halbergman

Cullen/Frost (CFR) is the largest regional bank headquartered in Texas. Operating from San Antonio, Cullen/Frost has been on a major expansion effort in recent years and is opening many branches in both Dallas and Houston to extend its footprint. The bank is also growing in terms of its product offerings; the bank is currently rolling out a mortgage lending division that will extend its range beyond its core commercial lending franchise.

While Cullen/Frost may not be widely known nationally, it is a massive player within Texas. The bank’s assets recently crossed the $50 billion threshold, and Cullen/Frost has a market cap of greater than $8 billion. This is a key player in one of the country’s most economically dynamic states.

I’ve followed CFR stock for quite a while. Unfortunately for value investors, Cullen/Frost tends to be one of those names that seems perpetually expensive, at least compared to other peer banks.

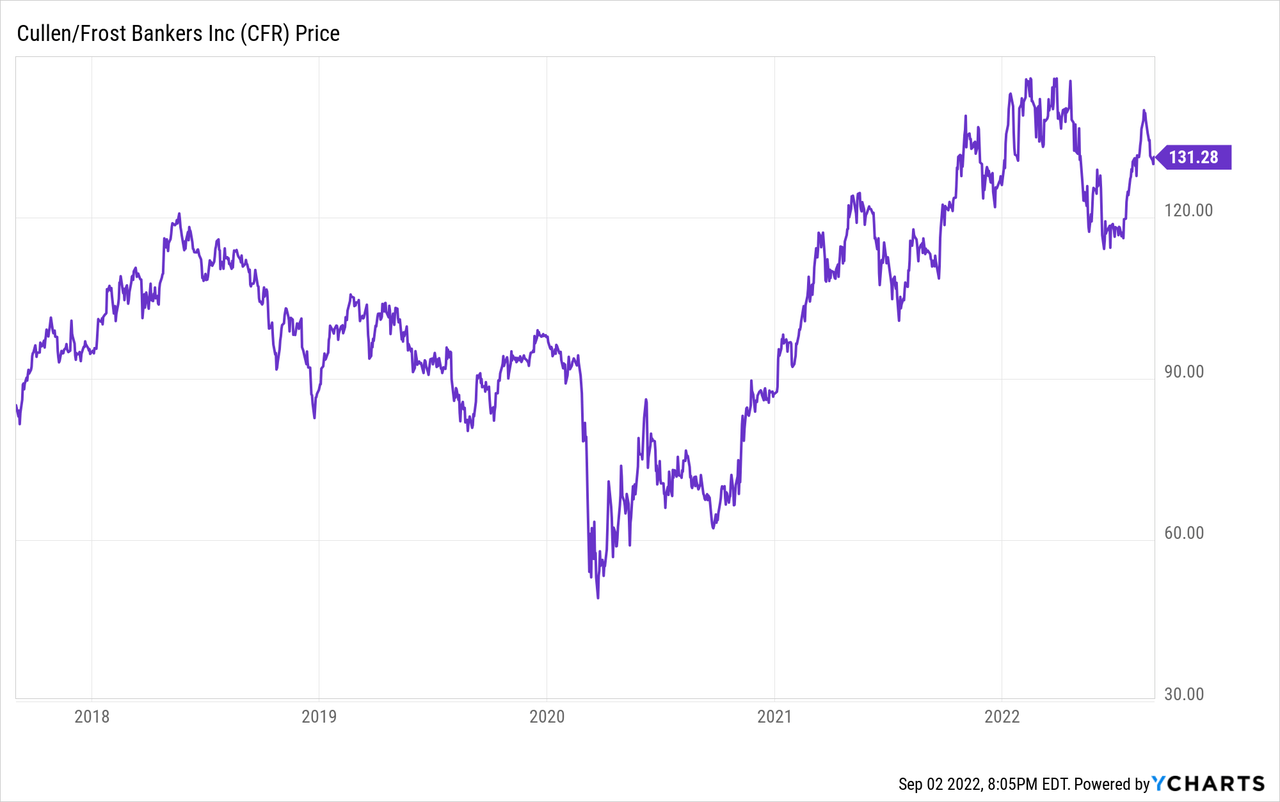

That briefly changed in 2020, when the combination of crashing energy prices and fears around credit losses for Texas-specific banks caused a major decline in Cullen/Frost shares. I used that opportunity to establish a small position in CFR stock at a cost basis of $60. I wouldn’t have a chance to add to the position at that price, however, as shares came roaring back in 2021.

