Darren415

Retirement Portfolio Strategy Overview

Buying undervalued stocks with solid fundamentals and holding them for the long-term is the key to wealth creation. Further, you must be highly diversified to reduce risk. What’s more, being diversified doesn’t simply mean you own 40 different stocks. If you own all high yield or all speculative growth stocks in your portfolio, even if they are from various sectors or structures, you are not diversified. These classes of stocks tend to fall in and out of favor just like all other classes of stocks. This is well documented. It just happened to the speculative growth stocks over the last year. Now let’s discuss in detail the retirement nest egg building and maintaining strategy my father developed over the years, referred to as the “Diversified Cash Flow Method.”

Diversified Cash Flow Method explained

Selecting a balanced retirement portfolio of holdings in quality income generation and capital appreciation producing securities based on your particular suitability, goals, and risk tolerance is the heart of the Diversified Cash Flow Method. Over time, the investor takes profits on growth stocks that have substantially appreciated and reallocates the funds to income generating stocks until an adequate level of income for retirement is cash flowing at a reasonable level of risk. Preferably, income generating stocks that you are able to sleep well at night holding such as dividend aristocrat blue chip stocks yielding in the 4-6% range. Now let’s delve a little deeper into the two main classes of stocks and their particular characteristics.

Diversified Cash Flow Method Portfolio breakdown

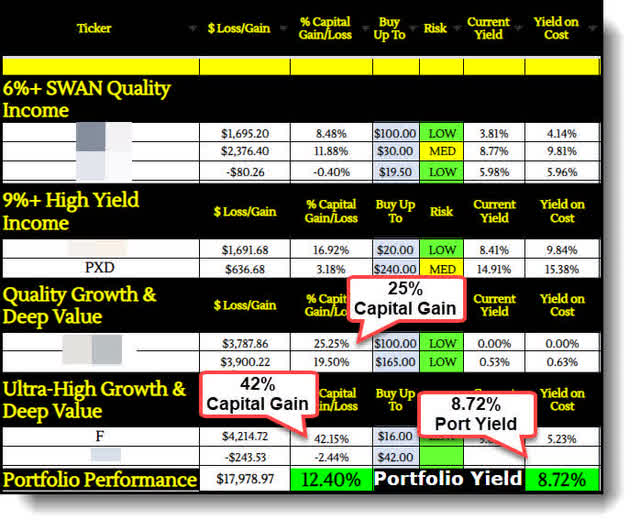

Each major category of stocks, income and growth, has two subsets delineated by risk. This is a current snapshot of the service portfolio’s performance by category. The four categories are as follows:

- 9%+ High Yield Income – 20% allocation

- 6%+ SWAN Income – 40% allocation

- Quality Growth & Deep value – 30% allocation

- Ultra-High Growth & Deep Value – 10% allocation

WWI Core Portfolio (WWI Service)

Capital appreciating growth and deep value stocks

The defining attribute of the Diversified Cash Flow Method is to always have a portion of your portfolio dedicated to growth or deep value securities with the potential for capital appreciation. (If you have been retired for quite some time and have an adequate level of income and funds for emergencies, this may be a very small allocation of less than 5%.) For example, Ford (F) is currently the service’s growth pick winner with the highest capital appreciation to date of 42%, while we have another close behind at 25%.

We bought Ford for the speculative growth subset of the portfolio due the fact it had been significantly sold off and was showing the first signs of a trend reversal in early July, which luckily turned out to be the start of a sustained rally. We also liked the set up for Ford going forward which played out as we expected. Below are some details of recent events that have spurred the stock higher.

