HeliRy/E+ via Getty Images

Published on the Value Lab 29/6/22

Successfully owning and operating a fleet of medium sized clean tankers like what Ardmore Shipping (NYSE:ASC) does is a business deeply affected by challenging external conditions which have to be faced by prudent and agile operational and financial management. In addition to the permanent complexities of the pricing of crude oil, we have seen the negative impact of COVID-19. More recently the impact of the invasion of Ukraine on shipping presents new challenges and opportunities. Carrying strategic cargos such as crude oil, oil products or industrial chemicals are the lifeblood vessels of the world economy and if all parameters are met could present an opportunity for investment. Since 2010, ASC operates in the sub-segment of MR carriers, which transport oil products between refineries and end-user depots. The company also owns and operates chemical carriers. The volume and carriage price varies (expressed in dwt miles), but the activity is continuous. In shipping, the entry barriers for new entrants are large and the number of participants is limited. The participation is conditioned by ownership of a vessel, a multimillion dollar asset, which needs to be financed, takes years to build, and whose price is in turn determined by the building capacity of the shipyards, price of steel and a number of other variable factors. Structural supply factors continue to favour the company, despite the cycle being long in the tooth, and a recovering China will be a backstop for macro concerns on oil prices. Overall, Ardmore remains fairly well positioned, and logistics has mitigating factors even on a macro reversal, but a turning cycle means we still pass.

A Bit On The Shipping Demand Side

The demand for service of tankers depends on the demand for the product which is being carried by the vessels. Essentially, it depends on the price of product, refining capacities, alternative ways of transport such as pipelines and the national policies of creating or depleting the product reserves. The tanker demand is a product of the volume of product transported in tankers and the distance which the product is transported. The price of carriage depends on availability of vessels to carry out the required journey.

The price of carriage does not always proportionally increase with the price of the product carried. One reason is that with the price of crude increasing, the fuel which is used by tankers also increases in price so the operational costs are higher. Whether the operators are able to pass this increase on to the charterers depends on many factors. One significant factor is the availability of vessels at the given time on the given route. Higher prices of cargo mean there is less demand, so a given number of ships is available for less cargo, which pushes the price of carriage upwards.

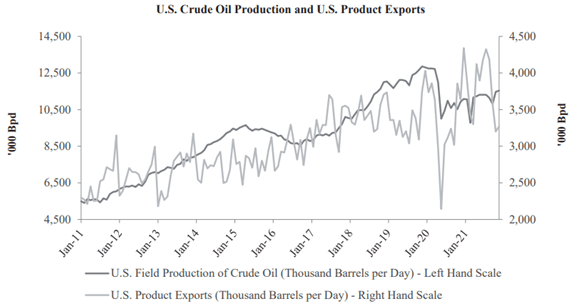

Affecting the demand for product carriers owned by ASC is the shift in global production of crude oil. Until 2008 most of the crude oil was produced in the Middle East and Africa. Since 2008, the US and Canadian oil production has increased as a result of shale oil deposits in the US and Canada. This means that there are more products to be exported from US and Canadian refineries. The below chart illustrates this trend:

More products to be exported from US and Canadian refineries (Ardmore 2021 Annual Report)

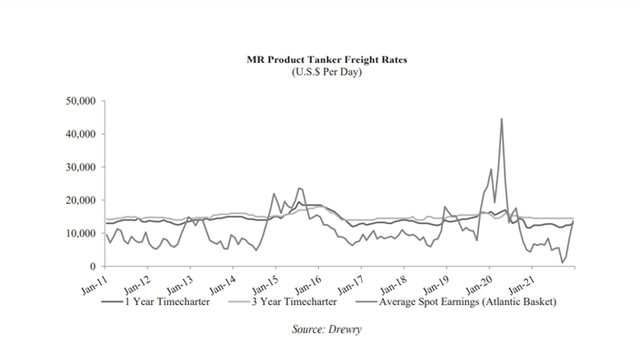

The spot price of charter is determined by shipping brokers in real time on the basis of supply and demand of cargo and carrying capacity on given shipping lines. The factors are the number of empty vessels available in the vicinity, dead weight of the vessels as their capacity of carriage, age of vessels, trading line, the level of ecological compliance with the standards, price of the commodity to name a few main ones. The daily rate is reported as Time Charter Equivalent TCE (in USD). The TCE is shown in the graph below:

Freight Rates (Annual Report 2021)

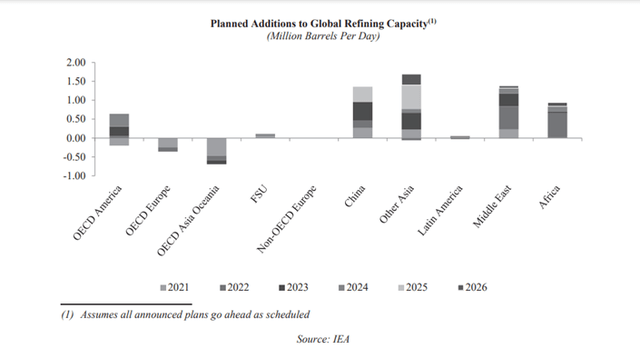

The change in the crude production geography also implies the change in the refining locations. The other significant trend in refinery locations is the moving of refineries from the developed regions such as EU to other regions, for better margins and easier ecological regulatory requirements. This change is also expected to increase the distances for transportation and positively impact the demand for product tanker services in the future.