Rather impressively, CFR stock is still down only 10% from its all-time high, and is one of the better-performing large regional banks out there. Over the long-term, I expect Cullen/Frost to continue outperforming its peer banks on whole. However, over the next year or two, I see reasons to think CFR stock will provide more pedestrian returns.

Cullen/Frost Focuses On The Long Term

Part of what makes Cullen/Frost unique is its focus on long-term management of its brand and franchise. Rather than competing to make every basis point of potential profit each quarter, the bank is willing to sacrifice some profit from time to time to ensure that it retains customers’ trust and loyalty.

What that means practically, for example, is that Cullen/Frost is willing to pay out more interest on deposits when rates go up, as they are doing now. On the bank’s most recent conference call, one analyst asked why Cullen/Frost was taking so many new interest-bearing deposits at a time then interest rates are rising and the bank already has way more deposits on hand than it needs for making loans. Here’s CEO Phil Green’s response:

This is a cultural decision and it’s one that’s based on experience too. A big part of our value proposition really rests on three things: That everyone’s significant at Frost, that we give a square deal that will give you excellence at a fair price and we’re a safe sound place to do business for employees and customers.

And as corny as it sounds, we’re just giving our customers a square deal. As we’ve seen interest rates move up it just makes sense for us to recognize that we’re going to have a value proposition that customers can trust.“

Green went on to explain how Cullen/Frost raised its deposit interest rates in 2017 during that rate hiking cycle. This was unlike the too-big-to-fail banks, which tried to keep their interest costs at zero as long as possible. Green said, by contrast, that since Cullen/Frost was paying some interest on deposits, it was able to attract additional customers and earn loyalty from people that saw that the bank was giving them a fair deal.

From a short-term profit maximization approach, this might not seem ideal. Cullen/Frost has almost always maintained a less than 50% of loan-to-deposit ratio. In 2021, this ratio fell to just 38%. This means Cullen/Frost has far more depositor capital on hand than it needs to support its loan book.

The bank can put this excess capital into securities to earn yield, but this doesn’t produce the same returns as when the bank originates its own loans. Cullen/Frost’s net interest margin “NIM” has slumped from around 3% to the lows 2s recently before picking back up to 2.6% in the latest quarter.

Cullen/Frost’s investment in its brand and positioning has paid off. It is well-liked by customers, having the highest net promoter score of the banks based in Texas. While Cullen/Frost may have to give up short-term profits in volatile interest rate markets such as we have now to maintain that loyalty, over the long-term, reducing customer churn tends to lead to a more durable business through the full economic cycle.

Another factor that is dragging on short-term profitability is that the bank has expanded heavily in Houston and Dallas. When a bank opens new branches, at first, these hit overall profit margins as the new branches will have far less loan production and deposits per employee than the existing branches where the bank is better known. It takes a few years for a new branch to reach the productivity levels you’d expect across the whole system.

