svetikd

Background

Wix.com (NASDAQ:WIX) is a cloud-based web development platform founded in 2006 by Avishai Abrahami, Nadav Abrahami, and Giora Kaplan. WIX’s headquarters is located in Tel Aviv, Israel, and it has offices worldwide, including the United States, Canada, Brazil, Germany, India, Ireland, Lithuania, and Ukraine.

WIX was founded to provide a simple, user-friendly platform for building professional-quality websites without coding or design skills. The company’s platform includes various tools and features, including templates, design elements, and integrations with other services, that allow users to create and customize their websites. WIX has grown significantly since its founding and now serves millions of users in over 190 countries. In addition to its website-building platform, the company also offers various services, including marketing and e-commerce tools, to help businesses grow online.

WIX operates on a freemium business model, which means that it offers a basic service for free while also providing premium plans with additional features and capabilities for a fee. For example, the free version of WIX’s website-building platform includes basic templates, design elements, and limited storage and bandwidth. However, users who want to access additional features and capabilities, such as more advanced templates, custom domains, and e-commerce capabilities, can upgrade to a premium plan. WIX offers several different premium plans, which vary in terms of the features and resources they provide.

In addition to its website building platform, WIX also offers a range of other services, such as marketing and e-commerce tools, which are typically available on a subscription basis. The company generates revenue by charging users for these premium services and features. Overall, WIX’s business model is designed to provide users with a flexible, scalable platform for building and growing their online presence, while also providing the company with a steady stream of revenue.

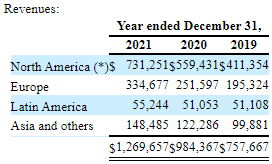

Wix has just one reportable business segment. The location of the end customer organizes revenues. More than half of the company’s revenues come from North America, with another quarter coming from Europe. The rest of WIX’s revenues come from Latin America, Asia, and Others. The table below shows how each region has performed over the past three years.

WIX FORM 20-F – 2/16/2022

Track Record

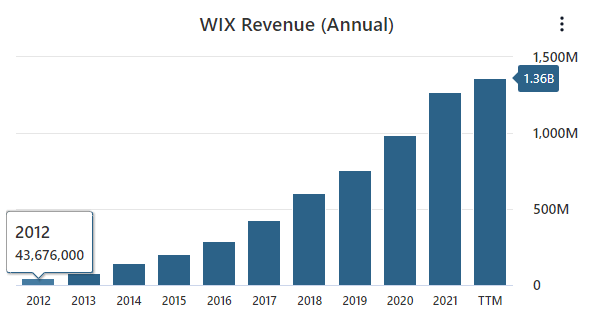

WIX has an experienced management team led by CEO Avishai Abrahami, who co-founded Wix in 2006 and has served as the company’s CEO since then. Under his leadership, Wix has become one of the leading website builder platforms, with over 200 million users worldwide. This rapid user growth has led to faster revenue growth. Since 2012, revenue has grown over 3000% from $43 million to $1.3 billion in the last 12 months.

Wix Data by Stock Analysis

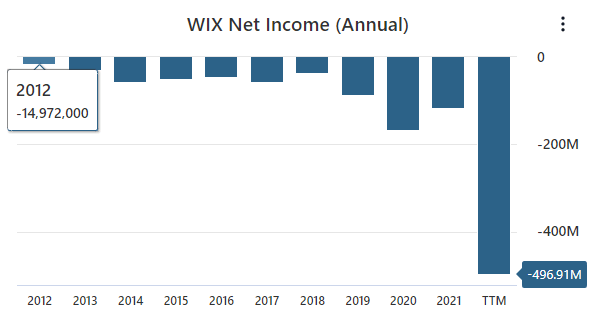

The rapid top line growth has not translated to the bottom line. Over the past 12 months WIX recorded -$496 million in net income.

WIX Data by Stock Analysis

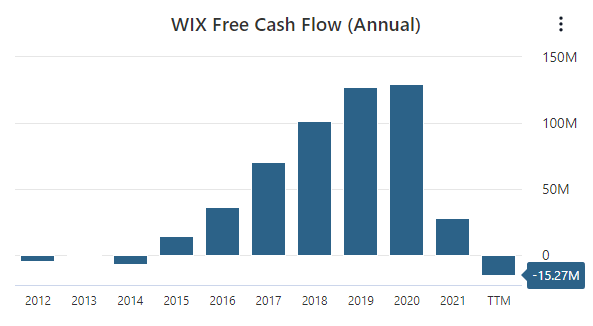

These have not been inspiring results for investors, as WIX has not turned a profit for a decade and counting. However, WIX has done a better job of generating free cash flow. WIX grew its free cash flow every year from 2014 through 2020, but free cash flows have declined since. Over the past 12 months, WIX has -$15 million in free cash flows.

