RichVintage

Introduction

I regularly check if I need to change anything to my 24-stock dividend growth portfolio. This includes checking when I’m going to add to my smallest positions. After all, I try to maintain a somewhat balanced portfolio. This includes regularly adding somewhat aggressively to the positions with the lowest exposure. One of these positions is Minnesota-based Xcel Energy (NASDAQ:XEL), a utility company that I find a bit boring. I have to admit, not adding to stocks that I find less interesting is one of my biggest weaknesses. I like to buy “exciting” stocks.

The good thing is that when it comes to investing, boring is good. Not in all cases, but you get my point. In this article, I will share my thoughts on Xcel Energy, as I once again worked my way through this utility company to assess how much exposure I’m willing to add. While Xcel Energy might be boring, it’s a truly fantastic dividend stock. The company has a decent yield, consistent dividend growth, and a business model providing strong earnings growth and dividend safety. It’s a company able to outperform the S&P 500 and its peers with subdued volatility. In other words, a dividend investor’s best friend!

Now, let me back all of this up by showing you the details!

Why Low-Volatility Dividend Growth Matters (Why Boring Is Good)

On December 7, I wrote an article titled “Investing $10,000 In These 3 Dividend Aristocrats”. As I often do, I started the article with some theoretical background.

In the case of the aforementioned article, I highlighted the importance of low-volatility dividend growth investing. After all, the article was aimed to find suitable trades for retail traders. While a lot of exceptions apply, going with low-volatility stocks is the way to as a lot of people cannot handle high volatility.

Anyway, the key to successful long-term investing is to buy companies that do well during bull markets and better than the market during bear markets. These stocks don’t even need to beat the market during every bull market. Limiting damage is key.

As I wrote in the aforementioned article:

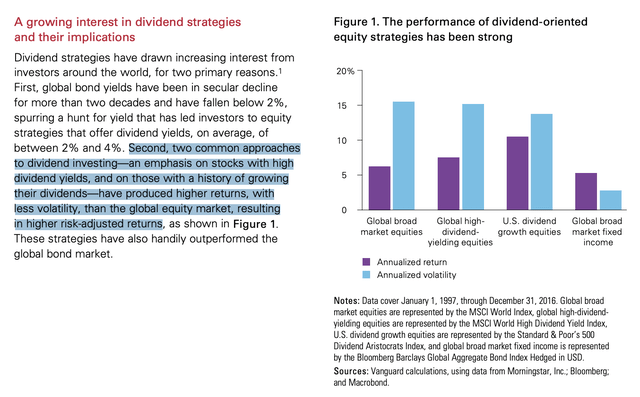

Vanguard hit the nail on the head as it made the case that buying quality dividend growth means having the ability to generate higher returns than the market with less volatility. The chart on the right side of the screenshot below shows that dividend growth equities perform better than the market with lower volatility. Even high-yield stocks do better than the market.

Vanguard

While there are many exceptions, a good rule of thumb is that a company with a reasonable valuation, a solid recession-proof business model, and a sustainable dividend does rather well during recessions. The stock price might still go down, yet investors rather own these quality stocks than highly speculative stocks that are more fun during bull markets. Hence, high-quality stocks tend to do better during bear markets.

The screenshot above proves this thesis. Quality dividend (growth) stocks have a higher return than the broader market and lower volatility.

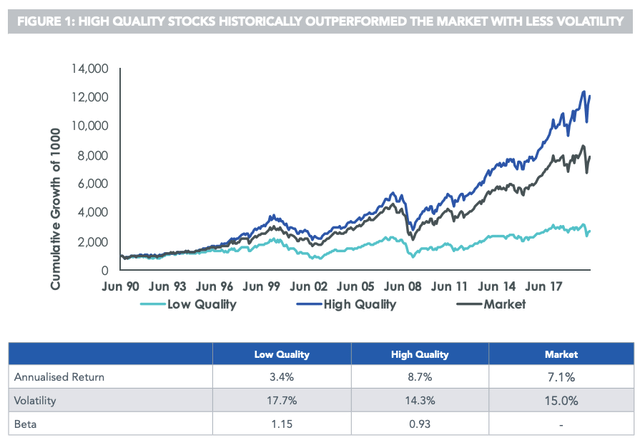

The data below from WisdomTree supports this. High-quality stocks (strong margins) have had a higher annualized return since 1990 than the market (almost 2 points better per year). Moreover, these stocks are less volatile.

