damircudic

In the face of adverse economic conditions, Northern Trust Corporation (NASDAQ:NTRS) continues to prove its durability. As inflation, interest, and mortgage rates peaked in 2Q, more challenges came. Yet, its financial results showed the consistent execution of its strategies to cushion the blow. It was effective as revenue growth offset the upsurge in costs and expenses. Cash flows were enough to cover dividends and borrowings. Also, it remains liquid with an excellent financial position in a stormy market landscape. Even better, the stock price appears undervalued as it remains hammered. It promises an ideal entry point to make a position.

NTRS Performance

Northern Trust Corporation operates a wide range of products and services. As a financial holding company, it engages in asset management, banking solutions, asset servicing, and the like. So, it has higher exposure to risks in a high-inflation market. Even so, it approaches the year-end on a strong footing while serving its clients and generating shareholder value. Its core operations remain stable and promising amidst inflationary pressures.

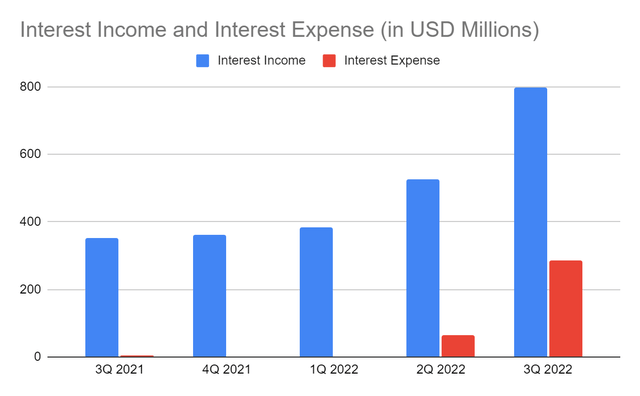

Its operating revenue is now $1.75 billion vs. $1.63 billion in 3Q 2021, or a 7% increase. This uptrend is mainly attributed to interest income, amounting to $799 million vs. $351 million in 3Q 2021. It is due to the sustained interest rate hikes that may peak in the following months. Indeed, it is a solid rebound from its slow-moving trend with near-zero interest rates in the last two years. It is proof that the unsurprising trend before was not an indication of its weakening performance. Instead, it was an opportunity to improve its interest-earning asset portfolio and drive its momentum. It is now paying off, given its 128% increase. Moreover, loans are stable, with only a 9% increase. So, it appears that loans derive more revenues as interest rate increases.

Likewise, interest expense shows a massive year-over-year change at $286 million. Although the decrease in deposits is larger than the increase in borrowings, rate increases lead to higher expenses. But, the net interest income amounts to $513 million, or a 48% increase from 3Q 2021. It shows that the current trend works better for its loans.

Interest Income And Interest Expense (MarketWatch)

However, interest rate hikes do not totally benefit the company. The non-interest income of $1.24 billion is 4% lower than in 3Q 2021. Trust and investment fees, Forex trading income, and other non-interest income dropped yearly and quarterly. These are driven by lower currency translation and transaction volumes and asset outflows. Also, the fair value of its investments, bank deposits, securities, and other earning assets is lower. Note that most of its securities are in the form of bonds and mortgage-backed assets. More often than not, they have an inverse relationship with inflation. Hence, their yields are lower, leading to lower investment gains, treasury management fees, and servicing fees. These match the 9% increase in non-interest expenses as inflation costs remain high.

