Thinkhubstudio/iStock via Getty Images

As I explain in my book, The Intelligent REIT Investor Guide,

“Data Centers are very specialized real estate facilities that house computer servers and network equipment within a highly secure environment. They come complete with redundant mechanical cooling, electrical power systems, and network connections. You can think of them almost as microwaves to “cook” all the data that’s generated.”

Digital Realty (NYSE:DLR) was the first data center REIT to complete an IPO in 2004. But it wasn’t until the real estate sector received its own Global Industry Classification Standard that the subsector began to stand out to investors.

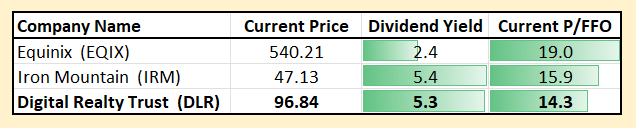

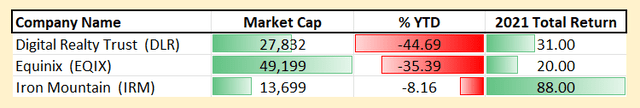

Today, there are two “pure play” data center REITs – Digital Realty and Equinix (EQIX) – as three REITs were recently acquired, two by private equity buyers, and one by American Tower (AMT). Another up-and-coming data center landlord, Iron Mountain (IRM), is increasing its data center exposure

As you can see (above), Digital Realty has returned -45% YTD which has created a significant margin of safety (as viewed below):

Digital Realty is now trading at an absurdly low multiple, which has resulted in a terrific opportunity for deep value investors like me. In this article, Wolf Report and I will examine the business model and determine why we think this REIT is now “pound for pound” one of the best bargains in REIT town.

Why We Consider Digital Realty Fundamentally Attractive

Look – I found it amusing back in December of 2021 when many analysts were literally saying that “Digital Realty is one of our favorite income growth ideas”.

They were literally saying that DLR was a “STRONG BUY” while the REIT was trading over 10x above its normal multiple. It’s of course possible that investors buying here could still recoup some of those losses and see that income growth – but I doubt it’ll happen in the immediate, near term.

And this analyst was far from the only positive at that multiple.

The arguments were simple – immense/near-unlimited growth potential, data consumption tailwinds, and expansion, much of it based on cheap money.

Combine “unlimited” growth potential based in part on “free” money at record-high multiples, and this is why I was negative/”out” on the REIT at the time.

So began the decline, and since its highs, we’re now nearly down 50%.

Now, the fundamentals for the business, they’re absolutely solid.

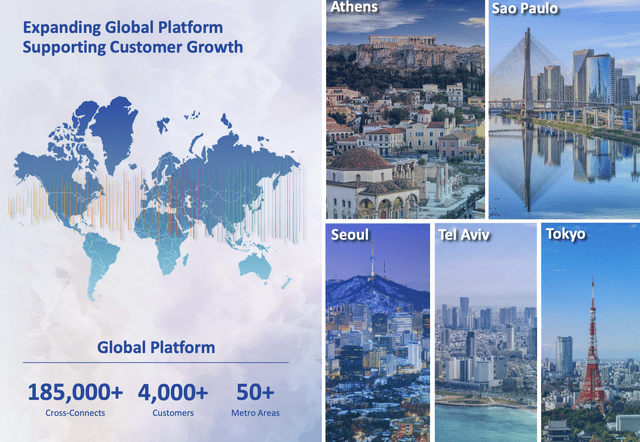

DLR Investor Relations

Digital Realty Trust is a global-spanning data center REIT “empire” that’s bound to, at the very least, deliver stable results going forward. Bookings on a historical basis have shown good growth for at least 10 years, and the company’s customer metrics are more than satisfactory.

Companies of all sizes, and of all sectors, go through DLR. The company’s portfolio size, scale, and breadth of assets mean that DLR does have the pricing power to offset not only energy pricing and inflation but keep their profitability metrics at a reasonably appealing level.

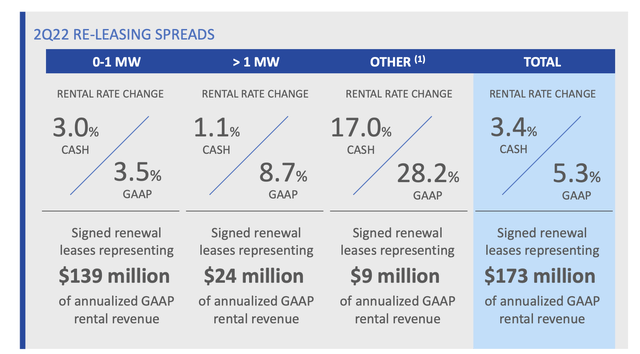

But I don’t expect the company to be that sort of “massive” grower that some seem to expect for the company. Take a look at some recent leasing spreads/re-leasing spreads.

