Uwe Moser/iStock via Getty Images

On Christmas Day 2021, we recommended what was one of our favorite investments for 2022. This was the Tuttle Capital Short Innovation ETF (NASDAQ:SARK), the inverse for the ARK Innovation ETF (NYSEARCA:ARKK). Since that time, SARK has gone up by almost 82%, generating returns >100% more than that of the S&P 500 through 2022. As we’ll see through this article, we expect ARKK to continue to underperform, and SARK to outperform.

ARKK Holdings

ARKK has a relatively concentrated portfolio in a number of tech companies it has been maintaining a strong connection to.

The ETF has a more than 9% stake in Zoom Video Communications (ZM), an almost 9% at Exact Sciences (EXAS) and just over 7% in Tesla (TSLA). Exact Sciences is a strong pharmaceutical company but it’s in an incredibly competitive industry and it’s incredibly tough to pick a winner here. Roku (ROKU) and Zoom are both pandemic picks that are still trading at lofty valuations.

Cathie Wood’s Problem and The Innovator’s Dilemma

Cathie Wood’s problem is that she made a bunch of investments betting on a changing future without acknowledging two problems.

1. Valuation matters. Being a great company with a bullish forecast that can result in a higher valuation doesn’t mean your stock is currently trading at a reasonable valuation. That was seen with a number of technology companies throughout 2022. Don’t throw good money after bad.

2. Innovator’s dilemma. Defining an industry doesn’t mean you’ll be the one to receive all of the profits. This has been seen plenty of times, DRAM was a classic example of this. There’s no guarantee that the market leaders the ETF is investing in like Tesla will generate the returns the ETF wants. History has shown that won’t be the case.

Technology Multiple

Many investors these days are young. Someone who’s less than 30 today likely wasn’t investing at all during the 2008 crash. That’s even true for many people in their early-30s. That means many have been exposed to a major bull market. For many, 2015-2021, roughly half of this time, was a major bull market for technology equities.

There’s no denying that technology stocks generated strong earnings over this time period; however, it’s worth highlighting that technology stocks weren’t what was driving the majority of the returns during this time period. Instead, it was multiple expansion.

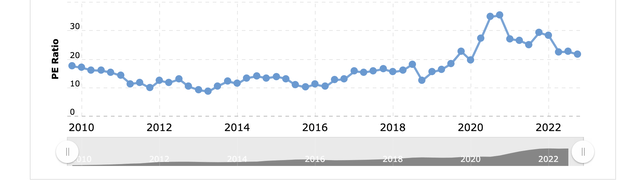

This is evident in a classic tech stock, Apple’s (AAPL) P/E ratio. During that bull market, the company’s P/E ratio went from a bottom of 10 to a peak of ~35 before dropping to current levels of 20. What does that mean? It means that if Apple hadn’t had a P/E expansion, its market capitalization would be closer to $1 trillion.

That would mean much lower returns than the company saw over that time period. It’s also worth noting that many large tech companies have large stock buyback programs, and the higher their P/E, the lower impact those buyback programs can have, which also means lower share price growth. Regardless of the nuances, multiple expansion is less likely to continue.

That means tech stocks will continue to suffer and perhaps even give up some of their prior multiple expansion as growth rates slow.

Our View

Many investors look at an equity like ARKK that has been hammered and think that tech is now at a fair value. In our view, that’s akin to catching a falling knife. Tech remains an incredibly difficult industry with new competitors appearing all of the time and numerous bankruptcies even for heavily established companies.

However, tech is still expensive and has a higher valuation than many other industries and where it was half a decade ago. Rising interest rates will affect valuations as well, with many expecting the Fed rate to peak at more than 5%. This combination will make ARKK likely to continue its underperformance through 2023 in our view.

Thesis Risk

The largest risk to our thesis is that technology stocks have already dropped substantially. Some like ZOOM have dropped almost 70%. With the continued risk of additional lockdowns globally and the lower cost of some COVID-19 adjustments, many of these tech companies can be expected to retain strong market positions going forward.

Conclusion

Our recommendation to own SARK through 2022 performed incredibly well. Rising interest rates combined with the end of multiple valuation and changing pandemic-related habits resulted in a massive multiple drop across the board for a variety of companies. With those drops, some might be at a point where they’re beginning to view technology as a value investment.

However, we disagree with this. We see that the tech industry is changing, and especially for many companies in ARKK’s concentrated portfolio, we expect increasing competition and high valuations to lead to continued underperformance through 2023. As a result, we continue to recommend against ARKK and recommend investing in SARK instead for continued returns.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment