ipopba/iStock via Getty Images

ToughBuilt Industries Inc (NASDAQ:TBLT) produces construction tools and accessories aimed at both do-it-yourselfers and professionals. The products here include everything from specialty work belts, storage bags, knee pads, job site sawhorses, and other items that have captured a following for their reputation of high quality and durability. While the company got a boost during the pandemic from the housing and renovation boom, the story this year has been a market slowdown considering the shifting macro environment. Indeed, the stock has been under pressure against negative earnings and otherwise poor sentiment amid the broader market selloff.

Keeping TBLT in a highly speculative bucket given its nano-cap $32 million market value and some ongoing fundamental challenges, our takeaway here is that this is more than just a “penny stock”. ToughBuilt has a real business with climbing sales and a roadmap to profitability. Efforts to expand distribution including a new agreement with “Ace Hardware” and an ongoing global expansion keep the stock interesting. We’re encouraged by the company’s latest update and see room for significant upside in the stock in a scenario where sales can accelerate higher.

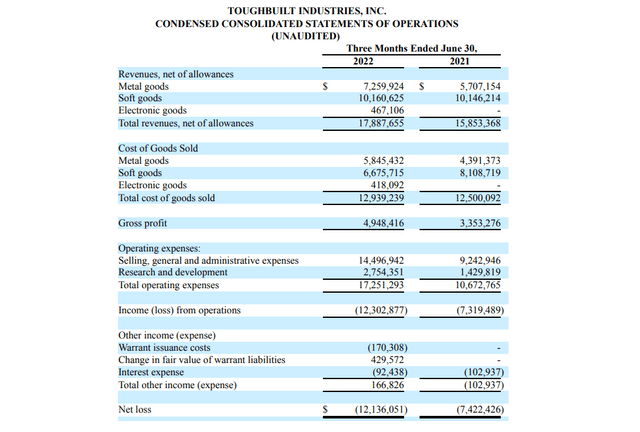

TBLT Key Metrics

The company reported its Q2 results on August 19th with a net loss of -$12.3 million, compared to -$7.4 million in the period last year. Revenue of $17.9 million, climbed by 12.8% year-over-year, but keep in mind that this was against a tough comparison period where sales rose 132% y/y in Q2 2021. Over the first six months, revenues are up 25%.

Favorably, the gross margin at 27.9% increased from 21.1% in the period last year, based on the sales mix towards more valued added items along with the introduction of electronic goods adding to some of the momentum. Operating expenses at $17.3 million are up 62% y/y with management noting both a higher staff count and R&D expenses for the development of new products explaining the recurring loss. On this point, comments during the conference call suggested a hiring push since last year has largely stabilized with anticipation of flattening SG&A going forward.

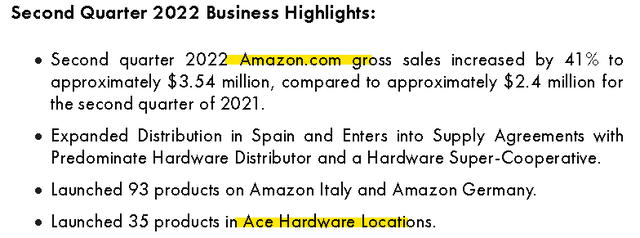

Among operational updates, ToughBuilt notes that its sales on Amazon.com climbed by 41% to reach $3.5 million, representing about 20% of the total business. The company signed new supply agreements to enter the European market including Spain with the country’s “predominate hardware distributor” and launched 93 products aimed at Amazon Italy and Amazon Germany markets. We mentioned the new availability at Ace Hardware locations in the United States. Management believes these factors drive a growth runway into the second half of the year.

In terms of guidance, the company expects full-year revenue growth of approximately 25% to around $88 million while targeting profitability for 2023. ToughBuilt ended the quarter with $2.1 million in cash against $4.1 million in total debt which includes warrant liabilities. A current ratio of 1.6x highlights overall stable liquidity over the near term.