DLR Investor Relations

So these indicators are good.

The top-line growth is also good in terms of indications on a quarterly basis, with revenue growth (even if the way this trickles down to FFO/NOI isn’t as good just yet).

Some investors characterize the recent results as proof that the company is delivering the bull case from late 2021 – I say it’s mostly a function of backlog support, the timing of expenses, and FX, which are at extremes.

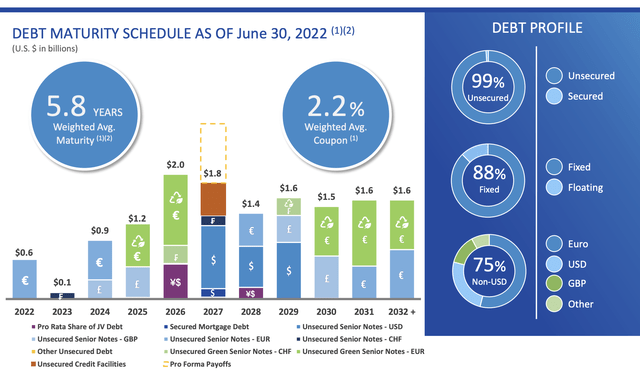

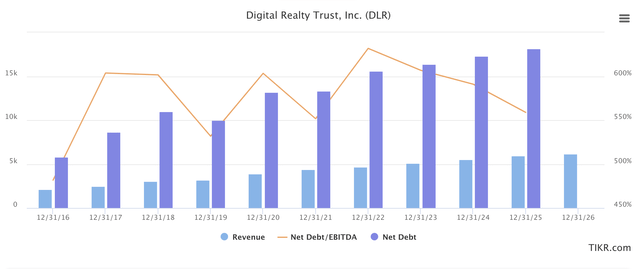

DLR is, for what it represents, not at a worrying debt at around 5.8x net debt/adjusted EBITDA. Fixed charge coverage rates are excellent, and maturities are well-laddered.

Nothing is really in the near term, and the average interest is at 2.2% at 99% unsecured. These metrics are top-notch.

DLR Investor Relations

All we’ve seen since late December of 2021 is the “overvaluation” being drained from the company like excess fat. To me, this overvaluation was never justified for a company that has grown FFO/NOI by bare high-single digits at most, with an actual 6% drop in 2020.

The company has not grown FFO by double digits since 2010 and isn’t expected to do so going forward to 2024E either. You could argue that the REIT has as high safety as some of the conservative REITs trading at 20-22x P/FFO, but I wouldn’t consider that valid either, based on what the REIT has/does – and the market has currently spoken.

As value investors, we’re used to extremes in both ways.

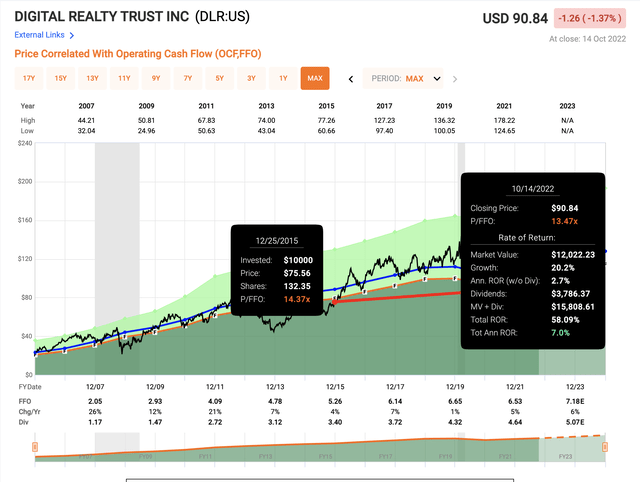

Companies go up way too much, and companies go down way too much. Recognizing what’s what here can be extremely profitable in the long term. If you’d invested at the latest trough in 2014-2015 and sold closer to the highs, you could have made around 300% in less than 6 years.

DLR Investor Relations

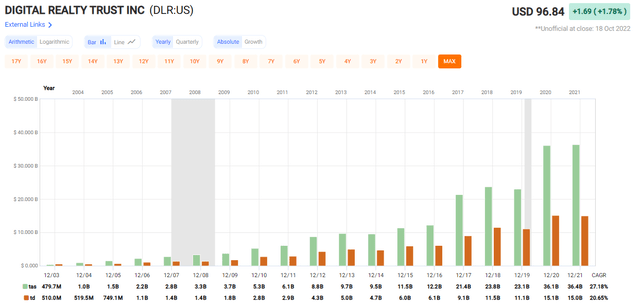

Digital Realty has always been a fairly simple “case” to me. It has been a massive grower of revenues, with revenue doubling in less than 5 years to 2021.