Ford is well positioned for growth

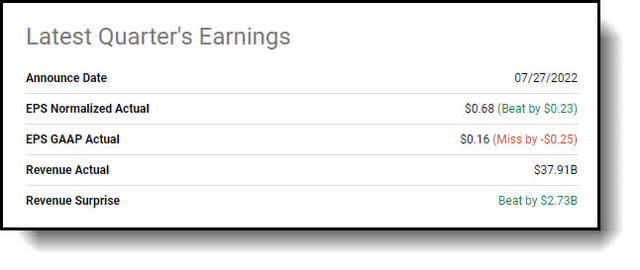

Ford shares popped after the auto manufacturer posted a stronger-than-expected earnings results and reaffirmed full-year targets.

Ford Earnings Results (Seeking Alpha)

For its fiscal third quarter, the automaker reported non-GAAP EPS of $0.68 and $37.9B in automotive revenue. Analysts had anticipated EPS to reach $0.44 and revenue to reach $35.17B, both of which were surpassed by a wide margin. Cash flow from operations rose to $2.9B for the quarter, up from $756M in 2021. The beat on top and bottom lines came despite slowing sales and supply chain problems in China, where sales dropped 22% during the quarter, and inflationary impacts pressuring the bottom line. CEO Jim Farley stated:

We’re moving with purpose and speed into the most promising period for growth in Ford’s history – to innovate and deliver great products and connected services, raise quality and lower costs. We’re giving customers great experiences and value, improving our profitability and making Ford the next-generation transportation leader.

Ford reaffirmed guidance

Moving forward, the company reaffirmed earnings guidance that includes a full-year profit based upon “continued strong pricing” and cost-cutting efforts.

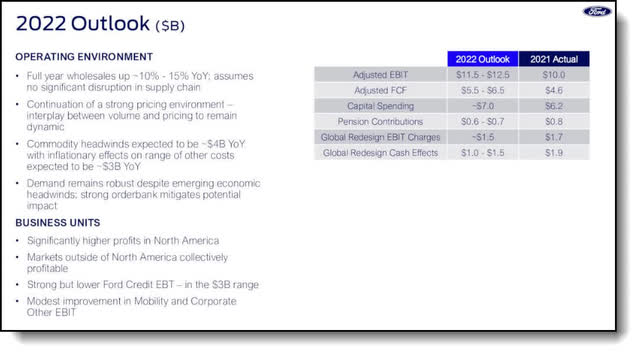

The company anticipates adjusted EBIT to range from $11.5B to $12.5B, up 15% to 25% from 2021 while adjusted free cash flow is expected to reach a range of $5.5B to $6.5B.

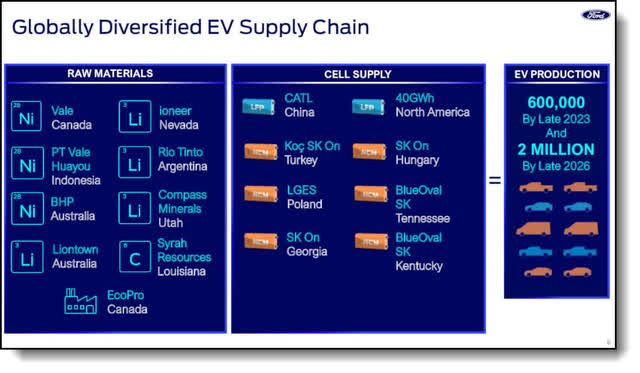

600,000 EVs produced globally by late 2023

The automaker also affirmed its intention to produce electric vehicles at a rate of 600K globally per year by late in 2023, first announced only a week prior to earnings.

Globally Diversified EV Supply Chain (Ford)