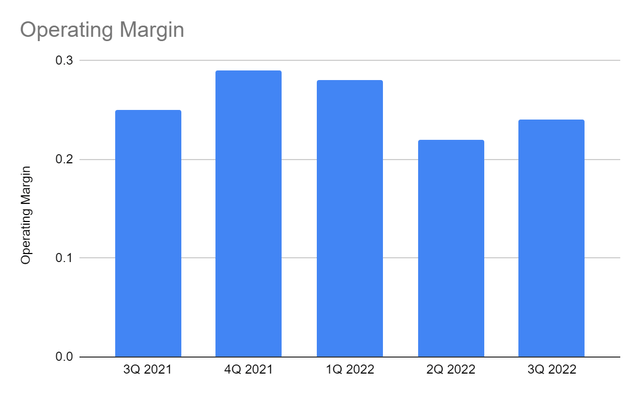

Nevertheless, it continues to execute its strategies amidst market volatility. It remains stable and promising, making its stakeholders safe from risks. Fortunately, the growth in its interest segment offsets the decrease in the non-interest segment. Its operating margin of 24% is lower than in 3Q 2021 but better than in 2Q 2022. It shows that NTRS is coping with economic volatility to maintain its sound performance. In 4Q 2022, I believe it will continue to adjust to market changes. Revenues and expenses will become more manageable to stabilize margins.

Operating Margin (MarketWatch)

External Factors

Its prudent portfolio diversification and earning asset management are evident. Its impressive liquidity and capital base help maintain its solid fundamentals. Yet, it must watch out for external factors affecting its operations. It must also cope with economic volatility to stabilize returns.

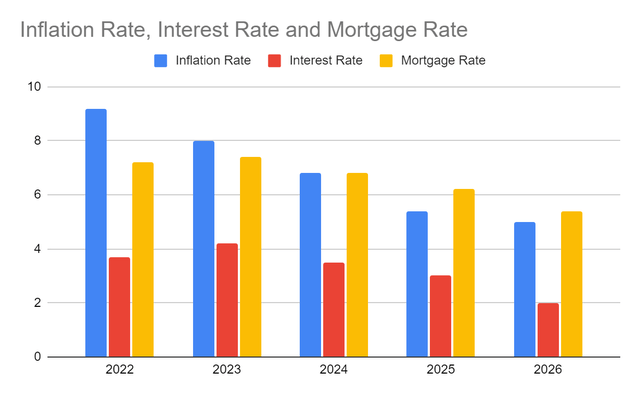

During the third quarter, inflation appeared to be in a lull. After peaking at 9.1%, it decreased from 8.5% to 8.2%. It may suggest that inflation has become more manageable, but NTRS must not become complacent. The demand in some industries is cooling down. These include properties and automobiles. But, pent-up demand is still becoming more visible in other industries. Also, the factors affecting supply chains are yet to improve. The war in Europe, restrictions in China, and the slow improvement in port congestion must be considered. With that, I still set inflation this year at above 9% for a more conservative projection.

Likewise, interest rates may continue to go up some more. Last September, the Fed made another increase by 75 basis points, raising interest rate estimates further. From the initial projection of 3-3.25%, it rose to 3.4% in 3Q. It may increase further and exceed 4% in the next 8-12 months as per the most recent projection. Doing so may stabilize the inflation rate. But, NTRS must be more careful since it may have a massive impact on its earning assets. Mortgage rates are also on a sharp uptrend. When I wrote about NTRS more than four months ago, mortgage rates ranged from 4.8-5.2%. Yet, it has started to skyrocket since the latter part of August. The 15-year average today is 6.59%, while the 30-year average is even higher at 7.2%.

These recent trends may have an impact on its fundamentals. They raise the cost of borrowing, hurting its borrowers. They may also lower the fair value of their investments and securities further. But, they also have a positive impact on its performance. It may generate higher yields on loans and bank deposits. Note that higher interests entice more savings. Also, they may enjoy higher dividends except for bonds and mortgage-backed assets. Once the economy becomes more stable, bonds may rebound and generate attractive returns in the following years.

Inflation Rate, Interest Rate, And Mortgage Rate (Author Estimation, Barron’s, And Forbes)

How Northern Trust Corporation May Remain Sound

Despite the chaotic economic trend, NTRS continues to perform well. Revenues are stable as interest income offsets the decrease in non-interest income. Expenses are well-covered, leading to stable margins. More importantly, it has adequate capacity to sustain its operations and cover financial leverage.

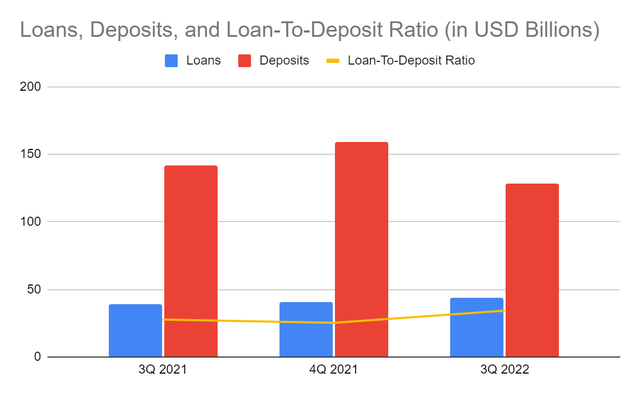

First, it has efficient management of loans and deposits, leading to an impressive interest segment. Loans increased to $43.99 billion, a 12% year-over-year increase. Interest rate hikes indeed raise its potential yield. What is more important is the substantial increase in value. Aside from increased yields, the demand for its loans also increases. With its banking solutions and fiduciary services, loans and deposits are vital to its operations. Meanwhile, deposits are lower but still high at $128.1 billion. Only, its allowance for credit losses is only 0.35% vs. 0.41% in the comparative quarter. Even so, its loan-to-deposit ratio is still low at 34%. NTRS has massive reserves if there are defaults and unpaid loans.

Loans, Deposits, And Loan-To-Deposit Ratio (MarketWatch)

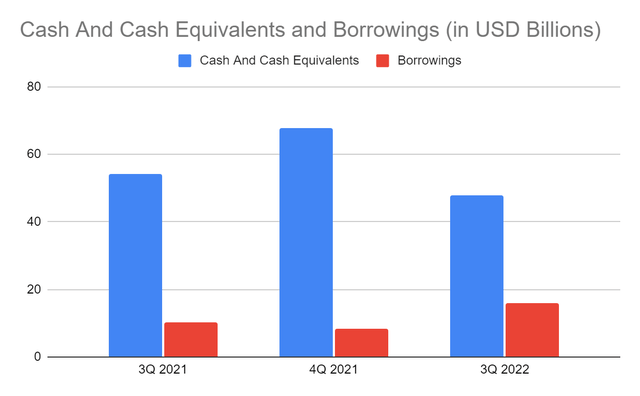

Second, its cash levels are stable and more than enough to cover its borrowings. It is more than thrice as much as its borrowings despite higher interest rates. Also, it is about 30% of the total assets, making the company liquid. Keep in mind that despite changes in operations, cash is king. As long as it is adequate, the company is secure and sustainable amidst volatility. It can also pay borrowings and dividends and enhance its operating capacity.

Cash And Cash Equivalents And Borrowings (MarketWatch)

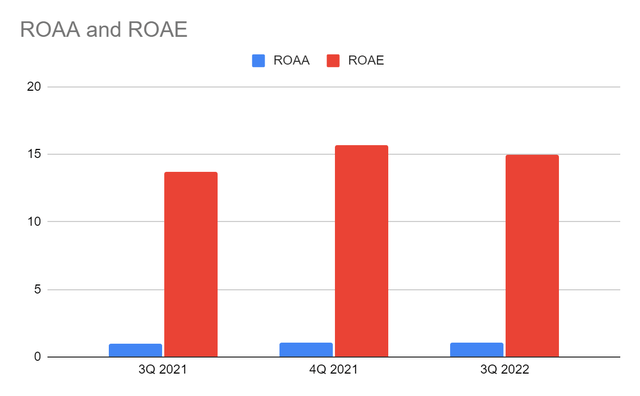

Even better, its capacity to turn its assets and equity financing into income is good. Its ROAA of 1.07% has been increasing since the pandemic. Since it operates as a financial holding company with custody banking and fiduciary functions, its ROAA is ideal. Banks with more than $1 billion in assets should have 1% or higher returns. Likewise, its ROAE of 15% is ideal. Indeed, the company earns enough to pay off its capital. It is returning to pre-pandemic levels but still has to ensure stability in its performance.