Valuation: Investors Are Rather Optimistic

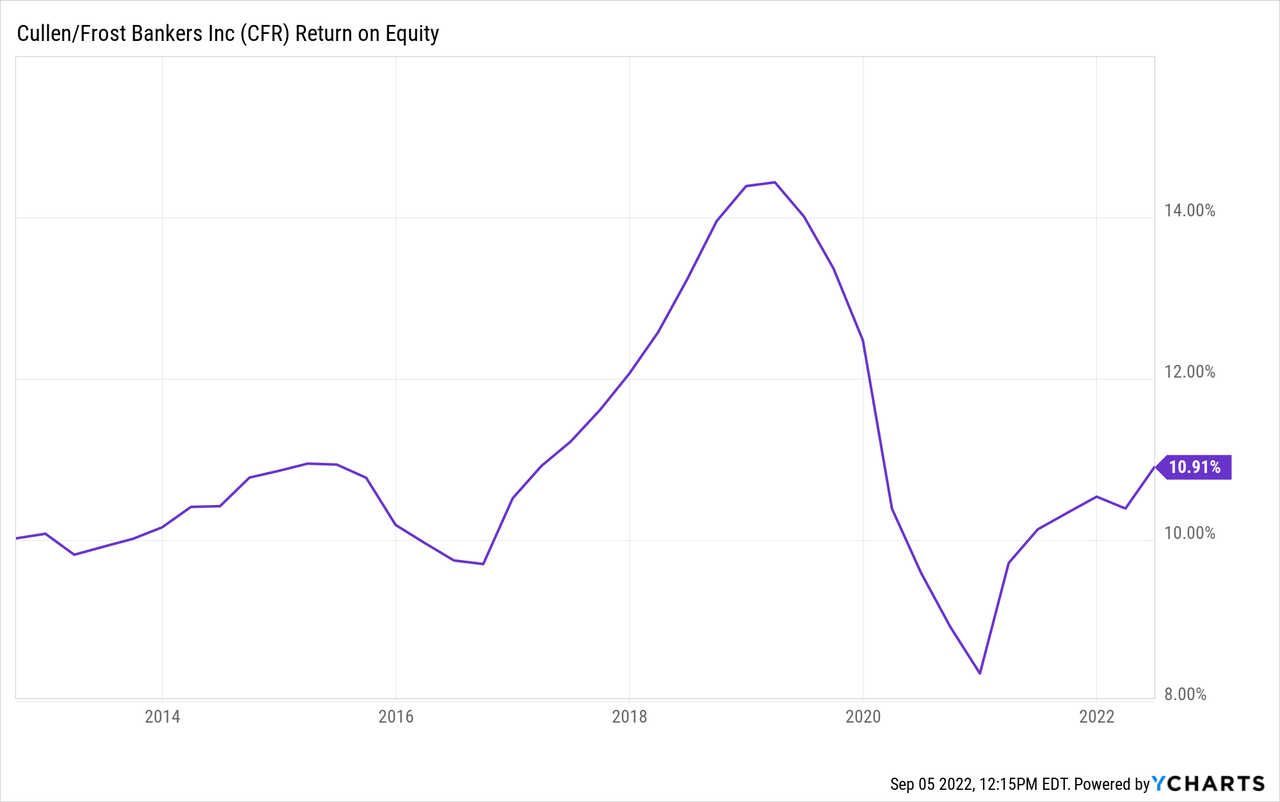

The big issue with CFR stock today is that it is priced near the top end of its ten-year valuation range. Yet, from a profitability standpoint, as measured by return on equity “ROE”, Cullen/Frost is merely around its median historical ROE, as shown below:

An 11% ROE isn’t bad by any means, especially given with the somewhat conservative nature in which the bank operates its business. However, Cullen/Frost is not at the sort of peak of performance that it saw in 2019 or prior to the 2008 financial crisis. It may get back there in a few years as its geographical expansion and new product offerings start to pay off. For now, however, Cullen/Frost is in the middle of its historical profitability profile.