The Ford+ Plan

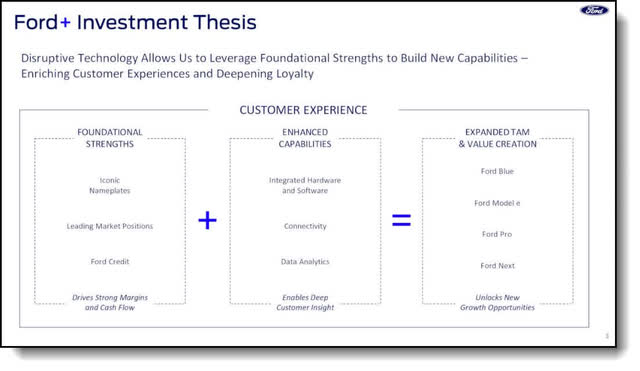

The bottom line is the Ford team delivered a very solid second quarter in a challenging environment where the company saw supply chain disruptions, new economic headwinds, and increased uncertainty. CEO Farley emphasized Ford achieved these results by advancing the Ford+ plan, which Farley stated was the biggest opportunity to create value at Ford since the company scaled the Model T.

Ford+ 3 fundamental promises to customers

At the core of Ford+ are three fundamental promises to customers: Distinctive and breakthrough products and experiences, an always on relationship with Ford, and an ever-improving post-purchase user experience powered by software. Now, let’s wrap up this section by reiterating the importance of maintaining a portion of your portfolio in stocks that offer the opportunity for capital appreciation.

Keeping up with inflation and preparing for expense increases

Having a portion dedicated to capital appreciation ensures your portfolio will continue to grow in value over time to keep up with inflation and increasing expenses you will inevitably incur during retirement. This will ensure you have an adequate level of wealth and income in case of an expensive emergency or for when your expenses may suddenly increase. Often, long term care needs, such as assisted living and nursing home care, and medical expenses arise quickly due to some sort of unfortunate medical development, as it did for both of my parents. Your expenses may increase two- or three-fold instantaneously. And unfortunately, Medicare does not pay for long term care. So you will want to have a portfolio that provides income to cover your current level of expenses, yet also have a portion dedicated to wealth creation so you never run out of money in case of emergency. My father’s portfolio actually doubled in value over the last decade based on having an allocation to growth and deep value stocks. Now let’s turn our attention to the income generating portion of your portfolio.

Income generating stocks

Income received from dividend paying stocks and interest from bonds are an entirely suitable source of funds for retirement. The highest yielding top income producing pick we bought for the service portfolio on 8/3/2022 is Pioneer Natural Resources (PXD) which yields 15% currently.

We bought Pioneer for the 20% allocation of the high yield subset of the portfolio because it currently has a 15% Yield, strong future growth catalysts, solid current cash flow, great management, and looks like it’s about to make a trend change after a major pullback. Furthermore, Pioneer Natural Resources just reported a solid quarter and gave strong guidance for the balance of the year. The company declared a special dividend yielding 15% ex. div. date Sept 2nd as well. I see this as a solid long-term hold. Nonetheless, I advise to not have more than 20% of a retirement portfolio invested in stocks with double digit yields for investors with an average risk tolerance level. Now let’s wrap this piece up.

The Wrap Up

The strategy developed by my father and implemented by me for my new retirement best practices service was developed to help those preparing for retirement and in retirement build an adequate nest egg over time which will allow them to sleep well at night. Those still preparing for retirement and looking to build up their nest eggs will be more highly weighted towards growth and deep value stocks. Those close to or already in retirement will be more highly weighted towards income generating stocks. The pieces of the puzzle that change are the weighing investors allocate to either income or growth stocks and whether you reinvest the dividends or use them for income.

I am 58 and my personal weighting at this time is 60% income generating stocks versus 40% growth and deep value capital appreciating stocks. I am currently still reinvesting all dividends. I believe we are now entering the sweet spot where buying opportunities abound.

The Clark Contrarian code

I am currently sifting through the ravaged rubble brought on by the bear market to discover the diamonds in the rough. I learned this contrarian mindset from my father who was an Air Force intelligence officer for the Strategic Air Command in Omaha, Nebraska, my birthplace. He became a stockbroker upon retirement. We are cut from the same cloth as Warren Buffett. As Buffett famously states:

Be fearful when other are greedy, and greedy when other are fearful.