WIX Data by Stock Analysis

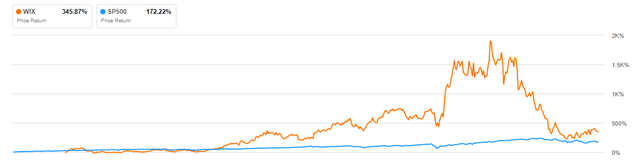

Ultimately what investors care about most is the share price. WIX went public on November 5th, 2013, and since then, shares of WIX have outpaced the S&P 500 2 to 1. However, WIX has recently traded in sync with its free cash flow growth, and over the last two years, there hasn’t been any free cash flow growth. Over the last 12 months, WIX has reported -$15 million in free cash flow, and as a result, WIX shares have lost 50% of their value. Some investors will look at a 50% drop in price as a buying opportunity, but I caution those investors. WIX is down 50% for a reason, it has not had positive operating income in the last decade, and free cash flow has turned negative.

Risk Factors

Before investing in a stock, investors must consider potential risk factors associated with the particular business, its industry, and the broader market. WIX has its fair share of challenges it needs to navigate. Chiefly among them is the company’s history of operating losses.

Since WIX was founded in 2006, the company has incurred net operating losses in every fiscal year of operation. The company expects these operating losses to continue and grow in the near future. These losses are attributed to increased marketing expenses needed to attract new users to its platform and increased research and development expenses needed to increase the functionality of its existing solutions, develop new solutions, and enhance customer care operations.

These expenses are necessary because WIX operates in a competitive industry full of other companies offering free website-building services. WIX’s competitors include Squarespace (SQSP), Site 123, Web.com, Zyro, Shopify (SHOP), Jimdo, and Ionos. WIX utilizes the freemium business model, which means it uses free services to attract customers and offers additional premium services for a fee. However, since this industry is so competitive, WIX must expand its free services to continue to attract and retain its customers at the expense of its paid services. As a result, WIX offers access to 800+ designer-made templates and hundreds of tools and features to customers for free, but the operating expenses to offer these services are very real for WIX.

Another headwind investors should consider when evaluating WIX is the growing concern that people have regarding their data privacy. As time passes, many countries and states are enacting and enforcing data privacy laws. As a result, WIX is limited in storing, using, processing, disclosing, and transferring personal information, including credit card information about its users and users, in accordance with such laws. Data privacy laws may be the right thing to do to protect people’s freedoms. However, they also may limit WIX’s ability to grow the business because WIX can use this data to store and process critical user information needed for marketing analysis.

A final risk before investing in WIX is that a significant portion of the company’s revenues come from small businesses. It is easy for small businesses to have limited budgets, so they might choose to spend their resources on other things besides WIX’s solutions. In addition, times of economic uncertainties, like the COVID-19 pandemic, supply chain challenges, high inflation, and recessions, are particularly tough on small businesses. We have experienced a few of these economic uncertainties in recent times. Though most companies struggle to some degree under these macroeconomic conditions, demand for WIX’s products is at risk of getting hit even harder due to its reliance on small businesses.

Valuation

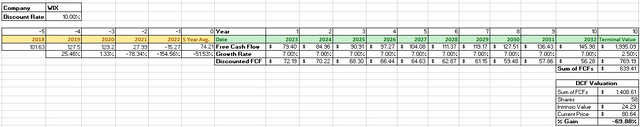

We will run a discounted cash flow analysis to estimate WIX’s intrinsic value. We will begin by taking the average of the last five years of free cash flows, which is $74 million, and applying a 7% growth rate to the free cash flows for the next ten years. We will use the 7% growth rate because, before the last two years, WIX’s free cash flows were snowballing, almost doubling each year from 2015 through 2019, before growth fell off a cliff in the years since. Therefore, we will assume growth resumes but at a much slower pace. We will then use a 2.5% growth rate into perpetuity to determine the terminal value. We will then use a discount rate of 10%. With these inputs, the discounted cash flow analysis gives us an intrinsic value of $24.29, representing a downside of -69.88% from WIX’s current share price. As I suspected, WIX is not trading at an appealing valuation based on this discounted cash flow analysis.

If you have read any of my previous articles, you may have noticed that I like to use multiple valuation techniques when estimating the intrinsic value of a stock. I typically run a discounted cash flow analysis and a comparative analysis based on an average analyst estimated of the next year’s earnings and the high, low, and average multiples that the market has paid for that particular stock over the last few years. Unfortunately, I cannot run such an analysis on WIX because the company has never achieved positive earnings making the comparative analysis a fruitless exercise.

Summary

Over the past several years, WIX has shown impressive revenue growth, and I expect this founder-led company to continue to grow the top line in the future. However, besides the company’s rapid revenue growth, there are a couple of red flags that investors should think about before purchasing the stock. First, WIX operates in an intensely competitive industry that requires it to expand its free product offerings to expand its customer base in hopes of converting more users to paid services. Time will tell if this can be a profitable strategy, but history does not favor the company since WIX has never recorded an operating profit since its founding in 2006.

In addition, WIX depends on small businesses to purchase its paid services. Unfortunately, small businesses are often the hardest hit during economic uncertainties, similar to what we are currently experiencing in today’s market. Therefore, as difficult macroeconomic conditions persist, the likelihood increases that small businesses divert their budgets somewhere other than WIX’s paid services.

Ultimately, I am a value investor. I seek to invest in businesses with unshakable free cash flow generation, which is not WIX. I caution potential investors in WIX to consider the risks before purchasing the stock, but if you disagree, please let me know in the comments section below.

Thank you for reading!

Be the first to comment