Hundreds of analysts around the globe make their brains go up in smoke in the attempt to predict what Liberty Media will do. Gearstd/iStock via Getty Images

The first move

On November 17th, Liberty SiriusXM (NASDAQ:LSXMK) (NASDAQ:LSXMA) (NASDAQ:LSXMB) announced a transaction which should not only allow its Live Nation (LYV) stake to get more consideration, but also represent a necessary first step towards the resolution of an apparently eternal problem: the NAV discount.

Everybody and his grandma know that Liberty SiriusXM trades at a ~34% discount to the net asset value of its holdings, which are mainly an 83% SiriusXM (SIRI) stake and a 30% Live Nation (LYV) stake. It has been like this for many years, management has not really tried to do anything against it, except for some timid share buybacks. Those, to be honest, could realistically not be carried out in size given the limited cash inflows at the holding level. So the NAV discount persisted, for whatever reason. (I highlighted a few of the circulating theories in an older article on the subject.)

In fact, my personal theory for the persistence of the NAV discount is that it has something to do with the rather sophisticated shareholder base of the Liberty entities. Complexity attracts folks that like to think and over-think and this leads to a perception of even greater complexity and thus uncertainty – and the market hates uncertainty.

For years, the market has expected every sort of transaction, from Reverse Morris to Active Trading Businesses, from dilutive acquisitions to mind-numbing mazes of tax avoidance deals. Meanwhile, SiriusXM has been chugging along as a remarkably stable and predictable business. And John Malone has been calm, rational and patient as always, while Greg Maffei has cracked jokes and been not more vague than his usual.

The solution may be complicated, but the facts are simple:

1) Any transaction must safeguard interests of several companies’ shareholders.

2) Any transaction will minimize tax leakage, which could lead to some byzantine transaction structure, but will ultimately solve the problem.

In my opinion, it makes no sense trying to predict the exact way the riddle will be solved. There are just too many variables involved. While we know that in New York it will be warmer in August compared to today, it makes no sense trying to predict the exact weather for August 11th.

Currently, the Live Nation stake is worth roughly $5B, while the SiriusXM stake is worth close to $20B. There are about $3.5B of debt against these holdings, resulting in a NAV of ~$21.5B. This compares to a Liberty SiriusXM market cap of $14.1B.

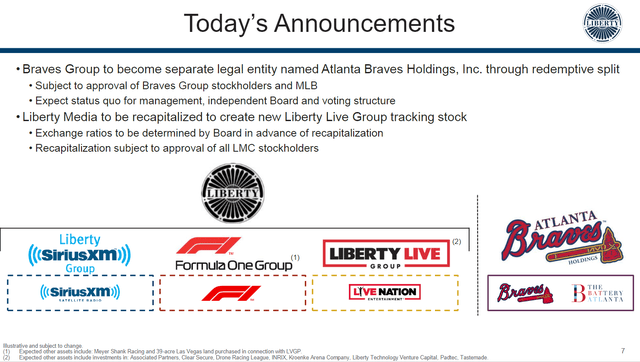

The announced transaction would create another tracking stock called Liberty Live Group and split off the Braves Group (BATRA) (OTCQB:BATRB) (BATRK), thus add one tracking stock and remove one.

Liberty Media Investor Day Presentation

As a result, the Liberty SiriusXM tracker will include (again) only SiriusXM holdings, which should pave the way for step two.

The second move

Both SiriusXM and Liberty have been quite open about the fact that it makes no sense to keep the Liberty tracker and the SIRI stock separated. The former is suffering from a complexity discount, while owning almost the entirety of the latter, which, in turn, suffers from little liquidity. In addition, the unpredictability of the further evolutions creates an overhang: What if next year will give Liberty shareholders access to their SIRI stock and massive selling depresses SIRI? What if SiriusXM agrees to a dilutive transaction which mainly benefits Liberty? Or what if, just to finally reduce the discount, Liberty agrees to a not perfectly optimized deal with some tax leakage and additional concessions to SiriusXM? What if there won’t be a major transaction and SiriusXM simply starts buying back LSXMA/K stock, creating another layer of complexity (cross-shareholding)?

Every once in a while, John Malone and Greg Maffei must share a good laugh imagining hundreds of analysts around the globe making their brains go up in smoke in the attempt to predict what they will do – while the two probably don’t know themselves yet.

My prediction is that something will happen in 2023 and that it will substantially reduce the discount. Maybe, however, it won’t close it entirely. And there might be second-order consequences like a wave of SIRI sales after a share distribution.

Both Liberty and SiriusXM will take into account the likely consequences of their actions and the second- and third-order consequences as well. Yet they don’t have a crystal ball either. Shareholders will need to cope with some uncertainty and volatility.

What is highly likely is that any transaction should provide a robust valuation uplift. And even if there won’t be any additional deal beyond step one, within a few years the NAV discount story will come to a close anyway. (See below why.)

Most likely however, the creation of the Live Group tracker and the resulting simplification of the SiriusXM tracker will enable some move within about one year.

Both companies have an interest to find a common solution: SiriusXM won’t like the prospects of a simple share distribution to Liberty shareholders with the highly probable consequence of massive selling. Moreover, there is likely already some discount in both stocks related to the expectation of a major deal with unknown consequences.

The worst case

In such situations it helps thinking about a worst case scenario. I exclude terribly dumb, value-destructive moves. This is simply not in Liberty’s DNA. Hence, in my opinion, the worst case would be another long wait with some added volatility. For example, if SiriusXM simply decided not to do anything special and continued to buy back its stock until Liberty owned almost the entire SiriusXM. SiriusXM could easily buy back ~$1.5B worth of stock every year (which it has usually done and will likely continue to do) and 83% of these buybacks would benefit Liberty which just needs a further $4B worth of SIRI stock to own the entire company. Therefore, within 2-3 years the LSXM-SIRI story will be over anyway and it should provide decent upside even in this not optimal scenario.

Upside and downside

SiriusXM trades for ~15x FCF(2022e), which is certainly not too much for its stable and predictable business. It is trading at the low end of the last few years’ trading range.

Live Nation trades for ~19x FCF(2022e), which is historically at the low end. The stock is down ~40% from its highs, despite a very robust business outlook.

Hence, given that the underlying assets are already trading at the low end of their historical valuation ranges, I expect the underlying value to remain intact.

Once the Liberty Live Group will have been created, current Liberty SiriusXM shareholders will own another tracker – which will likely trade at a discount to its NAV of $4B (including ~$1B of debt against its $5B stock holdings). Fully valued, the Liberty Live Group should be worth ~$12 per LSXM tracker currently outstanding. I would assume a market value of ~$9.

The new Liberty SiriusXM will have a NAV of ~$17B or ~$50 per LSXM tracker currently outstanding. Assuming some kind of deal will come along within 1-2 years that will reduce the discount to ~5%, LSXM shareholders will realize $47.50/share.

In total, while the intrinsic value will be a bit higher, the likely realizable value from both new trackers is around $56.50/share. So the upside from today’s $41.36 is 37%. This translates into a CAGR of at least 17% within 2 years or a still decent CAGR of 11% within 3 years.

Notably, this upside does not assume a better market environment than today’s.

Further upside could be realized if the underlying assets achieved a higher valuation – which is quite likely, given the current depressed mood. Live Nation is still enjoying huge demand for concert tickets after the pandemic, while SiriusXM should benefit from higher car sales after the last year’s supply disruptions and car production cuts.

What is exciting about this story is not the decent upside, but rather the very limited downside. If you are patient, the Liberty SiriusXM tracker looks like one of the safest bets out there.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment