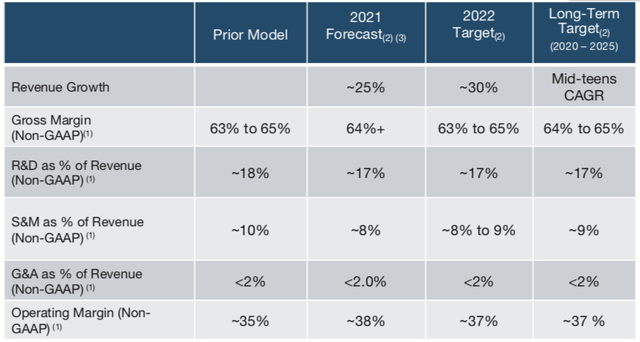

I think it’s also important to gauge ANET’s strong start to 2022 relative to their initial guidance framework provided at the late-2021 investor day. At the time, the company expected revenue growth ~30% yoy and non-GAAP operating margin ~37%.

So far this year, ANET has grown revenue around 40% and has had non-GAAP operating margin around 40%, both above their initial expectations.

Even though the company only recently provided this long-term framework, 2022 is off to a great start, and it wouldn’t be surprising to see management provide updated metrics at some point. Given their ongoing revenue growth, ANET has significant operating leverage capabilities, thus driving the potential for further non-GAAP operating margin expansion.

Valuation

Given the many moving parts around the macro environment, including challenging supply chains and fears around a potential recession, it’s no surprise to see ANET trade in a volatile fashion so far this year.

Nevertheless, the stock is down only 10% year to date, which compares favorable relative to many other technology stocks and the broader market.

The chart above does a great job depicting the ongoing premium ANET trades at relative to their peer group. This premium continues to be deserved given ANET’s above-average revenue growth profile and operating margins. In addition, the company’s long-term guidance frameworks demonstrate a path of mid-teen revenue growth CAGR and some margin expansion.

Currently, consensus is expecting 2023 EPS of $4.55 (per Yahoo Finance), which implies the stock is currently trading at a 28x 2023 P/E. While this remains well above the peer group of ~13-16x P/E, it’s important to note that ANET is growing much quicker.

It wouldn’t be surprising to see the company achieve a 2024 EPS number of $5.50, which would imply a 2024 P/E of ~23x, which does not seem overly aggressive given the strong revenue growth profile and path towards ongoing margin expansion.

Given these financial characteristics and the stock still being down 10% year to date, I believe long-term investors will continue to be rewarded.

Be the first to comment