Investors can be excused for viewing this and being exuberant – because such trends obviously look amazing. I also don’t deny that data centers will grow over time – as in, the sector.

But revenues and “growth” doesn’t equate to investors becoming rich from the investment.

You can be a market leader, you can have massive revenue growth, and you can still have zero (or negative) of that top-line going to profits. DLR has been funding this growth through massive share issuance and debt. Debt is up nearly 400% from a 10-year perspective, and obviously, shares outstanding have been growing as well.

The fact is that on a revenue/% total debt, has either been close to flat or even declining, depending on where you’ve been looking.

It’s also wrong to say that data centers started seriously growing more during COVID-19. While there is some truth to that, many of the positives were back in 2015 and forward.

Occupancy trends were over 93-94% and WALTs were up over 6-7 years. That reversed later, with lower WALTs and occupancy trends at the 8x% as late as in 3Q/4Q21.

People often talk about demand, but they forget to talk about supply.

While demand has been growing, DLR competes in a low-margin market where supply might outstrip demand if things aren’t careful. Also, because locations for data centers beyond their physical accessibility and power pricing don’t matter in the same way that they do for other RE asset classes, DLR has lower pricing power than other REITs.

DLR still has some pricing power due to scale and portfolio – just not the same as a REIT that owns an A-grade shopping mall in Kuala Lumpur.

Earlier in the summer DLR was informed by Dominion Energy (D) that power delivery around Ashburn could be delayed until 2026. The potential impacts are still to be determined, but could meaningfully reduce new supply delivery.

Northern Virginia is DLR’s largest market at 19% of annualized rent and DLR currently has 40MW of available capacity plus another 450MW of developable capacity in what DLR believes is at lower risk (includes 200MW substation at the Western Lands campus).

While there are still unknowns, leasing velocity is likely to substantially slow with some demand shifting to nearby markets. Conversely, the supply reduction should push prices higher which likely benefits DLR and its 200MW+ of leases expiring in NoVA thru 2025.

The Big Short

Jim Chanos, founder of Kynikos Associates, now known as Chanos & Company, came out with his data center short thesis and his premise of the trade was that hyperscalers (customers of DLR) are essentially the enemy.

He believes that eventually these hyperscalers will digest DLR’s core business and bring it into the cloud and the necessity of the kind of hybrid private, public cloud, public provider won’t be there anymore. Here’s how DLR responded at a recent conference,

“So I haven’t seen Jim’s deck or anything that supports any of the claims he’s made in the financial times. But if anybody has it or Jim, you are listening, you would like to send it to us, please do, I’d love to refute it actively, because otherwise it just seems a bit off relative to what we have actually seen in the market. It’s interesting that he’s made some of those claims around some of these large customers.

I would point out some of the customers he’s focused on and flagged in particular, probably, if you were to deduce who they were or if they were customers of ours from our supplemental, probably, a lot smaller relative to what he thinks they are relative to our overall portfolio. We are a pretty diverse customer base of 5,000 customers and lots of them are taking space with us, not just three.

And there seem to be, especially in the first six months of this year, the last six months of last year an acceleration in demand from these same customers that are being referenced in the cloud service providers generally.

And that really continues, and I know that Bill (DLR’s CEO) was out visiting specifically with a couple of these customers, few of these customers just a couple of weeks ago and the messaging is directly in contrast with what Jim is maintaining in terms of the partnership that they seek and how much they are relying on us as a partner.

And whether or not we want to partner with them is obviously at our option. …they are a portion of our business, but we have lots of other customers to serve and service and it’s not just going to be three customers who are going to one day eat our lunch.

And the other thing I would sort of point out is, if the end customer, the cloud user is going to situate themselves in a cloud data center or a data center that’s owned by Amazon (AMZN) or Microsoft (MSFT) or Google (GOOG), for instance, is that going to put that end customer at a disadvantage, right?

Where they — that provider – has all the power in pushing rate? Would you put all of your eggs in one basket? We maintain and we operate cloud neutral data centers, much the way 10 years ago…

They are carrier neutral. They are cloud neutral. So enterprise customers can use any cloud they choose, and they are all architecting towards hybrid multi-cloud architectures, right, and you can’t do that in an Amazon data center.”

Why We Think The “Big Short” Is Wrong

People were calling this REIT a “BUY” when it yielded less than 2.8%. Analysts are surprisingly mellow and quiet now that it yields almost twice that, currently close to 5.4%.

And that yield is, all things considered, very well-covered.