WisdomTree

What’s interesting is that stocks with higher risks do not end up providing investors with higher long-term returns. In other words, while one might assume that taking higher risks would have to result in higher returns, the opposite is true.

Now, with all of this in mind, let’s dive into Xcel Energy, a boring, but fantastic dividend growth stock.

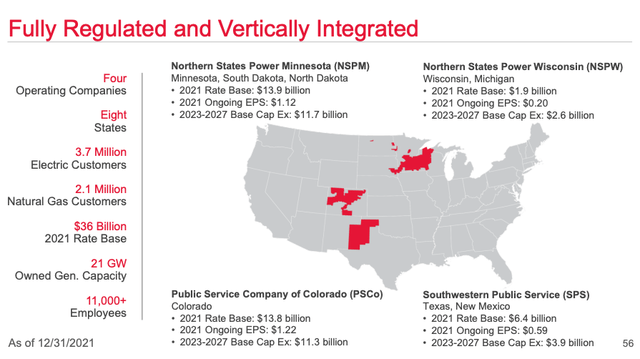

What Makes Xcel Energy Such A Great Stock

With a market cap of $38.2 billion, XEL is the nation’s 7th-largest regulated electric utility. The company has four operating subsidiaries covering eight states, 3.7 million electric customers, and 2.1 million natural gas customers.

Xcel Energy

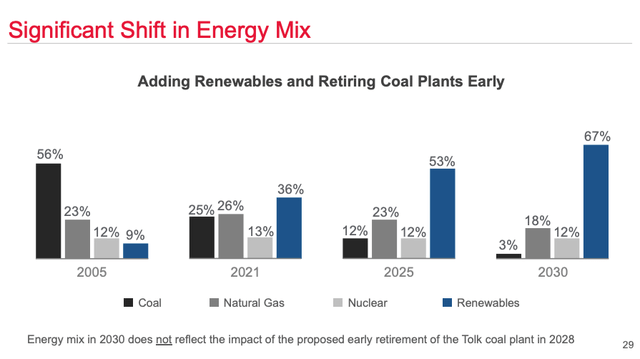

Like most peers, the company used to be heavy in coal in 2005, when it generated more than half of its electricity using this dirty (but affordable) fossil fuel.

Last year, a quarter of energy was generated using coal. 36% came from renewables. In 2030, the company aims to reduce carbon emissions by 80% versus 2005. This will likely result in 67% renewable exposure, 18% natural gas, and 12% nuclear (unchanged). By 2050, Xcel aims to achieve the Paris Climate Accord goal of carbon neutrality.

Xcel Energy

With that said, Xcel Energy is a terrific company – especially when it comes to generating shareholder value.

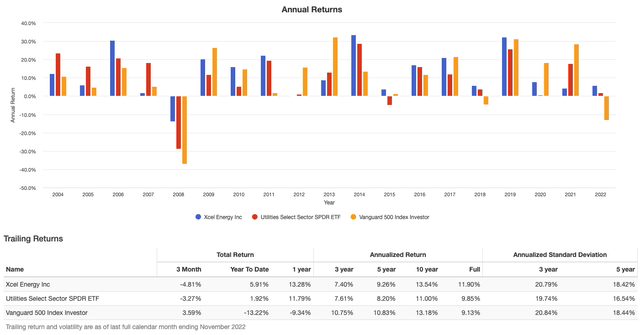

Since 2004, XEL shares have returned 11.9% per year. This beats the S&P 500 by almost 300 basis points per year. Over the past ten years, the performance of both XEL and the market is close to 13.5%. Both XEL and the S&P 500 had a standard deviation of 20.8% during this period. That excellent for XEL investors as we’re comparing a single stock to a basket of 500 companies.