Moreover, it continues to innovate and adapt to market trends. As a massive company, NTRS is already established in its existence for over 100 years. It has been through numerous crises, proving its durability and resilience. But what makes it more ideal is its continued evolution. As digital transformation peaks, it increases its focus on digital innovation and expertise. It is a wise move, given that more people and businesses are going online. This year, over five billion people worldwide have internet access. In a recent survey, over 70% of businesses rely on the internet for marketing and business transactions. With that, it may serve its clients better with a larger operating capacity and more efficient solutions.

Stock Price Assessment

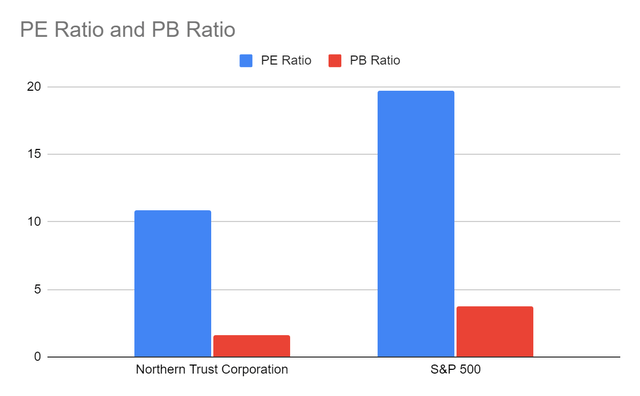

The stock price of Northern Trust Corporation has been in a downtrend after its sharp decline in June. Although I was optimistic in my previous article, economic volatility affects perception. At $79-80, it has already been cut by 29% from the stock price in my previous article. The stock price may decrease some more, given the current pattern, but it appears ideal. The PE Ratio of 10.83 adheres to my supposition, showing that the stock price is enticing. It is even lower than the S&P 500 average. Meanwhile, the PTBV Ratio is quite high but way lower than the S&P 500 average.

PE And PB Ratio (Yahoo Finance)

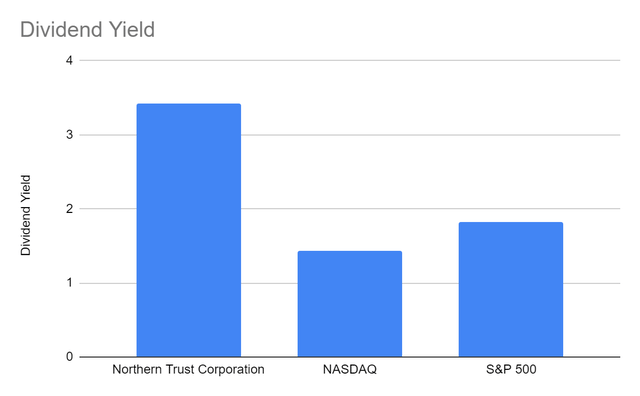

On the other hand, dividends are more attractive. NTRS raised it again after halting its growth in 2019. The annualized dividends per share of $3.00 is a 7% increase from the value in the last two years. They may also be sustainable, given the dividend payout ratio of 42%. It is an ideal ratio, showing that NTRS gives importance to dividends while ensuring it has adequate means to sustain itself. Also, the dividend yield of 3.42% is higher than the NASDAQ and S&P 500 average of 1.43% and 1.82%. To assess the stock price better, we will use the Dividend Discount Model.

Dividend Yield (Yahoo Finance)

- Stock Price: $79.28

- Average Dividend Growth: 0.1417127935

- Estimated Dividends Per Share: $3.00

- Cost Of Capital Equity: 0.1691733586

- Derived Value: $117.274369 or $117.27

The derived value adheres to my stock price assessment. It has potential undervaluation. So, there may be a 48% upside in the next 12-18 months.

Bottomline

Northern Trust Corporation continues to prove its durability amidst economic volatility. It remains profitable with sound fundamentals. It has adequate capacity to sustain its operations and dividend payments. Also, the stock price is a good entry point, given its potential undervaluation. The recommendation is that Northern Trust Corporation is a buy.

Be the first to comment