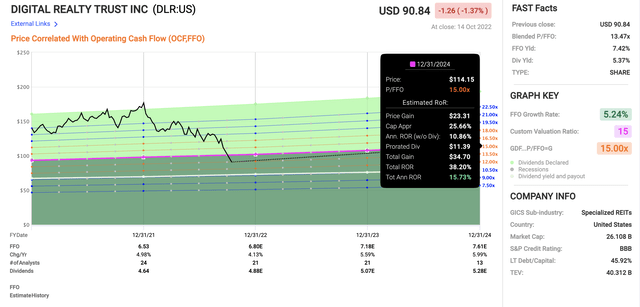

After having dropped nearly 50%, the P/FFO here is 13.5x on a normalized basis, which is again, around half of the valuation it was around Christmas last year.

Company FFO growth rate is around 5-6% on a forward basis – and this is a growth rate I consider to be valid, based on what the company has been able to achieve historically.

It puts it on par with Realty Income (O), but at a far lower multiple.

Even if you expect the company only to revert to a 15xP/FFO multiple, the upside here is over 15% per year under current forecasts.

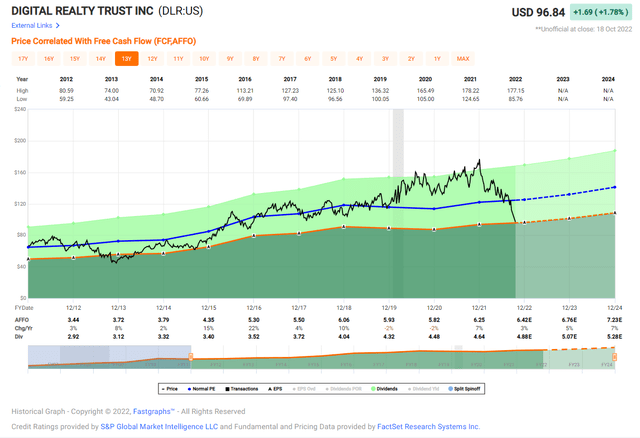

FAST Graphs

However, the interesting thesis starts to materialize once you consider that any time historically the company has been below 15x P/FFO, we’ve seen significant growth.

The last time was late 2015, and RoR since then have been 7% annually even if you look at today’s share price.

This illustrates the importance of never being blind to or ignoring a company’s valuation.

FAST Graphs

So, while the conservative thesis provides potentially market-beating upside here at this multiple, the potential for an 18-19x P/FFO reversal if the market turns around and then some of the bullish stance materializes, is closer to 20-30% annually.

Whether this is likely is another question, but it’s certainly possible, implying a share price target of around $140-$150/share. This wouldn’t have been a strange PT at all, less than 4-5 months ago.

Analyst valuation targets are actually at this level.

S&P Global calls for a range beginning at $90/share and going all the way up to $190/share, with a 19-analyst average of $142/share. The only thing analysts can agree on here is that the company is a “BUY”, with 15 out of 19 analysts being at either a “BUY” or an equivalent rating.

That much, we can agree on.

DLR isn’t the most qualitative, profit-yielding REIT out there – but it’s a solid pick with a solid portfolio, and most importantly of all, at a very solid price, allowing for a substantial upside even at what I would consider a conservative thesis.

Some say that the company still hasn’t fallen enough, after reaching what many describe as unsustainable levels in 2021. I would 100% agree with that a 40-45% decline in the REIT was justified in this environment.

The continued bearish thesis is further spending on CapEx, required to sustain its business, coupled with rising energy prices and inflation versus the company’s evidently somewhat weaker pricing power (in that, other businesses have better pricing power than DLR does).

The underlying profitability is the issue for bears/cautionary investors here.

Another significant argument is that the perceived high demand is just that – perceived, due to the massive amounts of supply in relation to the actual demand for DLR’s specific assets.

The current portfolio occupant closer to 80% than 90% would suggest that there is not at all a massive demand for the company’s space.

I would have basically parroted this argument 20-30% ago.

But at this price, I would say that eventual headwinds are very much baked into what is a 5-6 year low for the company, and the time has come to seriously start buying Digital Realty.

While it’s possible that existing giants can run their own data center real estate, I believe that demand from companies that do not do this coupled with the company’s existing scale and assets will be able to drive single-digit 5-6% FFO growth on a forward basis.

And for that 5-6% forward FFO growth, I’m willing to pay at least 15x P/FFO, or, in this case, around $120/share on a 2024E basis.

At the end of the day…

Our thesis and perspective are very simple.

Focus on math, not on exuberance.

For too long, investors have acted as though the exuberant bullish thesis is based on “free money” and “infinite demand”.

It’s essentially the same thesis/problem we saw for 99% of all tech investments a year ago – and why contrary to many investors, we had close to 0% invested in IT/Tech when the crash came.

Now that we seem to be going toward a trough for tech and tech-related stocks (with no one being able to tell how deep we might go), it’s a good time to pick what businesses you might want to go for.

This is one of these picks: The #1 Data Center REIT, Digital Realty:

iREIT

Be the first to comment