Portfolio Visualizer

Over the past five and three year time spans, the company has underperformed the market a bit. However, and this is very important, this underperformance was caused by the strong performance of tech stocks in both 2020 and 2021. As the chart above shows, XCEL was unable to keep up with that performance. Yet, in 2022, it is doing just fine, while the market is weakening.

Moreover, since 2004, XEL has had just one down year. That happened in 2008 when the stock fell just 14%. Excluding dividends, the stock had four down years since 2004. The three down years caused by excluding dividends all had a decline of less than 4%.

Also, XEL consistently outperformed the utilities ETF (XLU), as the data above shows. The standard deviation is similar.

These numbers perfectly confirm the “buy quality” thesis.

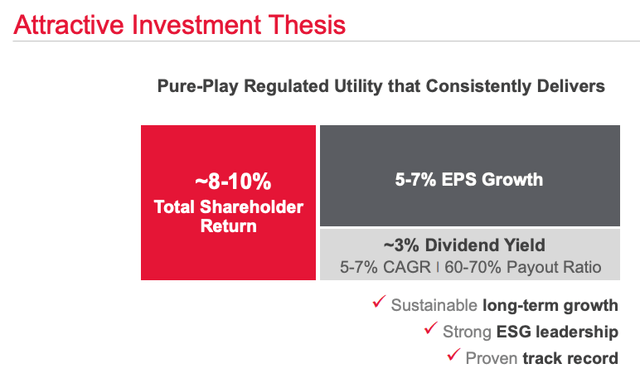

Not only that, it also confirms the company’s own goals.

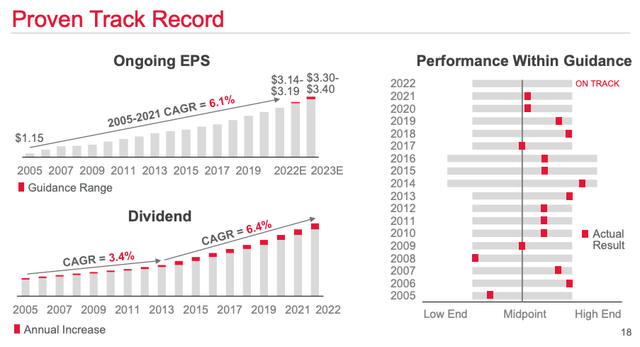

On a long-term basis, XEL returns 8% to 10% to shareholders – per year. These numbers include between 5% and 7% in EPS growth (assuming a consistent valuation), a 3% dividend growing by 5% to 7% per year, and a 60% to 70% payout ratio.

Xcel Energy

Essentially, what this means is that XEL is the definition of quality. Investors do not need a lot of fantasy to predict what XEL looks like in the future. The biggest change will be the energy mix. Other than that, it’s a business with predictable EPS and dividend growth. The biggest uncertainty is changes in valuation. After all, 5-7% EPS growth can have a much bigger impact on the total return if investors are willing to apply a higher premium!

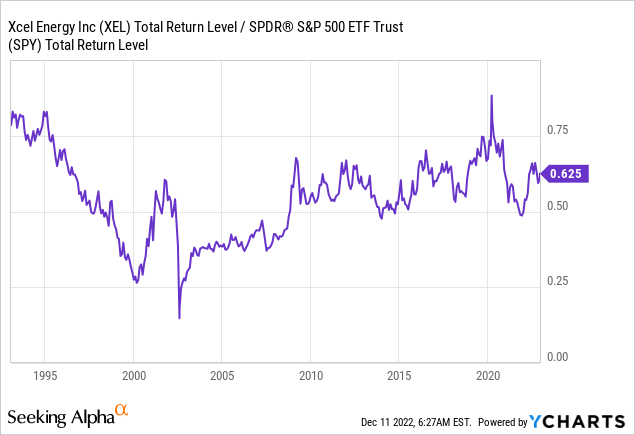

The chart below shows the ratio between the XEL and the S&P 500 total returns. The higher the number below, the stronger XEL’s outperformance. If the chart declines, it means the market outperforms XEL.

With regard to my valuation argument, XEL is doing tremendously well in periods of lower economic growth and lower rates. After all, during these periods investors seek safe investments that pay a decent yield.