TBLT Stock Price Forecast

The way we’re looking at TBLT comes down to the old adage; “if you build it, they will come”. In this case, the wider the distribution of ToughBuilt products will directly translate into higher sales which ends up having a snowballing effect with positive implications for brand awareness and market share. As the company approaches a milestone of $100 million in annual revenue likely by next year, the upside is the potential to capture just a fraction of the multi-billion dollar global construction tools markets.

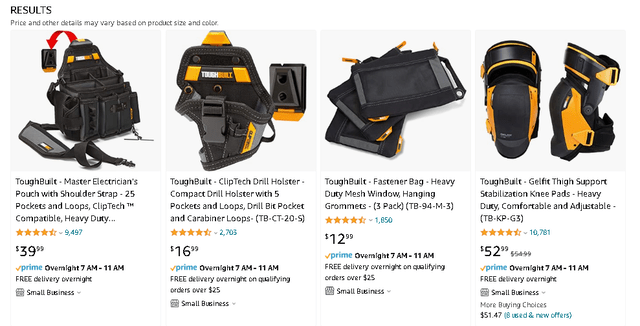

It’s not that ToughBuilt is attempting to replace more traditional and well-recognized category leaders like Stanley Black & Decker Inc (SWK) or Techtronic Industries Co. Ltd. (OTCPK:TTNDY), but simply offers an alternative option. Going through the product catalog, what stands out to us is the company’s emphasis on the use of high-quality materials and even over-engineered heavy-duty features that help create some differentiation.

The company has hundreds of items on Amazon.com which all appear to have generated high ratings. In many ways, we see parallels here at an early stage to what YETI Holdings Inc (YETI) was able to accomplish in the outdoor recreation market by pushing a premiumization of a legacy product category, like coolers. ToughBuilt still has a long way to go, but it’s clear to us that the potential is there.

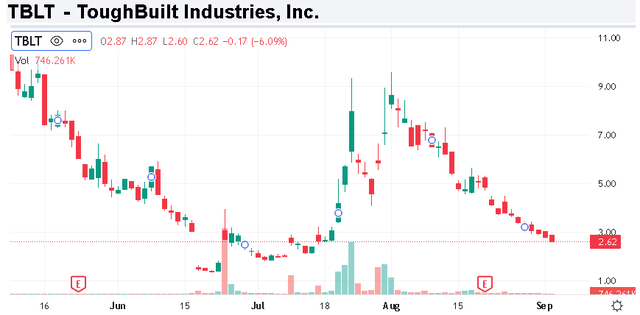

Before we can talk about a market fair value or an upside for the stock, a priority will be for the company to control expenses and provide some evidence it can approach that 2023 profitability target. The current macro environment isn’t helping considering the weakness in housing construction, along with headwinds related to consumer spending. For these reasons, the expectation is for shares of TBTL to remain volatile.

The bullish case looking out over the next few years is that the brand gains traction as being the top choice of its target customer. While the products are already sold at home improvement superstores like The Home Depot Inc (HD) and Lowe’s Companies, Inc. (LOW), the path to double and triple revenues from here will need even greater availability into more channels along with increasing penetration of the international market.

The good news for anyone just looking at TBLT for the first time is that the stock has already been decimated, down more than 65% in the last month, raising the prospect that it’s technically oversold. The one metric we’re looking at is TBLT’s forward price-to-sales ratio, currently at 0.36x considering the $32 million market cap and the guidance suggesting revenue to approach $88 million this year.

We’d make the case that a higher premium is justified considering both the sales momentum and upside potential. A forward P/S ratio closer to 0.5x would imply an upside target for the stock at around $3.60, or 38% higher than the current level. Getting into 2023, some indication that cash flows are trending higher and positive earnings is on the horizon would open the door for significantly more upside.

Final Thoughts

We’re bullish on TBLT and willing to give the company a benefit of the doubt by recognizing its potential. ToughBuilt has some fundamental weaknesses that need to be addressed including negative cash flows and a recurring loss, but the products and brand momentum are something to get excited about. In this case, TBLT is the type of stock that could evolve into a proverbial multi-bagger which is something that would only be obvious in hindsight. That high reward is matched by the high risk. Nevertheless, we like the stock enough to pick up a few shares and look forward to the next quarterly update.

Be the first to comment