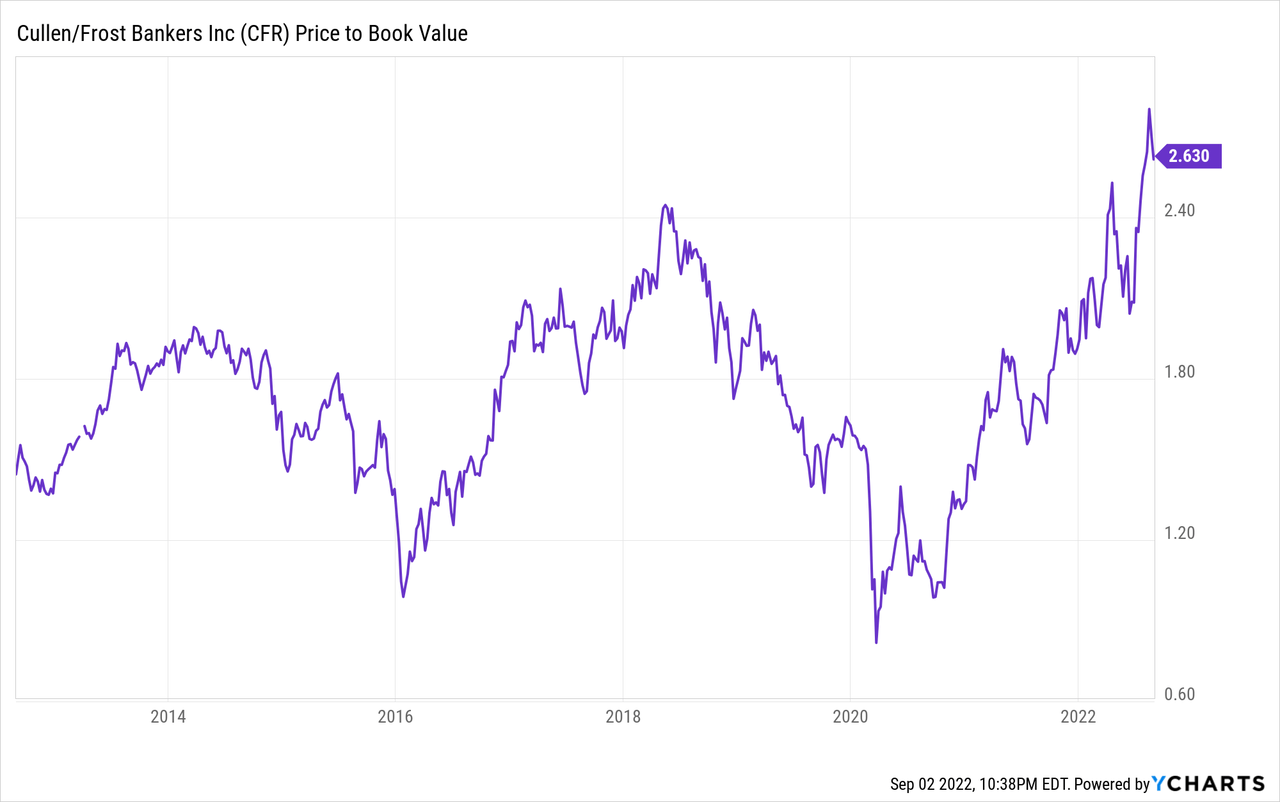

Yet, on a price-to-book value basis, CFR stock is near its highest point in many years:

We can debate just how much of a premium to book value that a high-quality operator with a differentiated business model deserves. However, 2.6x book value is probably too high for a bank that averages an ROE in the 11% range. Even if we assume the ROE can climb toward 15% in coming years, 2.6x book value is still a fairly aggressive valuation for a bank at that ROE level.

Perhaps this sort of steep premium is justified due to the booming nature of Texas’ economy. That’s true to an extent. The state is enjoying a big surge in manufacturing, for example, as American companies relocate supply chains closer to home in the post-2020 economic environment. Cullen/Frost should enjoy above average loan growth prospects going forward due to Texas’ economic strength.

However, I would note that the bank is not as much of an energy bet as it used to be. At one point, Cullen/Frost had as much as 16% of its loan book in energy-related credits. As of its most recent quarter, however, this figure is now down to less than 6%, and Green called that out as an achievement on the most recent conference call:

I was glad to see the great work of our energy team rationalizing our concentration in our energy portfolio. Energy loans represented 5.9% of loans at the end of the second quarter, and I’m happy to declare that we’ve reached mid-single digits.

It’s probably wise for Cullen/Frost to reduce its energy exposure, as it is a highly cyclical industry that is also facing regulatory headwinds. That said, to the extent that investors are buying CFR stock as a correlated play to higher oil prices, the effect may not be as strong as folks might expect. I’d prefer a bank such as Alaska’s Northrim BanCorp (NRIM) to profit from the improving backdrop for North American oil production.

CFR Stock Verdict

The bottom line is that Cullen/Frost is a great bank. However, this is far from a great valuation for the company at a time when so many other community and regional banks are selling at more attractive prices.

Over the long-term, I expect CFR stock to continue to outperform most of its regional banking peers. Banks that focus on unusually good customer service, such as First Republic (FRC), have historically generated large shareholder returns. Cullen/Frost can do the same.

For the time being, however, a 2.6x book value and a 16x forward P/E ratio seems too steep. I’d wait for either a lower entry point or a couple years of further earnings and book value growth before adding to a holding in CFR stock.

Be the first to comment