In 2014, commodities crashed as global manufacturing sentiment weakened. It caused inflation to fall. In 2014, XEL returned 28.6% excluding dividends! In the year after that, the stock was flat.

In 2017, the first signs of global growth weakening started to appear. These are the capital returns (excluding dividends) of XEL in the years that followed:

- 2017: +18.2%

- 2018: +2.4%

- 2019: +28.9%

With that said, I already briefly highlighted the company’s dividend growth targets. However, there’s more to it.

The XEL Dividend

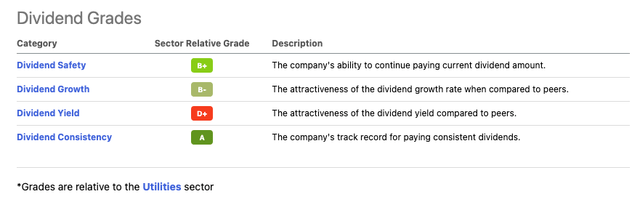

Investors tend to buy utilities, REITs, energy stocks, and related for their high yields. XEL is not a high-yielding stock.

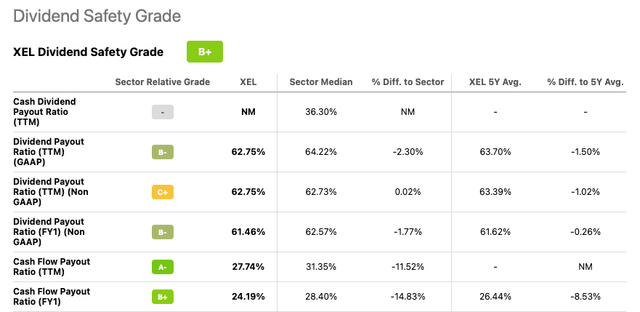

Hence, when looking at Seeking Alpha’s dividend scorecard, we see that XEL scores poorly when compared to the median utility sector dividend yield.

Seeking Alpha

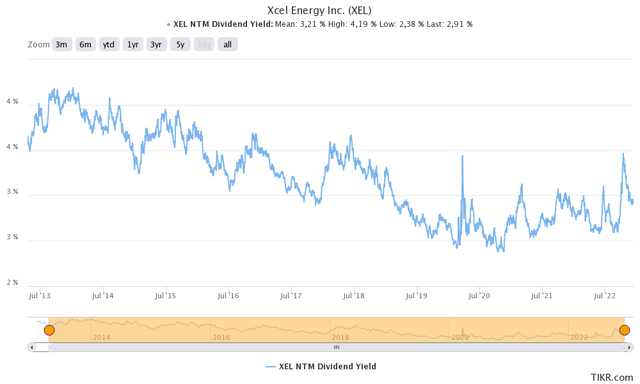

XEL is currently yielding 2.8%. That is based on a $0.4875 per share per quarter dividend ($1.95 per year). The median sector yield is 3.4%, which explains the poor relative score.

TIKR.com

With that said, the company scores high on safety, growth, and consistency. After all, while investors get a lower yield buying XEL, they have enjoyed significant and reliable long-term outperformance as I showed in this article.

Over the past ten years, the average annual dividend hike was 6.1%. That number has been very consistent.

These are the most recent hikes:

- February 2022: +6.6%

- February 2021: +6.4%

- February 2020: +6.2%

- February 2019: +6.6%

Note that the company has adjusted its dividend to long-term EPS growth. Since 2005, the dividend has grown by 6.1% per year. Hence, starting in 2013, the dividend was hiked more aggressively.

Xcel Energy

These EPS numbers are fueled by excellent cost control. Operating costs have been flat between 2014 and 2021. Including 2022E and 2023, O&M costs are expected to rise by just 0.4% per year (compounding). That’s truly impressive and a result of advanced technologies like drones, supply chain efficiencies, and optimized work processes.

The non-GAAP dividend payout ratio is 63%. That’s equal to the sector median. The cash flow payout ratio is 28%, which beats the sector median by a few points.