Refining Capacity Increases Means More Throughput (Annual Report 2021 Ardmore)

The new refineries are being built near the new crude oil production centers. The future routes of product carriers will connect the refineries of product exporting centers to the end users which do not have refineries, or where the demand for oil products exceeds the local refinery production, in regions of significant growth. This is expected to increase the demand for product tankers, i.e., the dwt mile required. India and China are an example for the increase of production capacity, and the benefits of emerging market infrastructure works which, less elective than what we’re doing in the west has been, demonstrated by companies like Rubis with Bitumen volumes.

The situation in China could play in favour of ASC, as the placing of Covid under control and the revival of the economy would mean greater consumption of oil and oil products. This scenario would also provide a stronger engagement for the chemical tankers.

Ardmore Supply Side

The total number of carriers in operation is a complex function of the price of carriage, degree of vessel utilization and operational costs. The costs increase significantly with the age of the vessel, so most vessels are recycled after 20 years. The age of recycling also depends on the freight rates and the price of steel. The average age of 6 years is a positive characteristic of the ASC fleet. They can command a better freight rate, the costs of operation are lower etc.

ASC currently operates 27 vessels, all MR tankers of less than 50,000 dwt. The fleet consists of 21 petroleum product tankers and 6 chemical tankers. The product tankers, or clean tankers, transport oil products between the refineries and the end-user depots. The customers are oil majors such as BP Plc. (BP), national oil companies, chemical traders and companies. As per the Annual Report, the customers are well diversified with the biggest single customer being BP with 10% of dwt miles. The ships operate in a separate segment, transportation of refined products and chemicals.

The 6 ASC chemical tankers carry industrial chemicals, or edible oils. The chemical tankers are used to transport industrial chemicals or oils used in the food industry such as palm oil, or industrial chemicals. The demand for chemical tankers is driven by global GDP growth, the forecast is shown below. This is under the assumption that GDP growth is an indicator of the development of the chemical industry, and with inflation and economic growth rates risking being independent under the stagflation possibility, this assumption might not hold to the medium-term benefit of the industries that support demand for Ardmore assets. Moreover, exposure to the food sector means that 20% of Ardmore assets are exposed to some extent to less macroeconomically exposed markets.

The world product carrier order book in the MR range decreased by 0.8 million dwt in 2022 due to quite meaningful scrapping, which means that the supply side is given some more structural support to charter rates. Given higher freight rates, the recycling of ships is expected to be reduced to 2.4 million dwt in 2022, but some scrapping is bound to occur as ships age.

The prices of both second-hand and new vessels are increasing, following the freight rates and supply chain issues are growing lead times and reducing the rate of incoming capacity to the market. Moreover, the EEXI and CII, the ecological requirements, introduction is expected to have a positive effect on the supply of MR clean carrier capacity. Some carriers will choose to reduce the speed of vessels in order to comply with these requirements as they did when the IMO 2020 regulations came online. According to Bimco:

For product carriers a reduction of speed of 0.5 kn will reduce effective carrying capacity supply by 4.3%, causing the effective supply of carrying capacity in 2023 to be lower than in 2021 despite the fleet growth.

Bimco June 8th 2022 Webinar – Niels Rasmussen

The recent Russian Invasion of Ukraine had the following effect on the trends in oil products:

- Under normal circumstances EU imports about 8.5 mbpd of seaborne crude oil where 2.2 mbpd was sourced from Russia. Now that Russian crude is not available, this is being replaced by imports from various other exporters such as the US and West Africa. Given that the global seaborne trade is assumed to be at around 38 mbpd, means that significant amounts of crude are now sailing longer distances, increasing the demand for vessels.

- The same transformation is going on with the oil products, which are now transported from the Far East instead of Russia. In terms of vessel size, this shift has an effect on the Aframax LR2 vessels, which are now incurring longer ton miles and the demand for the service of LR2 vessels which are a vessel class suitable for the EU ports.

- During the first quarter of 2022, the world tanker fleet over 10,000 dwt increased by 4.6 million dwt taking into account the recycled vessels. The crude fleet increased by 4.4 million dwt, namely 1.9 million dwt on VLCC, 1.9 million dwt on Suezmax and Aframax by 0.6 million dwt. The product carrier fleet increased by 0.2 million dwt, all in the MR sector. Year on year, the tanker fleet increased by 8.8 million dwt with the VLCC Suezmax and Aframax increasing by 5.1 million, 0.9 million 2.0 million dwt and 1.5 million dwt. The LR 1/ Panamax declined by 0.8 M dwt.