I do my best to invest with the same prudence, selectivity, contrarian mindset, and midwestern values as the Oracle of Omaha himself, he lived right down the street from us in the city deemed the gateway to the west. Now, let’s get something straight before you get all riled up! When I say I am “cut from the same cloth” as Buffett, I mean I do my best to follow his investing style, not that I buy and sell exactly what Buffett does. It is a well-known fact that is a sure way to lose money. I am talking about his contrarian and conservative bent. The following is how I describe it.

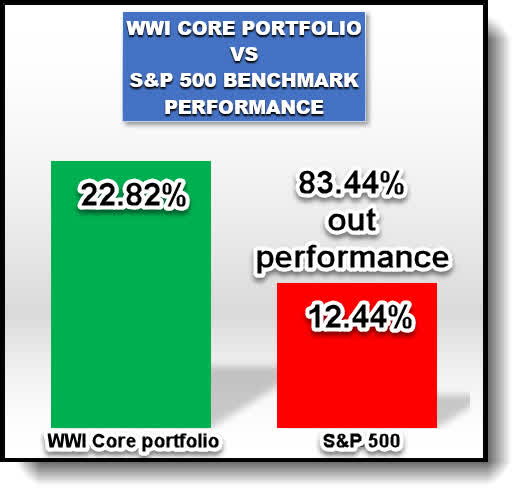

A contrarian is one who attempts to profit by going against the crowd. A contrarian believes that certain crowd behavior can lead to exploitable opportunities. Pervasive cynicism about a stock can drive the price so low that it exaggerates the investment’s perils and belittles its future prospects. The strategy has worked out well so far with the service portfolio nearly doubling the S&P 500 benchmark over the past 6 weeks.

Core Portfolio Performance Metrics

Our core portfolio is currently nearly doubling the performance of the S&P 500 benchmark.

Comparison with S&P 500 Benchmark

WWI Core Portfolio Vs S&P 500 Benchmark (WWI)

The current portfolio is up 22.82% in 6 weeks vs. the S&P 500 benchmark of 12.44% in the same timeframe.

Detailed Core portfolio performance breakdown

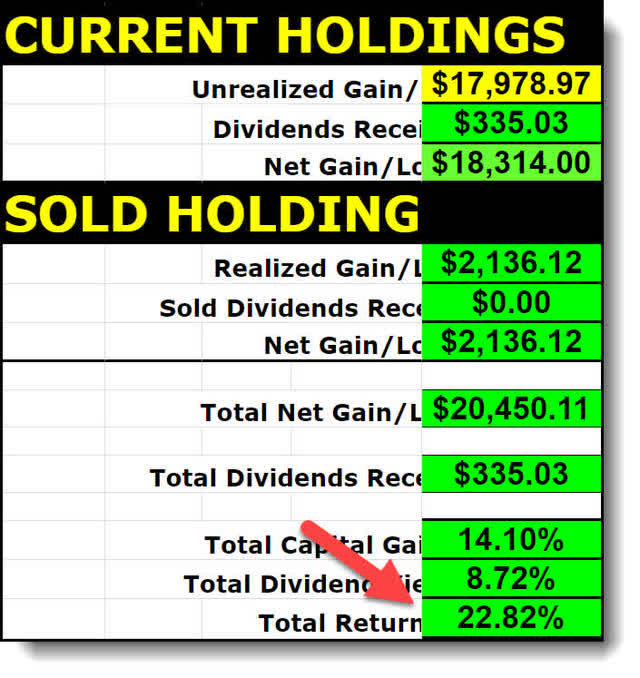

WWI Core Portfolio Performance Summary (WWI Service)

The core portfolio currently has an overall capital gain of 14.10% and yields 8.72% overall. This equates to a 22.82% annual total return, based on the current performance. I understand this is a short timeframe and we still have much to prove. All I can say is – so far so good. We are in the process of building up the portfolio with fresh picks now. Thank you for your time and consideration. Those are my thoughts on the matter and I look forward to reading yours.

Be the first to comment