Seeking Alpha

Moreover, when looking at the historic dividend yield above, we see that the yield bottomed in 2020. Since then, the stock price has not outperformed dividend growth, allowing investors to buy a yield close to 3.0%. Prior to 2020 (falling inflation, low rates), capital gains outperformed dividend growth.

Now, let’s take a deeper look into XEL’s financials.

XEL’s Balance Sheet & Valuation

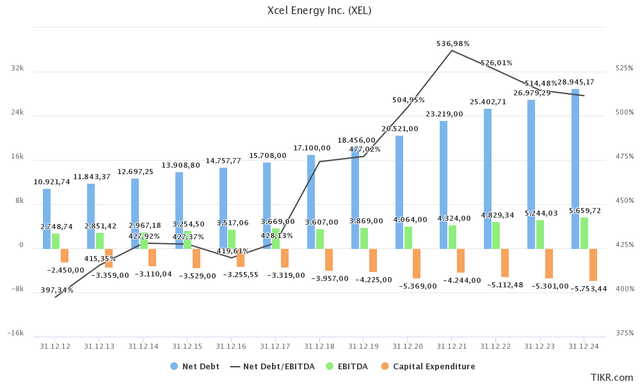

The biggest drawdown of the energy transition is the price tag. Shutting down coal plants and replacing it with renewables costs billions. As the chart below shows, annual CapEx is now expected to be twice what it was in 2012.

TIKR.com

As a result, net debt is expected to hit $27.0 billion in 2023. That’s up from $11 billion in 2012.

After 2028, roughly half of total capital spending is expected to be used for electric transmission and distribution assets. 20% will flow towards renewables. Hydrogen and storage will account for 5% of CapEx. Like most peers, XEL is looking to incorporate hydrogen into its business model. Producing hydrogen with renewables will allow the company and its customers to decarbonize. This means mixing natural gas with hydrogen and selling hydrogen to industrial customers.

Moreover, the good news is that the company is generating value with new debt. It’s not a bottomless pit. The net leverage ratio peaked in 2021 at 5.4x. The ratio is expected to fall to 5.1x in 2024.

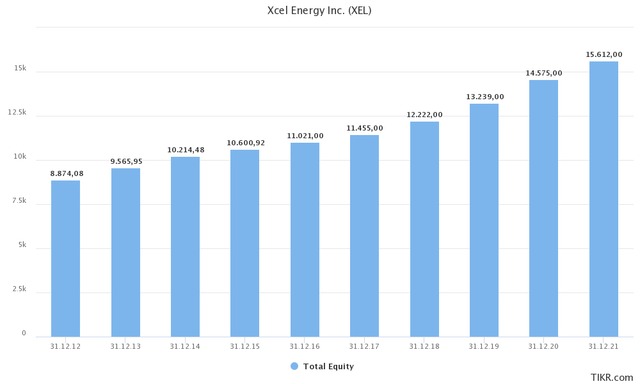

On top of that, the assets value on the balance sheet is outperforming the liability side. Between 2012 and 2021, the company has grown its equity book value by 5.8%.

TIKR.com

Thanks to these numbers, XEL enjoys a healthy balance sheet and a strong credit rating.

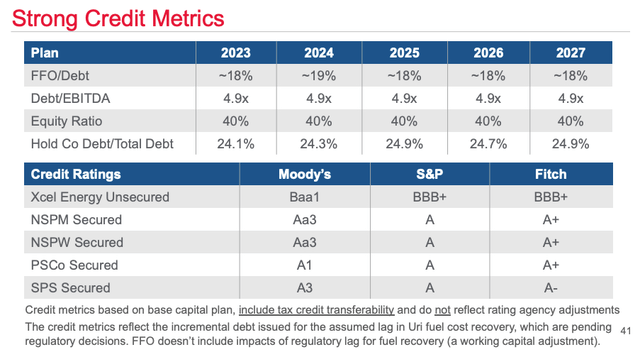

As briefly discussed, the company’s net debt ratio is falling to the low-5% range. Meanwhile, the equity and FFO (funds from operations) to debt ratio are expected to remain consistent – despite accelerating CapEx plans.