So in addition to structural factors such as supply chain issues limiting capacity growth, environmental regulations and secular forces requiring greater travel distances further reduce capacity availability for the benefit of Ardmore.

Financials, Valuation and Conclusion

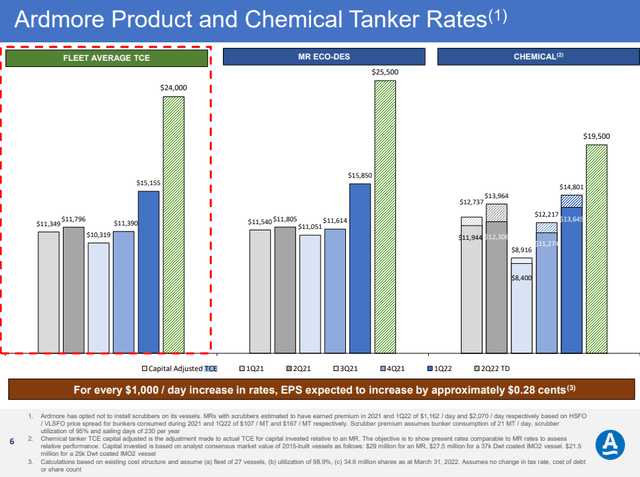

Rates are rocketing across their fleet to new highs as logistical issues become the world economy’s bottleneck.

Charter Rates Q1 2022 (ASC Q1 Pres)

The EBTIDA is expected to rocket in 2022 as a year that fully reflects the benefits to shipping brought on by logistical constraints, but also further improvements from the currently annualising level of a Q1 2022 EBITDA of $12.5 million. This might not be so realistic.

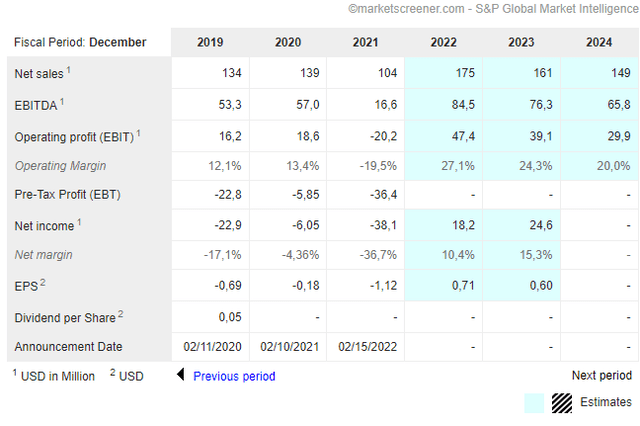

Forecasts (Marketscreener.com)

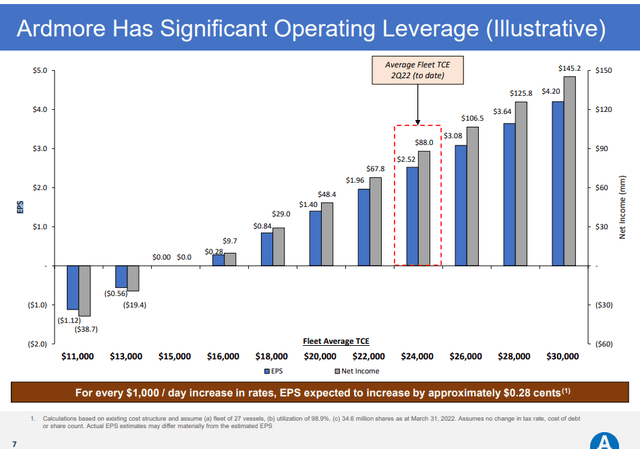

We have to acknowledge that the shipping boom is only part of a cycle, and the downside is coming from the demand-side in this case, where supply side factors as elaborated above remain structurally favourable. Substantial operating leverage means profits can rapidly reverse into negative territory again, and the current levels are not going to be sustainable if monetary authorities are serious about bringing inflation, coming meaningfully from logistic costs, down to more normalised levels. The company isn’t even profitable all year round, and it’s not the biggest drop till the fleet becomes unprofitable again on an EPS basis.

Operating Leverage (Q1 2022 Pres ASC)

The company trades at over 5x on EBITDA despite a cycle that is long in the tooth and a very substantial operating leverage. There are cheaper bets that are more recession resistant for similar market caps on the market like DDH1 (OTCPK:DDHLF). With the shipping trade being crowded anyway, and despite Ardmore having a young and clean fleet with some more resilient end-markets than a pureplay crude carrier, we’d rather look elsewhere.

Be the first to comment