Xcel Energy

Hence, the company’s (and its subsidiaries’) secured debt is A-rated. Corporate unsecured debt is BBB+-rated.

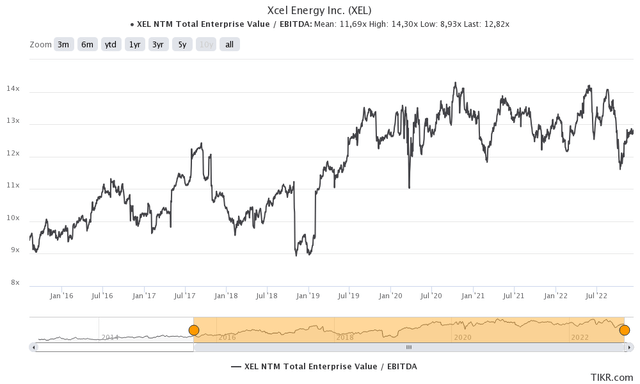

With that said, XEL is trading at 12.6x 2023E EBITDA of $5.2 billion.

This is based on its $38.2 billion market cap, $27.0 billion in 2023E net debt, and $250 million in pension liabilities.

As the chart below shows, that valuation is fair. It’s not overvalued and it also isn’t deep value. It’s a valuation that won’t keep me from adding more XEL shares to my portfolio.

TIKR.com

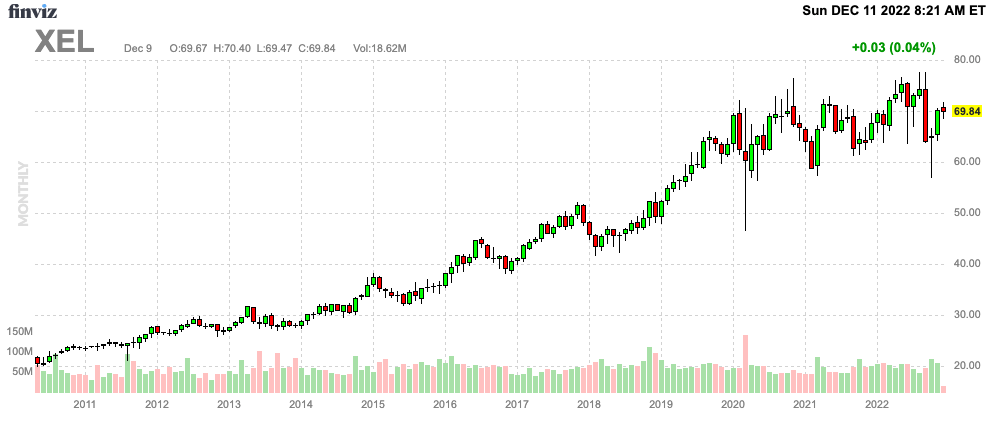

Right now, the average analyst price target is $70. The stock price is also at $70.

That said, I’m hoping a bit for another move lower towards $60. A few months ago, XEL was trading below $60 as high-yield stocks (and the market in general) suffered from hawkish Fed comments, red-hot inflation, and weak economic growth indicators.

FINVIZ

While the Fed is sounding a bit more dovish, I’m not ruling out a market move lower going into 2023 as inflation is likely to remain higher for longer (especially compared to consensus).

Don’t get me wrong, I’m not rooting against the market, but I would love to pick up XEL with a 3% yield and believe there’s a realistic chance we might get that opportunity.

If not, I will still end up buying as I am somewhat rebalancing my portfolio (only adding to small positions, NOT selling outperformers).

Takeaway

In this article, we discussed a dividend stock that is flying under the radar. However, it’s completely undeserved. While Xcel Energy pays a below-average (versus its sector) dividend, it’s still a decent yield. Moreover, it’s backed by consistent and reliable dividend growth thanks to its stable business model.

The company is a great dividend stock for everyone looking to add conservative and defensive dividend growth.

I believe that XEL shares will continue to outperform the market on a long-term basis without exposing investors to above-average volatility.

In other words, while XEL may be boring, it’s truly a wickedly cool dividend stock for wealth generation (and protection!).

(Dis)agree? Let me know in the comments!

Be the first to comment